Recommendation Tips About Gross Margin On Income Statement

Formula for calculating gross profit.

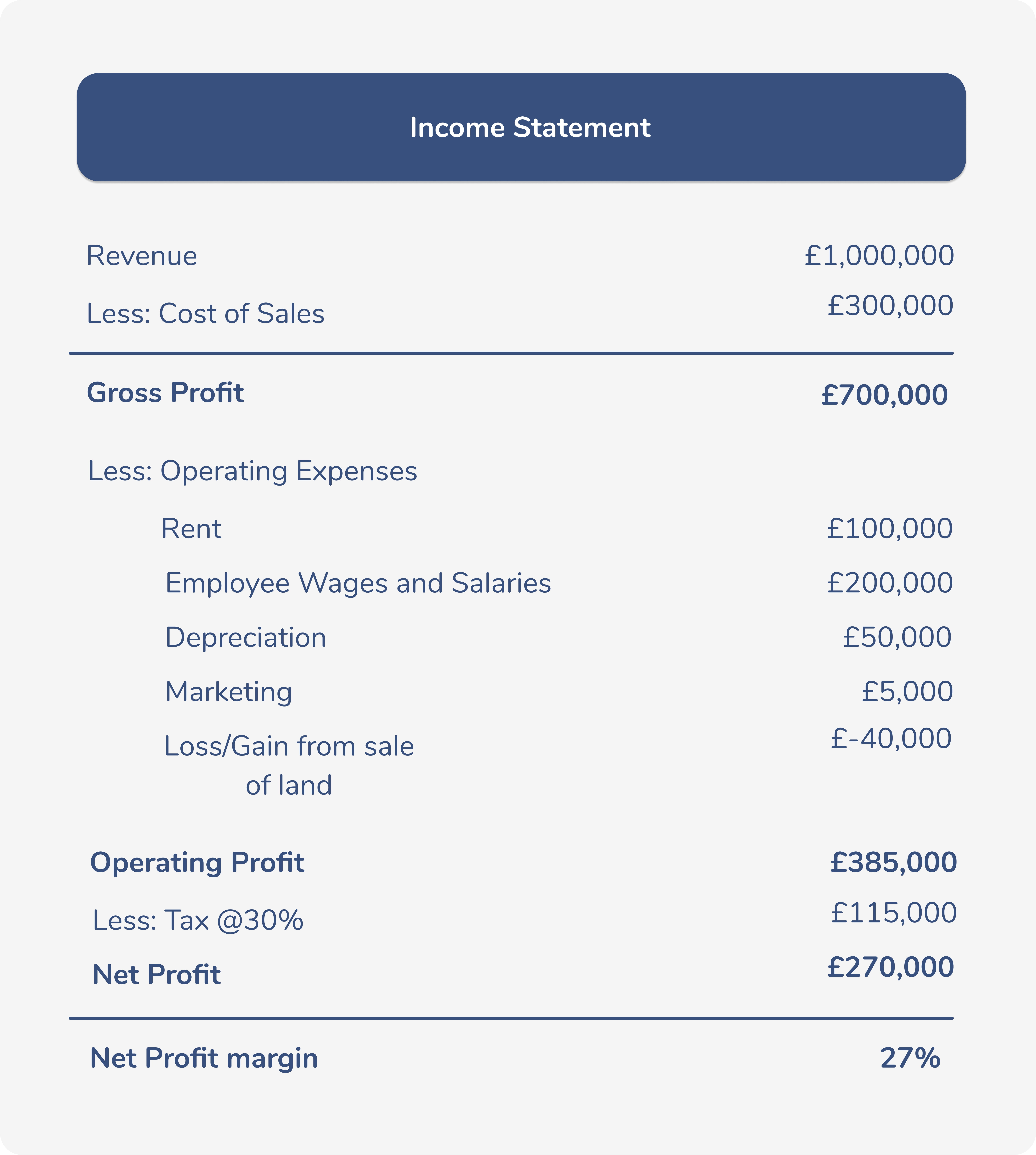

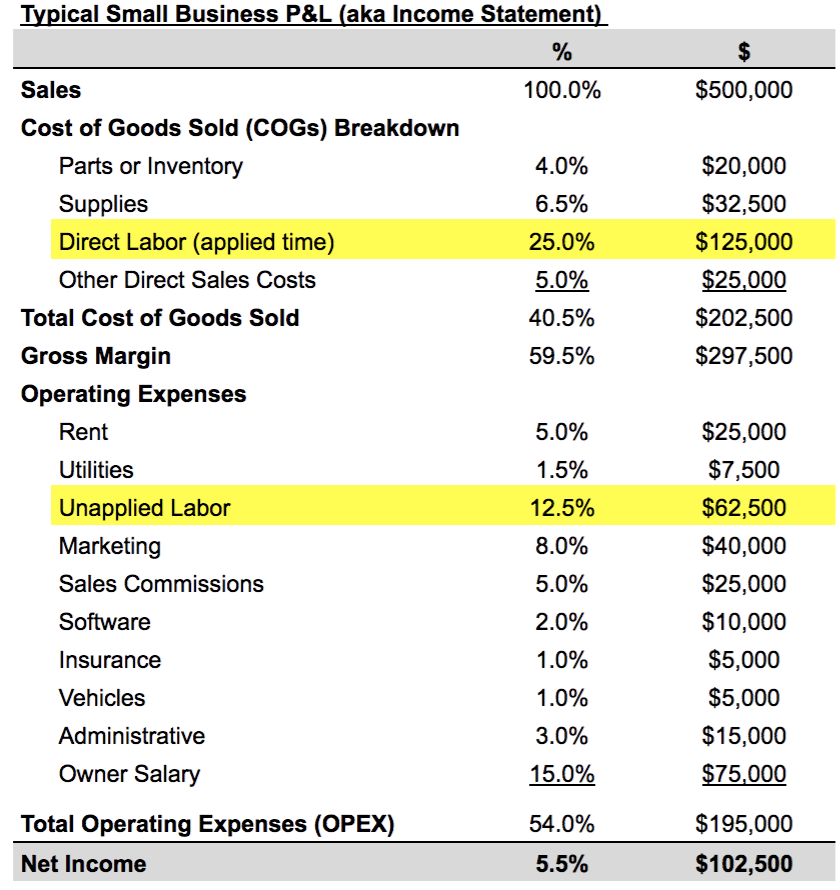

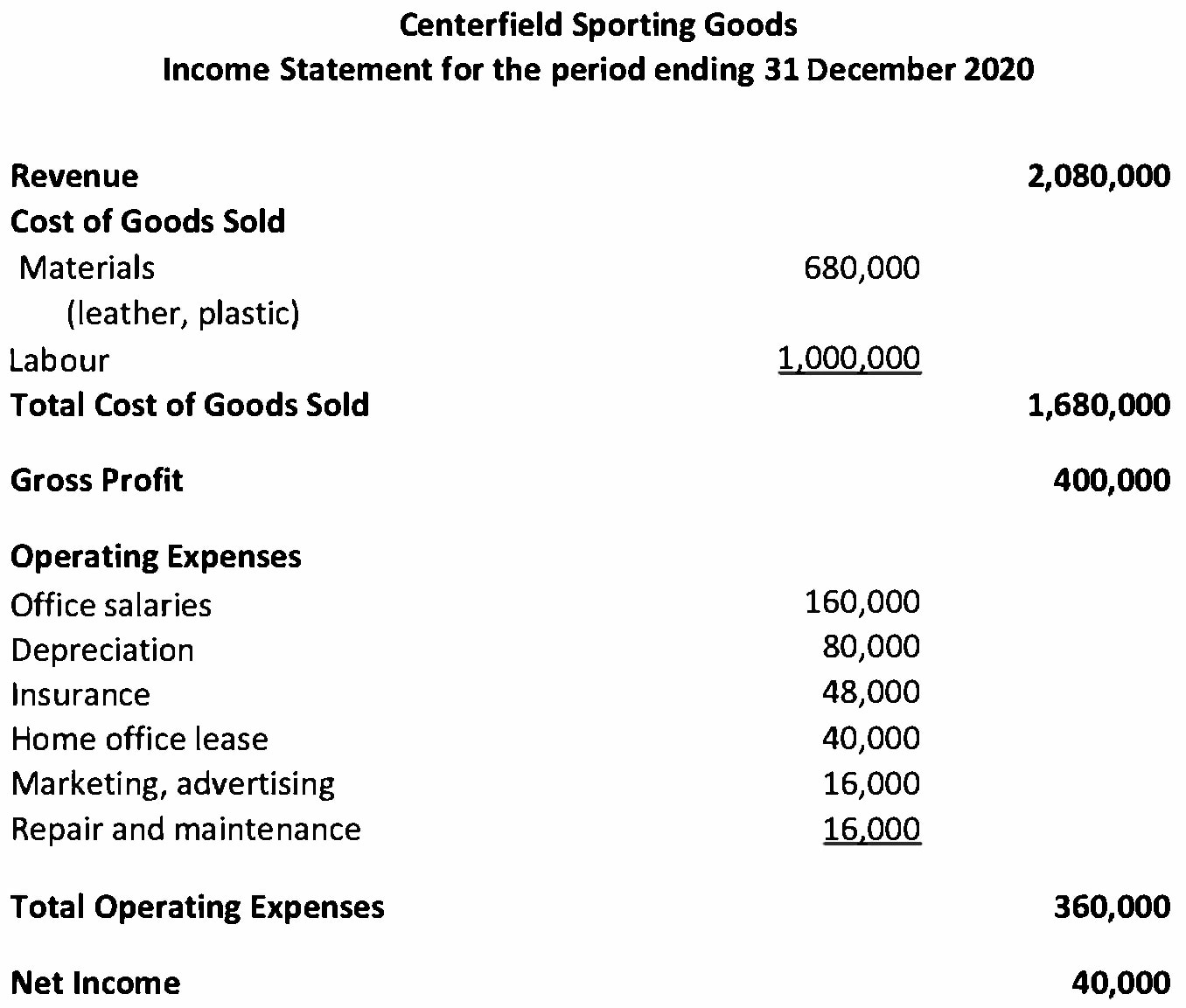

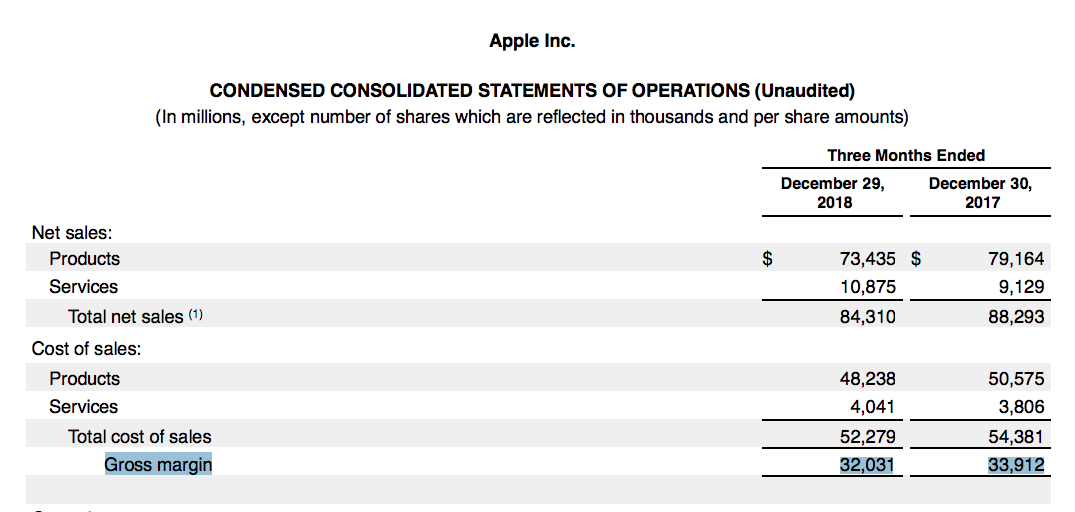

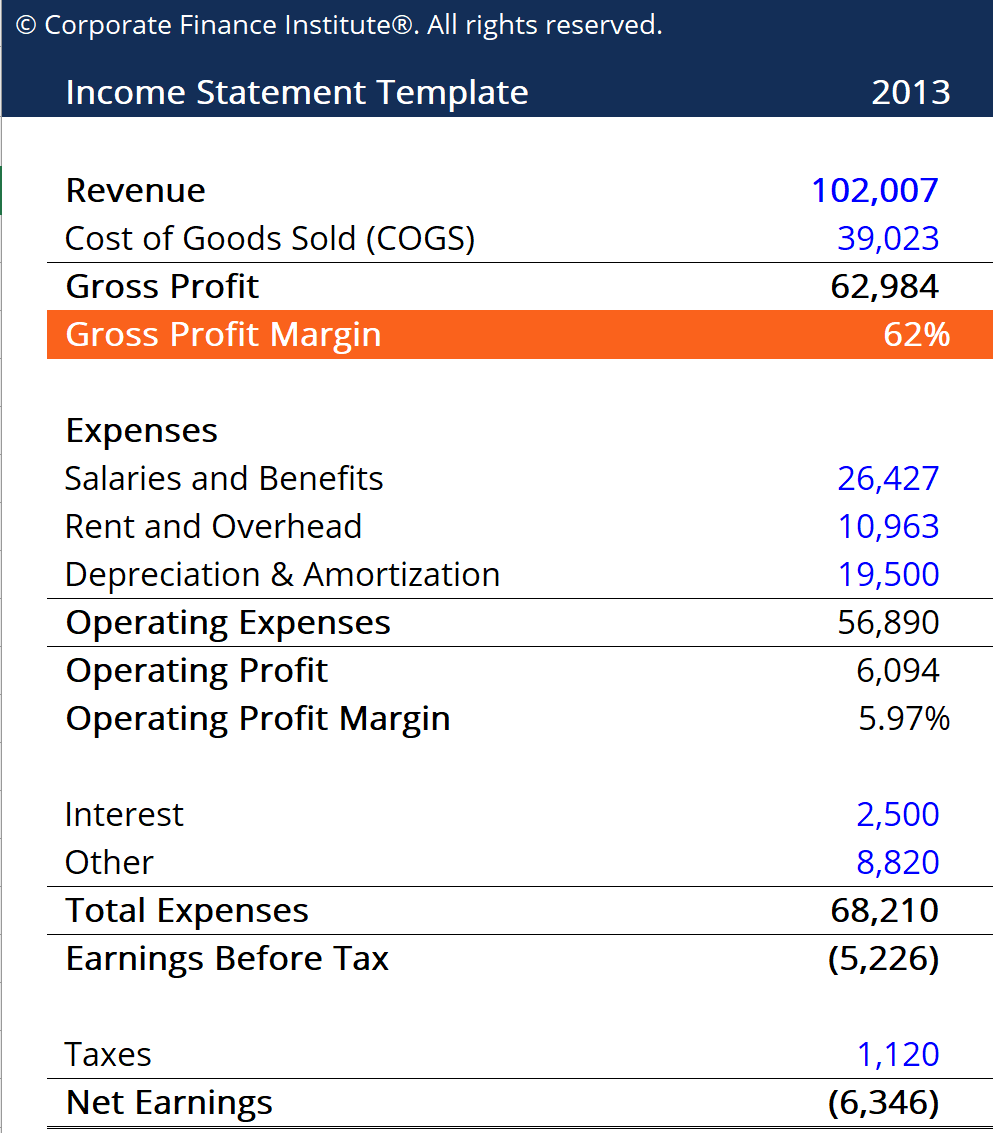

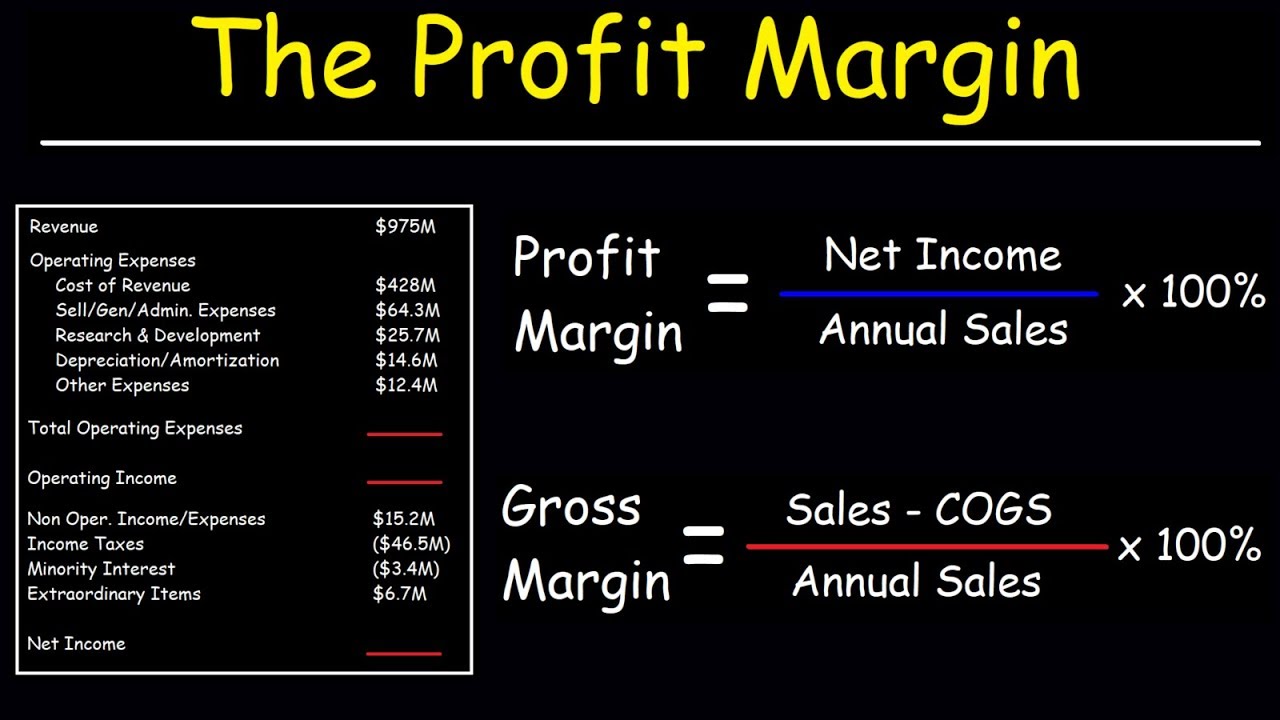

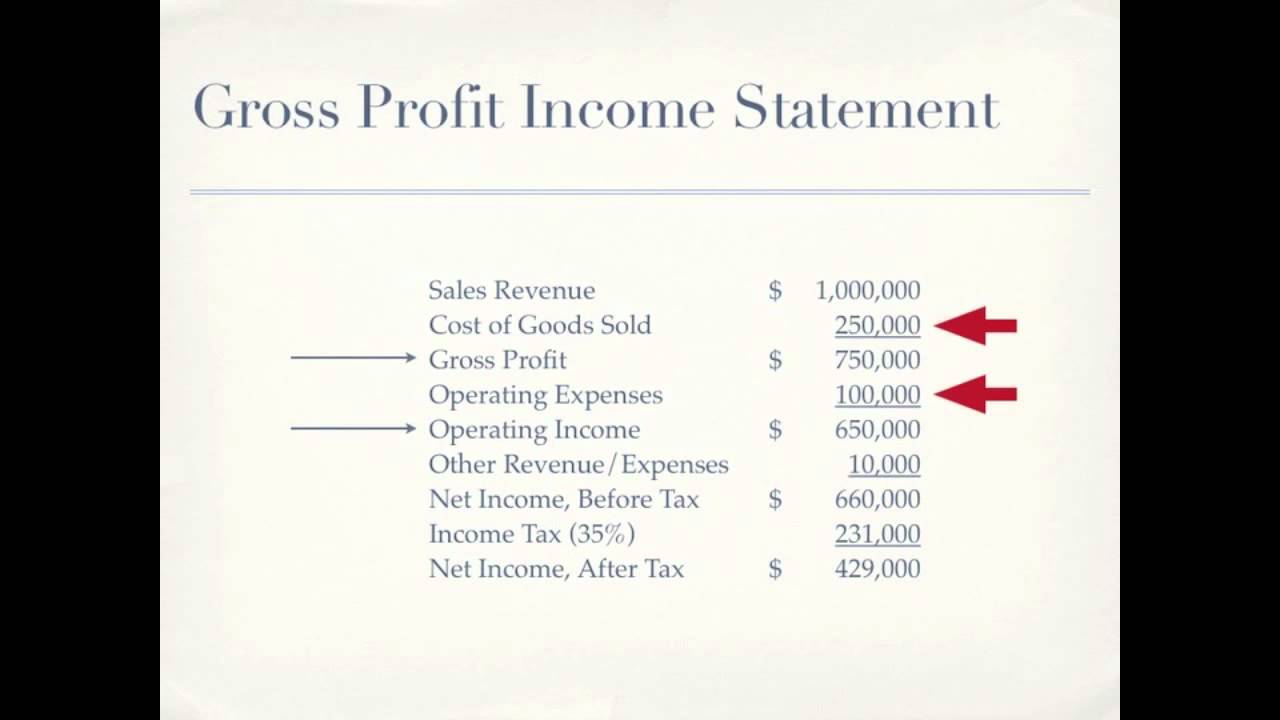

Gross margin on income statement. Then, all fixed expenses are subtracted to arrive at the net profit or net loss for the period. The gross profit formula is: The gross margin formula is:

The definition of gross margin is the profitability of a business after subtracting the cost of goods sold from the revenue. A company’s profit is calculated at three levels on its income statement. What is gross margin?

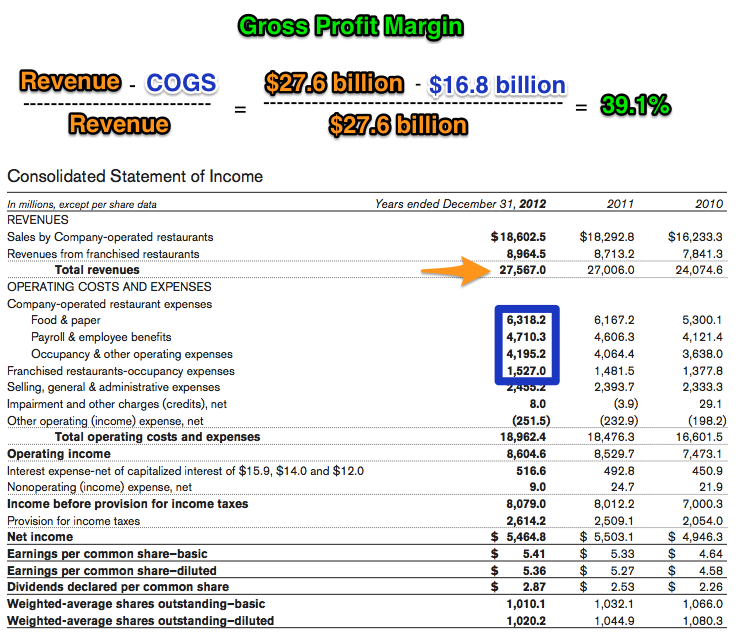

Common size income statement formula in order to change an income statement to a common size income statement you must divide. Gross margin = gross profit / revenue * 100. A company's gross margin is expressed as a percentage.

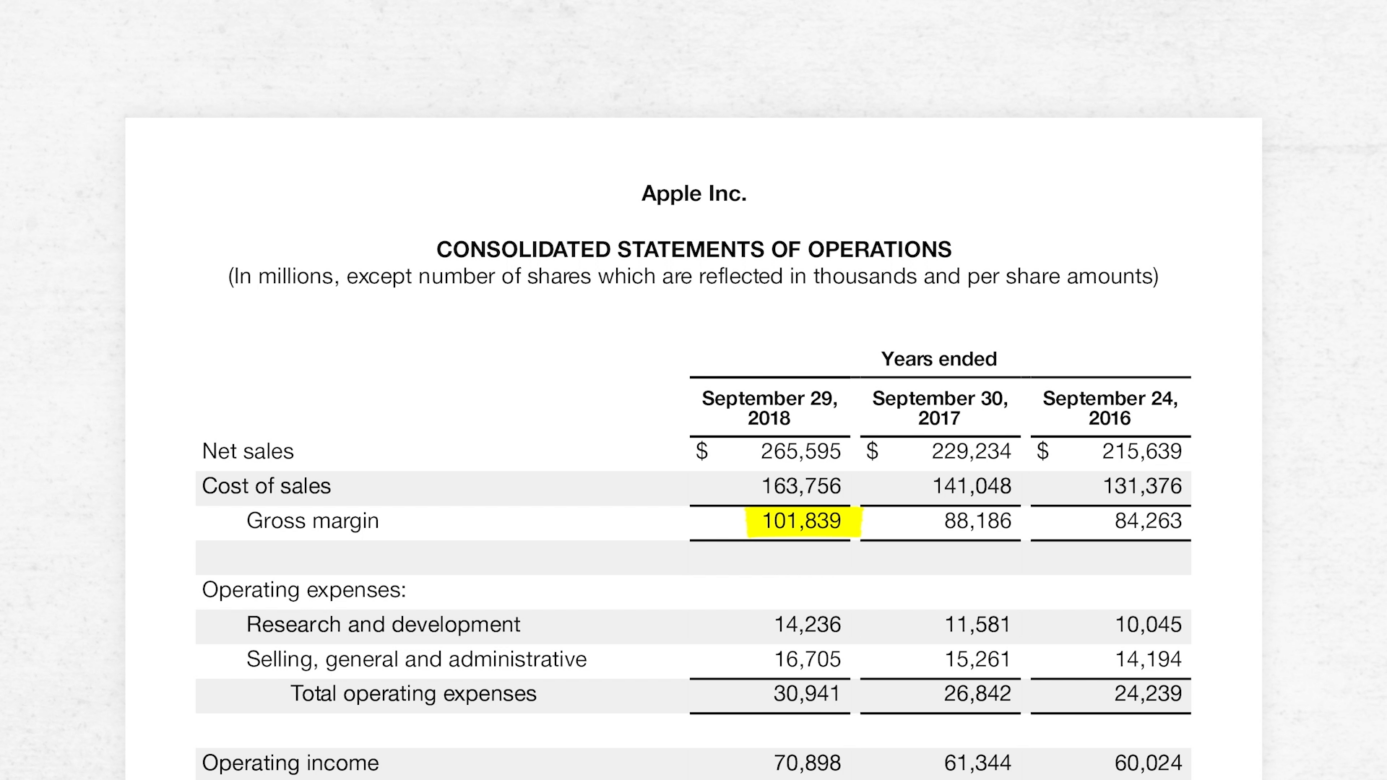

Gross profit margin = gross profit ÷ total revenue using a company’s income statement, you can find the gross profit total by starting with total sales and subtracting the line item cost of goods sold. Gross profit margin, operating profit margin, and net profit margin are the three main margin analysis measures that are used to analyze the income statement activities of a firm. The income statement shows a company or individual’s money coming in (revenue) and money going out (expenses) over a period.

The gross margin metric answers the following question, “how much in gross profits is kept for each dollar of revenue?” In short, it shows how a company makes money and how it spends it. If the business is a retailer, then the gross margin will instead be located after the cost of merchandise sold line item.

For example, gross margin is calculated by dividing gross profit by sales. The gross margin shows the percentage of its sales that are kept in the business after. Nonetheless, the gross profit margin deteriorated in year 2.

Gross margin is also known as gross profit. Gross margin is a required income statement entry that reflects total revenue minus cost of goods sold (cogs).

Notice that in terms of dollar amount, gross profit is higher in year 2. The sales and cogs can be found on a company's income statement. Gross profit margin (y1) = 265,000 / 936,000 = 28.3%.

This finance video tutorial explains how to calculate the net profit margin, the gross profit margin, and operating profit margin of a company given an incom. Gross margin represents how much of a company's sales revenue it keeps after incurring any direct costs associated with producing its goods and services. It's a simple profitability evaluation the gross margin is an easy, straightforward calculation that provides insights into profitability and performance.

Thus, the arrangement of expenses in the income statement corresponds to the nature of the. Why is gross margin important? location on income statement:

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)