Favorite Tips About Financial Statement Ratio

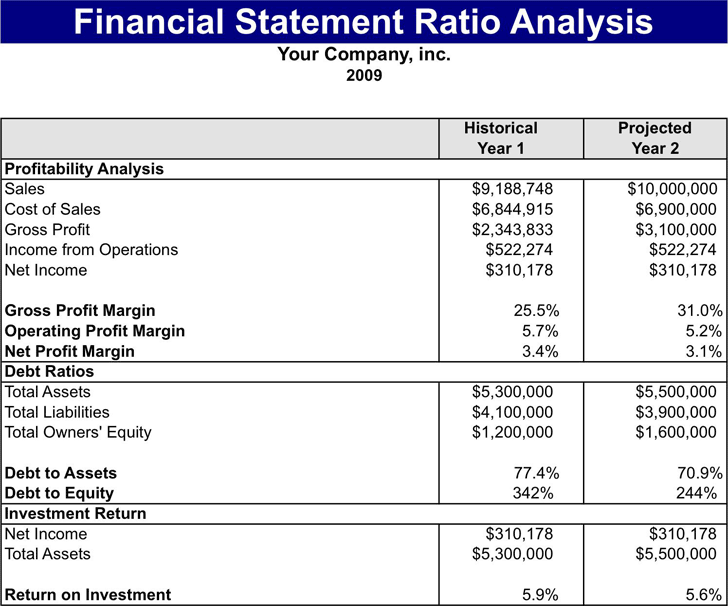

Financial ratios are mathematical comparisons of financial statement accounts or categories.

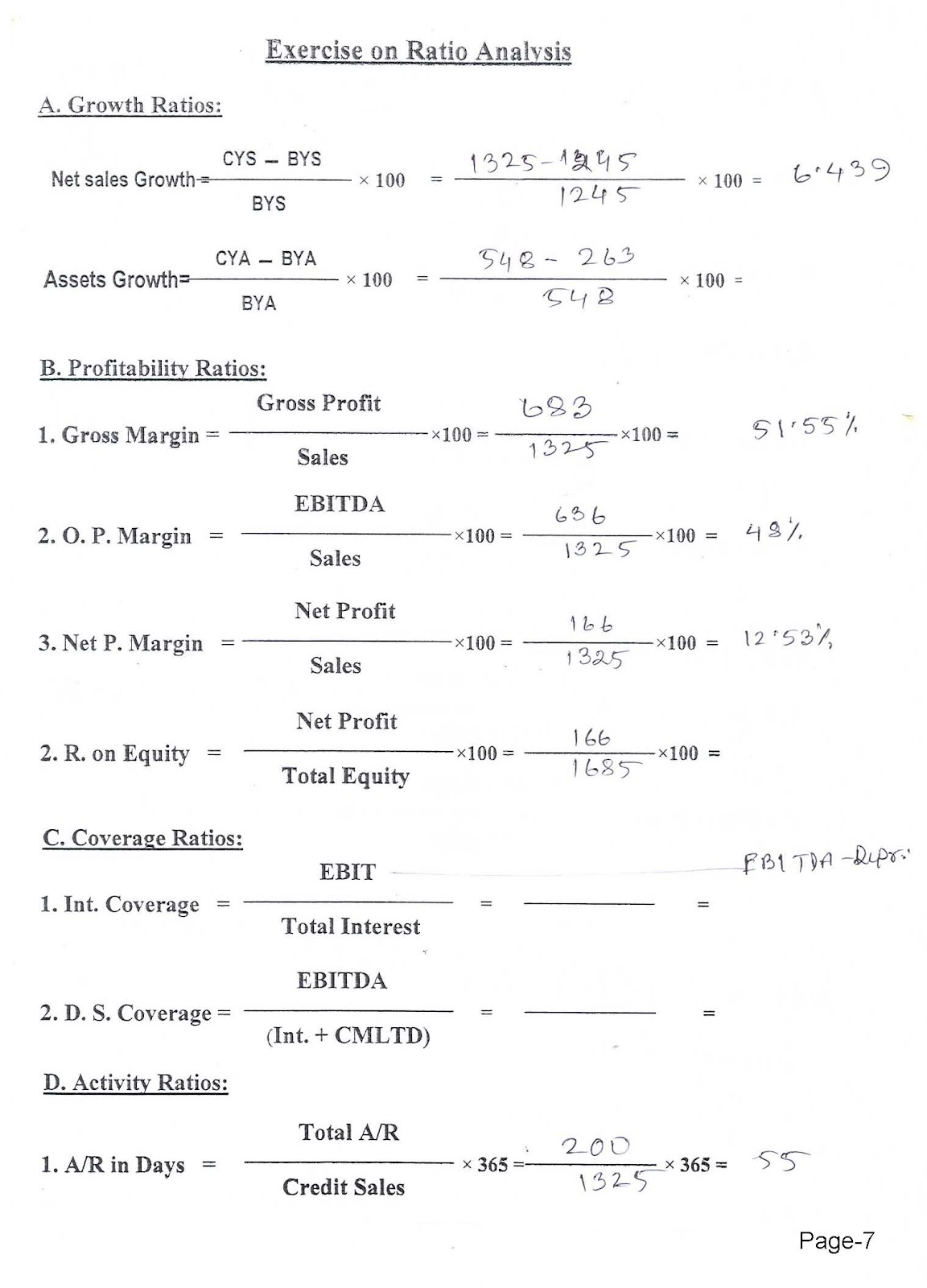

Financial statement ratio. Here is a list of various financial ratios. The resulting ratio can be interpreted in a way that is more insightful than looking at the items separately. Ratio analysis refers to the analysis of various pieces of financial information in the financial statements of a business.

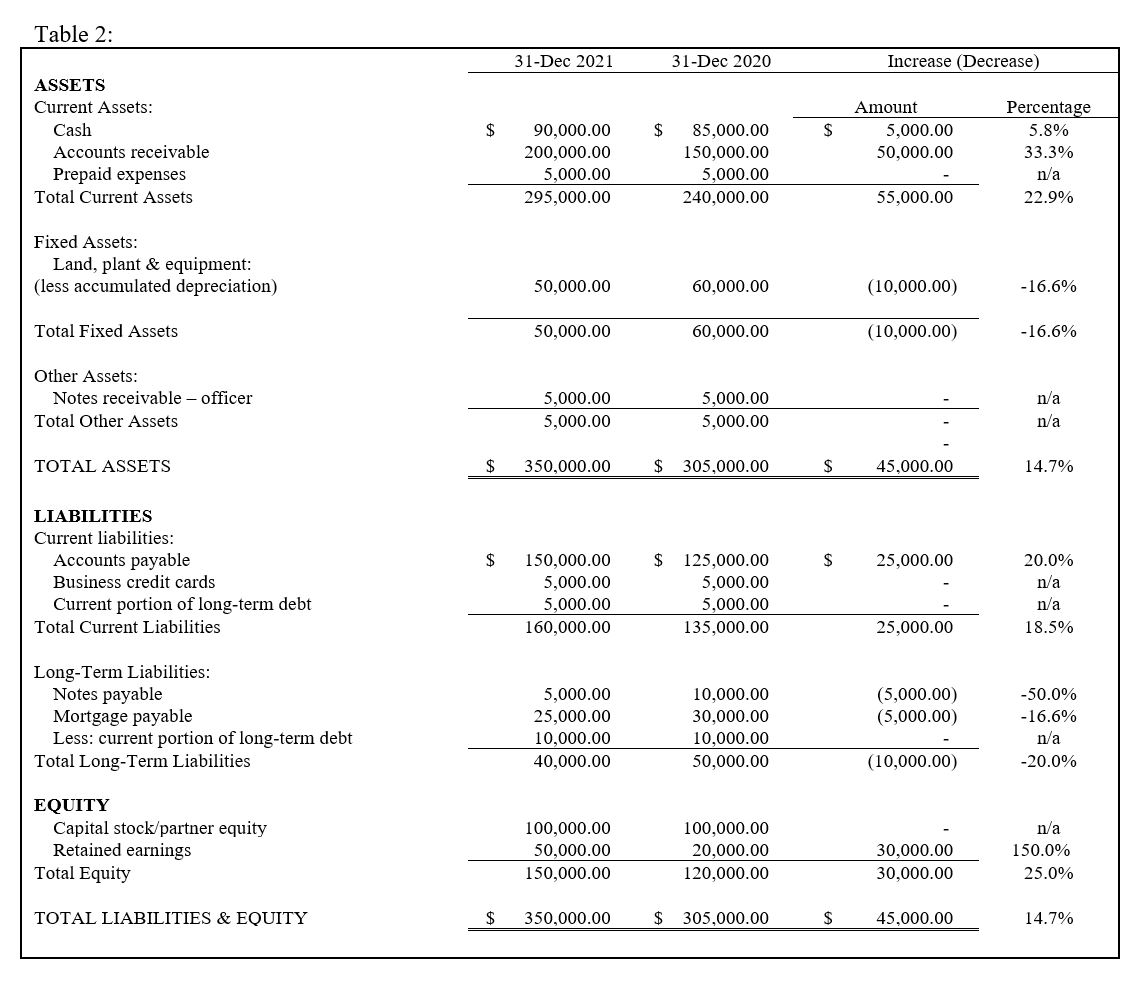

The balance sheet for financial ratio analysis. The income statement for financial ratio analysis. Uses and users of financial ratio analysis.

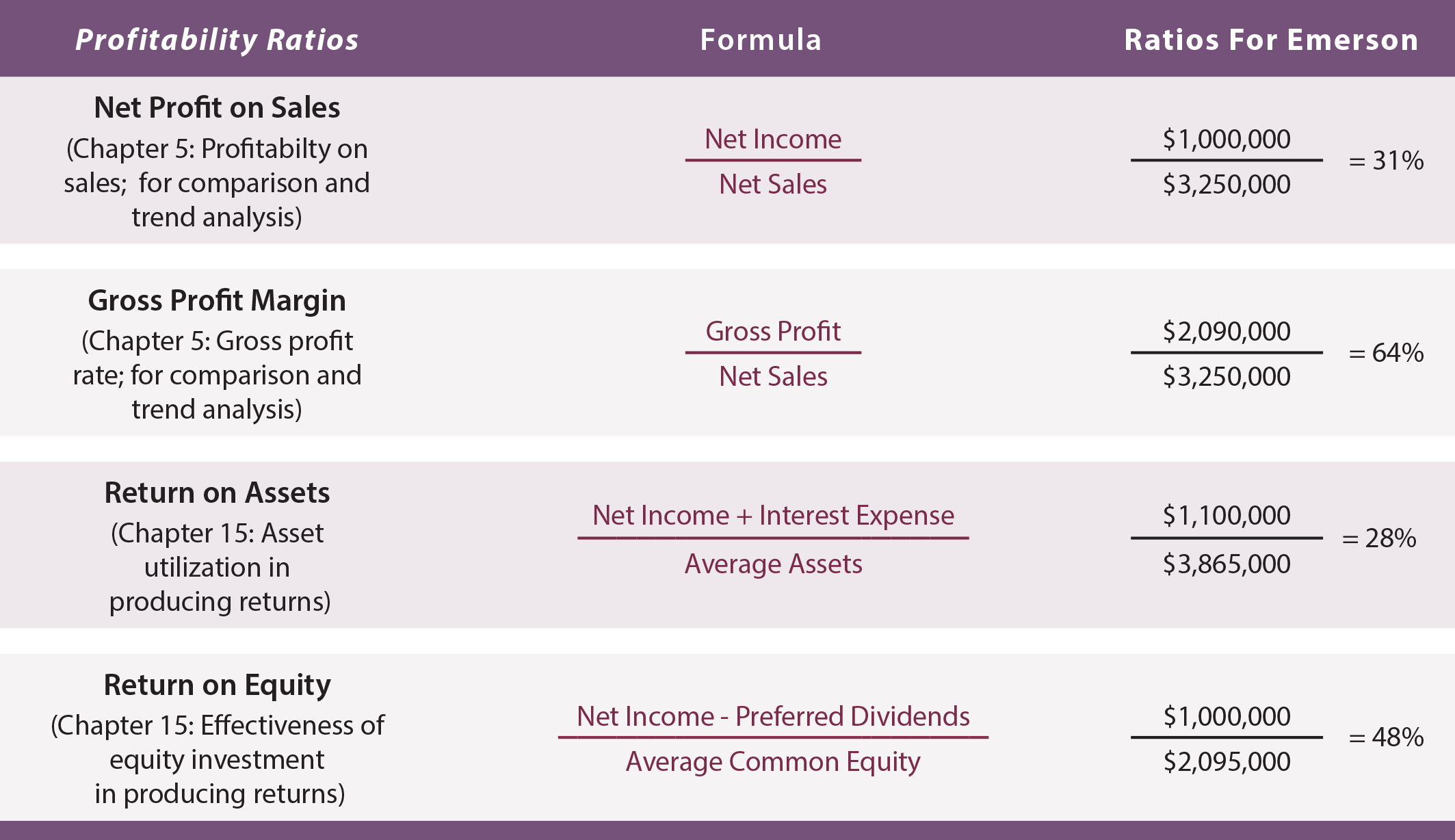

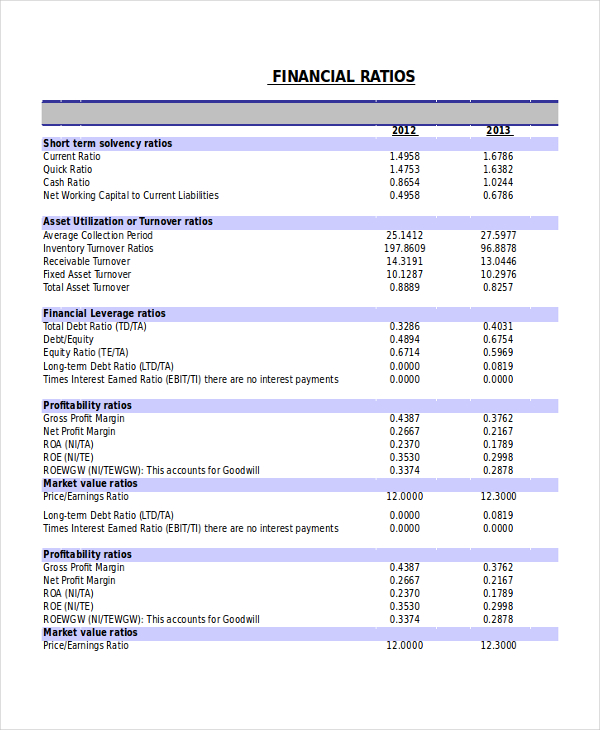

Financial ratios are grouped into the following categories: Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial. A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements.

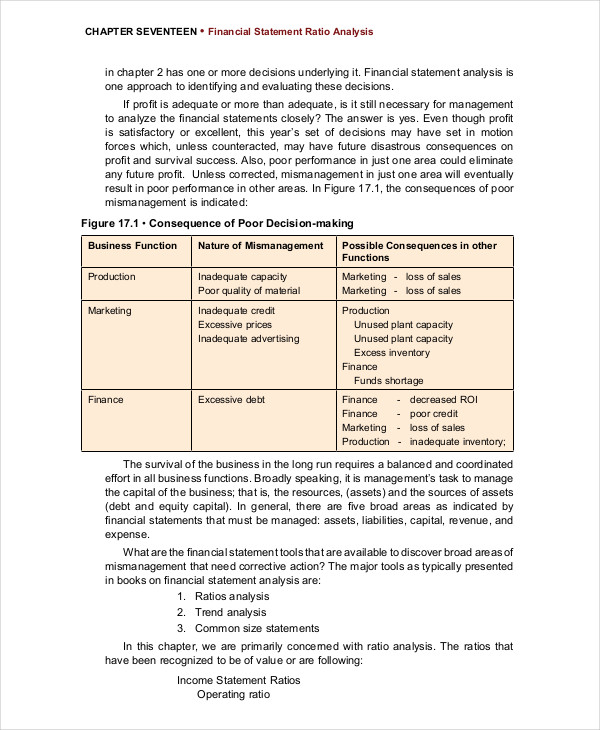

Updated on november 30, 2022. Analysis of financial ratios serves. These relationships between the financial statement accounts help investors, creditors, and internal company management understand how well a business is performing and of areas needing improvement.

Financial ratios are the indicators of the financial performance of companies. What is ratio analysis? Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc.

Learn the most useful financial ratios here. They are mainly used by external analysts to determine various aspects of a business, such as. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)