Matchless Info About Financial Statements Should Be Prepared

Prudent investors might also want to.

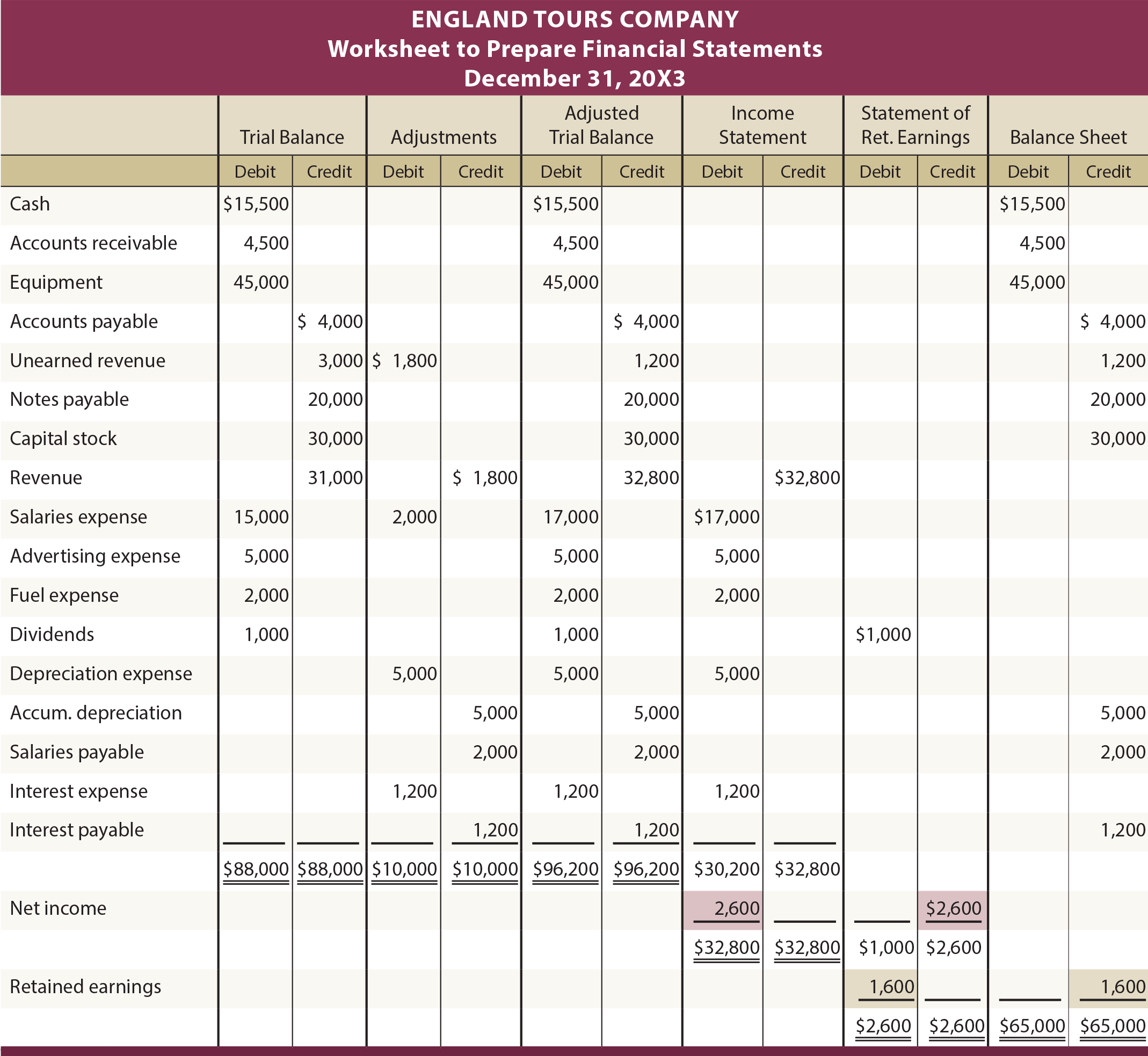

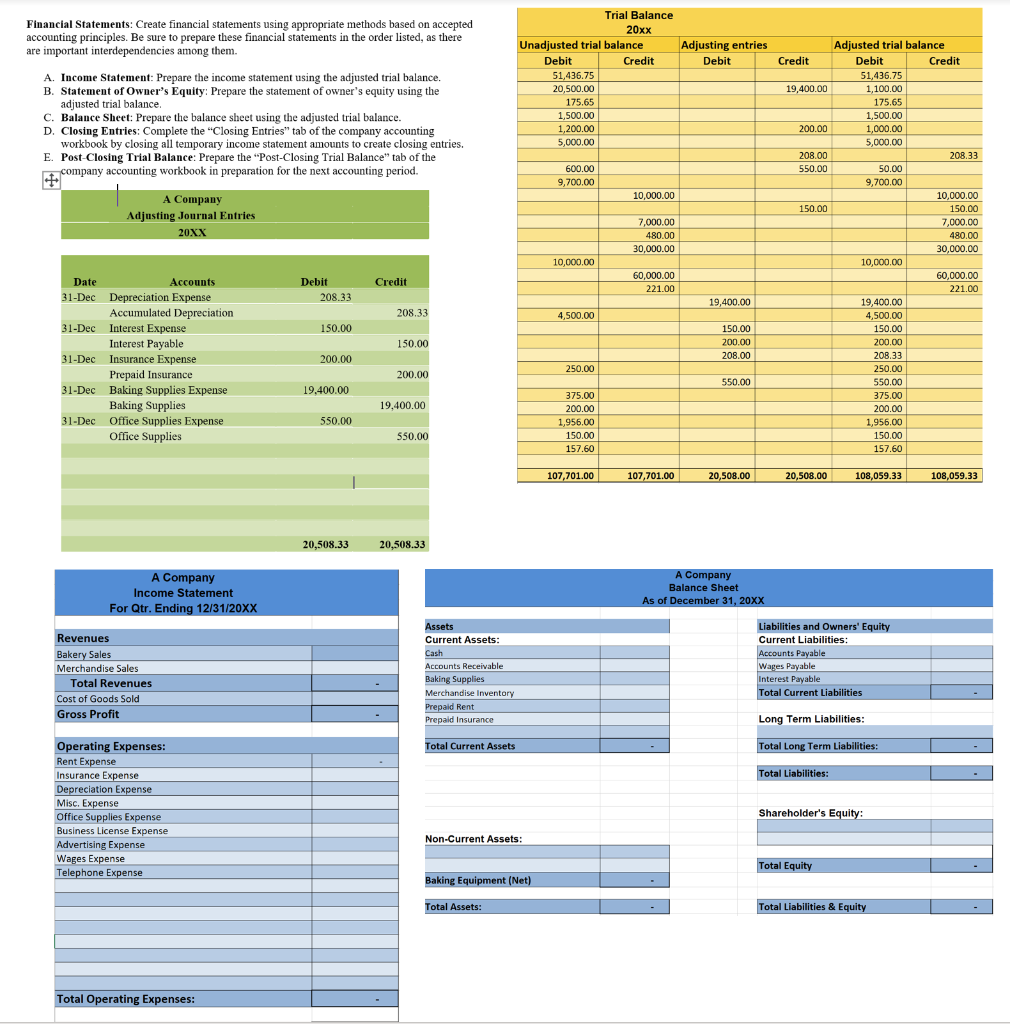

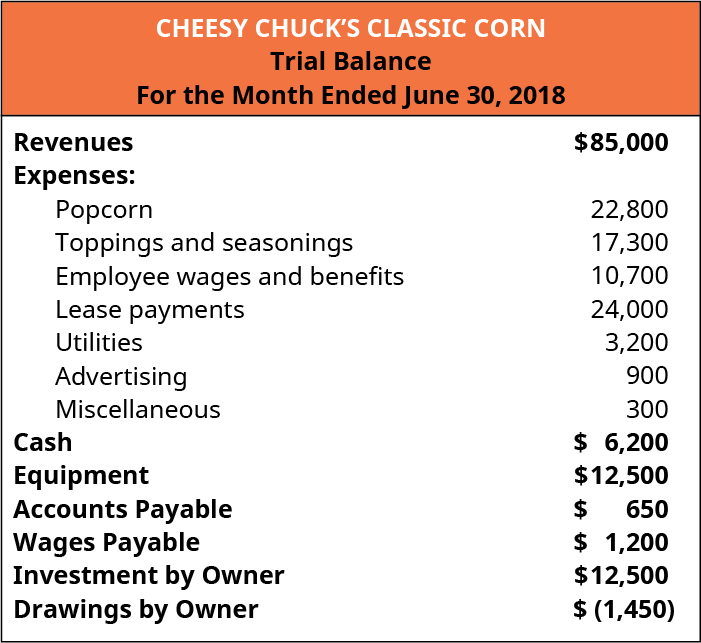

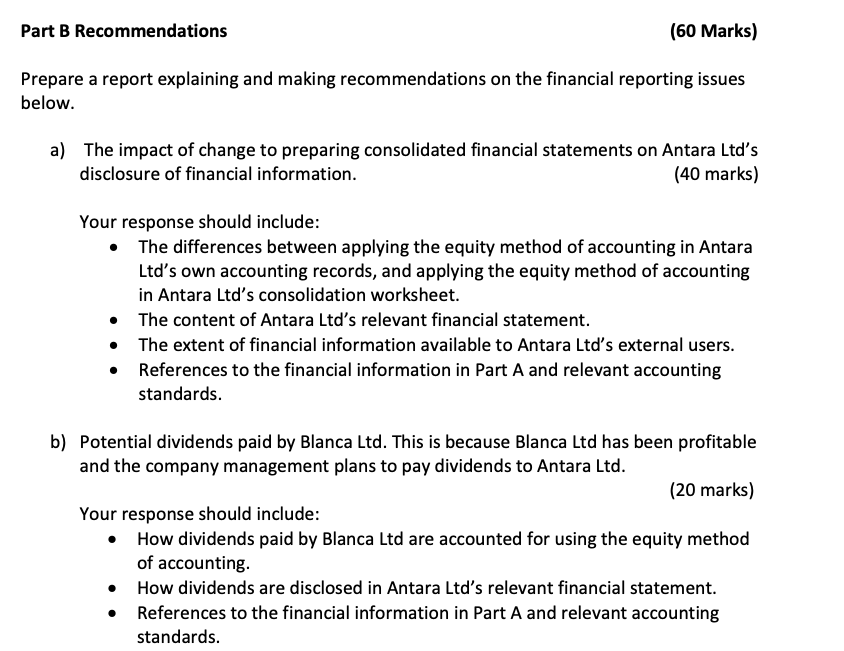

Financial statements should be prepared. This information is used by a wide range of stakeholders (e.g., investors) in making economic decisions. Remember that we have four financial statements to prepare: Including the balance sheet, income statement, statement of retained earnings, and statement of cash flows;

The preparation of financial statements is easy once you've mastered the accounting elements and know the different accounts that comprise them. Companies produce financial statements that provide information about their financial position and performance. Businesses today have automated accounting systems wherein financial statements can be prepared with a few clicks of a button.

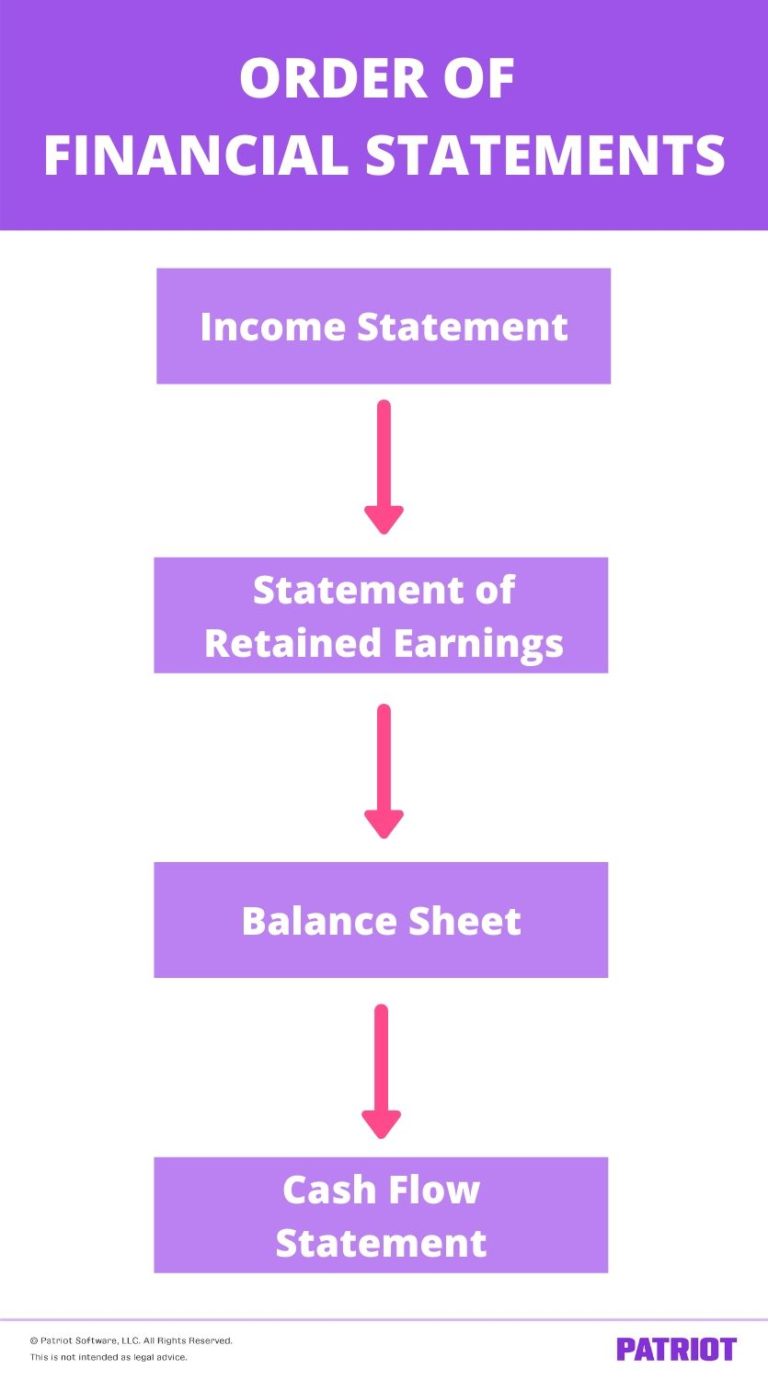

It is crucial to understand which financial statement is prepared first and why. All the paragraphs have equal authority. Income statements show how much money a company made and spent over a period of.

These financial statements were introduced in introduction to financial statements and statement of. There are four sections to a company's financial statements: The completed financial statements are then distributed to management, lenders, creditors, and investors, who use them to evaluate the performance, liquidity,.

As you know by now, the income statement breaks down all of your company’s revenues and expenses. There are three main types of financial statements: Presentation and consideration of annual activity reports and audited financial statements of kanifing municipal council for the years ended from 31.

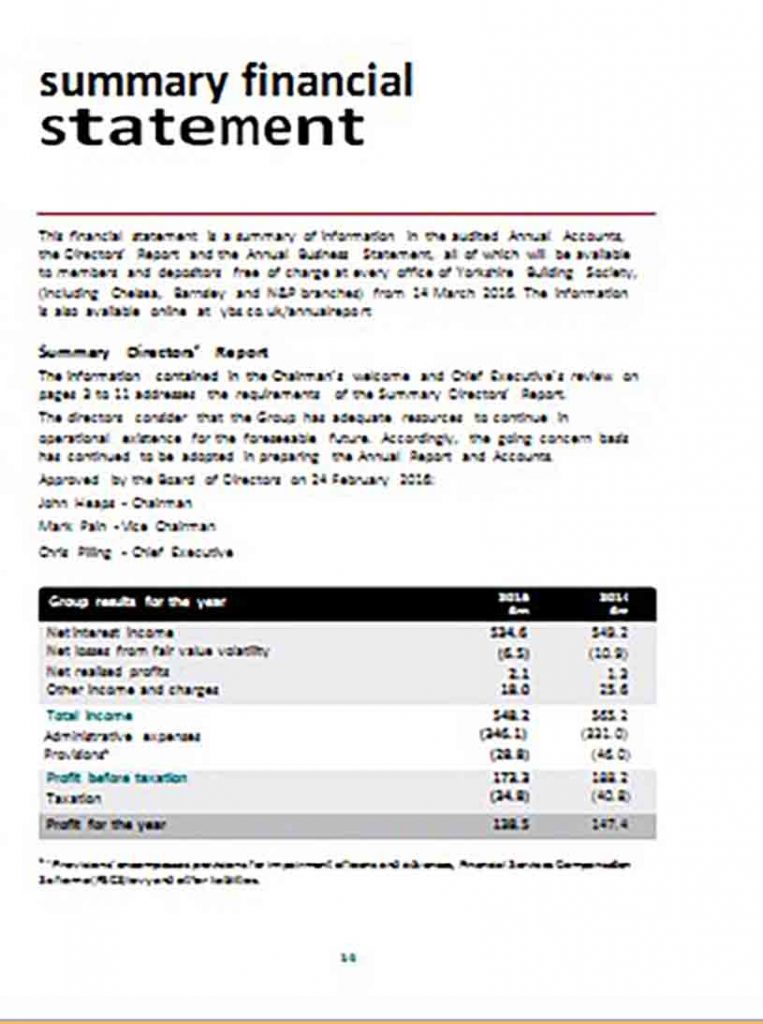

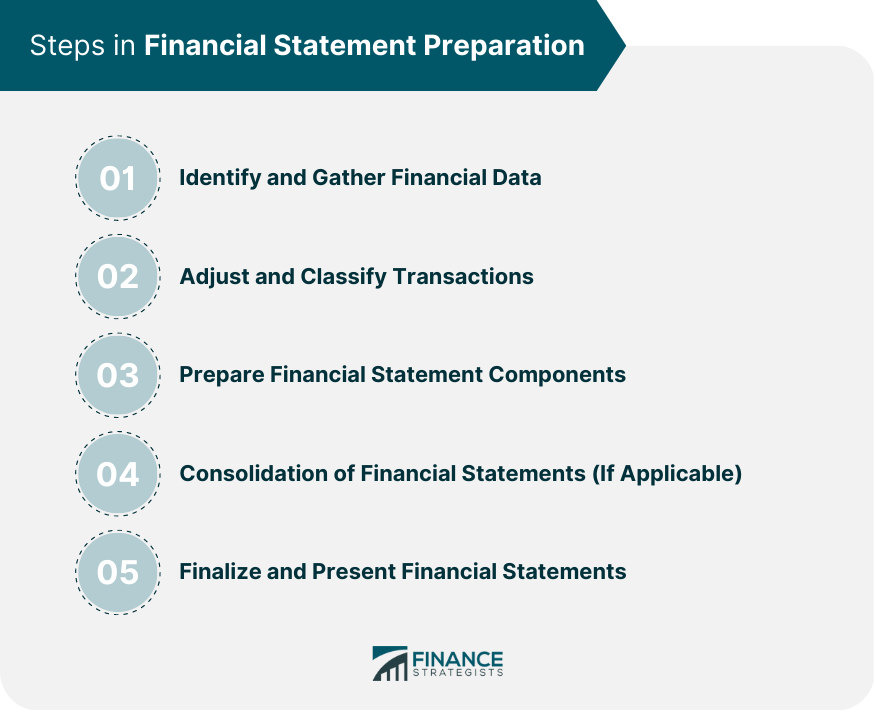

The income statement should always be prepared before other statements because it provides an overview of the company’s revenue and expenses during a specific period. The financial statements should generally not be prepared on a break up basis but rather on a basis that is consistent with ifrs but amended to reflect the fact that the ‘going concern’ assumption is not appropriate. Preparing financial statements is the seventh step in the accounting cycle.

Prepare at least 2014 and 2013 financial statements and the opening statement of financial position (as of 1 january 2013 or beginning of the first period for which full comparative financial statements are. The income statement, statement of retained earnings, balance sheet, and statement of cash flows. There are four main financial statements.

Purpose of a financial statement audit. How to prepare financial statements. The financial statements of the parent and its subsidiaries used in preparing the consolidated financial statements should all be prepared as of the same reporting date, unless it is impracticable to do so.

A statement of changes in equity; General requirements for financial statements. Fact checked by suzanne kvilhaug what are financial statements?

Select accounting policies based on ifrss effective at 31 december 2014. And (4) statements of shareholders’ equity. That profit or loss figure is needed for the statement of changes in equity.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)