Divine Info About Balance Sheet Is Statement Of

Sales and balance sheet update, further trading statement, strategic response and cautionary announcement pick n pay stores limited incorporated in the republic of south africa registration number:

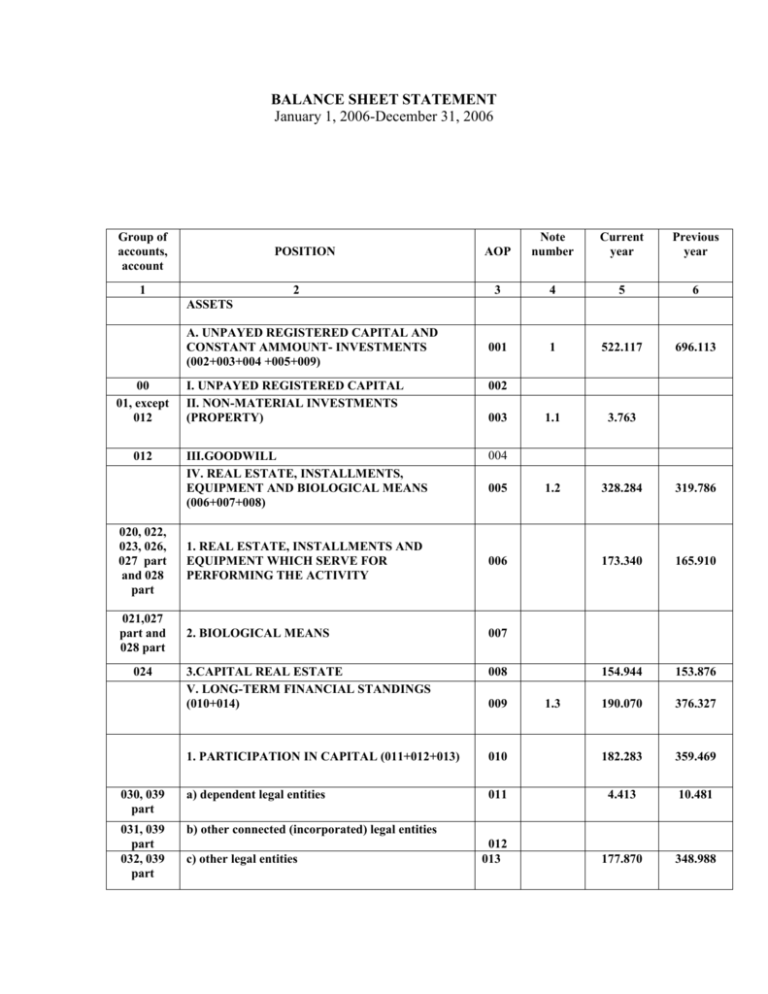

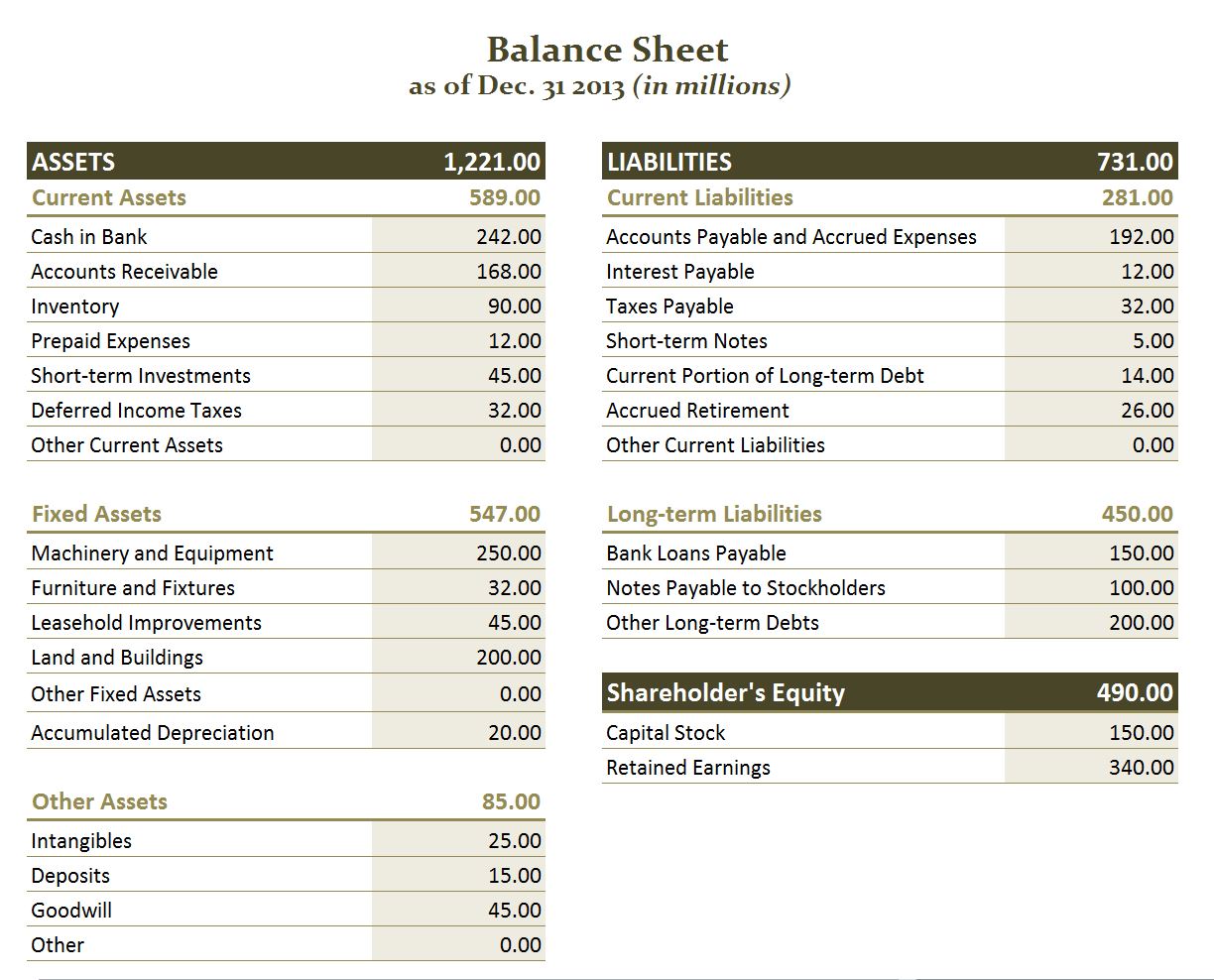

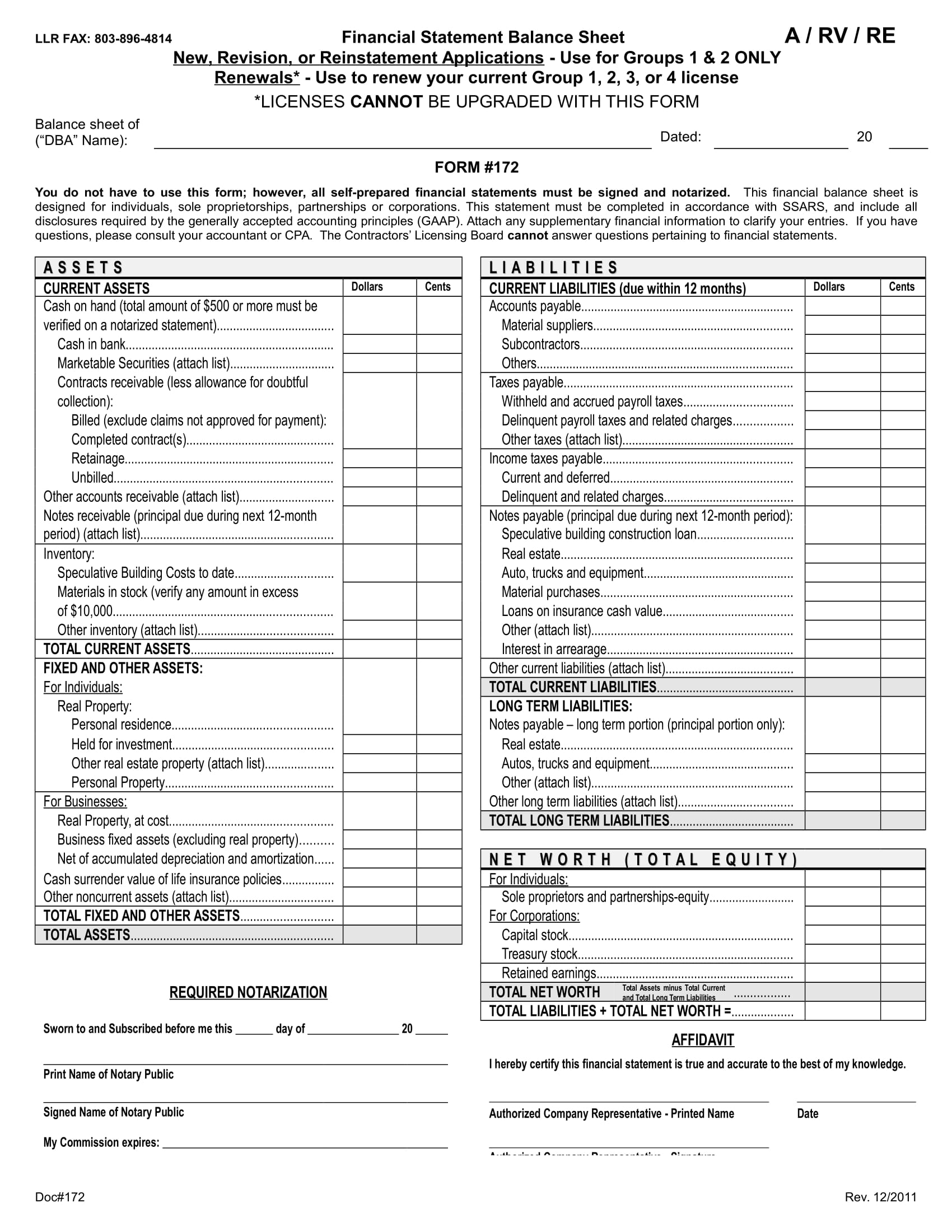

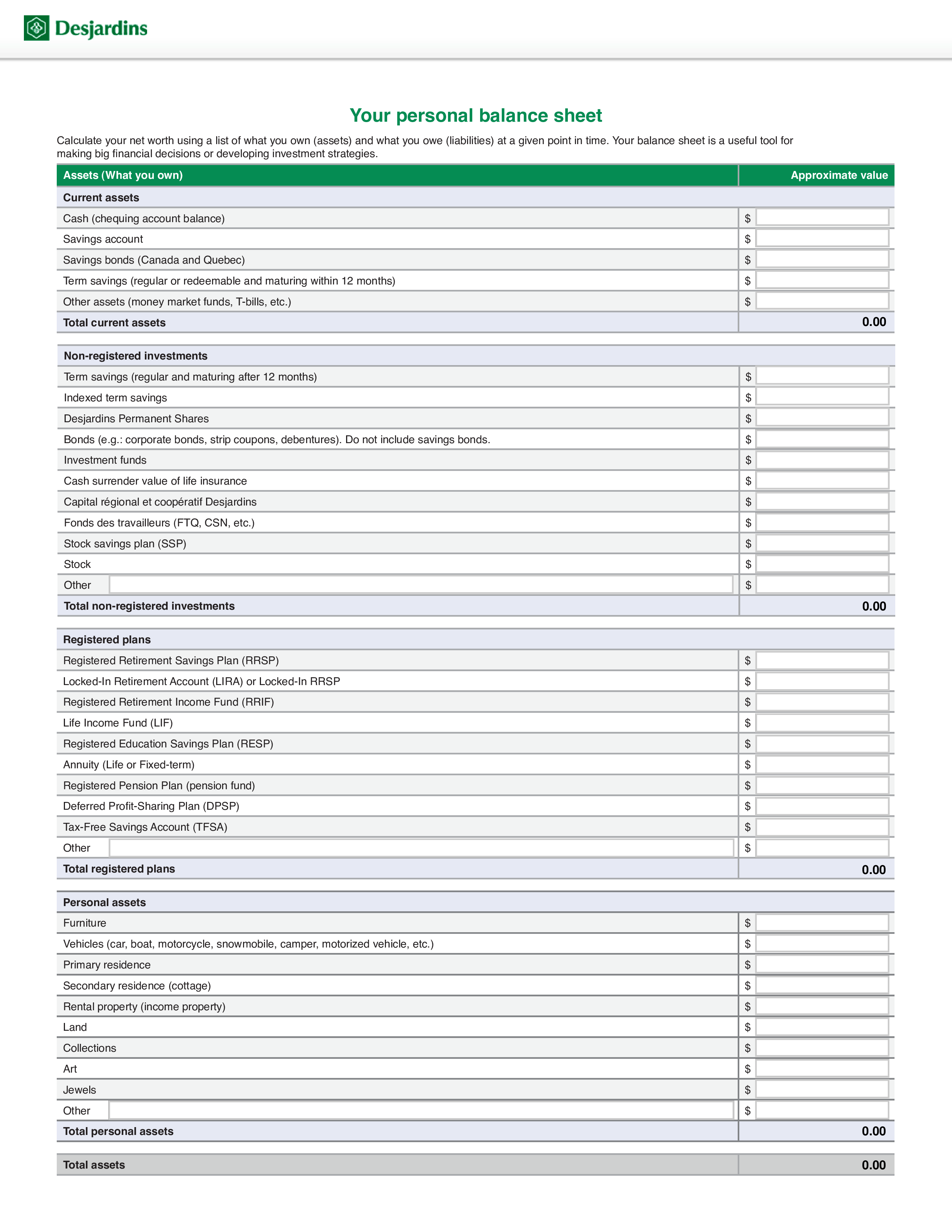

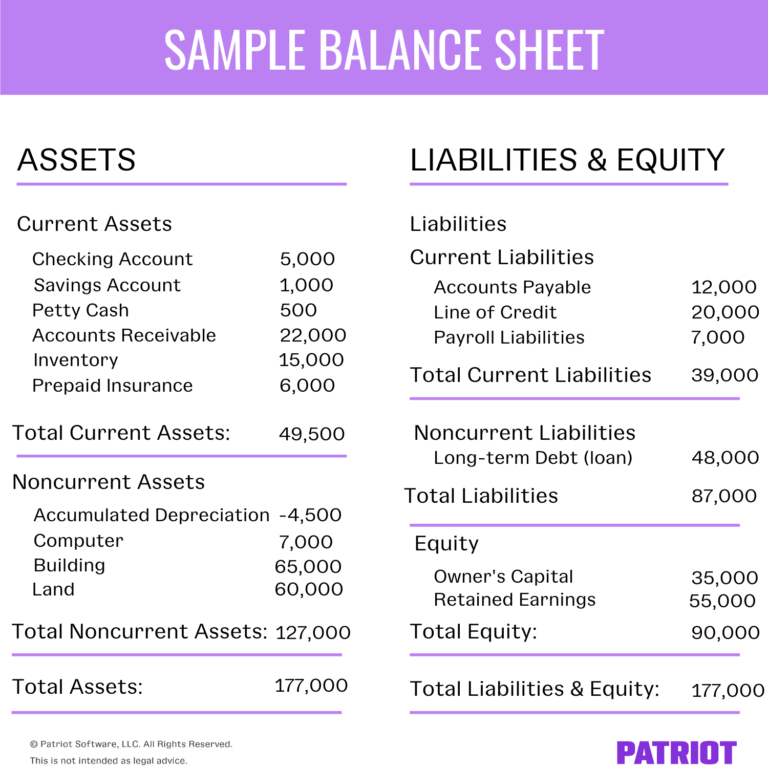

Balance sheet is statement of. All its accounts are divided into equity, liabilities and assets. The first line presents the name of the company; A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time.

The balance sheet is a financial statement that is an important component of a company’s final account. Balance sheet is the statement that shows the balance of assets, liabilities, and equity of the entity at the end of accounting periods. A balance sheet is a financial statement that contains details of a company’s assets or liabilities at a specific point in time.

It reports a company’s assets, liabilities, and equity at a single moment in time. A balance sheet is a type of financial statement. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

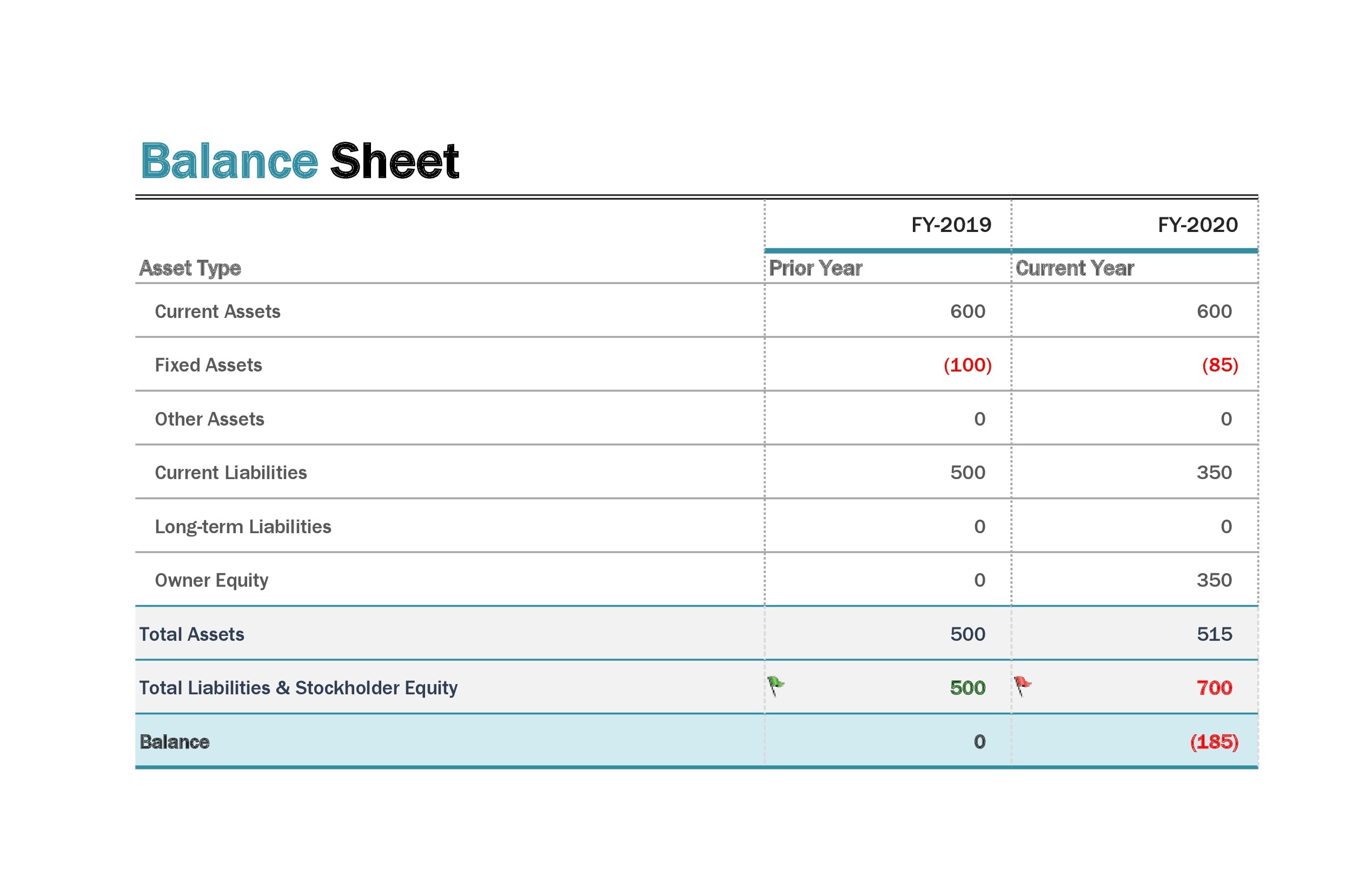

The balance sheet is based on the fundamental equation: As a result, these forms assess a business's health, what it owes, and what it owns. Fed minutes suggest officials are seeking smallest balance sheet possible.

What is the balance sheet? In simpler terms, a balance sheet is a summary of. How healthy is intel's balance sheet?

Balance sheets report a company's assets, liabilities, and equity at a certain time. Policymakers said slower qt could ease shift to ample. Zae000005443 (pick n pay or the company) sales and balance sheet update for.

The balance sheet is a statement that shows the financial position of the business. Individuals and small businesses tend to have simple balance sheets. It is one of the three core financial statements (income statement and cash flow statement being the other two) used for evaluating the performance of a business.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. The balance sheet may also be called the statement of financial position or statement of financial condition because it presents assets, liabilities, and shareholders’ equity as a snapshot in time, on a date at the end of the accounting period. It is made for use within the company.

It provides useful data about the entity’s financial status or position. It is made for the company’s external affairs. A typical balance sheet starts with a heading which consists of three lines.

It reports assets, liabilities, and shareholder’s equity to provide an overview of what a company owns, what it owes, and what is left over for the owners. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The second describes the title of the report;

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)