Unbelievable Info About Cash Flow Statement From Net Income

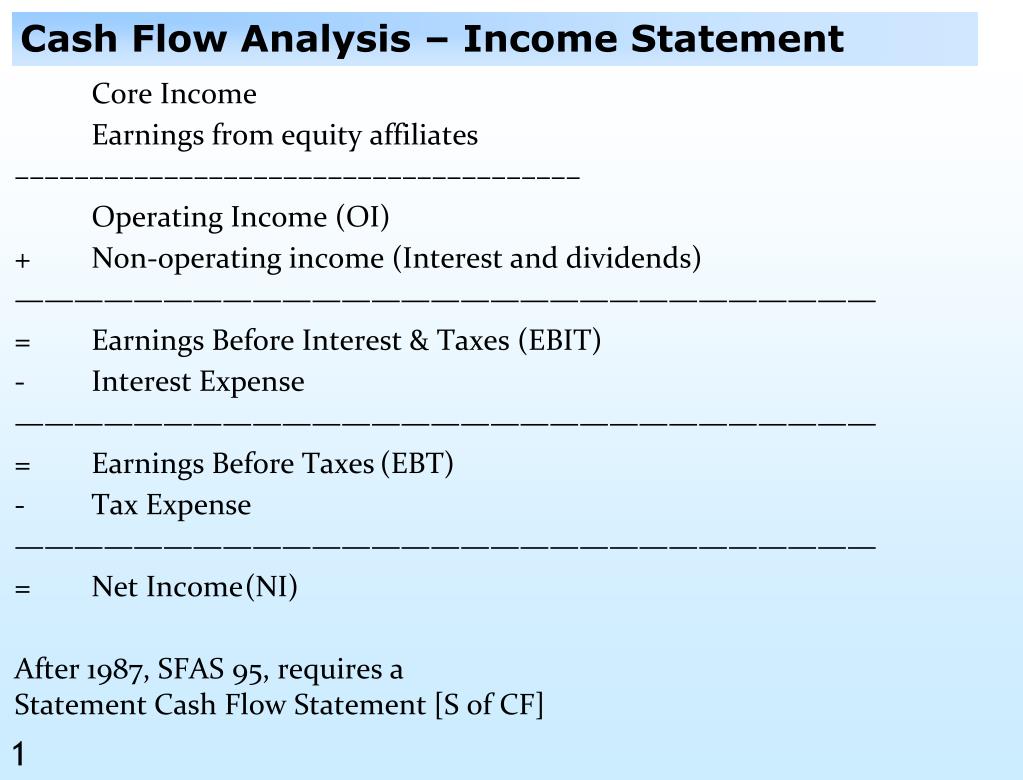

Financial statements income statement revenues, expenses, net income balance sheet snapshot of assets, liabilities, equity statement of cash flows.

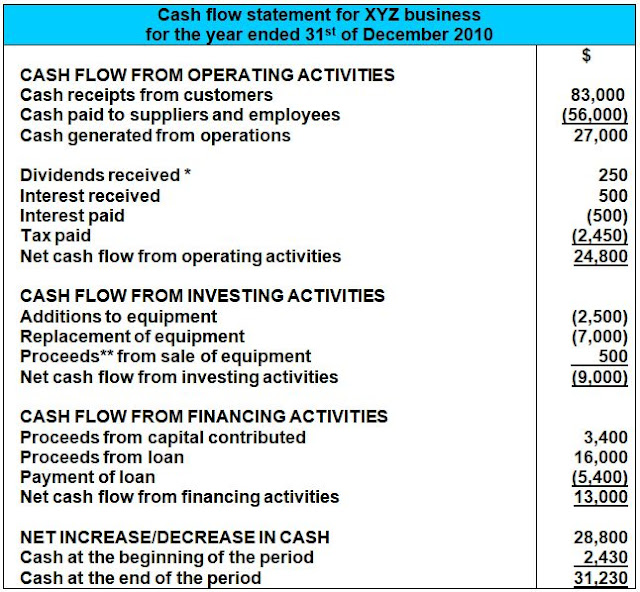

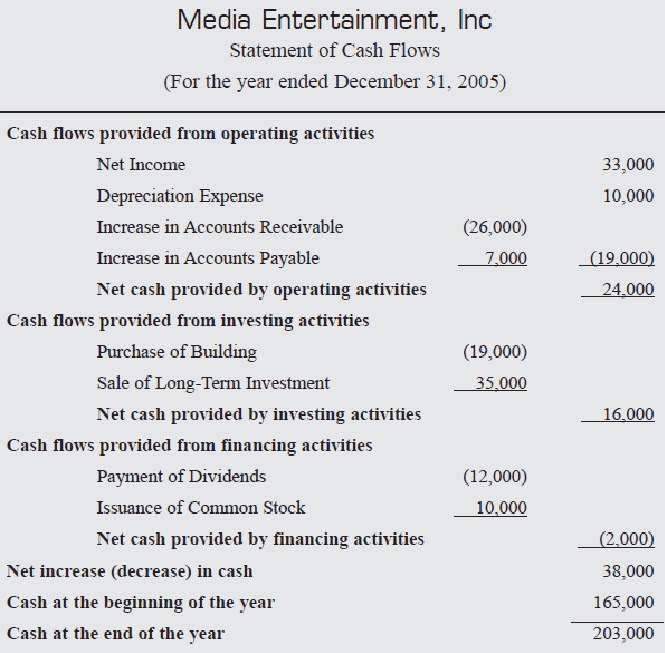

Cash flow statement from net income. The income statement, balance sheet, and statement of cash flows are required financial statements. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and. O 00 n o0 0 a w n = s s o o o y r 8 % b n & g r &g r b b 23 statement of cash flows for the year ended december 31, 2012 cash flows from.

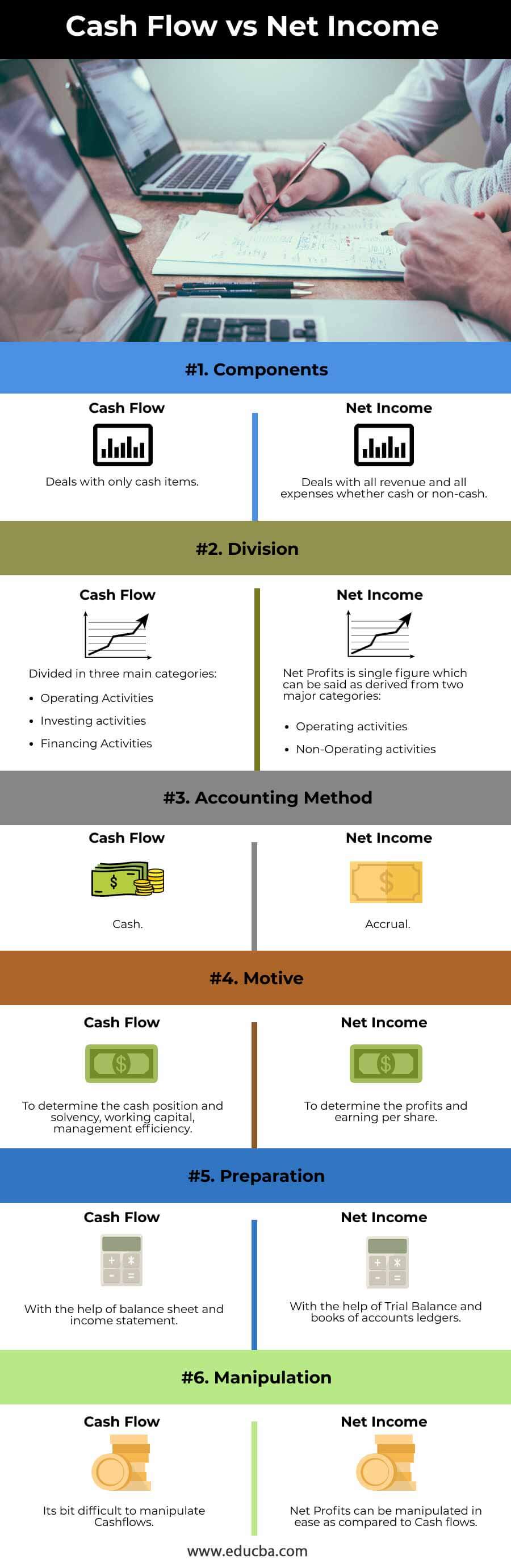

To illustrate how operating cash flows (prepared on the cash basis of accounting) relate to net income (prepared on the accrual method of accounting), as discussed in asc 230. With the most likely used indirect method, the starting point of this section is the company's net income. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

These three statements are informative tools that traders can use to. It is followed with adjustments to convert the amount of net income from. Determine net cash flows from operating activities using the indirect method, operating net cash.

A cash flow statement starts with net income. Start calculating operating cash flow by taking net income from the. Some people refer to net income as net earnings, net profit, or simply your.

Let’s look at a simple example together from cfi’s financial modeling course. Based on the income statement, it’s the profit or loss after all expenses, including taxes, have been deducted. Net cash flow is the net change in the amount of cash that a business generates or loses during a reporting period, and is usually measured as of the end of.

The cash flow statement reports the cash generated and spent. These two terms are often treated as if they’re the same. Review the first line of the cash flow statement.

The statement of cash flows is prepared by following these steps:

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)