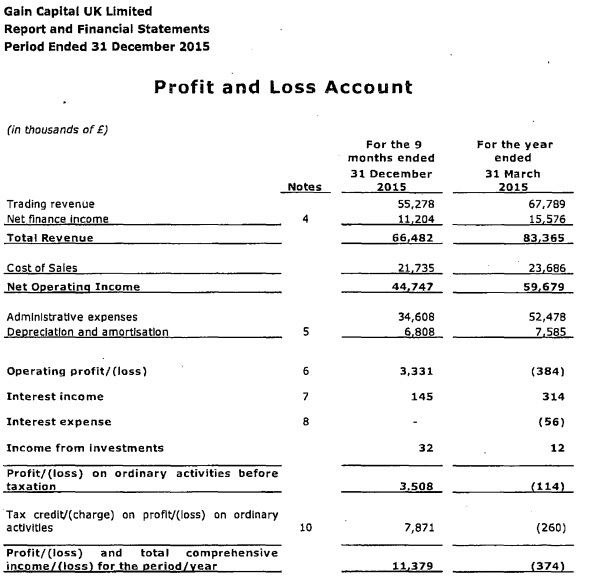

Recommendation Tips About Capital Gain Income Statement

However, if your total income for a financial year includes.

Capital gain income statement. An overview most companies report such items as. Capital gain / loss statement. More than $44,625 but less than or equal to $492,300 for single;

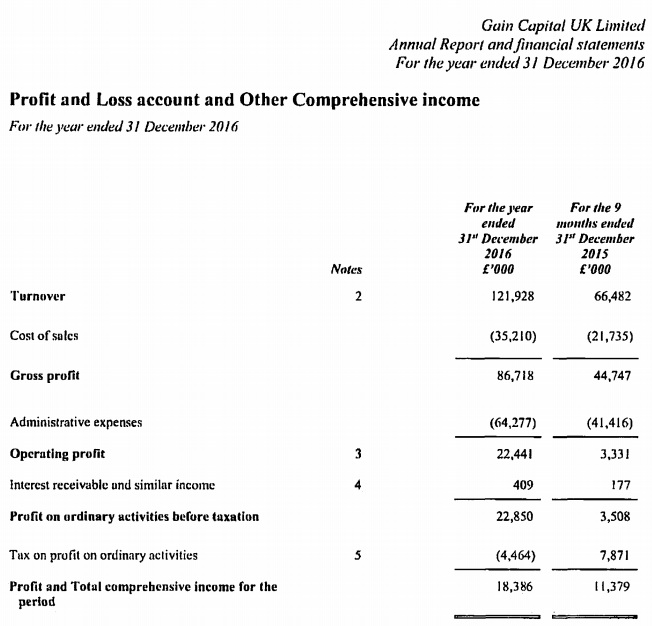

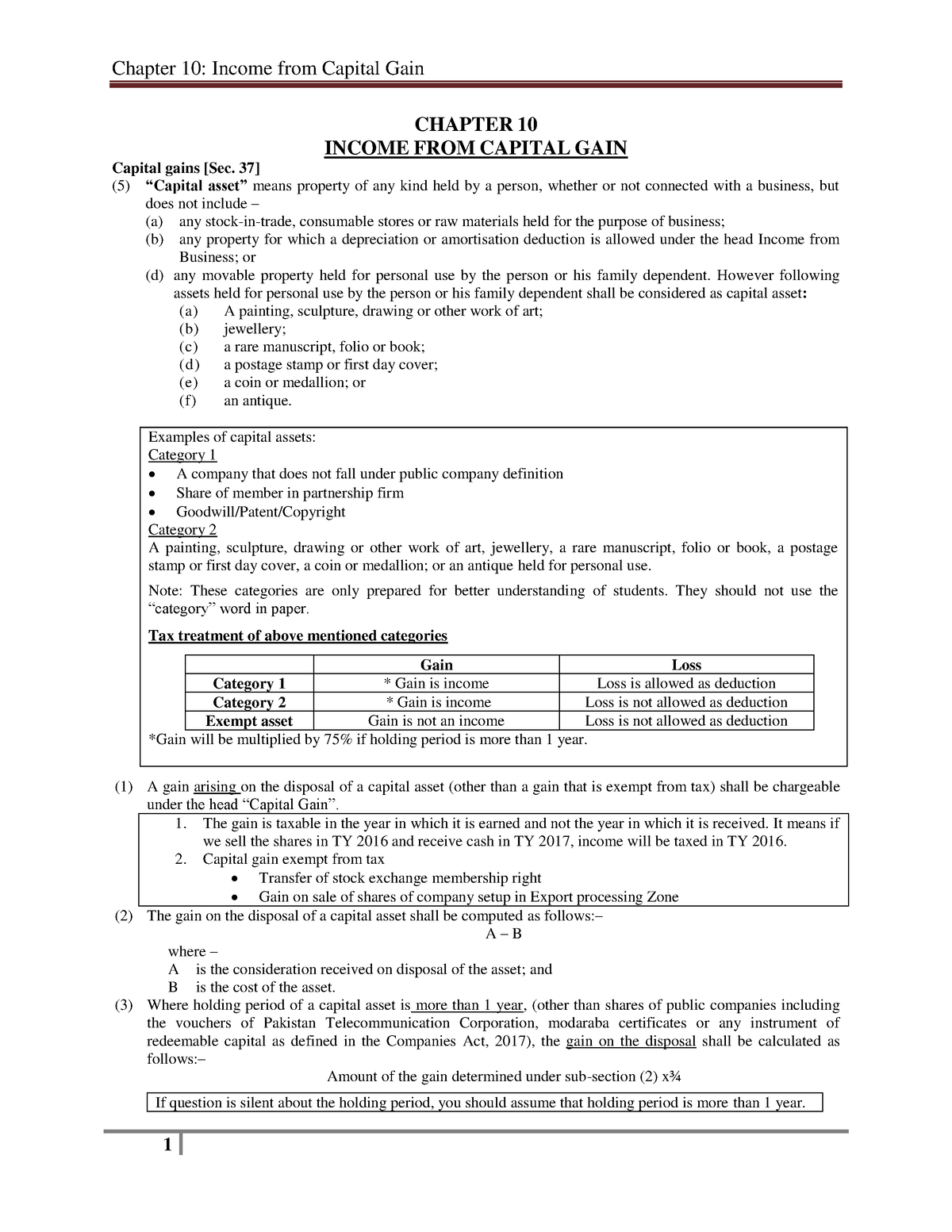

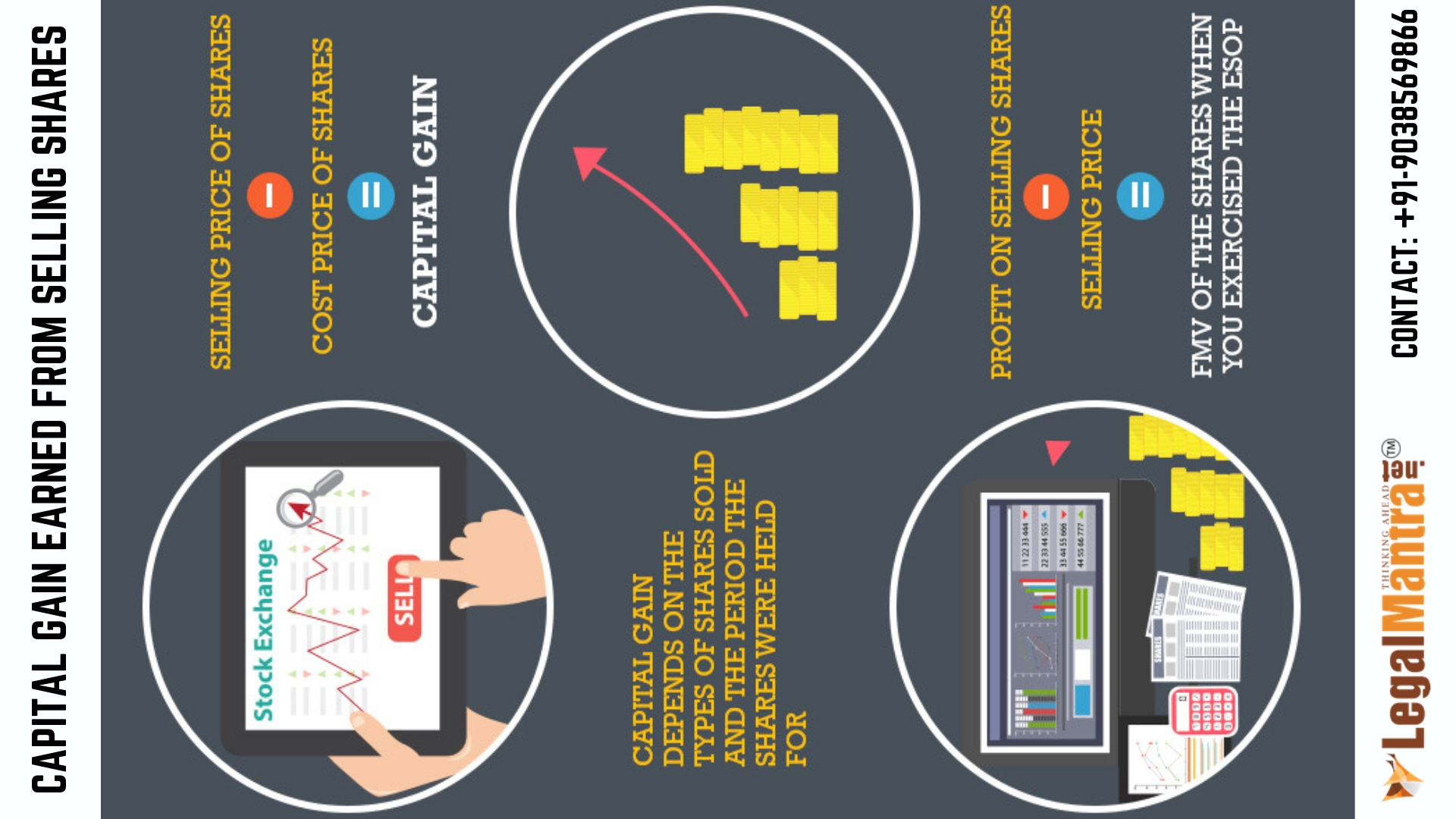

A capital gain is the money received from selling an investment for more than the purchase price. Gains and losses are reported on the income statement. 3 min read the income that any individual earns through the selling of bonds, mutual funds, or stocks is known as capital gains.

This income is taxable under. 1 turbotax premium learn more on intuit's website federal filing fee $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's. Mutual fund * statement format * pdf.

Certain investment accounts are exempt from capital gains tax or benefit from tax deferral. Log in to ‘ zerodha console’ to get the capital gain report for a tax audit. If you want to model yourself correctly (like a business), change your income account to revenue.

Log in to your 5paisa account, click on. Following are the steps to upload your cams p&l account for itr filing via cleartax. It is owed for the tax year during which the investment is sold.

Read the detailed process here. Capital gains are the returns earned when an investment is sold. Email * pan * delivery option.

The tax rate on capital gains varies between 10% and 28%. The company debits cash for $500 and credits a gain account for $300, which creates a $300 gain on the income statement. Password * password should have.

Key takeaways capital gains and other investment income differ based on the source of the profit. Taxpayers need to file itr for capital gain by submitting itr form 2 to the income tax department. Updated september 05, 2021 reviewed by andy smith fact checked by yarilet perez gains & losses vs.

More than $44,625 but less than or. Sign up on the cleartax portal and navigate to the ‘income sources’. The income statement is where income and expenses live.

A capital gains rate of 15% applies if your taxable income is:

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)