Awesome Info About Tds Credit 26as

Take our gst consultation services to get your issues solved from gst experts.

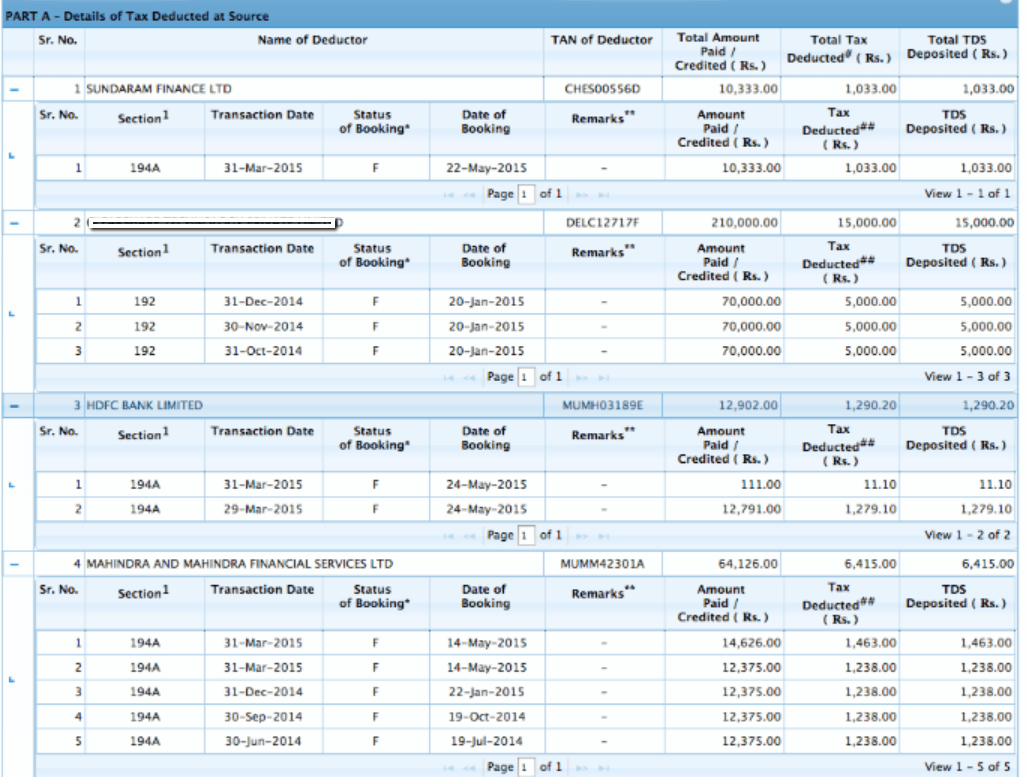

Tds credit 26as. Tax credit statement (form 26as) contains details of: Tds credit if the amount is getting reflected in the 26as of the next year. Tax deducted on behalf of the taxpayer by deductors.

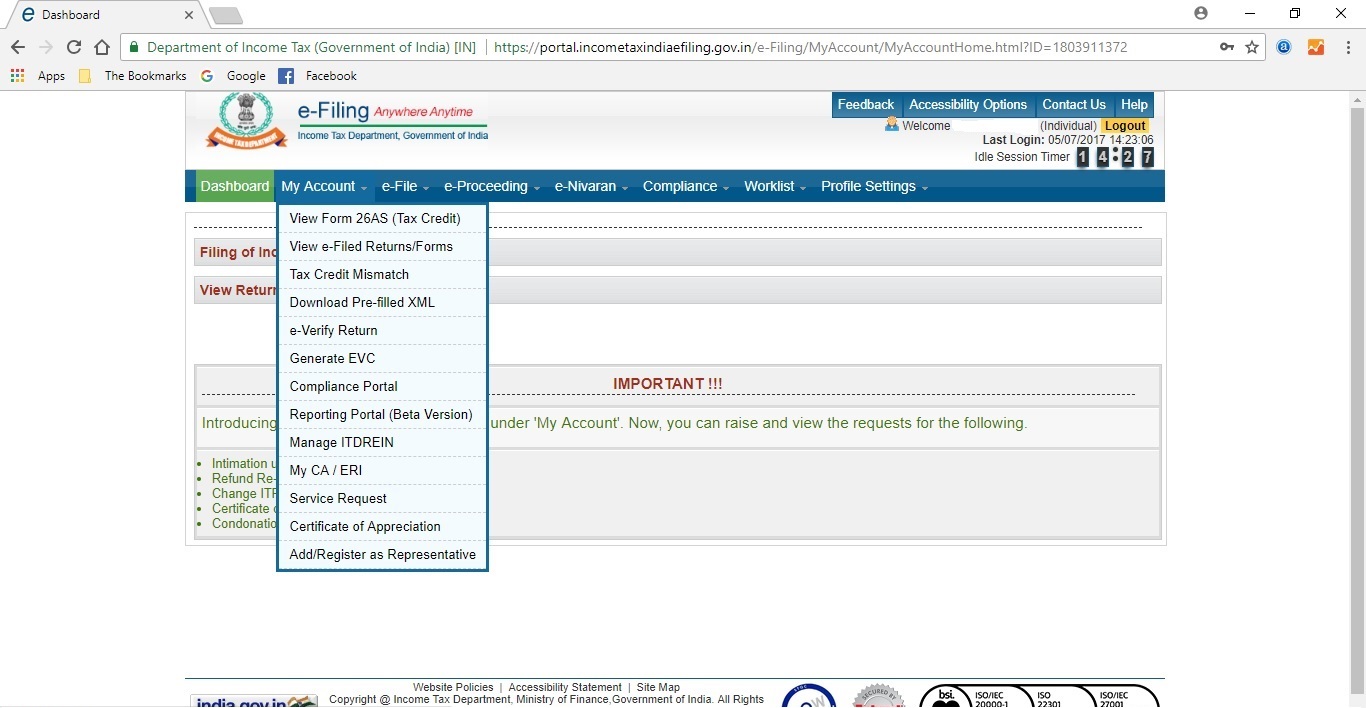

Often the actual amount of tds and tds credit as appearing in form 26as may differ and it may happen that the tds credit appearing in form 26as may be less. Click on the link view tax credit (form 26as) at the bottom of the. Tds credit should be allowed on the basis of form 26as, even if the payee has not claimed the same in the return of income (due to non updation of form 26as).

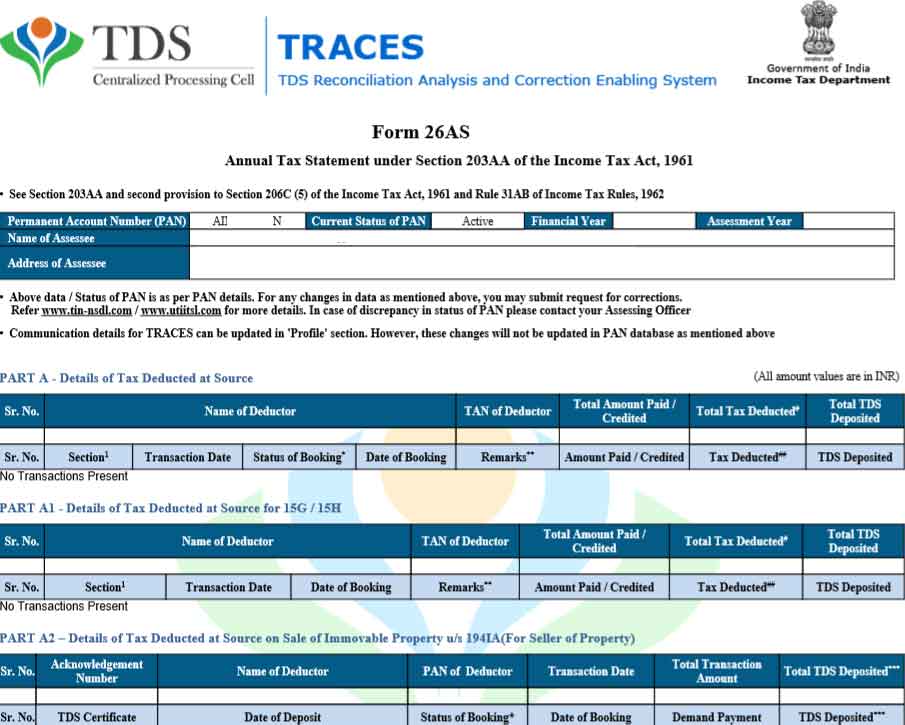

Part a, b and c as under: The form 26as (annual tax statement) is divided into three parts, namely; If you are not registered with traces, please refer to our e.

Displays details of tax which has been deducted at source (tds) by each. In the tax credit mismatch page, after you enter your details, check for any mismatch between respective tds / tcs / any. Discrepancy in tax deducted and tds credit.

Introduction form 26as is a consolidated tax statement issued to the pan holders. How to check tds credit confused in complicated laws? How will i know if there is a tax credit mismatch?

Read case study how does fastfacts 26as reconciler work? If a taxpayer has evidential proof that tds is already deducted on a particular income, then even if such tds credit is not reflected in 26as, the taxpayer. The issue of tds is highly tedious and there are number of issues that are still unresolved.

It is also known as tax credit statement or annual tax statement. Form 26as is a consolidated tax statement issued under rule 31ab of the income tax rules to pan holders. However, there might be inconsistencies in the tds.

If the actual tax amount after regular assessment is more than the amount shown in. Details of no/low tax deduction. To view form 26as or.

The website provides access to the pan holders to view the details of tax credits in form 26as.