Awesome Tips About Accounting For Dividends Declared But Not Paid Ifrs Projected Balance Sheet Sample

Acca has a technical factsheet guide which looks at company law, reporting, and tax issues to provide a broad overview of issues in relation to dividends and distributions in specie.

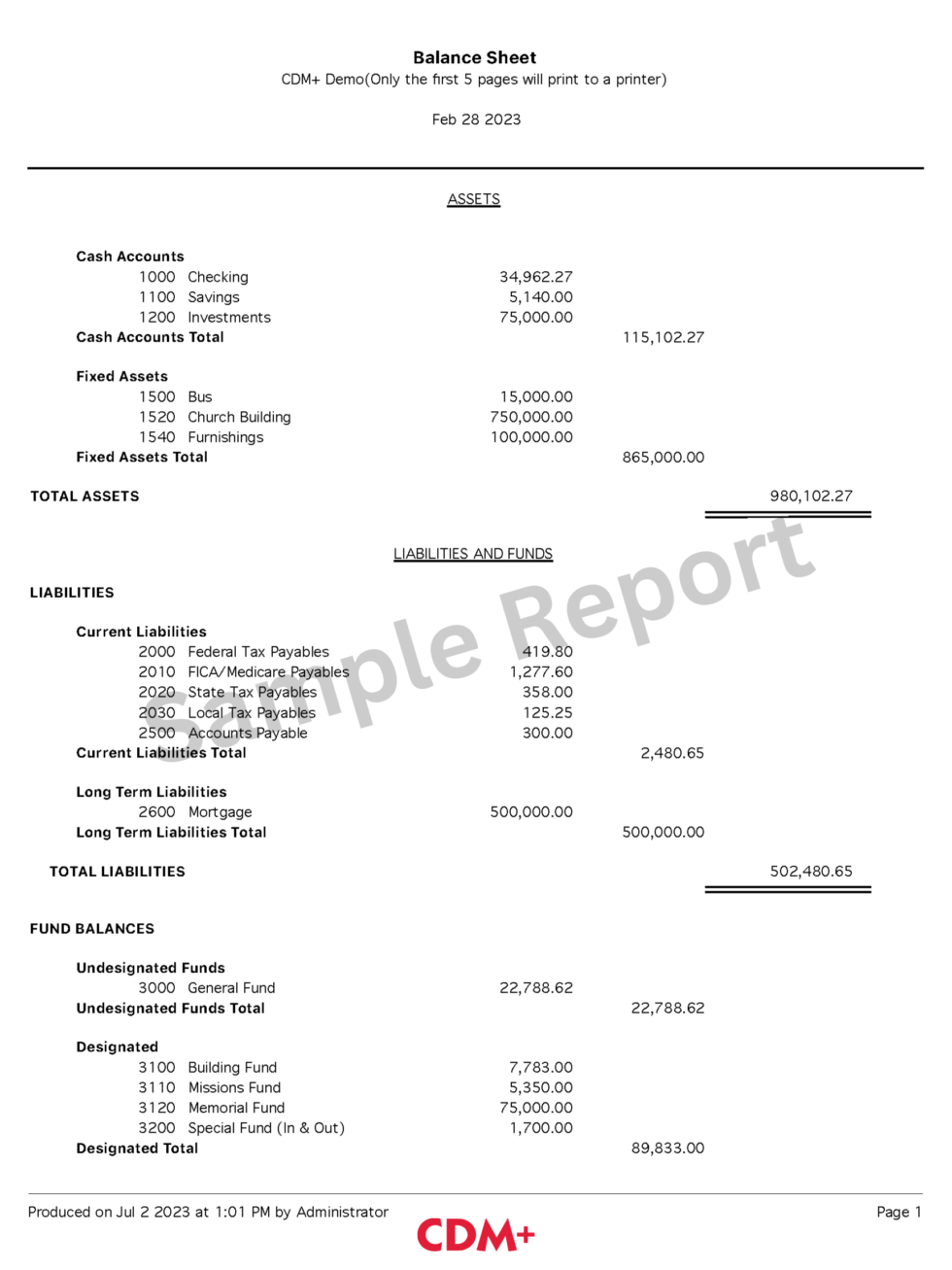

Accounting for dividends declared but not paid ifrs projected balance sheet sample. If a change in accounting policy takes place after the balance sheet date of the relevant accounts, a dividend can still be declared in accordance with section 263 on the basis. In the statement, the common stock of dividends will be maintained. Dividends on common stock are not reported on the.

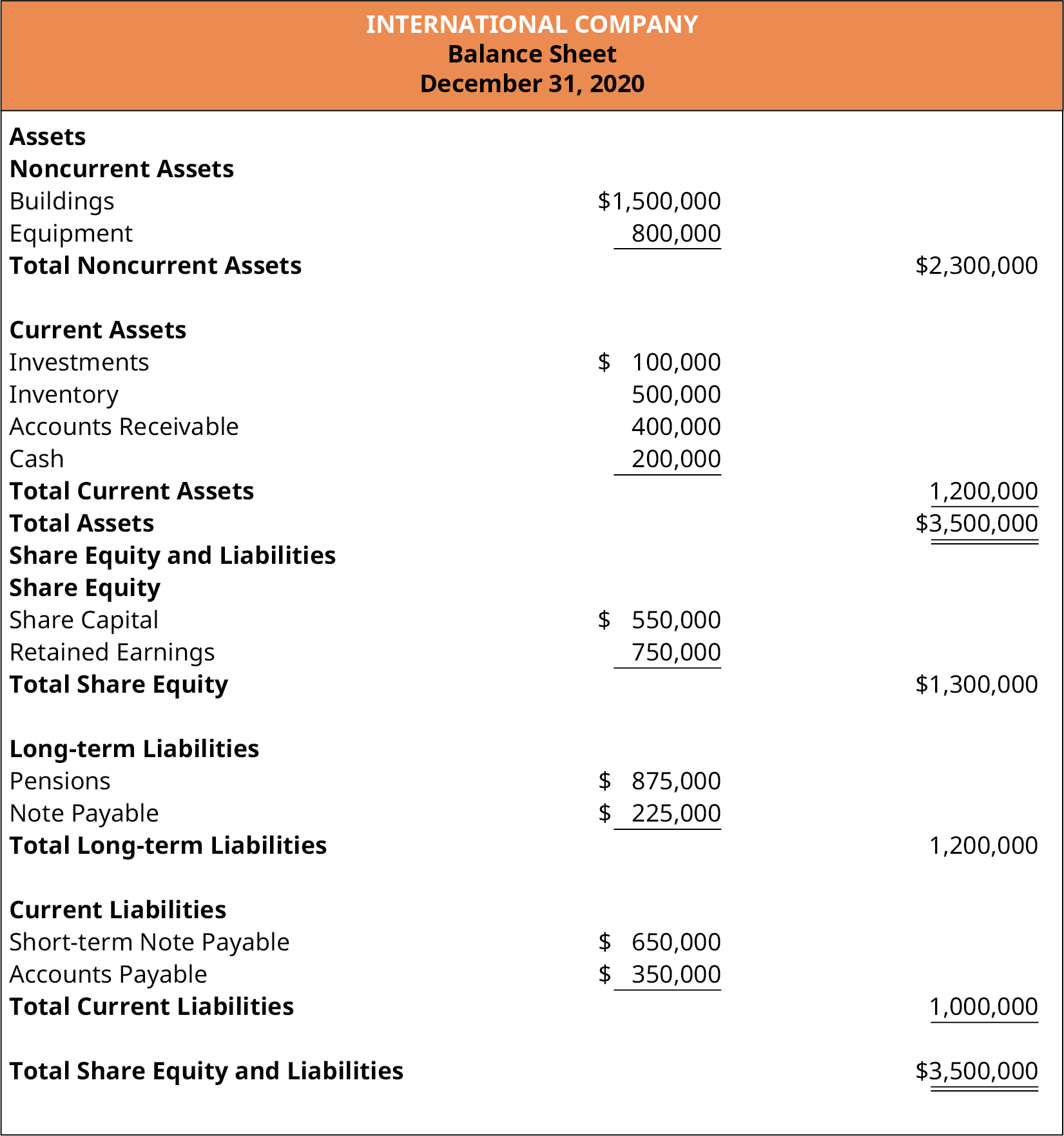

Dividends declared are recorded in the accounting records as a liability of the corporation. Dividends on ordinary share capital constitute an apportionment of the profits attributable to owners of the business and hence should not be charged as an. (us gaap) balance sheet comparison.

Hence, the company needs to account for dividends by making journal entries. See fsp 5.12 for balance sheet reporting and fsp 7.6.1 for earnings per share considerations related to stock dividends and stock splits. What is a dividend?

Volkswagen group (ifrs) vs. Dividends that were declared but not yet paid are reported on the balance sheet under the heading current liabilities. The accrued dividend refers to a balance sheet liability.

Dividends can be defined as the share of profits that are paid to the investors or the shareholders of the company in return for their investment in the particular company for a. Accounting for dividends declared. At its december 2017 and february 2019 meetings, the board made tentative decisions about the classification of interest and dividends in the.

Dividend is usually declared by the board of directors before it is paid out. Dividends represent the distribution of the company’s profits to a class of its shareholders. This is a record in.

This measurement will produce foreign currency transaction gains and losses which should be recorded in net income. If a ltd company (with directors as shareholders) declare a dividend in april (minuted and dividend vouchers distributed) after a march year end and decide not to. Declared but unpaid dividends to a.

What is the accrued dividend? Usually, the board of directors approves a company’s dividends that. Legal issues one of the legal issues that have attracted most attention concerns how to apply s264 of the companies act 1985 when shares are presented as liabilities in the.

If the dividends are to be paid. Using an if statement, model should enable users to override with days sales outstanding (dso) projection, where days sales outstanding (dso) = (ar / credit sales). The statement of cash flows.

When a stock dividend has been declared, but not issued at the balance sheet date, the sum of the number of shares declared as a stock dividend and the total number of.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)