Divine Tips About Cost Volume Profit Income Statement

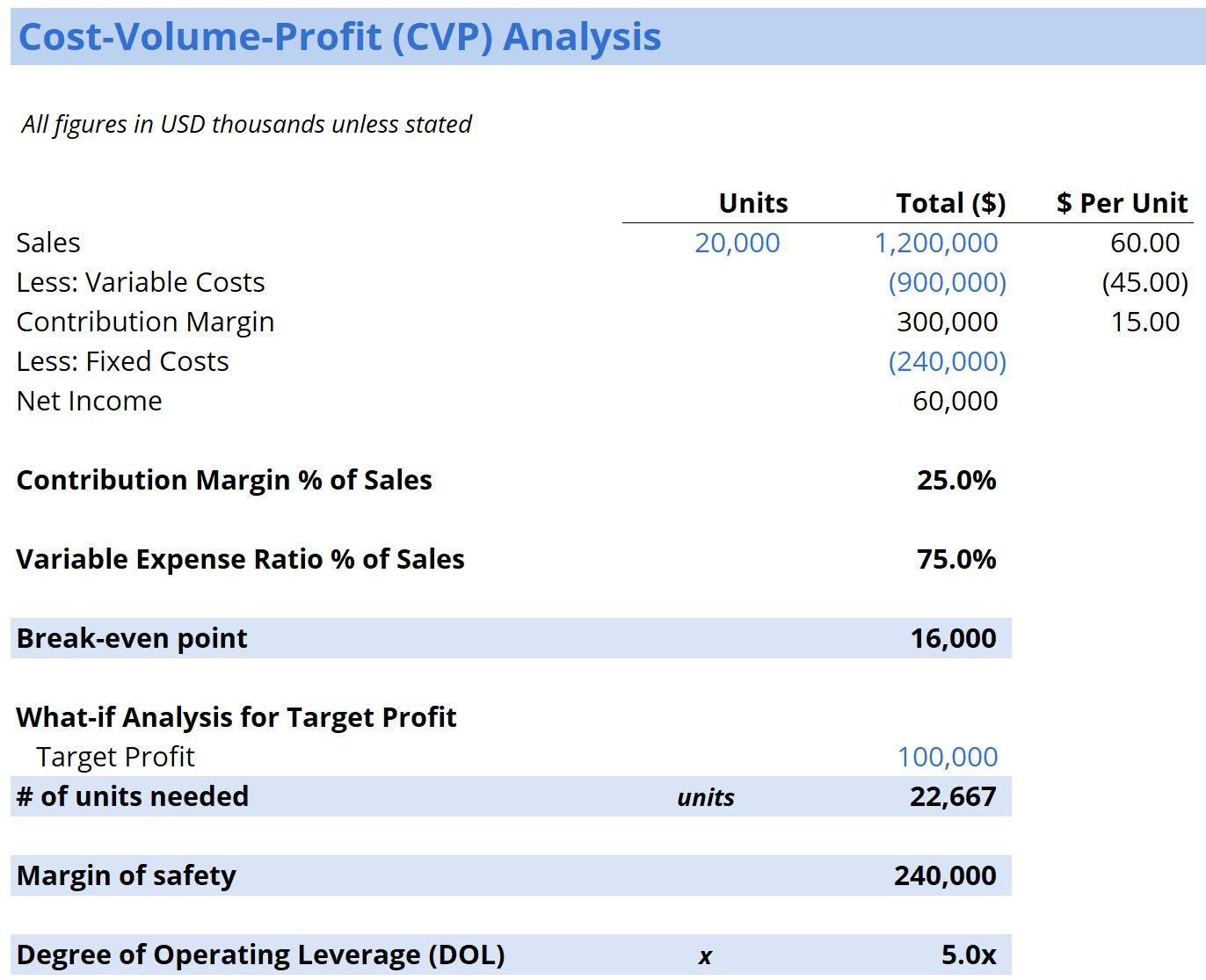

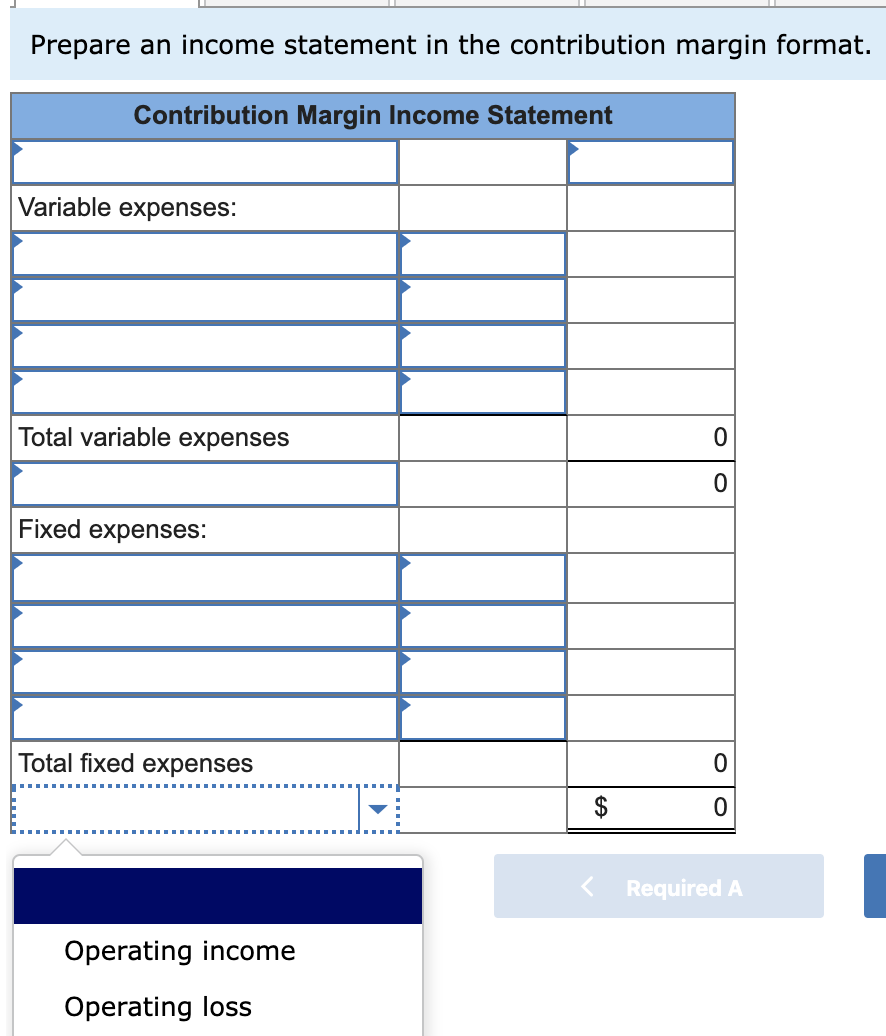

(in our income statement, this is also called net income) fixed costs:

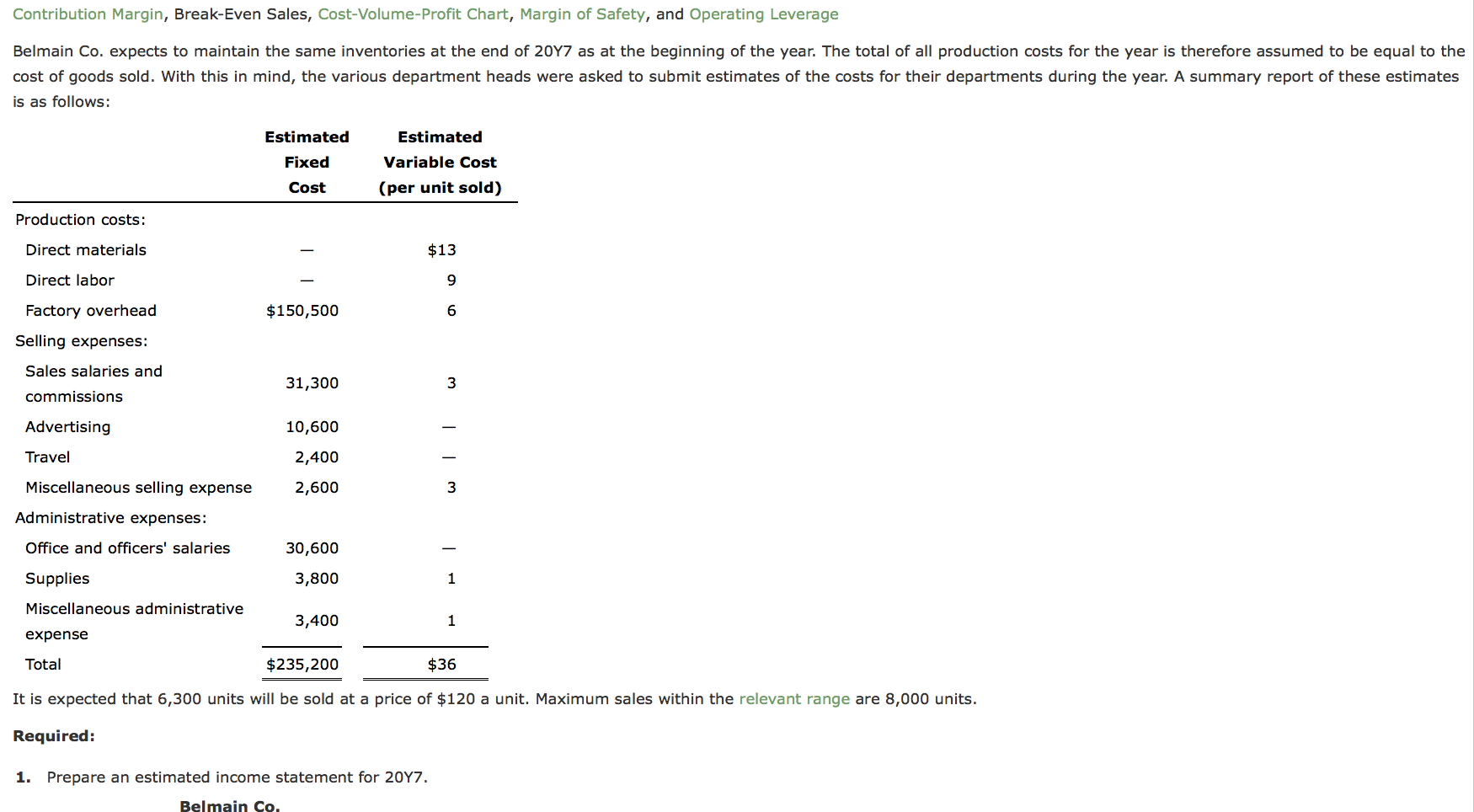

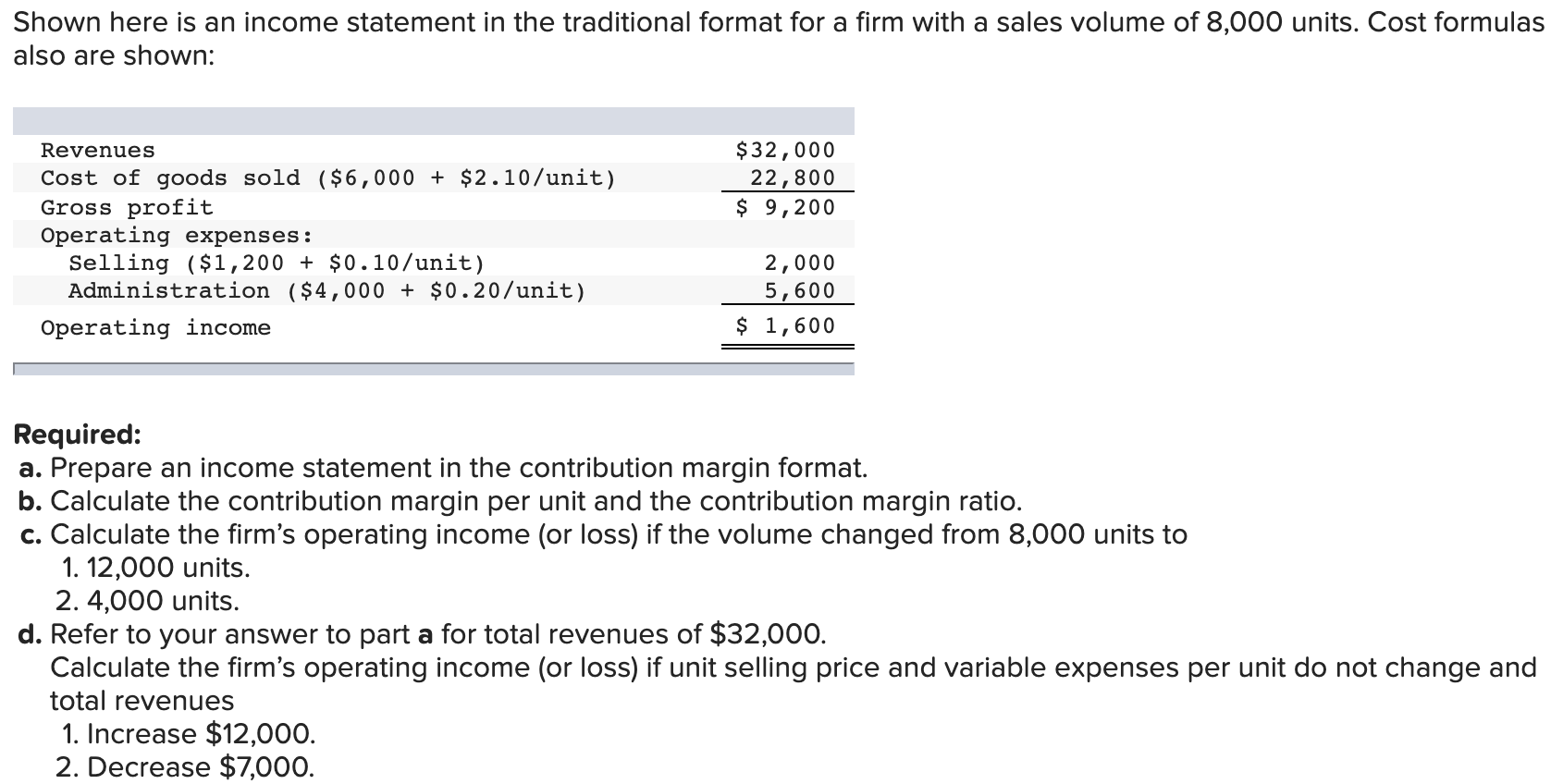

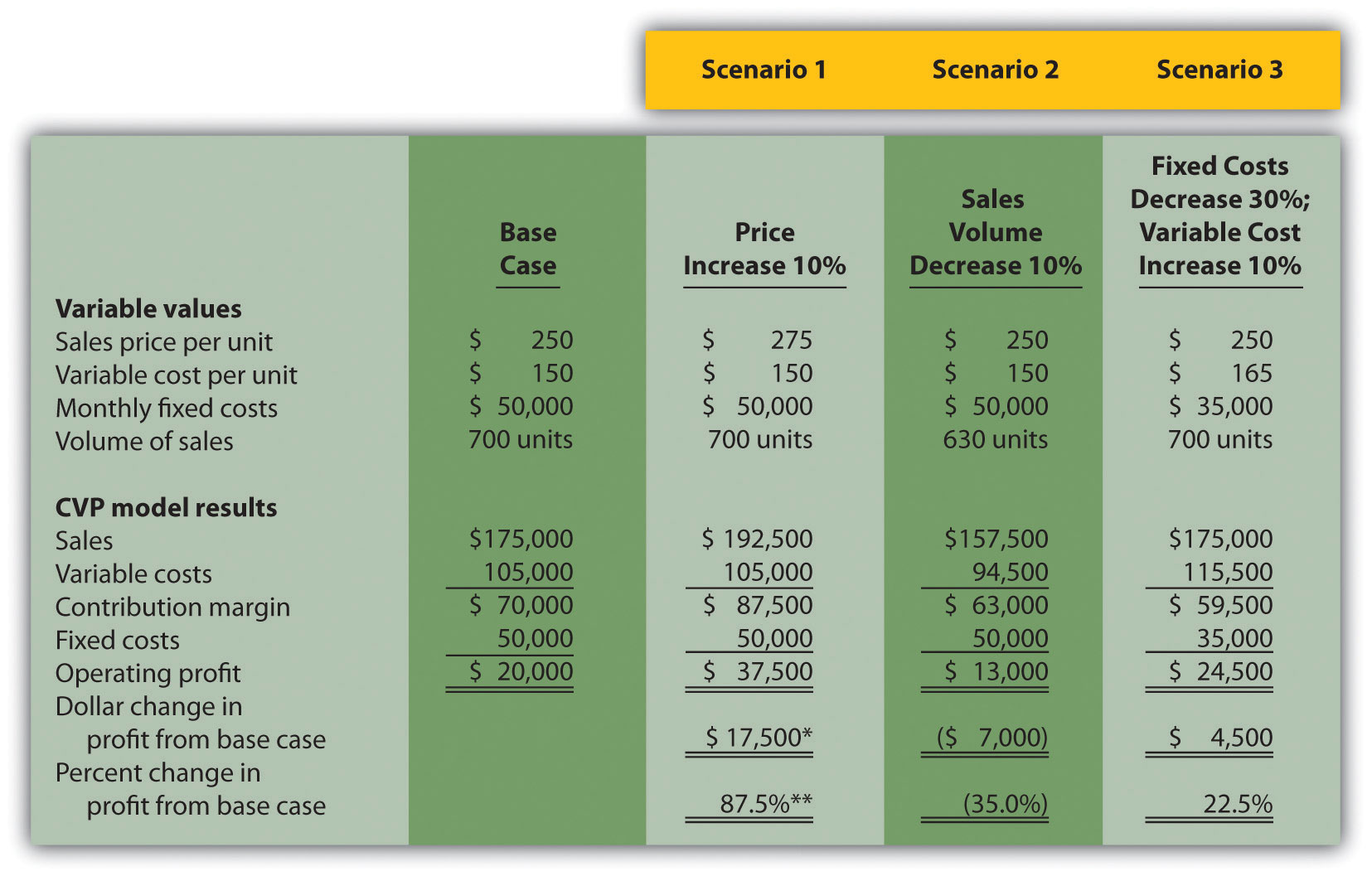

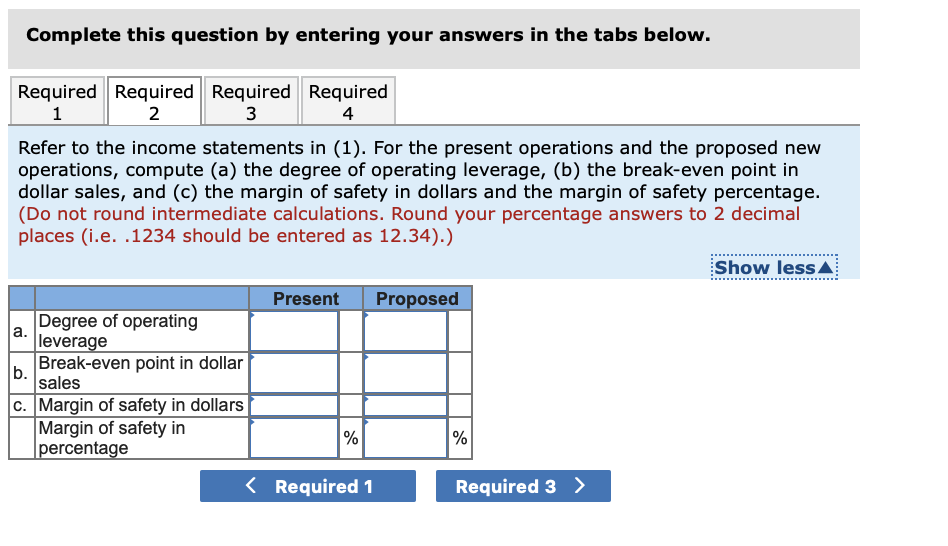

Cost volume profit income statement. Variable costs per unit are constant. Whether you spend 5 nights a week there or one night a week, your rent remains constant. Responses should include a description of how the cvp analysis information can be brought into a projected income statement that takes into account additional revenues and expenses of the business to create a “big picture” of what happens as a result of a change in cost, volume, and profit.

For example, your rent may be $500 a month. Explore the components in these analyses, the assumptions they take,. This approach would help students learn about cvp analysis and reduces their memorization of.

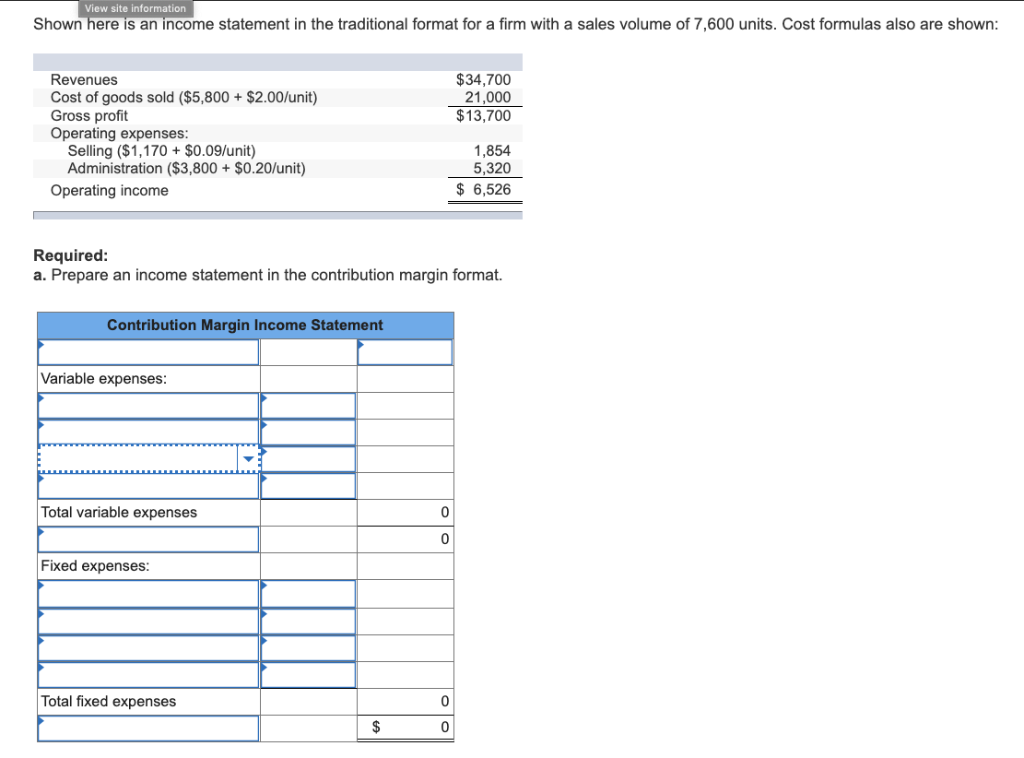

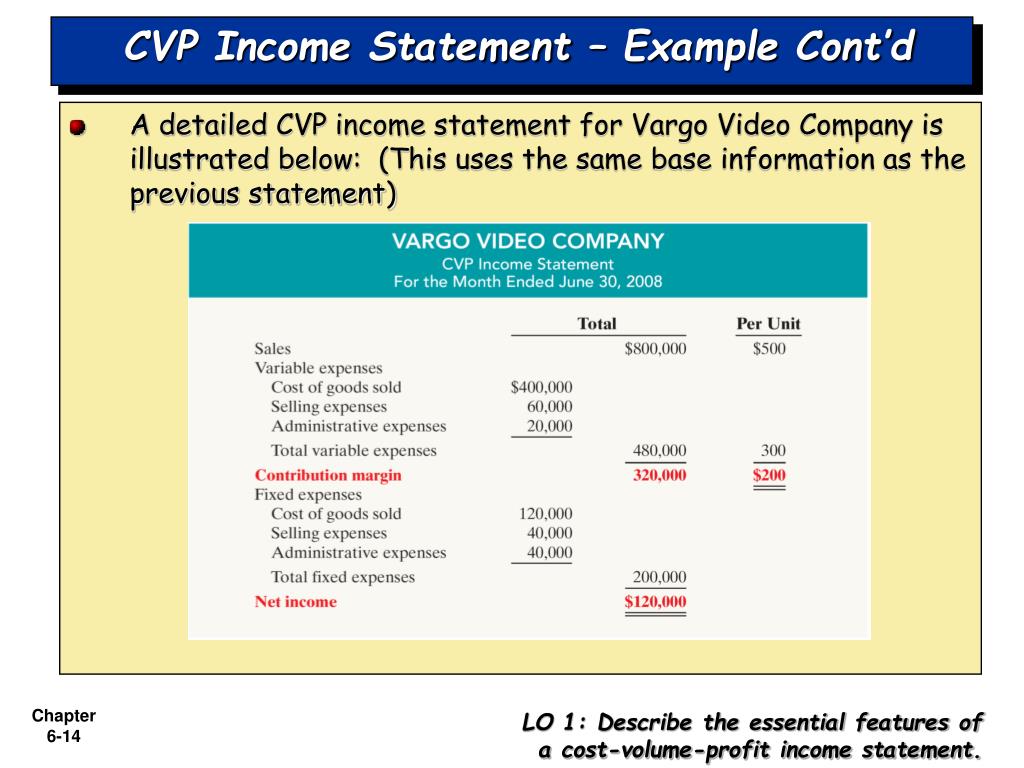

You can view the transcript for “contribution margin income statement” here (opens in new window). In performing this analysis, there are several assumptions made, including: The profit equation 1 shows that profit equals total revenues minus total variable costs and total fixed costs.

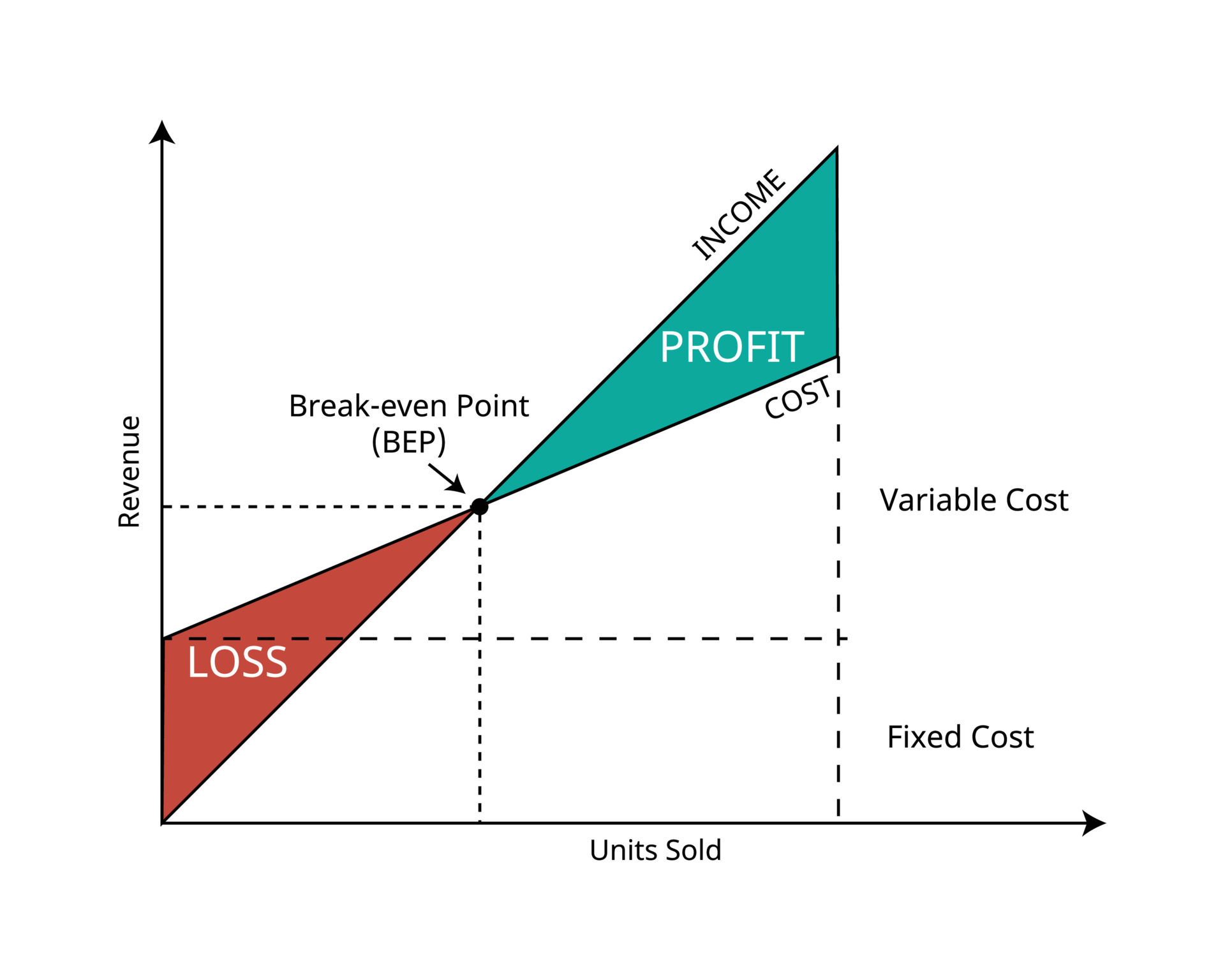

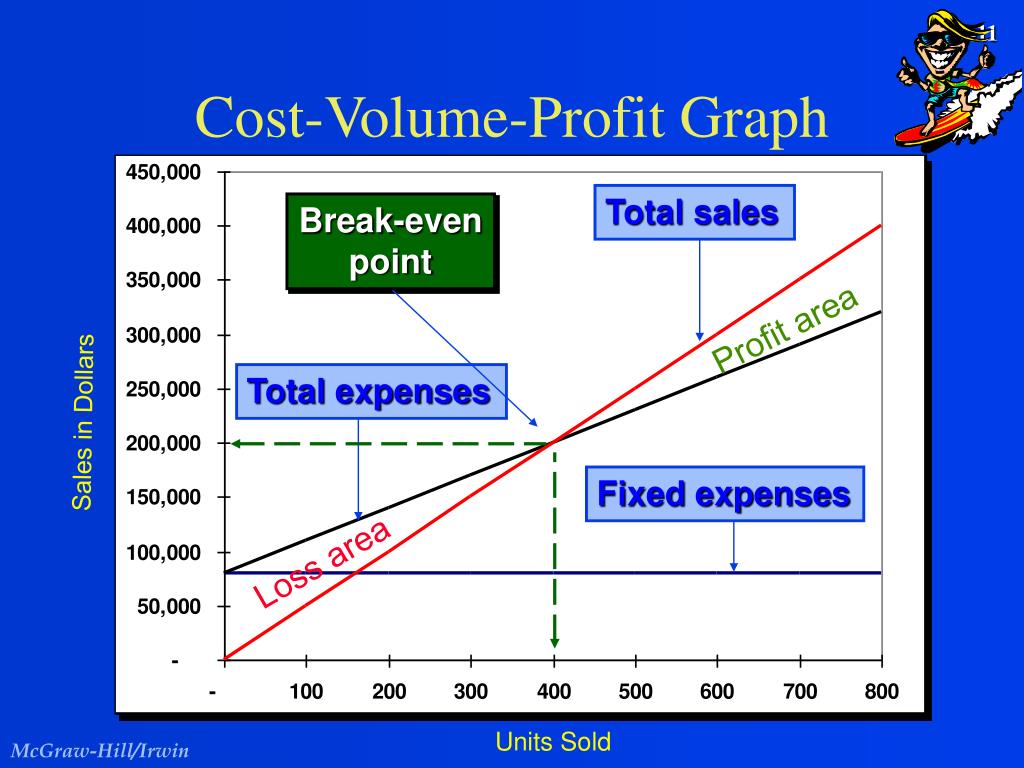

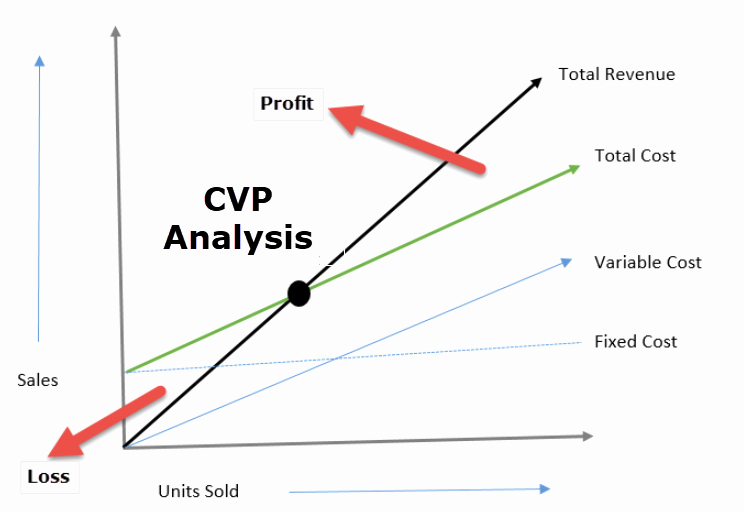

It is a financial analysis tool that helps business owners and analysts to understand the relationship between costs, volume, and profits. In the chart, we demonstrate the effect of volume on revenue, costs, and net income, for a particular price, variable cost per unit, and fixed cost per period. Cost volume profit (cvp) analysis helps managers make many important decisions such as what products and services to offer, what prices to charge, what marketing strategy to use, and what cost structure to maintain.

What is cost volume profit analysis? The expenses that exist regardless of the quantity of product sold. Total fixed costs are constant.

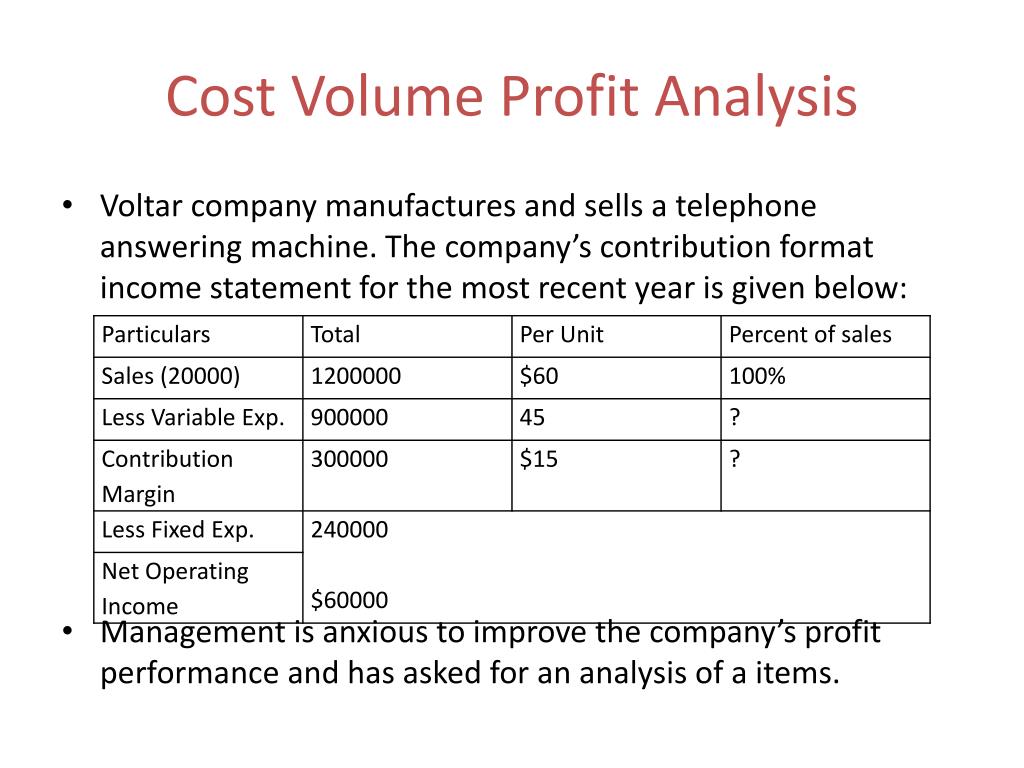

Cost volume profit (cvp) analysis is a managerial accounting technique used to determine how changes in sales volume, variable costs, fixed costs, and/or selling price per unit affect a business’s operating income. Cost volume profit analysis can be used to analyze the effect on net operating income from changes in variable costs, also considered a change in cost structure. The key formulas for an organization with a single product are summarized in the following list.

At each volume, one can estimate the company’s profit or loss. From the accounting records, you were able to build this cvp model based on the company producing an estimated 2,500 units. These costs include things like rent.

The focus may be on a single product or on a sales mix of two or more different products. For the full year, net revenues grew 6% to $45.8 billion, and. Its primary purpose is to estimate how profits are affected by the following five factors:

Sales price per unit is constant. Overview a critical part of cvp analysis is the point where total revenues equal total costs (both fixed and variable costs). A change in variable cost is a per unit change, so it affects the per unit amounts on the contribution margin income statement.

Introduction to the application of cost. At each volume, one can estimate the company’s profit or loss. The table shows an income statement that observes total income from sales, contribution margin.