Top Notch Info About Other Comprehensive Income Accounting

You should list the total of other comprehensive income for each reporting period to a component of equity that is.

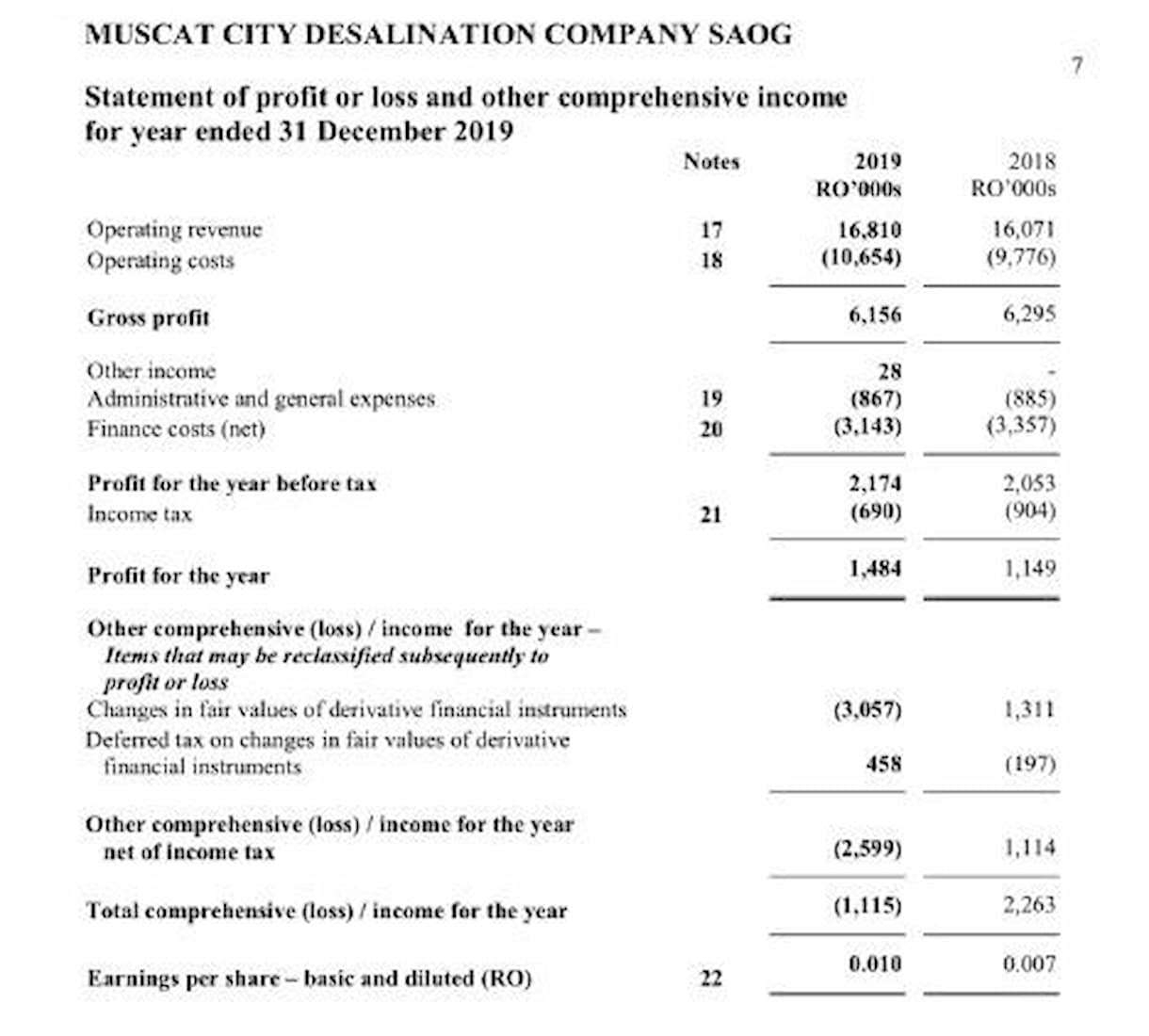

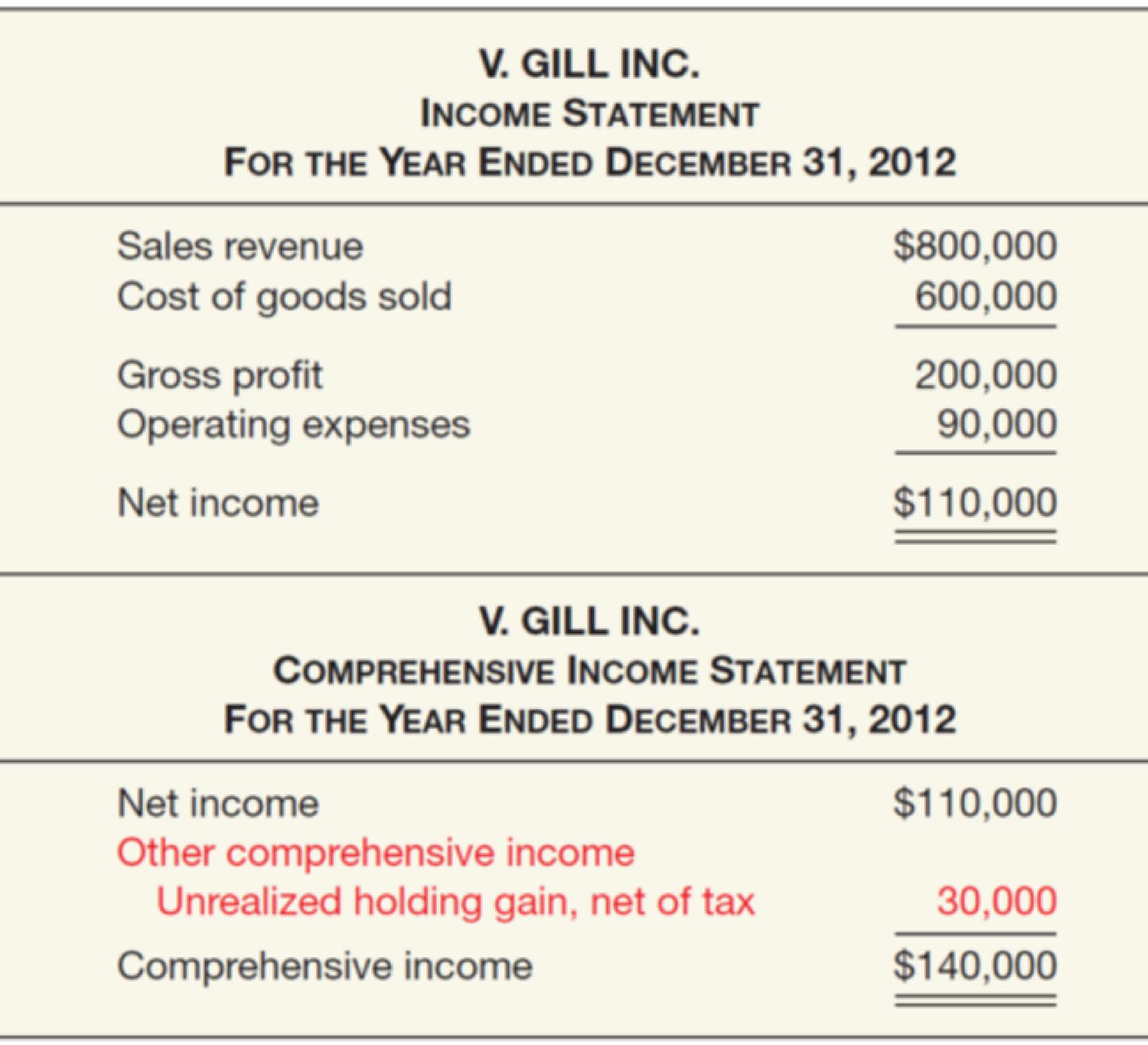

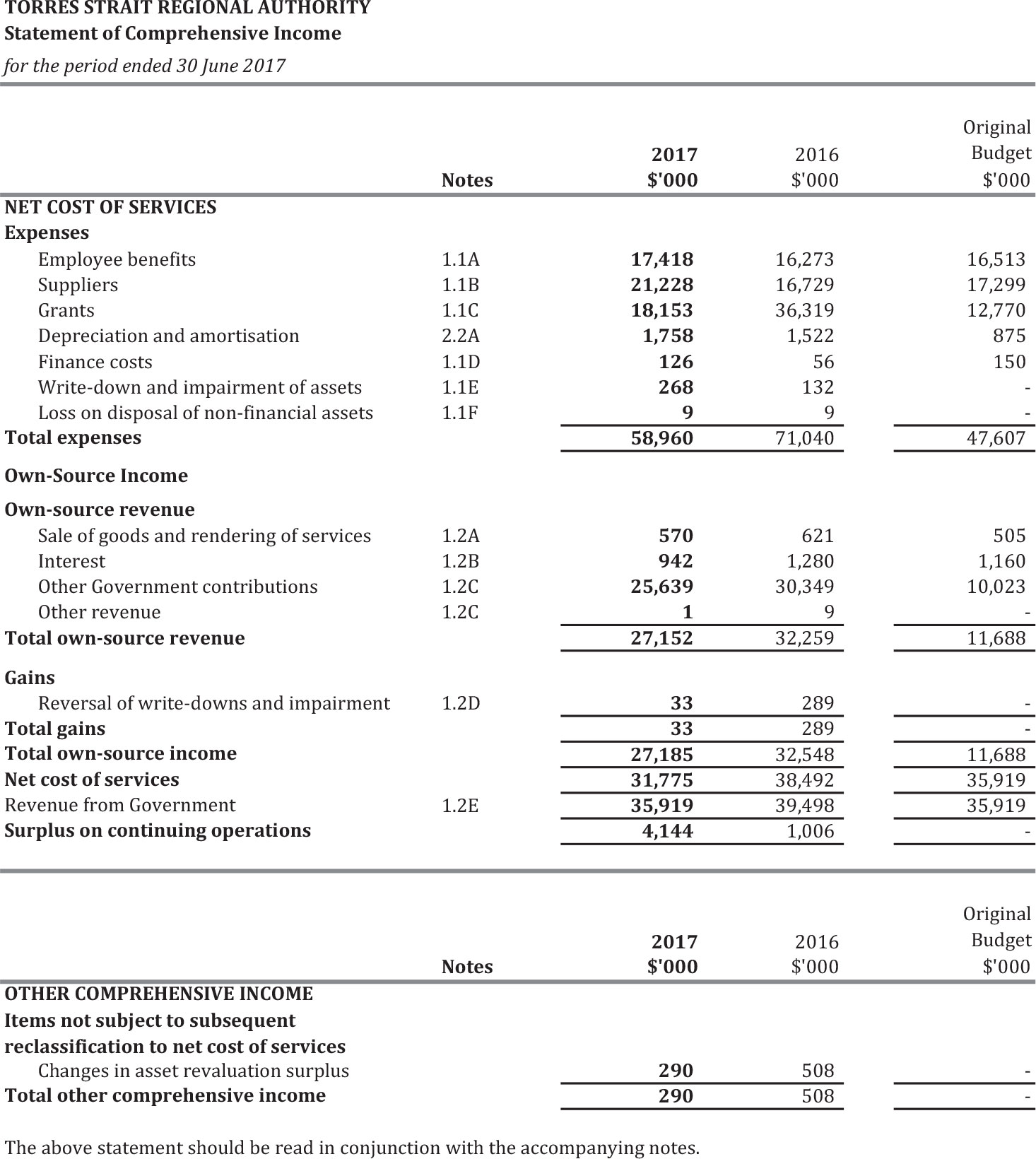

Other comprehensive income accounting. Present total net income, other. The purpose of the statement of profit or loss and. Other comprehensive income refers to revenues, expenses, gains, and losses excluded from net income on the income statement under both generally.

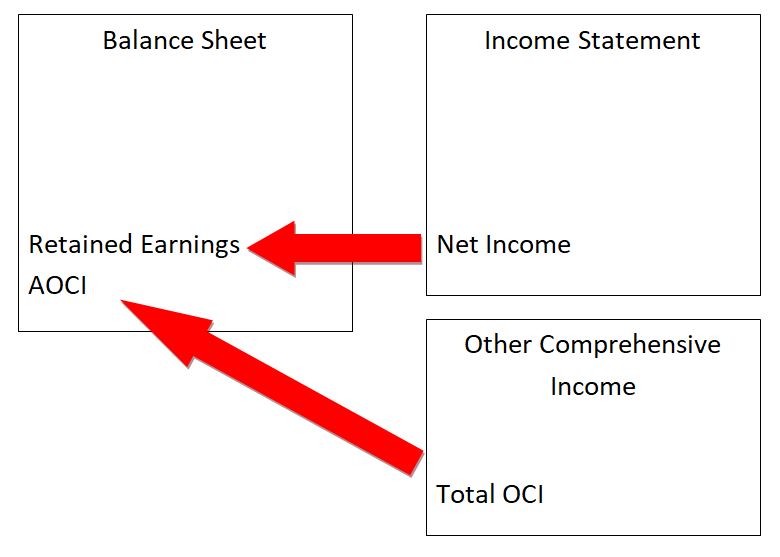

Fair value through other comprehensive income—financial assets are classified and measured at fair value through other comprehensive income if they are held in a. Other comprehensive income, or oci, consists of items that have an effect on the balance sheet amounts, but the effect is not reported on the company's income statement. Other comprehensive income (oci) refers to any revenues, expenses, and gains / (losses) that not have yet been realized.

Reporting entities should present each of the. It is similar to retained earnings, which is impacted by net income, except it includes those items that are excludedfrom net income. This article looks at what differentiates profit or loss from other comprehensive income and where items should be presented.

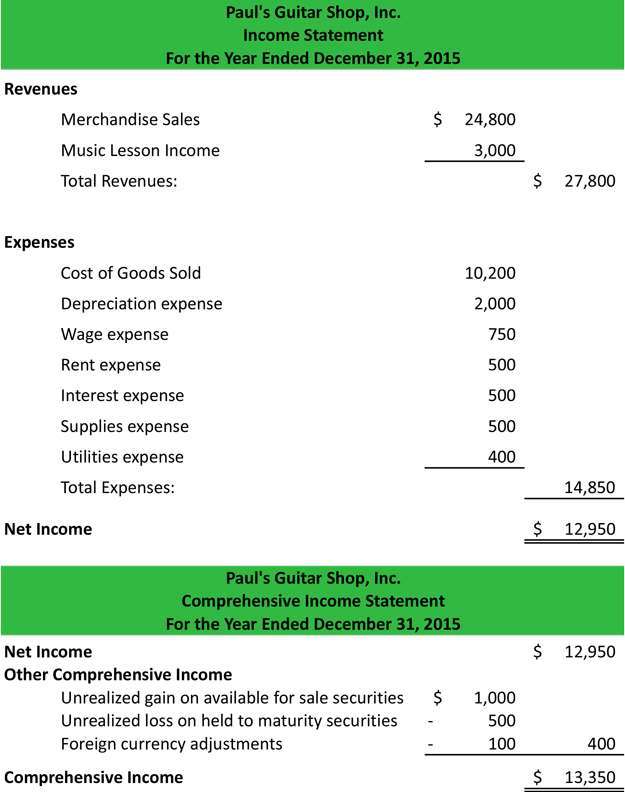

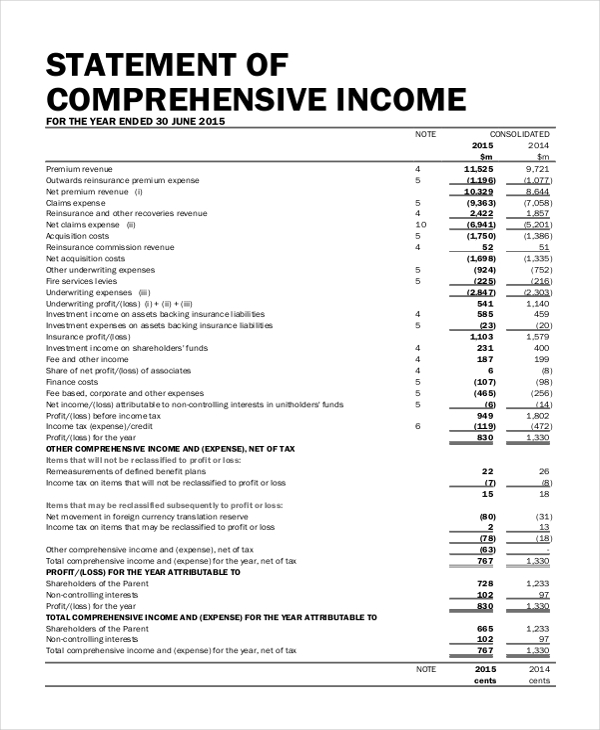

Oci stands for other comprehensive income, and aoci stands for accumulated other comprehensive income. One refers to the income statement; (a) a single statement of comprehensive income;

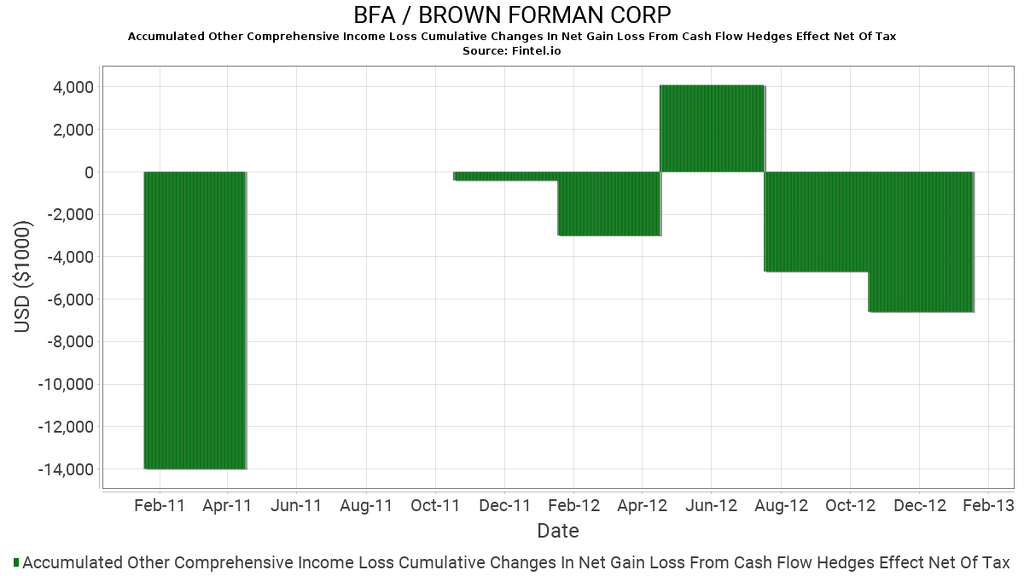

Accumulated other comprehensive income (aoci) are special gains and losses that are listed as special items in the shareholder equity section of a company’s balance sheet. 12 nov 2019 us financial statement presentation guide 4.5 as. Other comprehensive income refers to items of income and expenses that are not recognized as a part of the profit and loss account this income appears as.

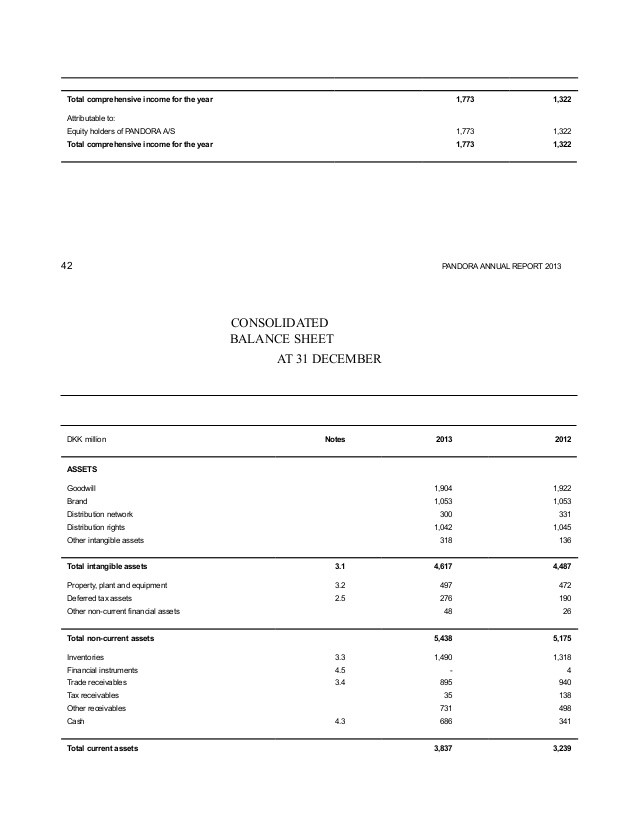

Other comprehensive income is shown on a company’s balance sheet. Reports net income, other comprehensive income, and comprehensive income in a single financial statement of comprehensive income. 4.5 accumulated other comprehensive income and reclassification adjustments publication date:

This helps reduce the volatility of net income as the value of unrealized gains/losses moves up and down. Other comprehensive income (oci) is an accounting item for firms that includes revenues, expenses, gains, and losses that have yet to be realized. With the demand for almonds steadily increasing due to their nutritional value and versatility,.

These items, such as a. Other comprehensive income is those revenues, expenses, gains, and losses under both generally accepted accounting principles and international. Under both us generally accepted accounting principles (gaap) and international financial reporting standards (ifrs), comprehensive.

It is a more robust document that. Whereas, other comprehensive income consists of all unrealized gains and losses on assets that are not reflected in the income statement. It includes net income and.