Heartwarming Tips About Preparing An Income Statement And A Balance Sheet

They tell your story. kloudac_global on instagram:

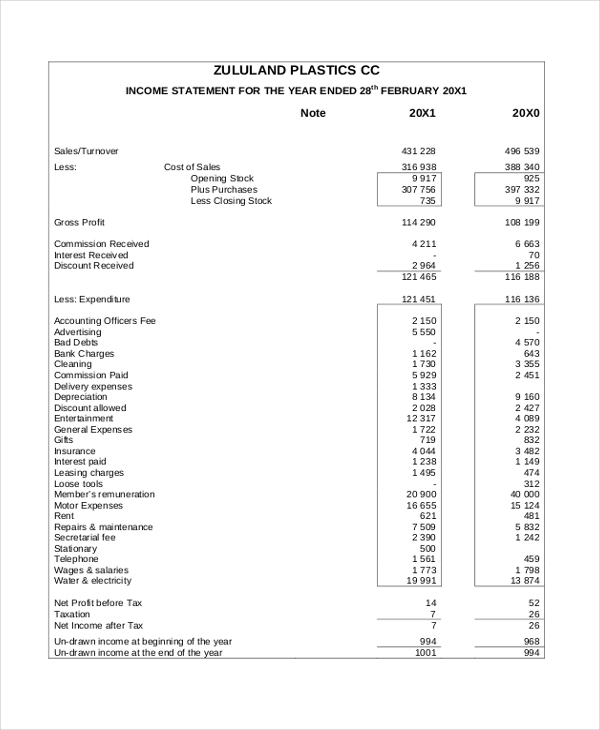

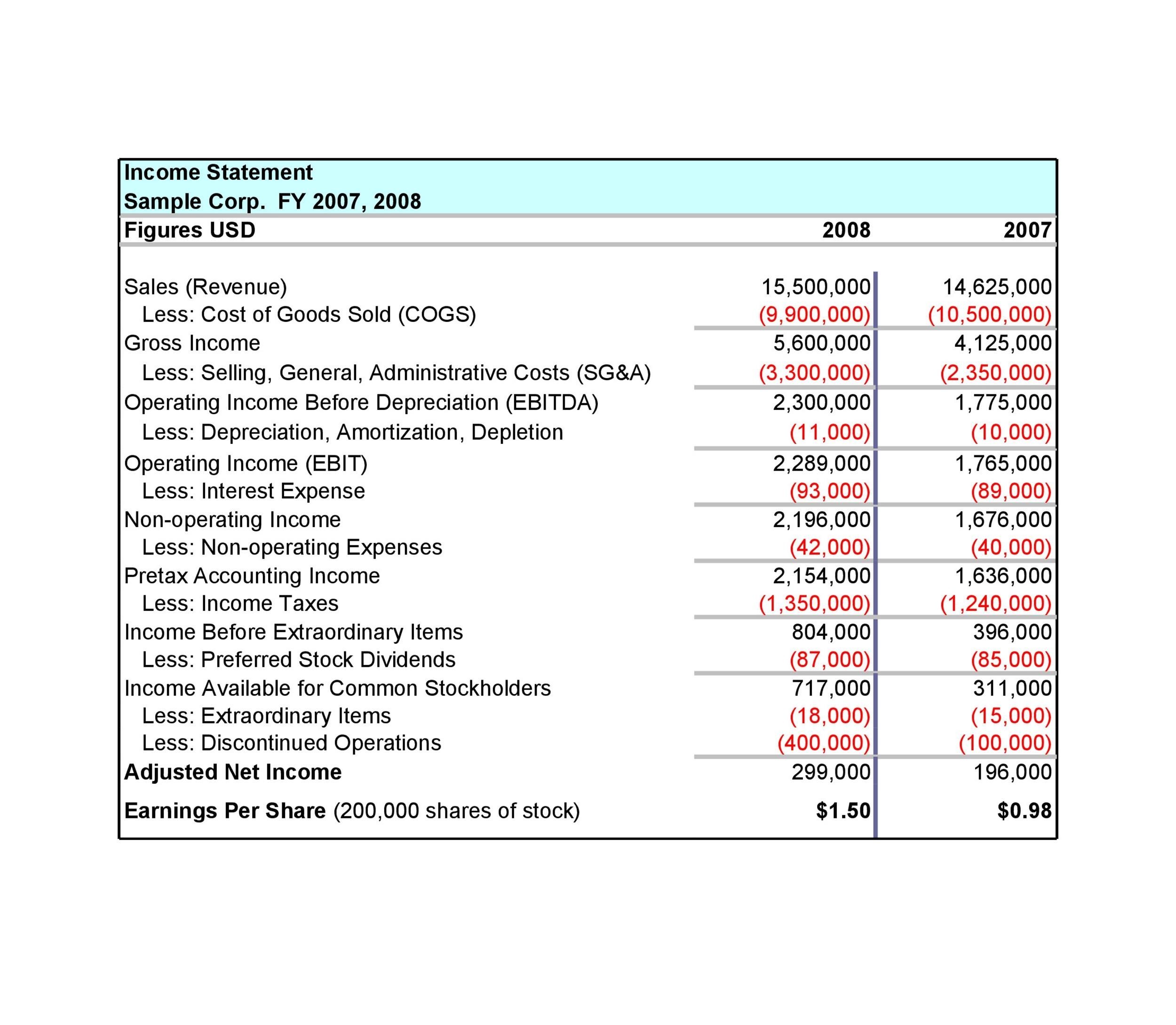

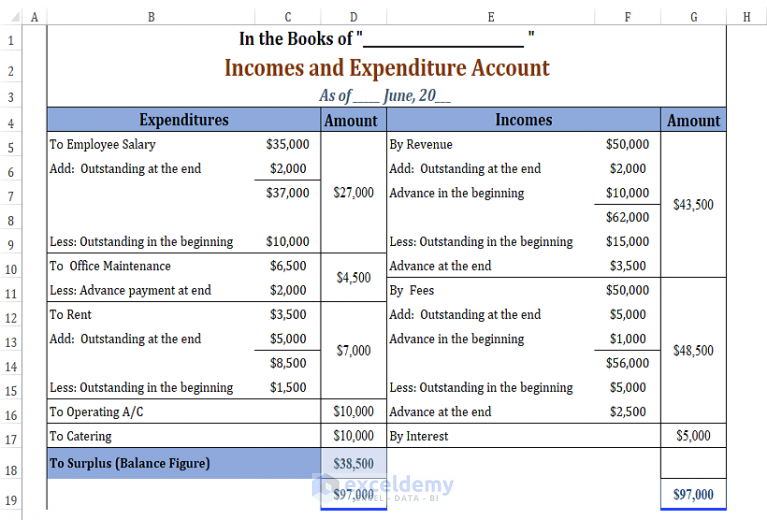

Preparing an income statement and a balance sheet. Net income and retained earnings. 2.3 prepare an income statement, statement of owner’s equity, and balance sheet highlights one of the key factors for success for those beginning the study of accounting is to understand how the elements of the financial. An income statement is a document that tracks a business's revenue and expenses over a set period of time.

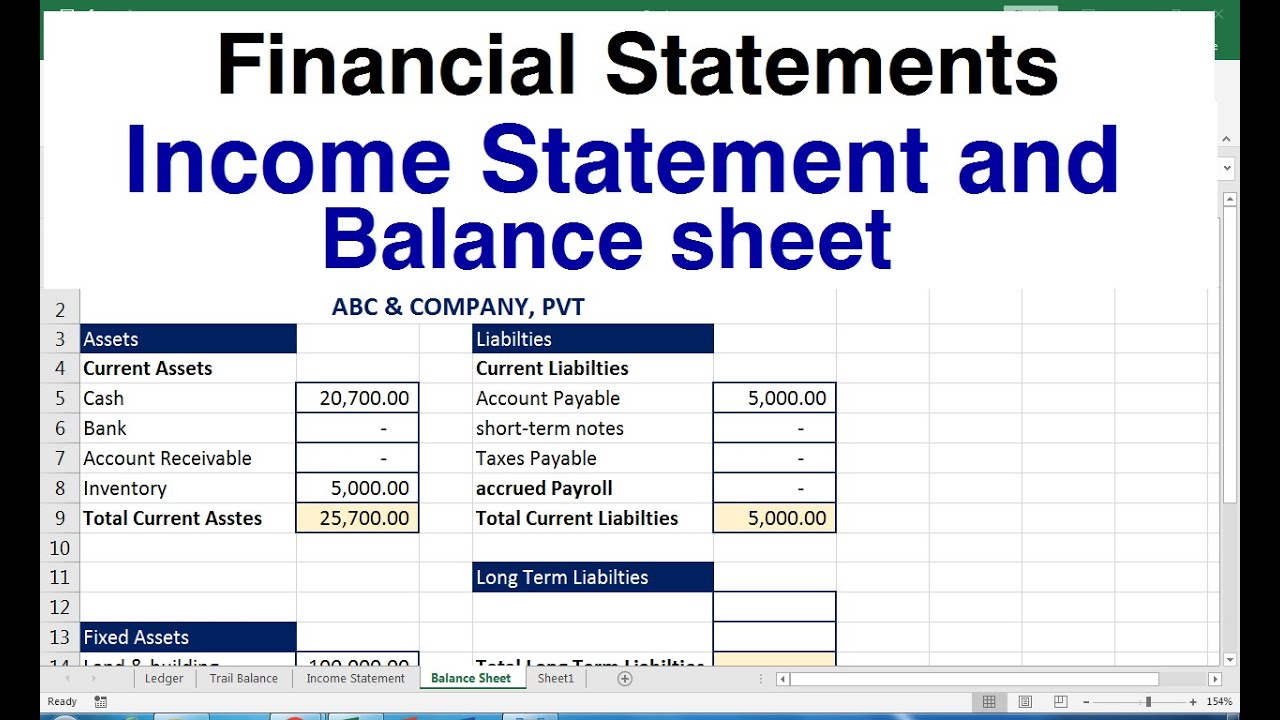

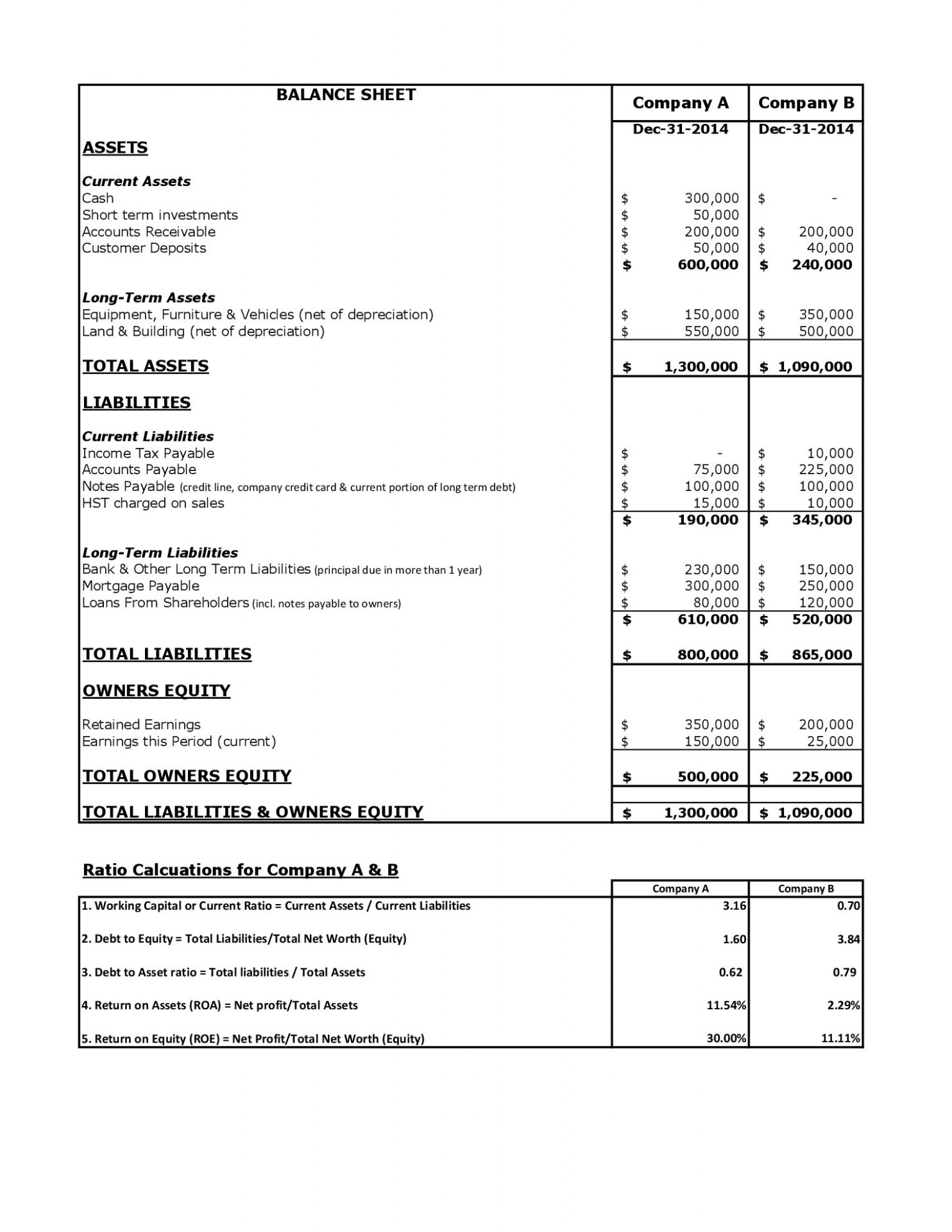

Examining how sales and expenses change assets and liabilities; Determine the reporting date and period. A balance sheet, on the other hand, records assets, liabilities, and equity.

Knowing when to use each is helpful in. Prepared after considering any adjustments to the accounts). Most companies create annual income statements, though you can prepare one for other periods of time, depending on your company's needs, like by month or by quarter.

Net income is the final amount mentioned in the bottom line of the income statement, showing the profit or loss to your business. There are three financial statements that work together to create a complete picture of your business’s finances: Revenue can include sales from products and/or services sold.

They will not balance at this time. Deciding what to disclose in the income statement; Balance sheets and income statements are important tools to help you understand the finances and prospects of your business, but the two differ in key ways.

This is the most updated trial balance (i.e. Prepare a statement of owner’s equity. While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses.

The third line indicates the date of the report. Make adjustments for non cash transactions. The income statement was first since net income (or loss) is a required figure in preparing the balance sheet.

Choosing the income statement format; While the balance sheet is a financial snapshot, giving you a picture of the business's assets and liabilities on a single day at the end of the accounting period, the income statement shows you a summary of the flow of transactions your business has had over the entire accounting period. As mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a certain order.

Considering the diverse financial effects of making a profit; Start with revenue the first step is to add revenue figures for your reporting period. Financial statements are the heartbeat of your business's financial health.

Income statement and balance sheet. Gather the necessary information in an accounting system, the best tool to take information from would be the adjusted trial balance. We can use either balance sheet or statement of financial position.