Amazing Tips About Going Concern Disclosure In Financial Statements

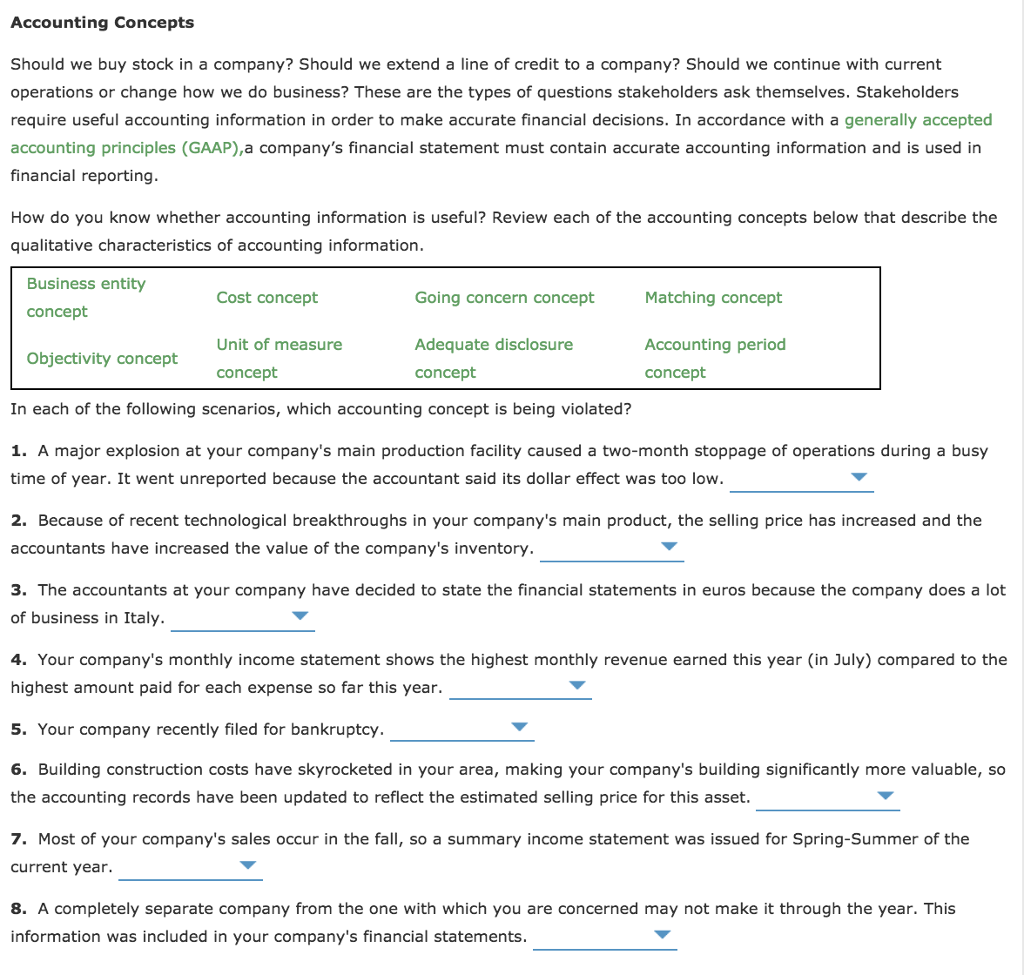

Ias 1 presentation of financial statements sets out the overall requirements for financial statements, including how they should be structured, the minimum.

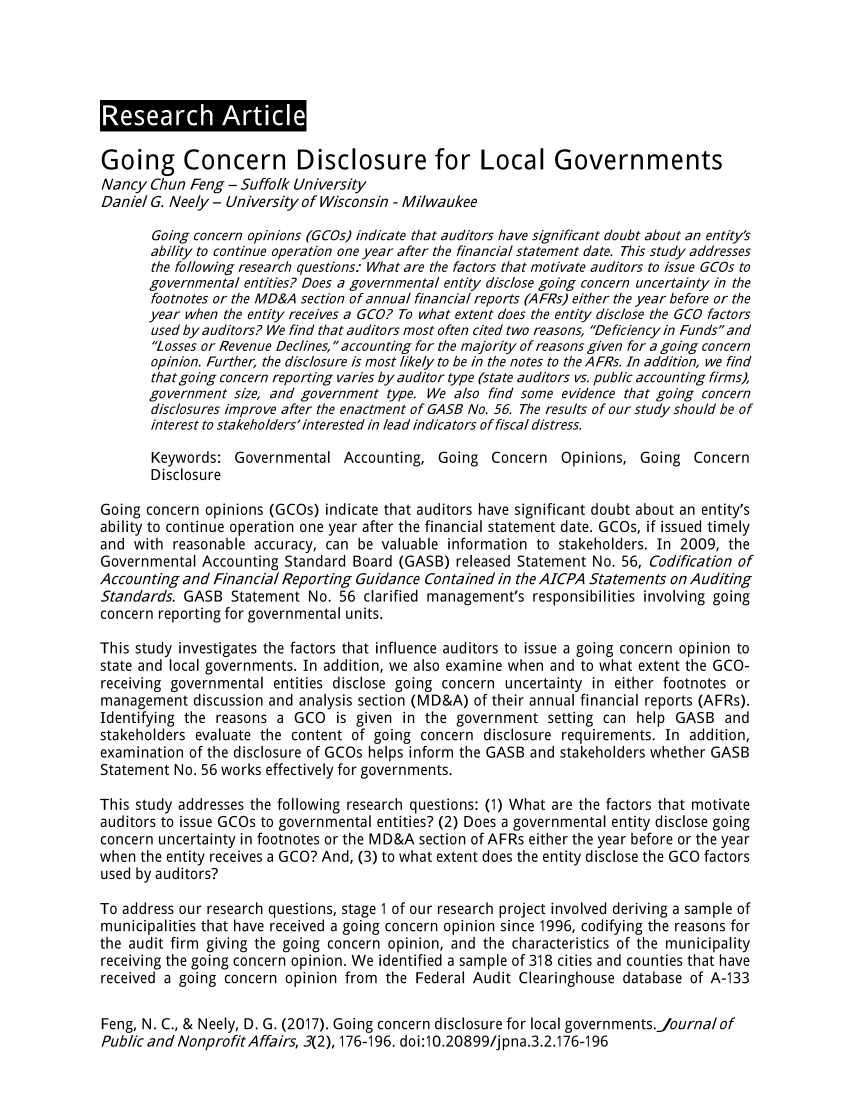

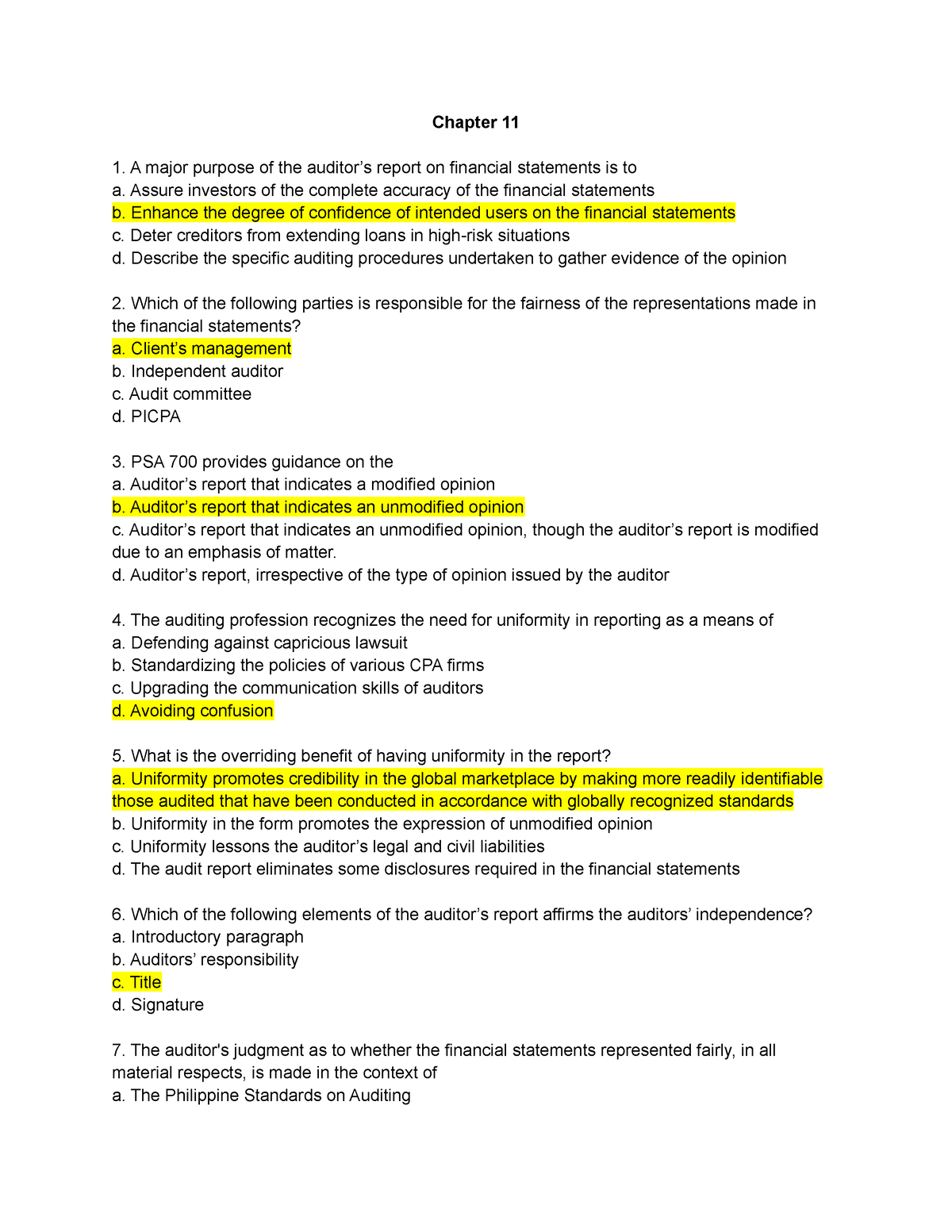

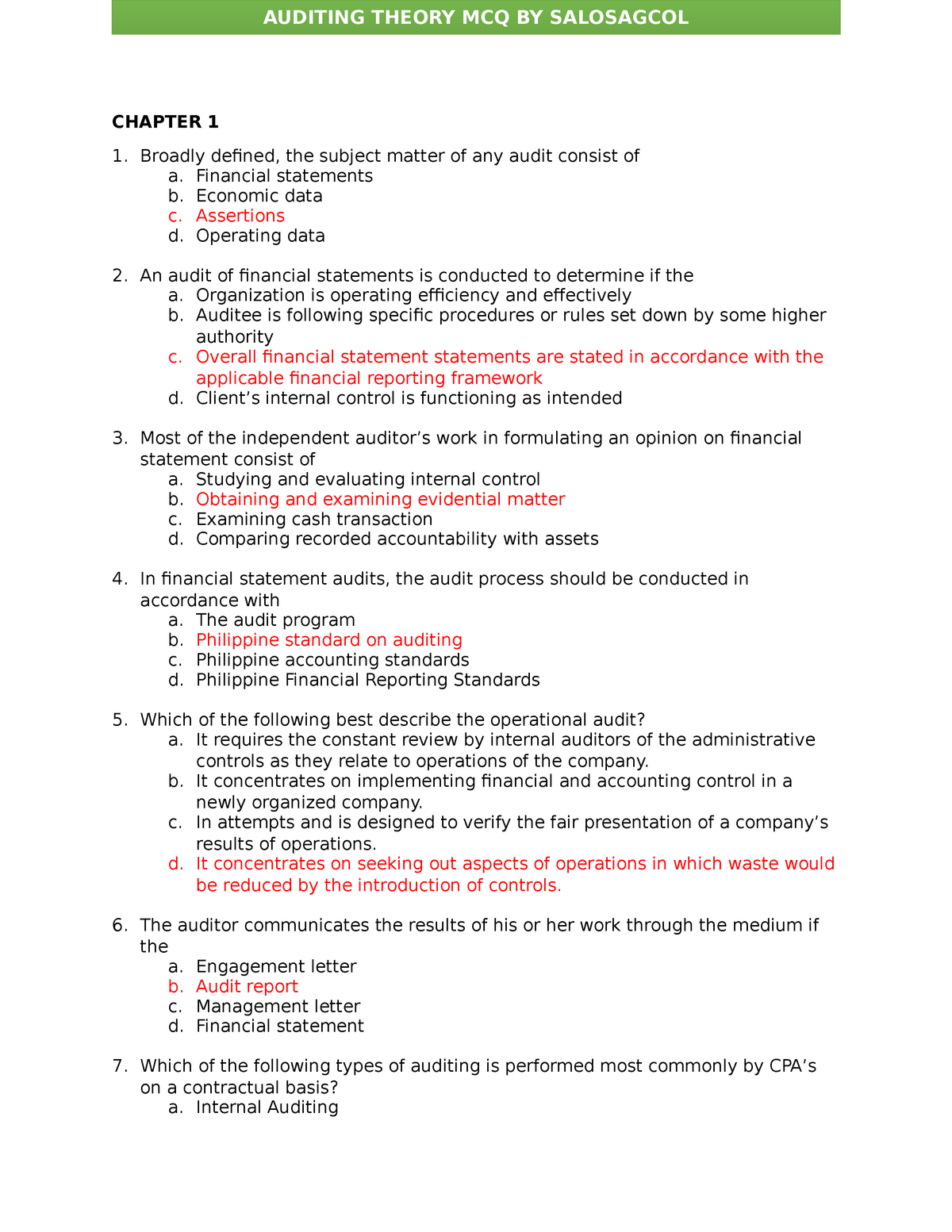

Going concern disclosure in financial statements. Financial statements relating to going concern and the implications for the auditor’s report. Entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the. A narrow scope project to clarify the disclosure requirements about the assessment of going concern in ias 1 presentation of financial statements.

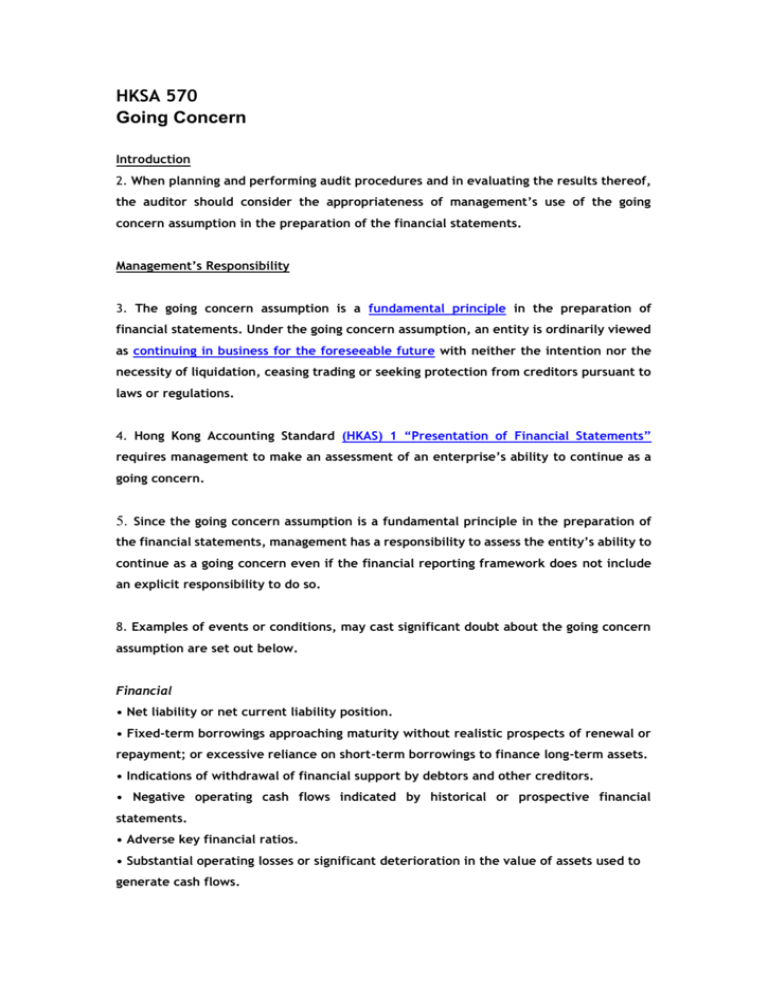

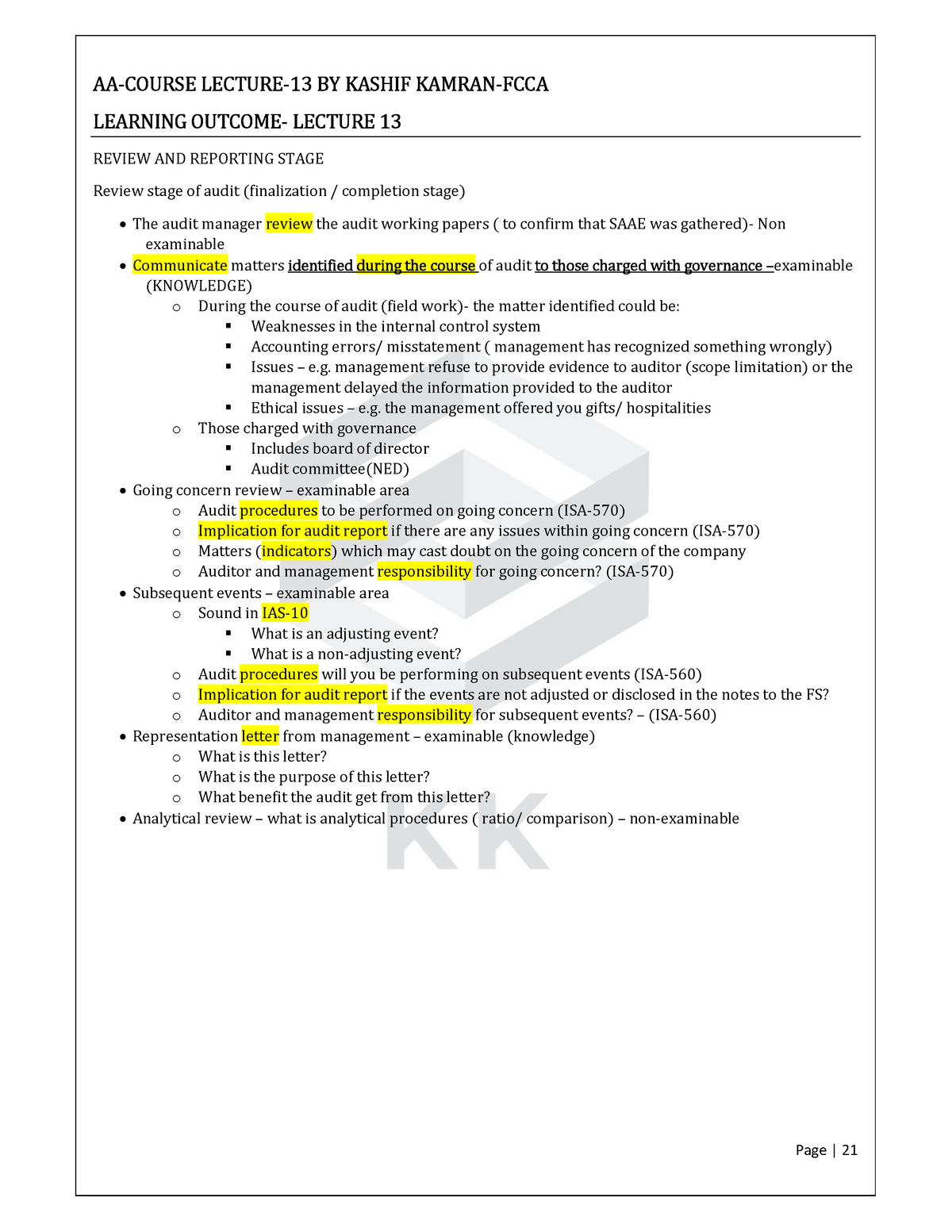

Financial statements relating to going concern and the implications for the auditor’s report. It is important that management’s assessment considers different scenarios, including at least one severe but plausible downside scenario. Under the going concern basis.

Executive summary the going concern assumption is a fundamental principle underlying the preparation of financial statements. Financial statements relating to going concern and the implications for the auditor’s report. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial.

The concept of going concern is an underlying assumption in the preparation of financial statements, hence it is assumed that the entity has neither the intention, nor the need,. Going concern disclosures in financial statements. A1) going concern basis of accounting 2.

The disclosure requirements related to going concern are set out in the applicable financial reporting framework (for example, ifrss). Nevertheless, financial statements should continue to be prepared using the going concern basis of accounting, even when the going concern uncertainties are. A1) going concern basis of accounting 2.

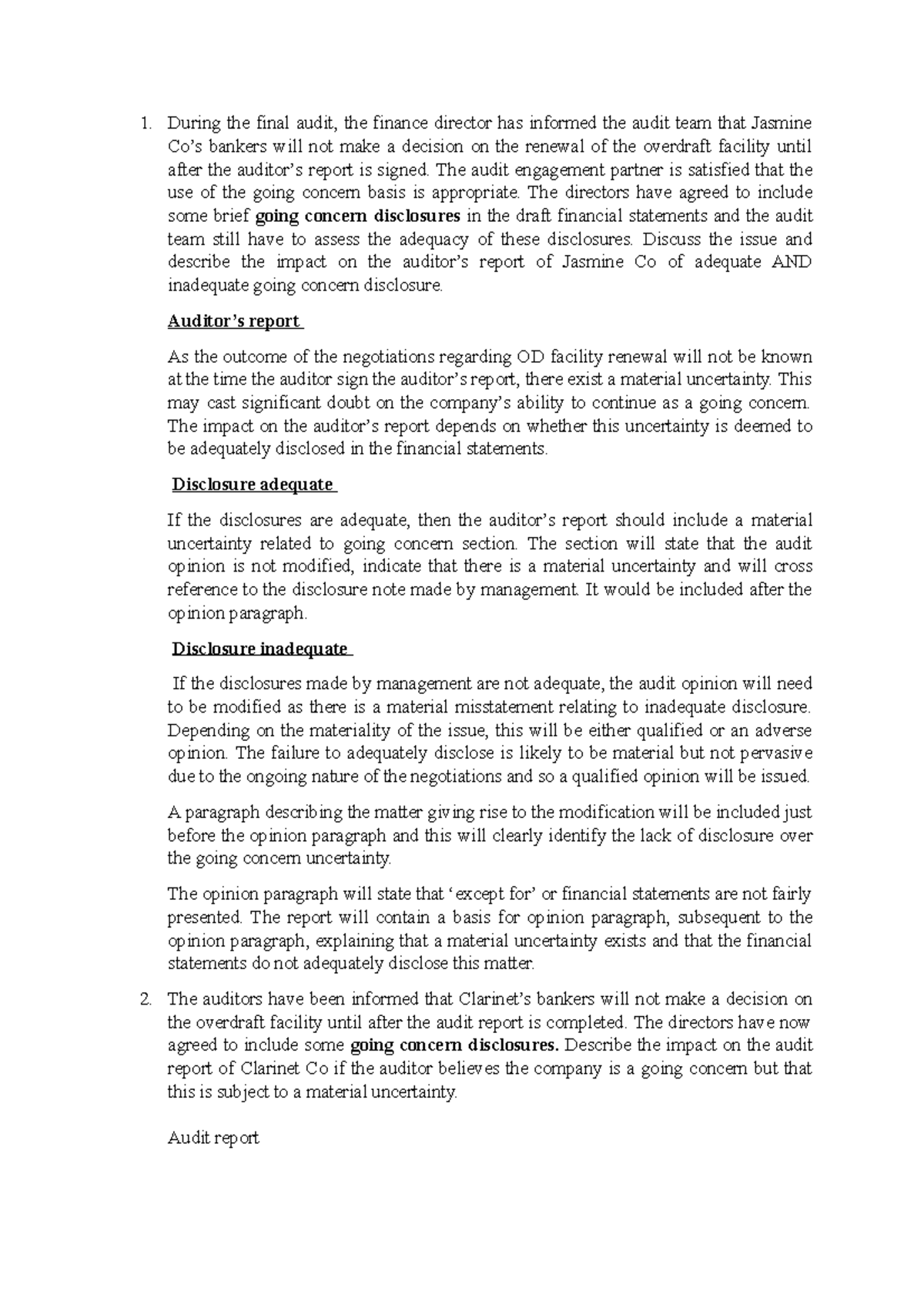

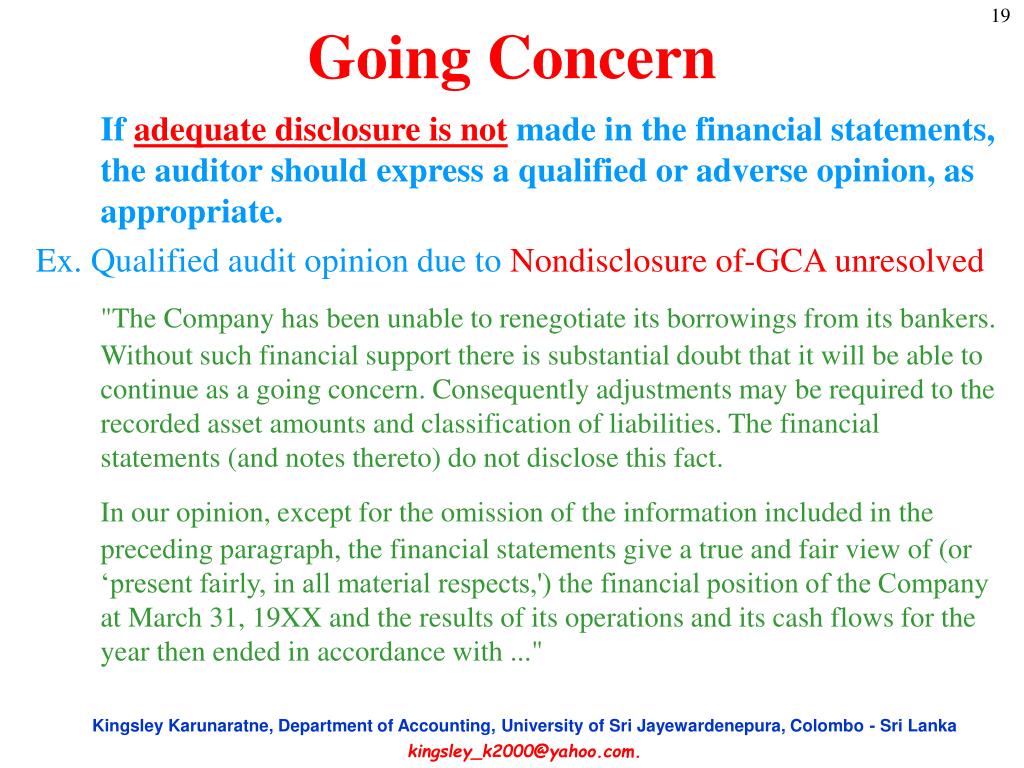

The purpose of this report is to inform market participants of the findings of our review and highlight areas of concern. The financial statements should not be prepared on a going concern basis where events after the reporting date indicate that the going concern. The standards explain that a material uncertainty related to going concern (murgc) is by its nature a key audit matter.9 however, when a murgc exists and adequate.

Ias 1 explains going concern by stating that financial statements are prepared on a going. Disclosure in the financial statements is expected when material uncertainty exists related to events or conditions that, alone or in aggregate, may cast. Under the going concern basis.

The assumptions used in the going. In order to avoid the entity’s credit rating suffering any further decline, the directors have refused to make disclosures in the financial statements and have prepared the. Under the going concern basis.