Ace Info About Cash Is Debit Or Credit In Trial Balance

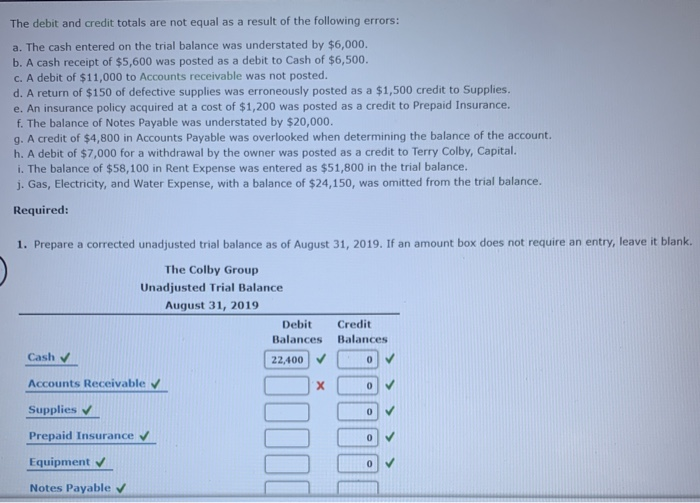

An example would be an incorrect debit entry being offset by an equal credit entry.

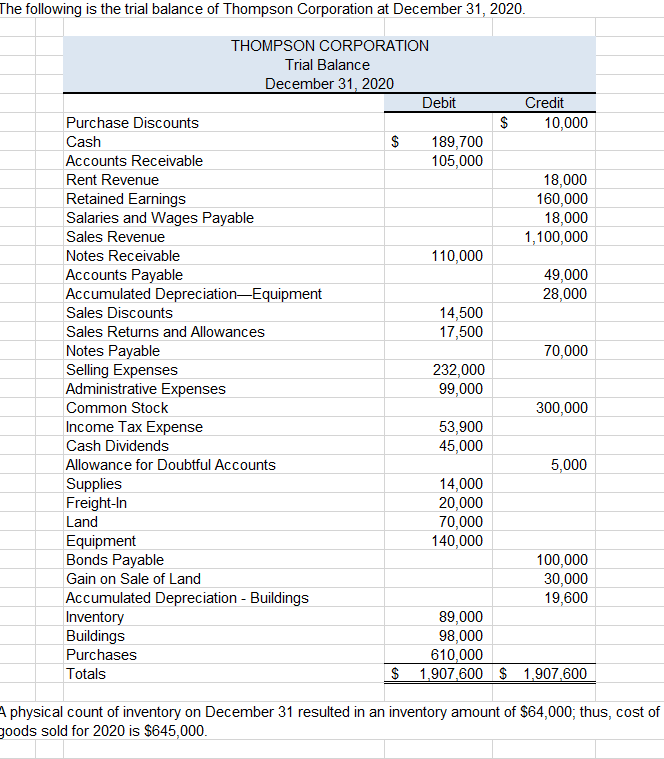

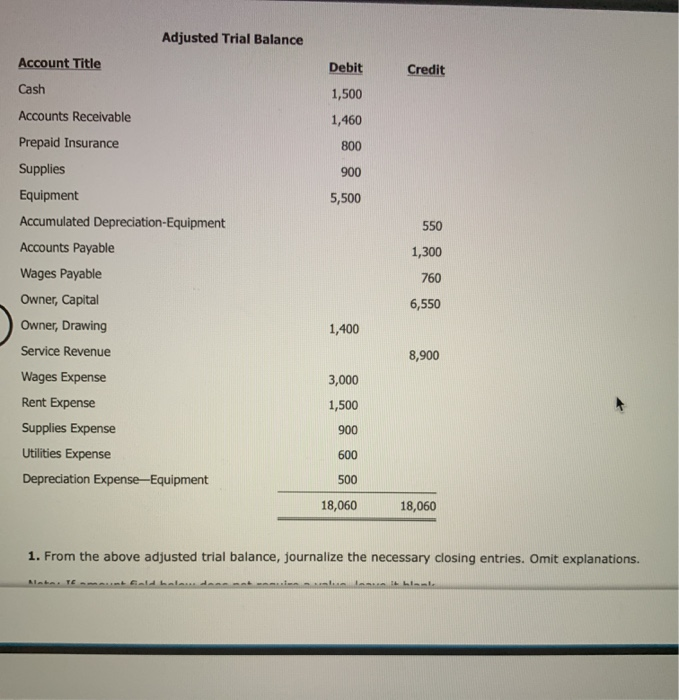

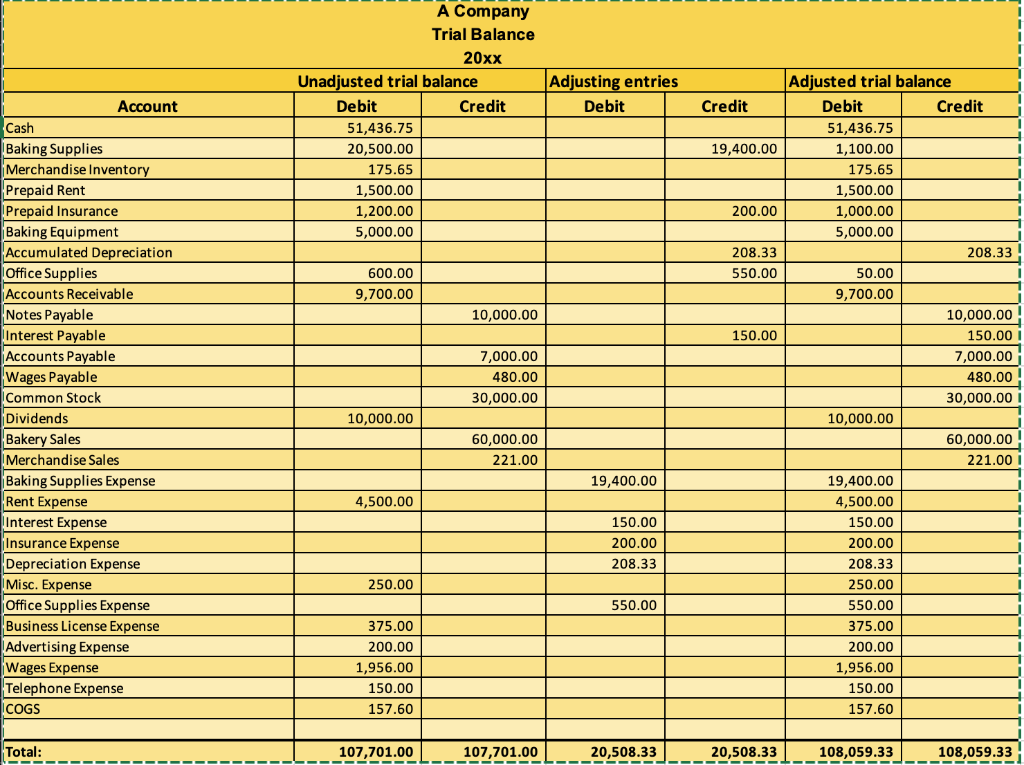

Cash is debit or credit in trial balance. Balance sheet accounts include cash accounts, marketable securities, accounts receivable, inventory, fixed assets, prepaid expenses, and intangible assets. For example, the company receives the payment from the customers in cash. This statement comprises two columns:

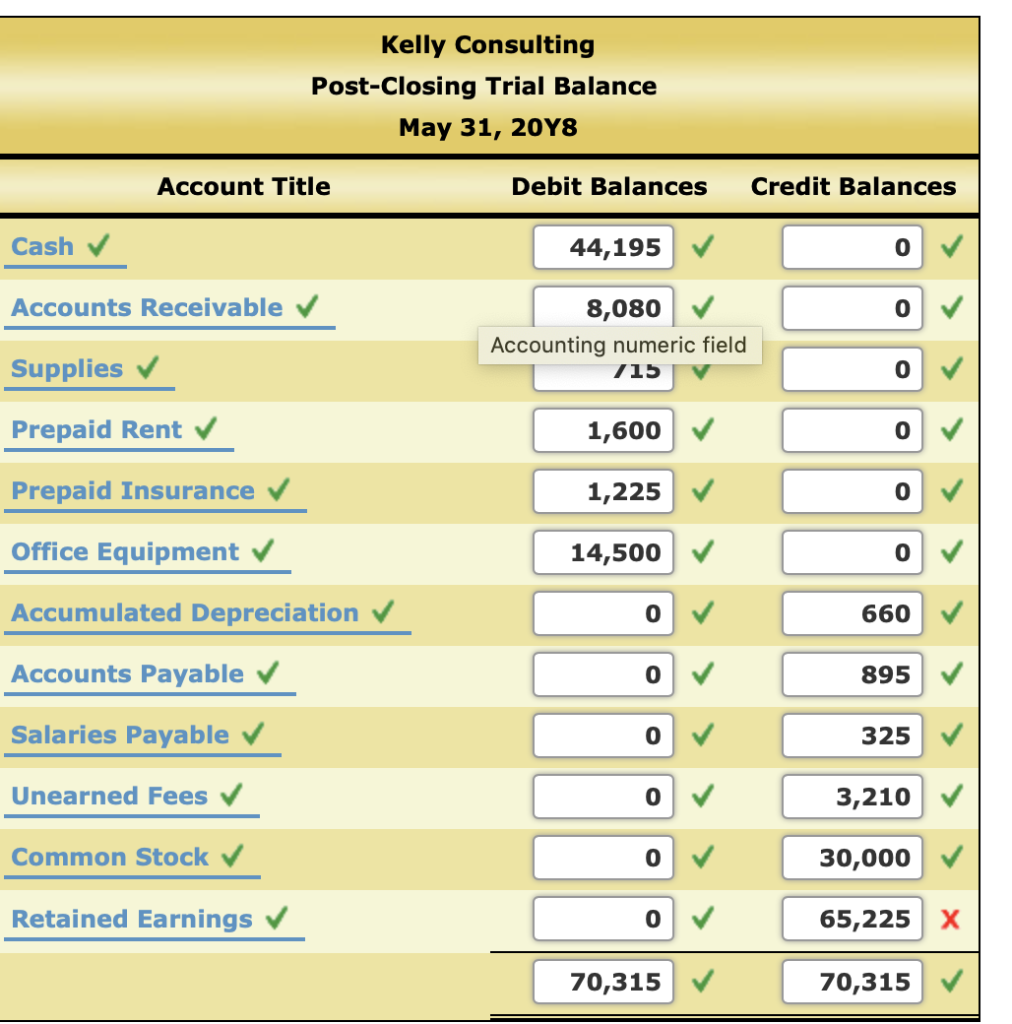

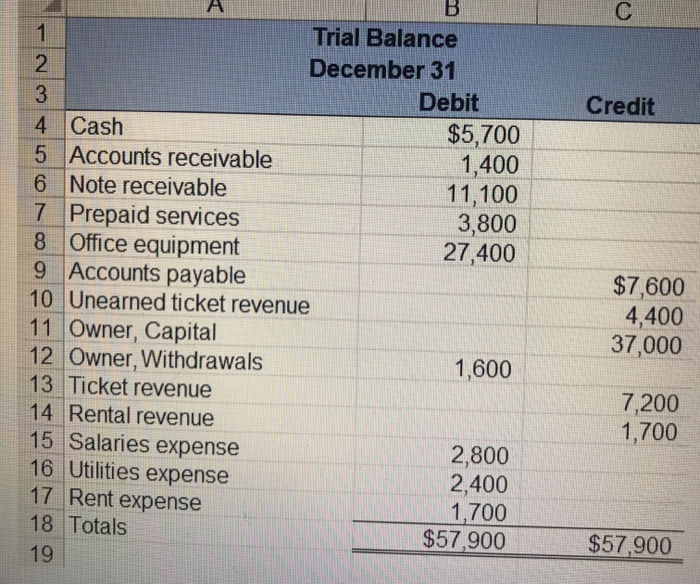

The moment customer payments start rolling in, this asset turns into actual cash for the company’s use. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process.

Similarly, the remaining debit or credit balances of all the accounts of ledger are. So, if credit side > debit side, it is a credit balance. Credit status following customer payment.

Total debit entries = total credit entries. Both cash and accounts payable would be overstated by $ 100. It is a statement prepared at a certain period to check the arithmetic accuracy of the accounts (i.e., whether they are mathematically correct and balanced).

The term trial balance refers to the total of all the general ledger balances. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. The primary purpose of a trial balance is to identify errors and ensure the equality of debits and credits.

The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. The rule to prepare the trial balance is an equation which is as follows: The cardinal rule of the trial balance is that the total of the trial balance debit and credit accounts and ba lances taken from the ledgers should be the same or tallied.

Trial balance only confirms that the total of all debit balances match the total of all credit balances. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. In financial statements, cash is debited when there is increasing in it.

But at an amount that is $ 100 too high. Creditor’s account above example shows credit balance in creditor’s account (to balance c/d) which is shown on the debit side. In addition, it should state the final date of the accounting period for which the report is created.

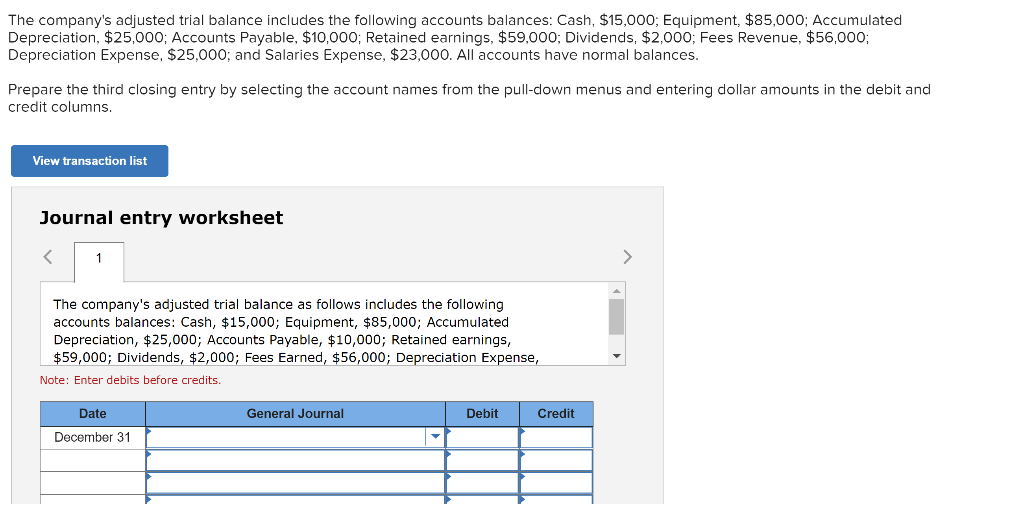

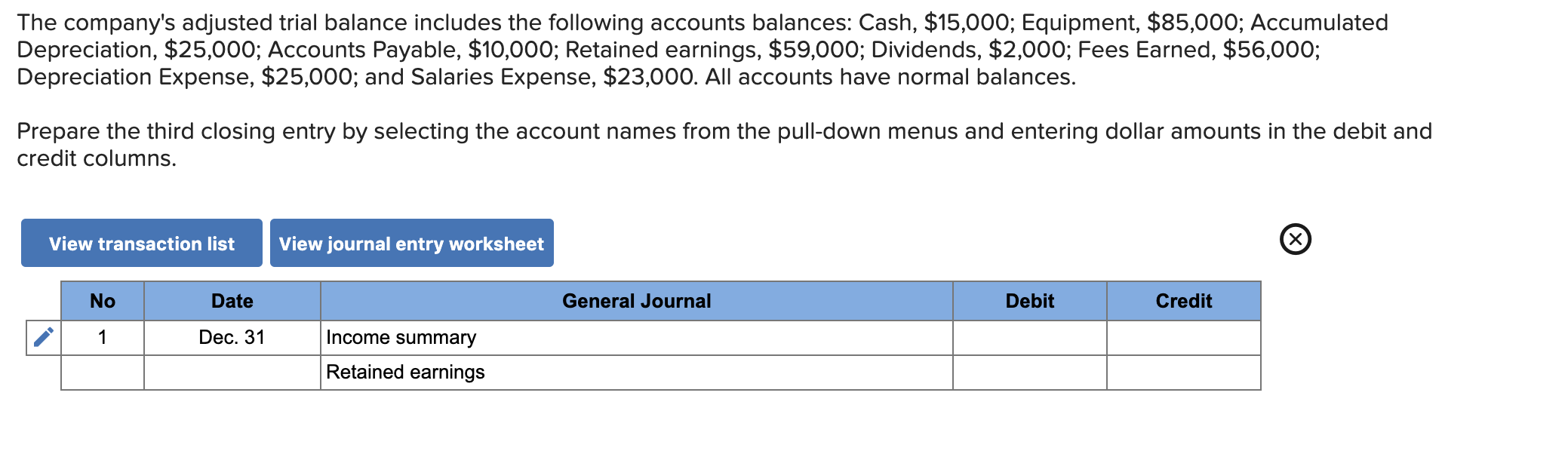

The trial balance may contain columns for unadjusted balance, adjusting entries, and adjusted balance, with debit and credits indicated. In this case, cash is increased and we need to debit it. If the sum of all credits does not equal the sum of all debits, then there is an error in one of the accounts.

The debits and credits include all. The trial balance is a summation of or list of credit and debit balances drawn from the many ledger accounts like the bank balance, cash book etc. This means the company is waiting for money from customers who bought goods or services on credit.