Wonderful Info About Increase In Creditors Cash Flow Statement

In general, a positive cash flow statement is a sign of a healthy company.

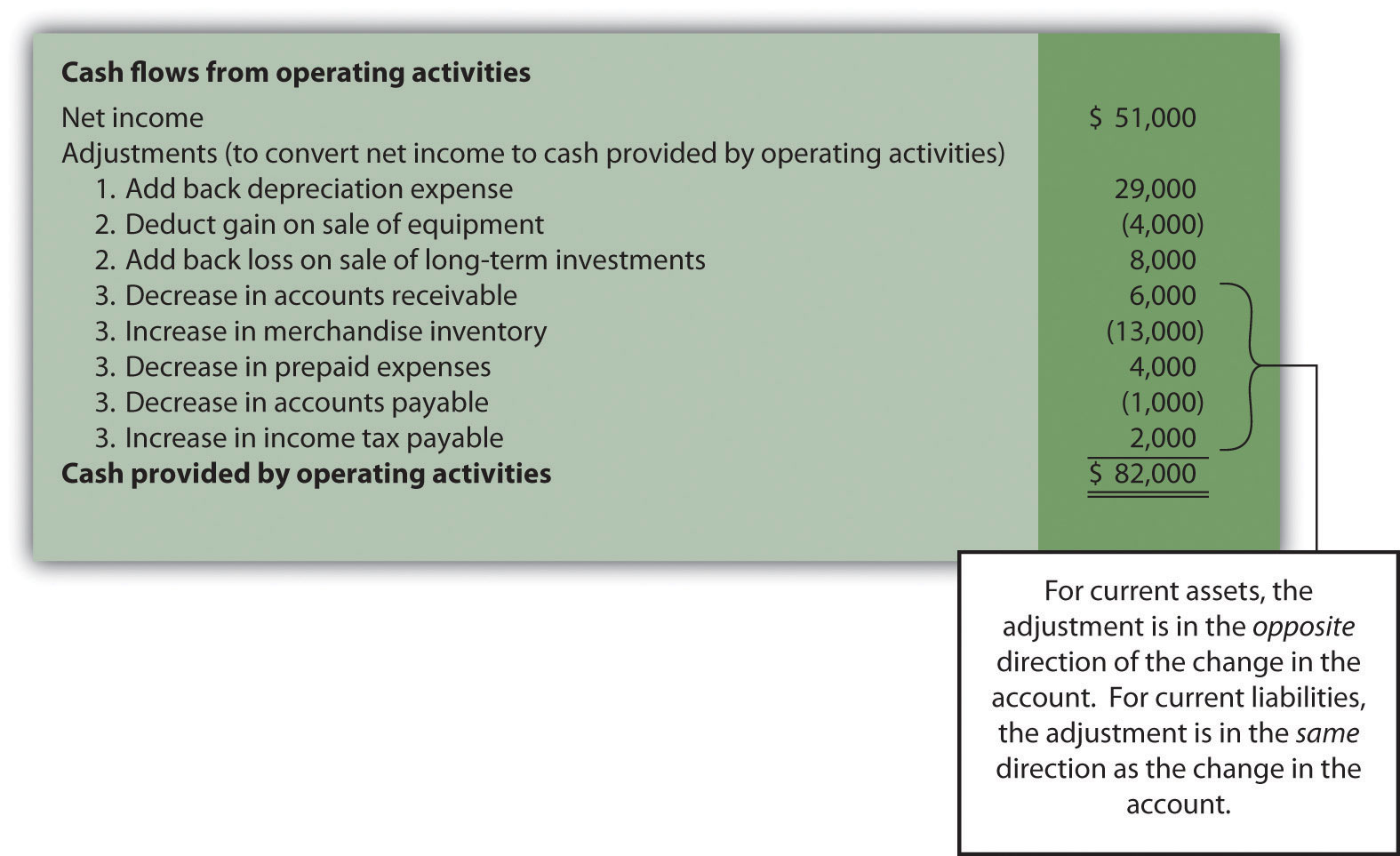

Increase in creditors in cash flow statement. When a business purchases inventory, assets such as machinery, and other items on credit terms, it creates liabilities. Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash. Increase in creditors is in the cash flow statement.

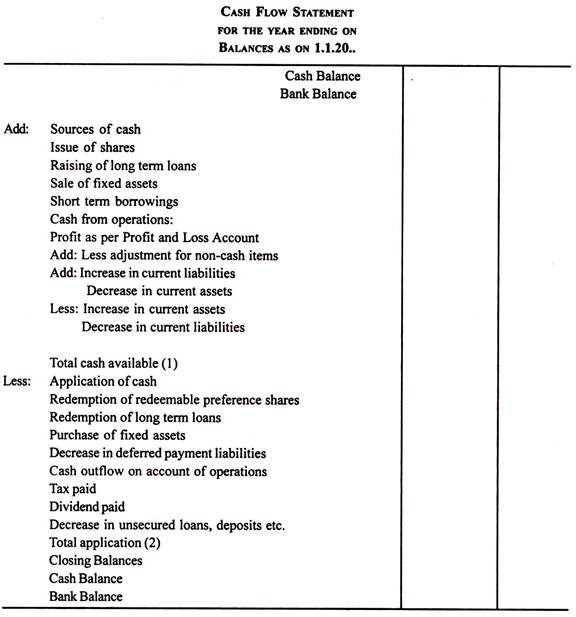

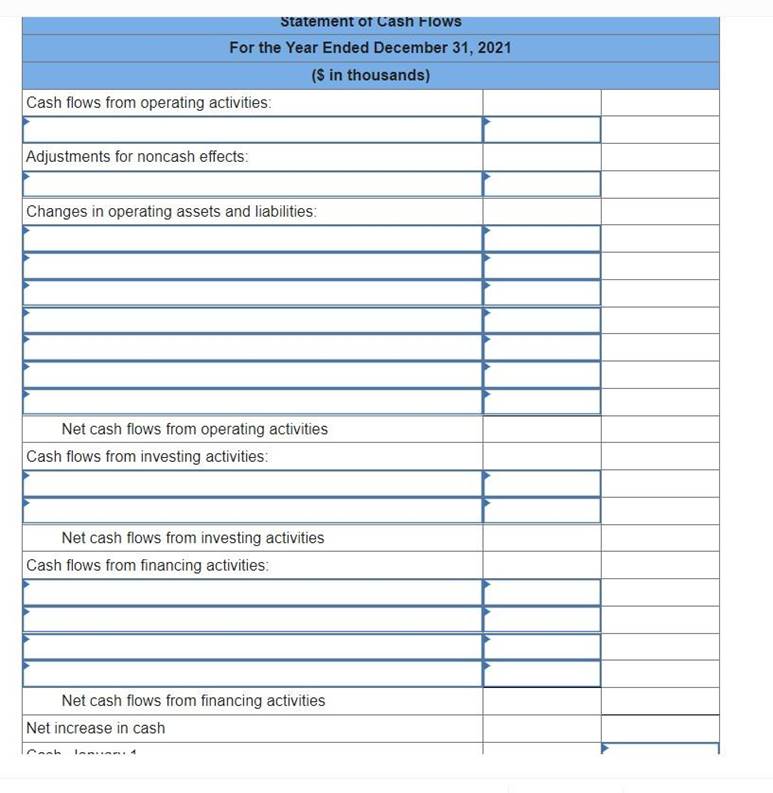

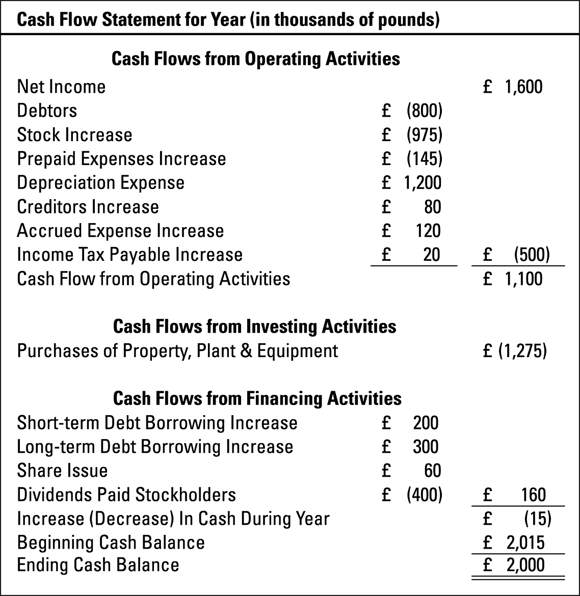

Accounts payable is the current liability of a business. A cash flow statement, along with the balance sheet and income statement, is one of the primary financial statements used to measure your company’s financial position. Determine net cash flows from operating activities using the indirect method, operating net cash.

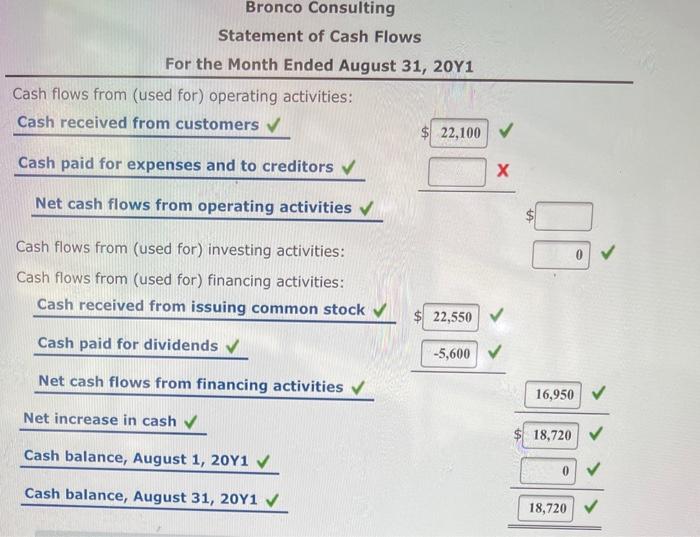

Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. This article considers the statement of cash flows, including how to calculate cash flows and where those cash flows are classified and presented in the statement of cash. Conclusion what is cash flow to creditors cash flow to creditors shows how much money goes from the company to its creditors in the form of interest.

At the bottom of the cash flow statement, the three sections are summed to total a $3.5 billion increase in cash and cash equivalents over the course of the. Enhancing your company’s cash flow to creditors 1. Positive cash flow indicates that a company's liquid assets are increasing, enabling it to settle debts, reinvest in its business, return money to shareholders, pay.

That’s $42,500 we can spend right now, if need be. It may mean a business is. Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company.

At the bottom of our cash flow statement, we see our total cash flow for the month: Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. The cash flow to creditors calculator allows you to calculate the net change in a company's cash during a given period, understanding your cash flow to creditors is.

When a business makes more purchases on credit terms, the accounts payable balance increases. The statement of cash flows is prepared by following these steps: Paragraph 7.20 of frs 102 requires an entity to present the components of cash and cash equivalents together with a reconciliation of the amounts presented in the.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)