Outrageous Info About Off Balance Sheet Finance

During last spring’s banking crisis, when a competing lender went under, new york community bank pounced, acquiring a big chunk of its business.

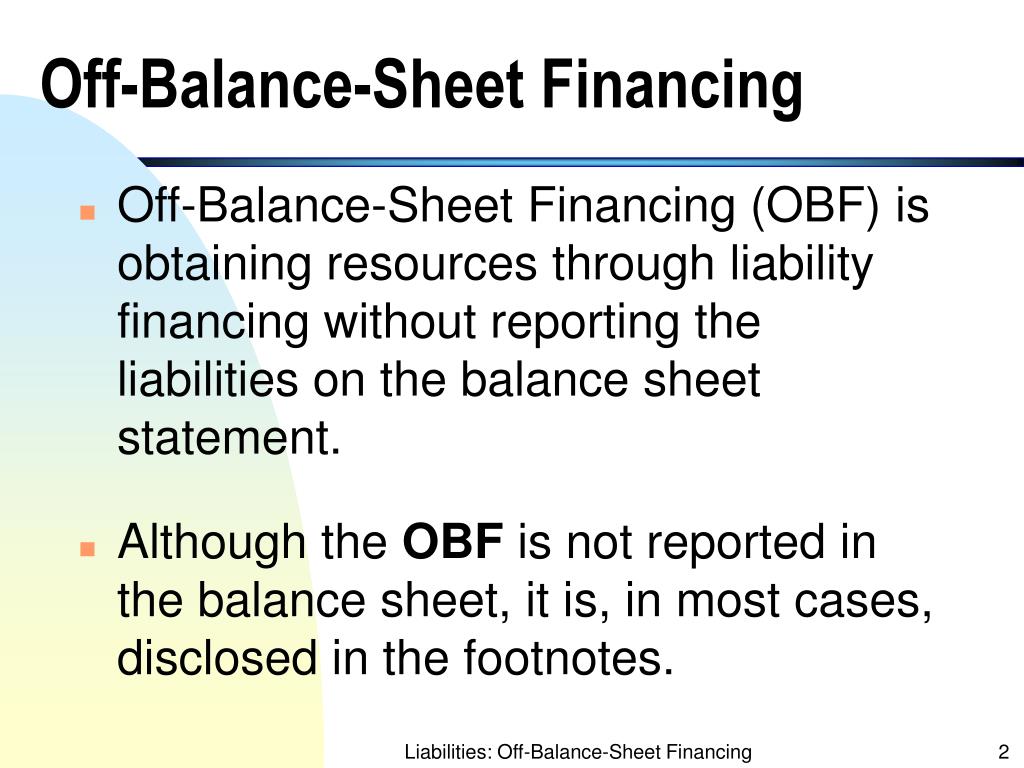

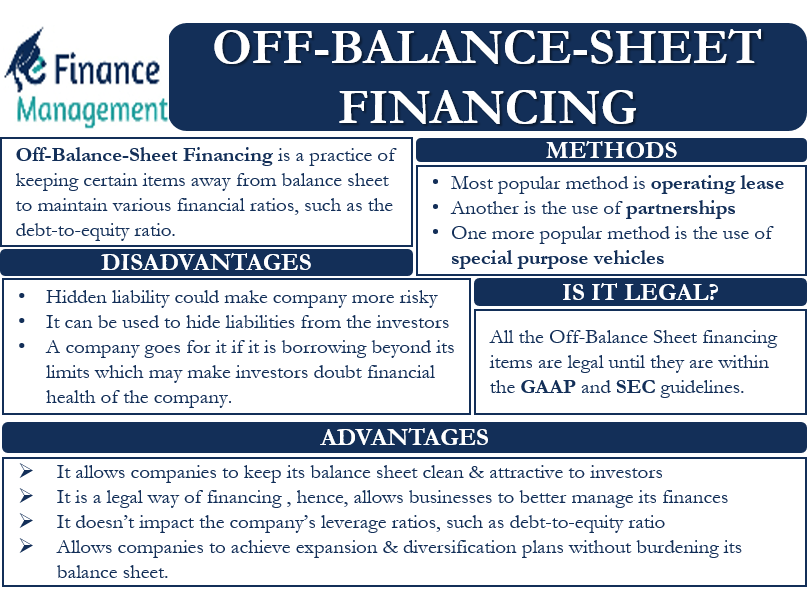

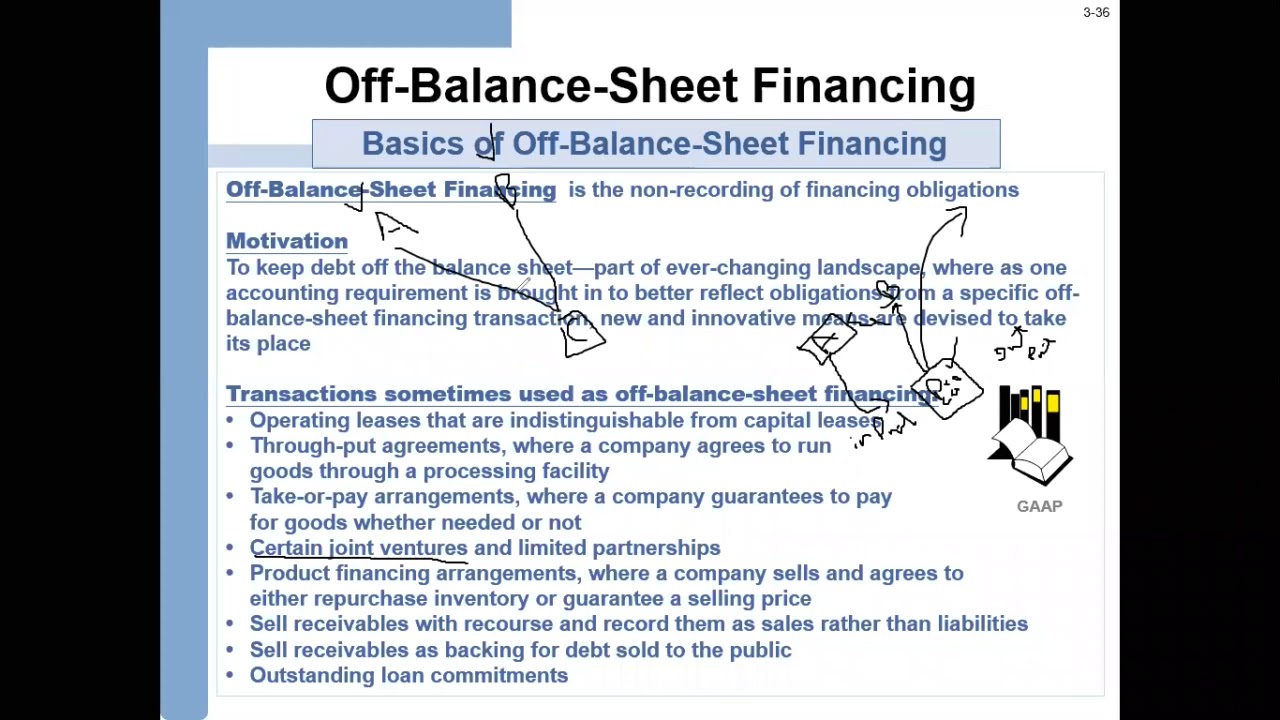

Off balance sheet finance. Lenders may see these companies. The federal reserve’s internal debate over the fate of its balance sheet reduction effort is set. These items are assets and liabilities of the company, even if they don't show up on the balance sheet.

This practice helps companies keep. You can check your credit card balance over the phone, online, or mobile app. Investors use balance sheets to understand a company's assets and liabilities and to.

Now, it is paying dearly for that. Succursale française, 28 avenue victor hugo, 75116, paris. They still remain important components of the business but are just not directly fall under company obligations of ownership.

While not recorded on the balance sheet itself, these items. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. +33 1 44 29 91 38.

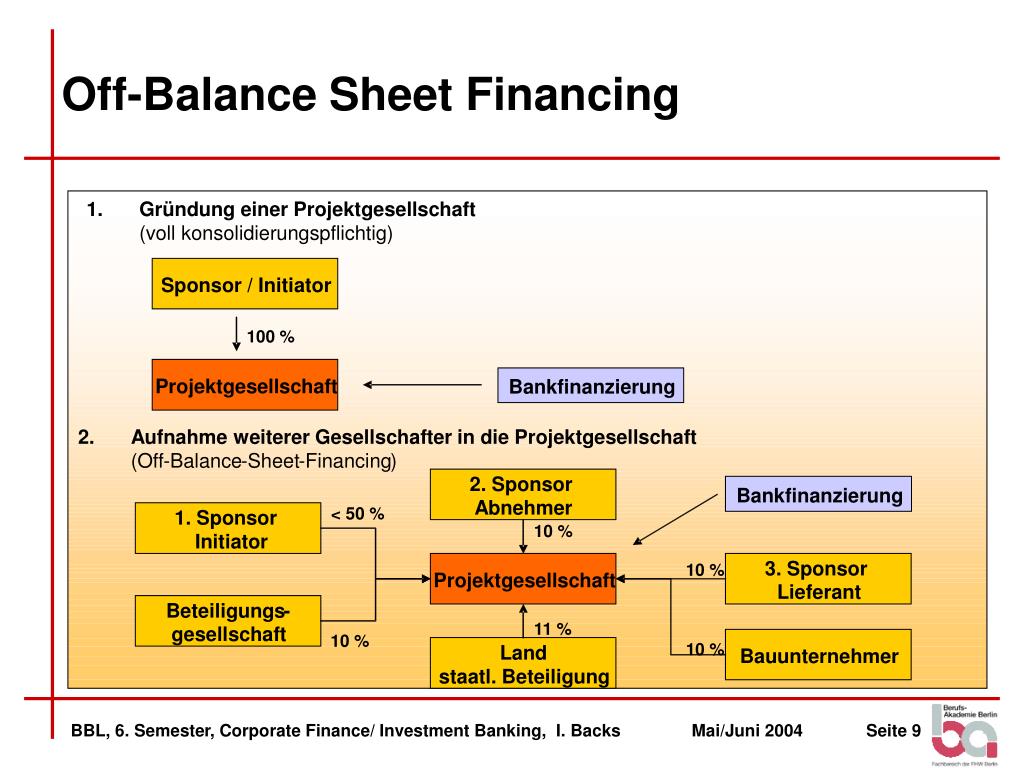

A form of financing in which large capital expenditures are kept off a company’s balance sheet through various classification methods. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The report replaces the existing sme balance sheet securitisation rating criteria, dated 19 october 2021.

Federal resources minister madeline king says she will put nickel on the critical minerals list, allowing nickel miners to apply. This means those potential future obligations don’t appear as debt on the corporate balance sheet, making the company appear less indebted than it might actually be. For example, let's assume that company xyz has a $4,000,000 line of credit with bank abc.

But that does not mean that they are not relevant to the business operations. Keep a close eye on your credit card balances to avoid overspending. Gaap and ifrs accounting standards.

It is one of many accounting principles companies use. The implementation of asc 842 greatly narrows what can be properly left off. Off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors.

It will allow nickel miners to apply to access a $4 billion fund. It is used to impact a company’s level of debt and. Sometimes this occurs because the generally accepted accounting principles (gaap) don’t require the disclosure.

:max_bytes(150000):strip_icc()/GettyImages-172940273-28a7232c2a9149a9a191440b7b8a397c.jpg)