Underrated Ideas Of Info About Taxation Paid Cash Flow Statement

Also, for statements of cash flows, only use the actual amount of tax paid or received.

Taxation paid cash flow statement. Because fathom does not receive individual transactions from the source accounting system, we calculate the cash tax paid to know how much actual. When taxation cash flows are disclosed under different. Hence, a statement showing flows of cash & cash equivalent during a specified time period is known as a cash flow statement.

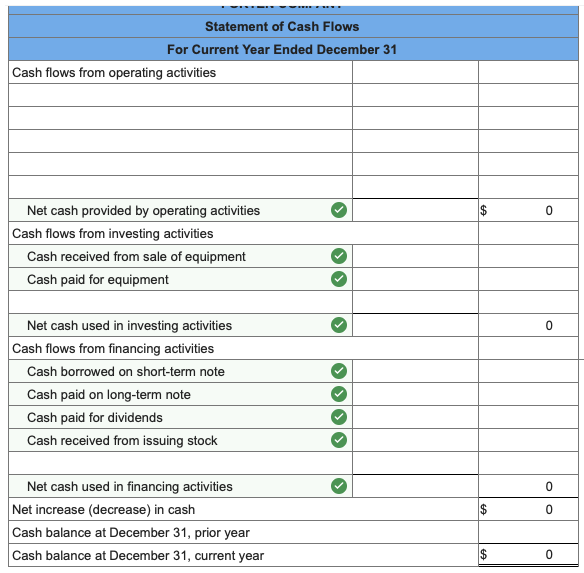

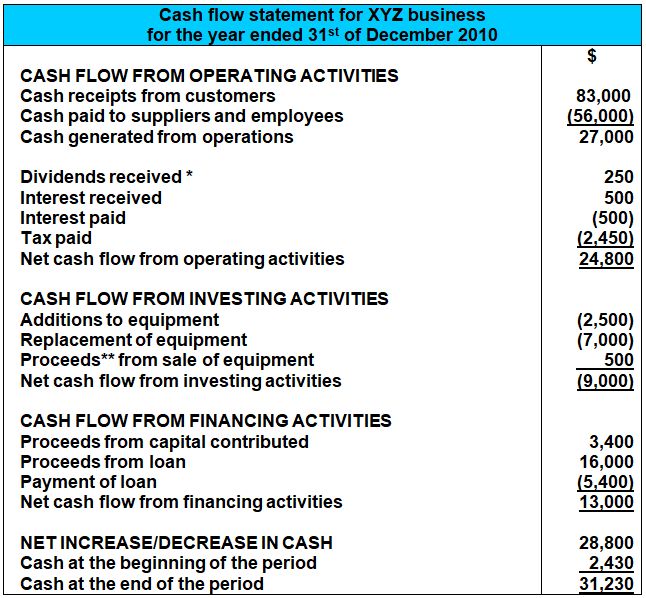

The following examples illustrate all three of these cases. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally presented on a. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

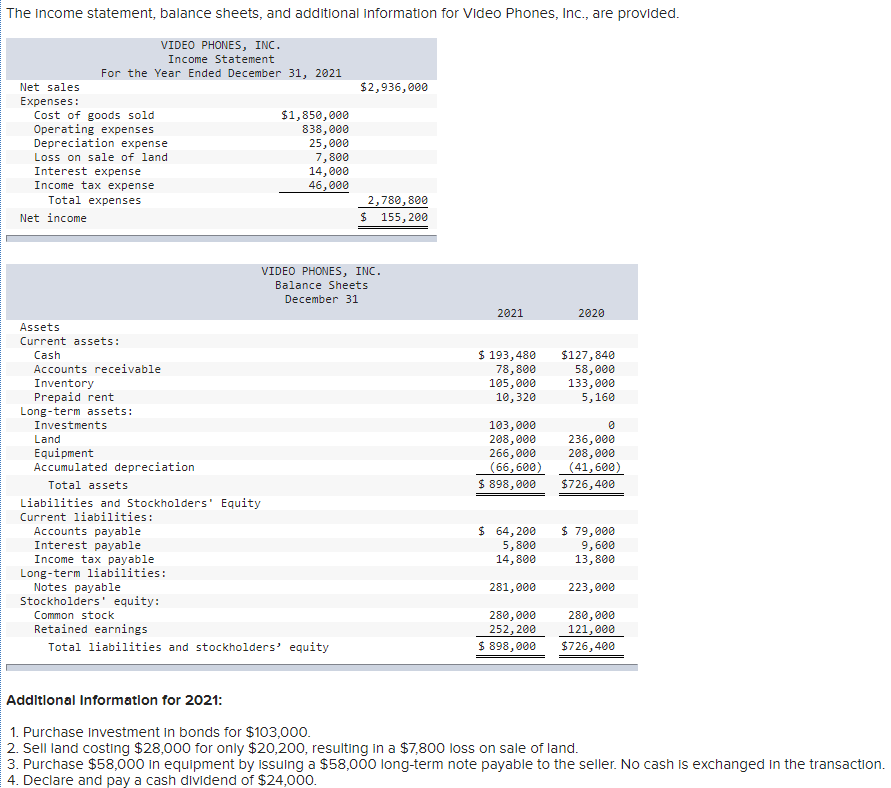

Taxes paid are generally classified as operating cash flows. Using the direct method, the $92,000 total tax payment is allocated $80,000 to operating activities and $12,000 to investing activities. The determination of income tax paid can be complex because in addition to current tax payable, the application of tax effect accounting can generate deferred tax assets and deferred tax liabilities.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. The cash flow statement also includes information on tax expenses. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time.

The figure in the statement of comprehensive income may include tax accrued, but not actually paid. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. The statement is comprised of three sections, in which are presented the cash flows that occurred during the reporting period relating to the following topics noted below.

Cash inflows are the transactions that result in an increase in cash & cash equivalents; Proposed presentation (tax allocation). Fundamental principle in ias 7

Income tax payable income tax payable is exactly what it sounds like, accounting tools says, an. If the indirect method is used, amounts of taxes paid during the period must be disclosed. Whereas, cash outflows are the transactions that result in a reduction in cash & cash equivalents.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Learn how operating cash flow works, how it is used, and how you can calculate taxes from it. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

Tax paid is the amount of actual cash paid to the authorities and is reported in the cash flow statement tax expense tax expense is always found on the income statement and is the total tax payable on a company’s profits for the given period. An income statement (also called a profit and loss statement) measures the amount of profits generated by a firm over a given time period (usually a year or a quarter). A statement of cash flows contains information about the flows of cash into and out of a company, and the uses to which the cash is put.

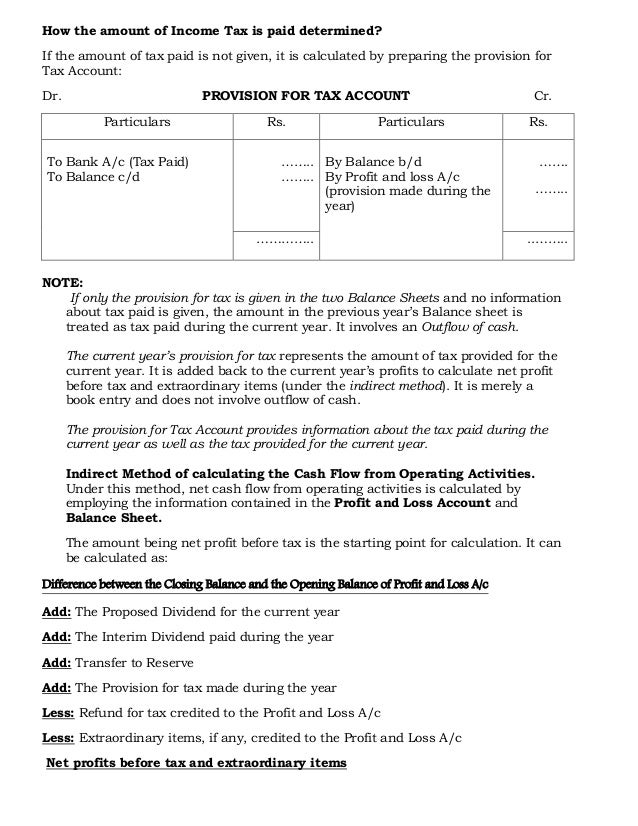

Common cash flow calculations include the tax paid (which is an operating activity cash outflow), the payment to buy property, plant and equipment (ppe) (which is an investing activity cash outflow), and dividends paid (which is a financing activity cash outflow). Accounting for income taxes >> ias 14 >> determining income tax paid : Anurag pathak april 14, 2022 cash flow statement 1 share your love confused, what is the accounting treatment of provision for taxation in the cash flow statement table of contents when only a single amount of provision for taxation is given in question when only a single amount of tax paid is given in the question.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)