Have A Tips About Acca Financial Ratios Profit And Loss Balance Sheet Format

A p&l statement provides information.

Acca financial ratios profit and loss balance sheet format. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and. Drawings are not the expenses of the firm. The balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements.

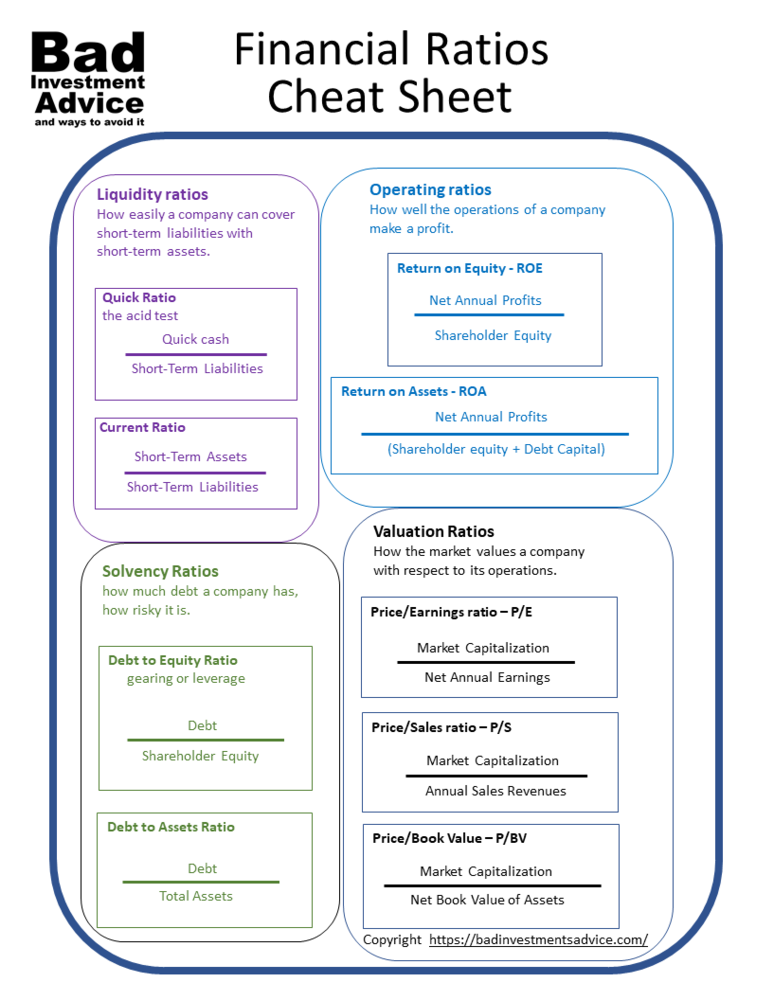

Ratio analysis is a method traditionally used by people who wish to understand more fully the financial statements and performance of an entity. Return on capital employed (roce) = (profit before interest and tax. What is the profit and loss statement (p&l)?

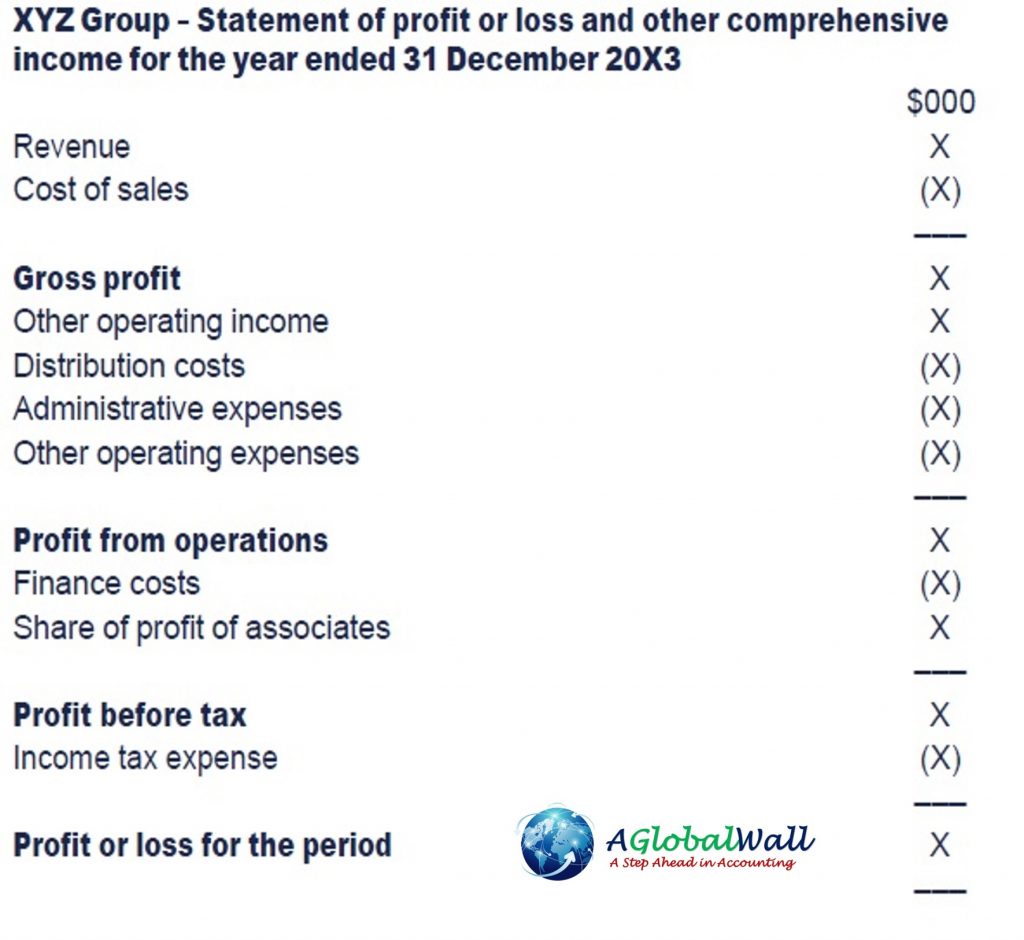

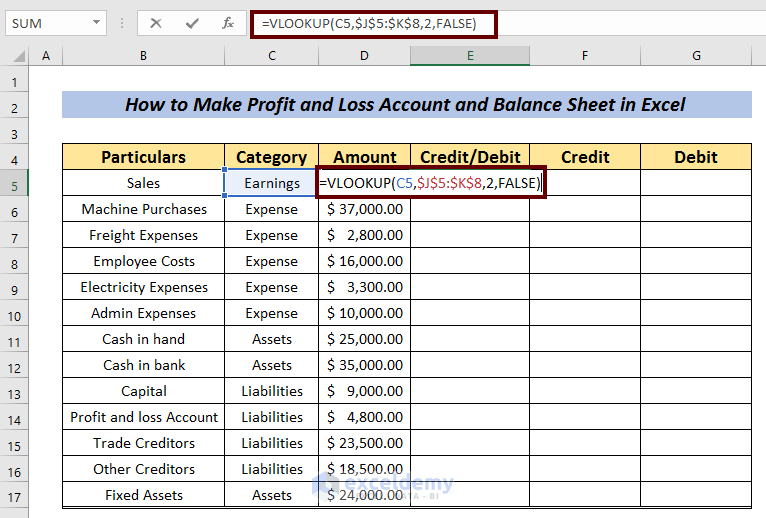

Items not shown in profit and loss account format. Profitability ratios, as their name suggests, measure the organisation’s ability to deliver profits. The first step in the process of preparing the financial statements is to open up another ledger account, called the statement of profit or loss.

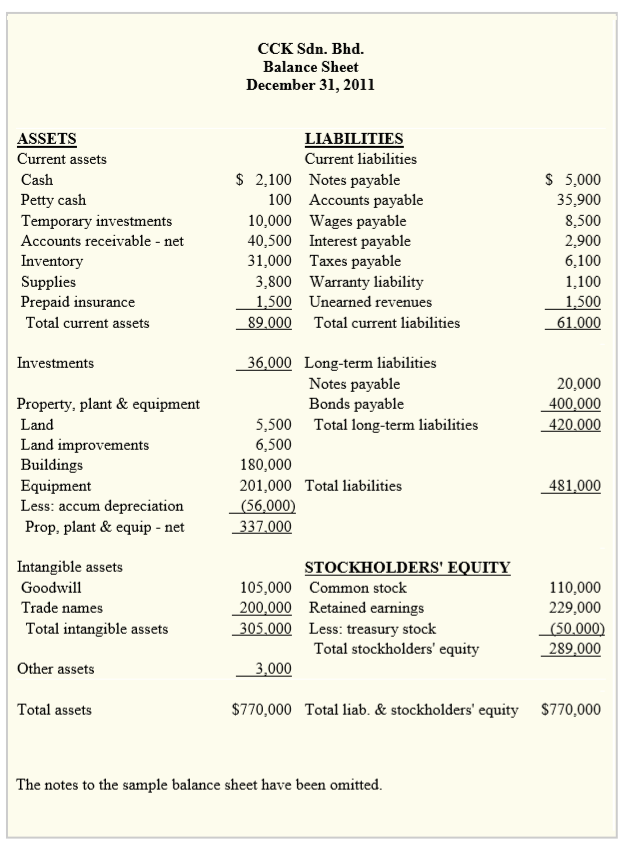

Let’s start with a quick summary of one of the main financial statements. Balance sheet (a) there is a separate capital account for each partner instead of just the one required for a sole trader (b) we often maintain a separate current account for each. Statement of profit or loss.

Understanding the balance sheet. Statements of financial position ias 1 (revised) presentation of fs next syllabus f. Preparing basic financial statements f2.

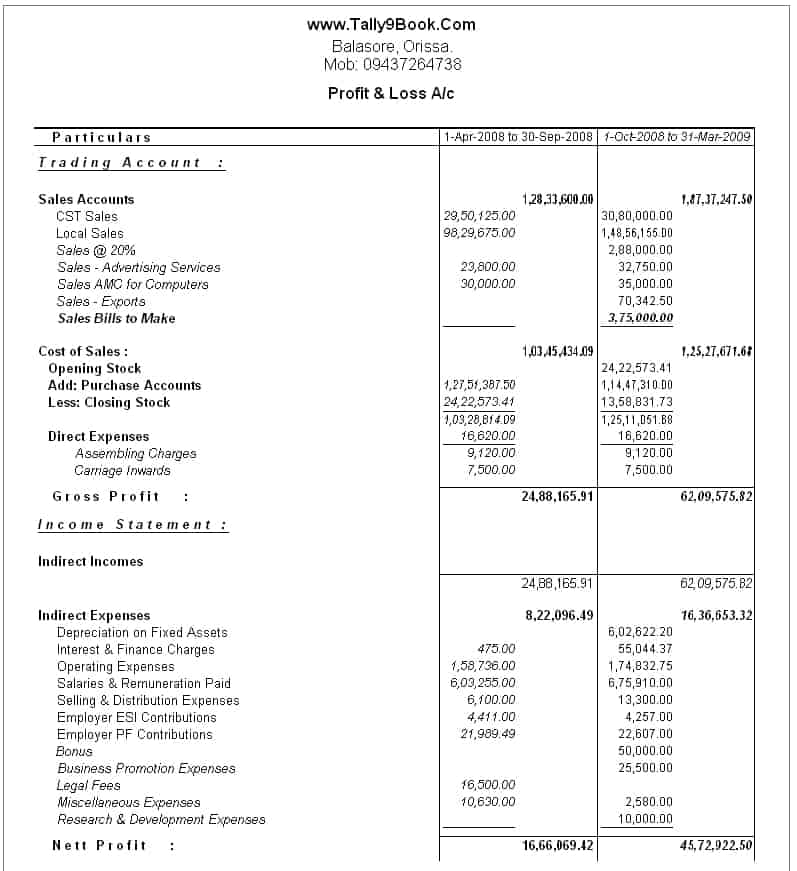

The balances on all the income. 7.1 the profit and loss account the profit and. The balance sheet provides a statement of the assets, liabilities,.

For the fr exam, candidates need to know the formulae for the. The balance sheet is a snapshot of a business at one point in time. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a.

Accounting ratios are based on income statements/profit and loss accounts and balance sheets, both of which are subject to the limitations of historical cost accounting. Calculate balance sheet ratios with the balance sheet and income statement in the example above, we can calculate the balance sheet ratios as below: (b) calculate mooncake ltd's tax adjusted trading loss for the year ended 31 march 2024.

Your computation should commence with the operating loss figure of £93,820,. The income statement is dynamic and describes the flow of money through the business over a period of time. Published financial statements • proforma financial statements following ias1 (revised) xyz group statement of profit or loss and other comprehensive income.

Five ratios are commonly used. So suppose the capital at the start of the year is 10, the profit is 100, and the drawings are 50. The statement shows whether the.