Here’s A Quick Way To Solve A Info About Capital And Reserves Balance Sheet

The section is referred to as property.

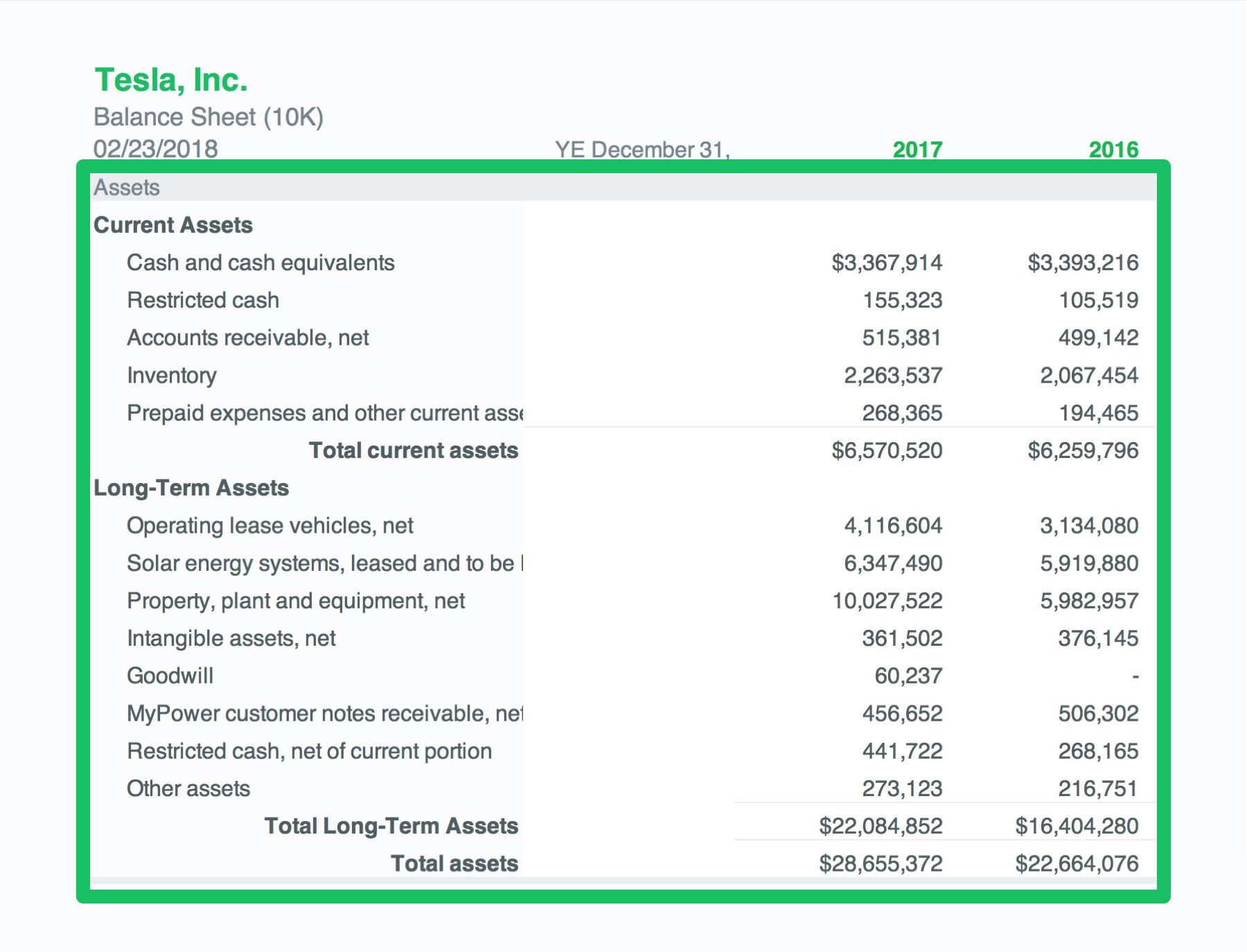

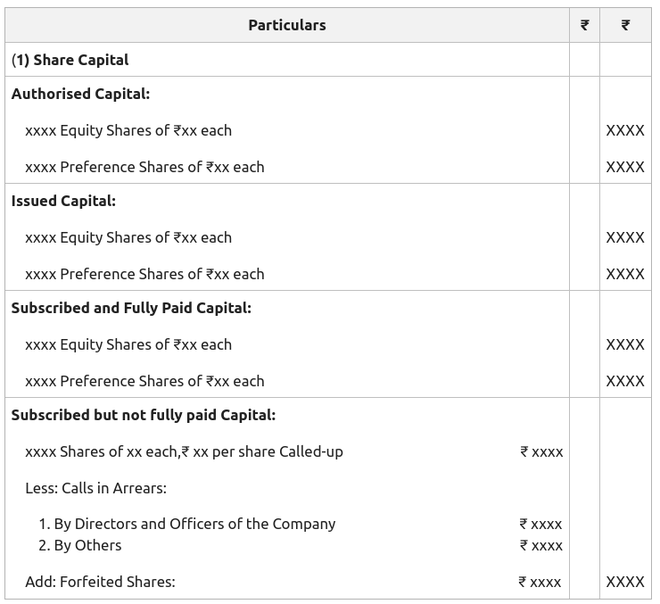

Capital and reserves balance sheet. The balance sheet is a snapshot of the assets and liabilities of a. This stands at rs.1345.6 crs for the fy 14 against rs.1042.7 crs for the fy13 the total shareholders’ fund is a sum of share capital and reserves & surplus. Updated june 24, 2022 balance sheets are the best way to periodically review a company's financial status, and capital is one of the most important elements on a balance sheet.

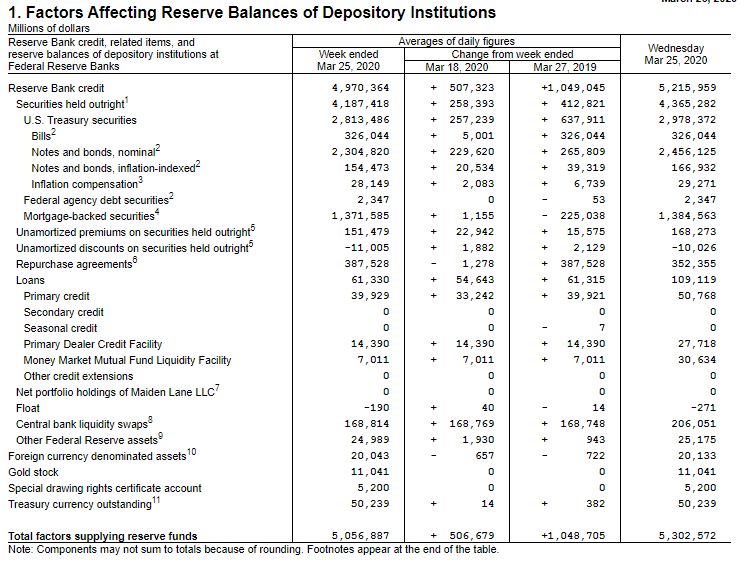

There are several key elements on a statement of financial position. It can also be referred to as a statement of net worth or a statement of financial position. The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero.

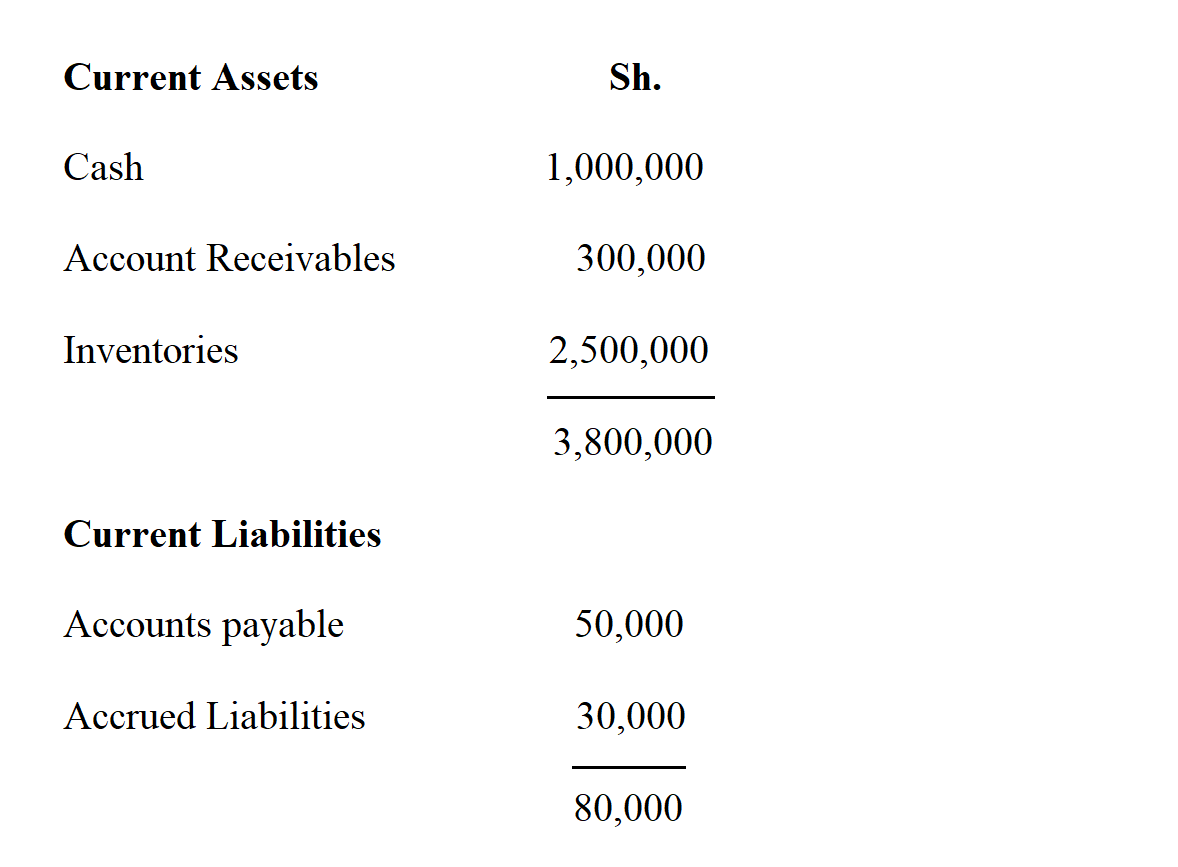

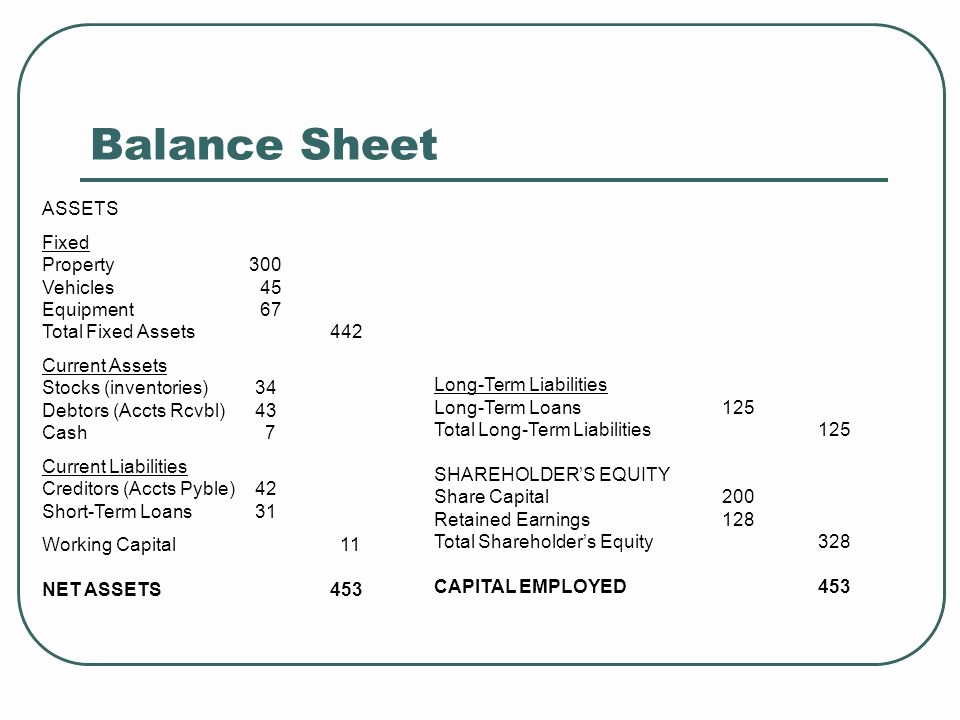

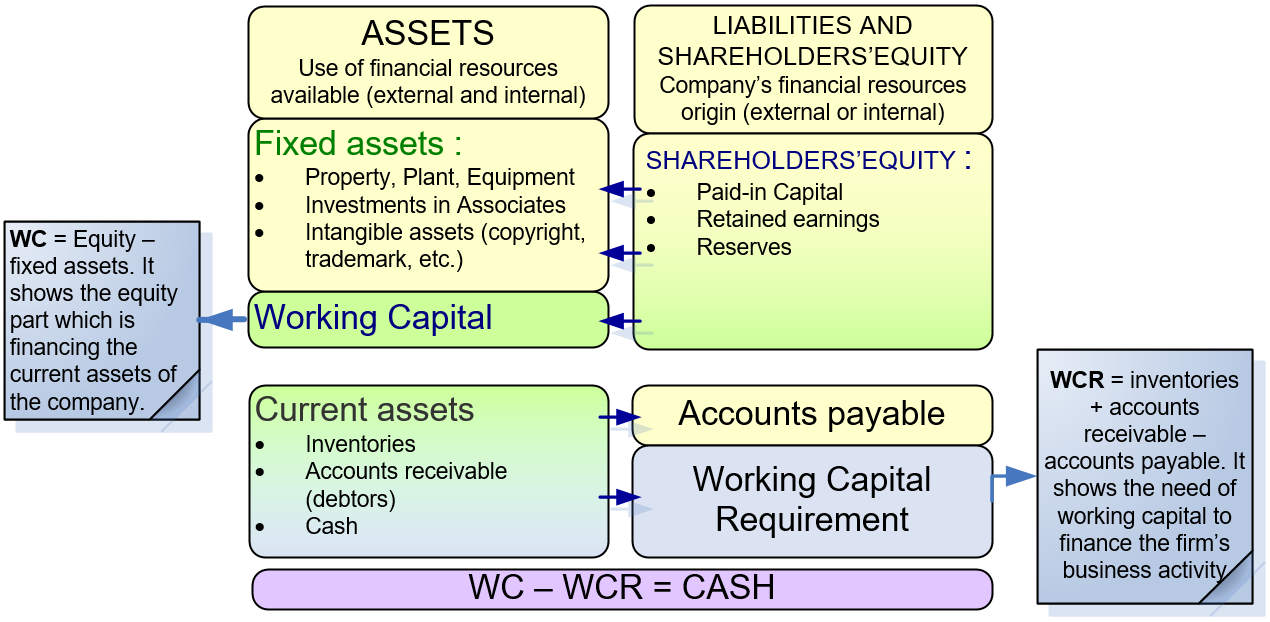

Locate the net value of all fixed assets. Reserves should without exception be found upon the righthand side of the balance sheet. The total of fixed and current assets less the total of current and long term liabilities.

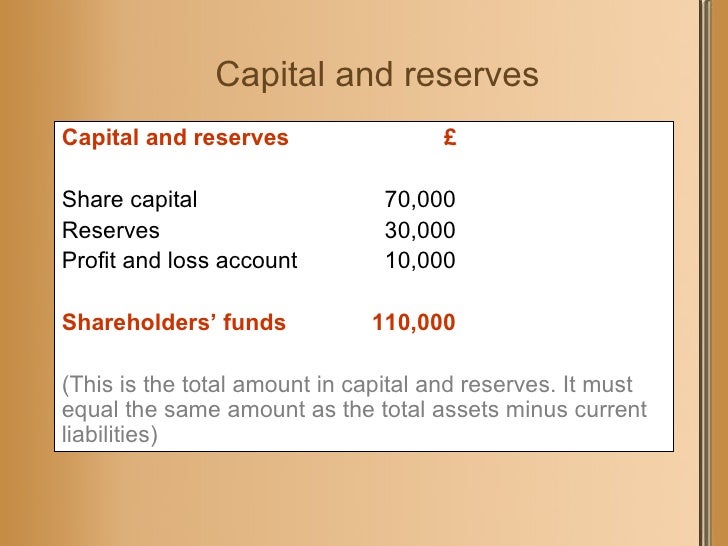

The balance sheet is a snapshot of the assets and liabilities of a business at a moment in time and how those net assets are financed by capital and reserves. In the example balance sheet, the total net assets of £43,000 balance with the total net worth of £43,000. Graph and download economic data for balance sheet:

Usually, these come from past profits. To general fund ‐ state. The balance sheet is one of the three core financial statements that are used to evaluate a business.

Beginning fund balance revenue. The net worth of a business will always be equal to the net assets, and therefore the balance sheet will ‘balance’. These usually end up coming from the result of capital expenses such as excess stock.

The name balance sheet is based on the fact that assets will equal liabilities and shareholders' equity every time. Inside financial statements reserves are shown on the liability side of a balance sheet under the head “reserves and surplus” along with capital. We have transformed the group and delivered consistent execution of our “driving progress 2023” plan, building a strong earnings and capital distribution track record, while maintaining a robust balance sheet.” “today we have an attractive business model, with leading and scaled.

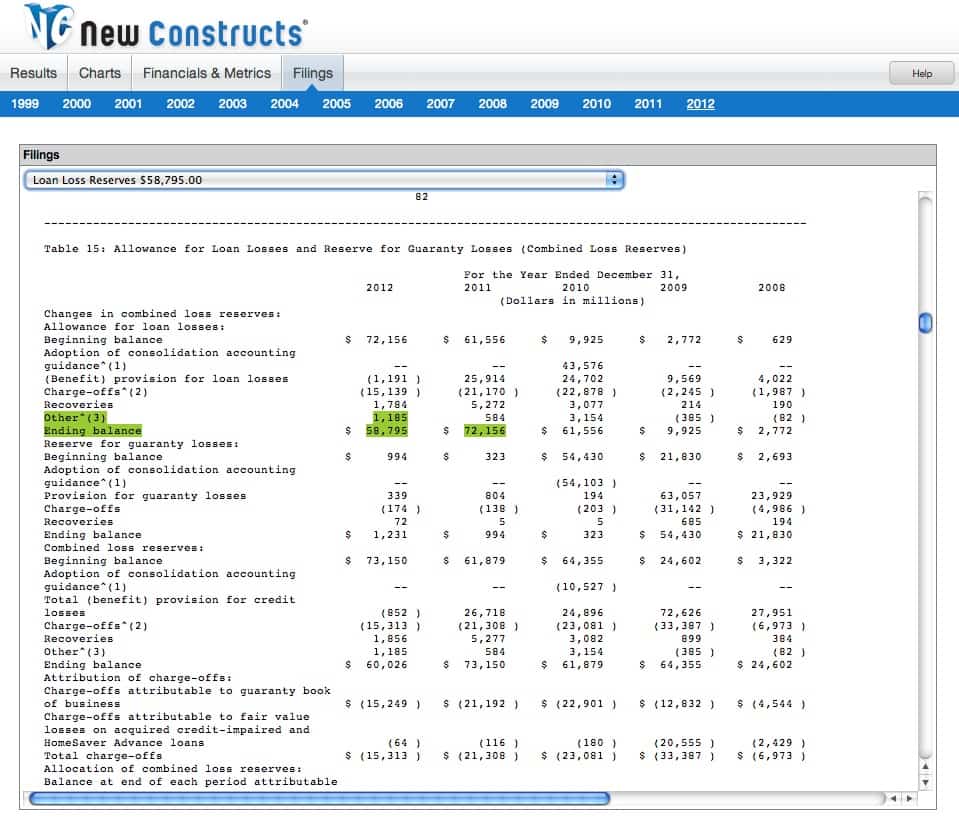

Total resources (including beginning fund balance) 71,510 240,731 73,985 386,226. Balance sheet reserves appear as liabilities on a company's. They’re basically net profits that haven’t been paid out to.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. A capital reserve is a line item in the equity section of a company's balance sheet that indicates the cash on hand that can be used for future expenses or to offset any capital losses. It would thus appear that a reserve for capital surplus need only stand until such time as the value of the offsetting asset.

I couldn’t find a clear, simple, easy to understand explanation anywhere. There are mainly 2 different types of reserves; Normally initial cash injection (share capital) plus retained profits to date.

:max_bytes(150000):strip_icc()/Balance-Sheet-Reserves_Final_4201025-resized-b426e3a4e56040f29fba29b238f53ec3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)