Marvelous Info About Example Of Cash Budget For 3 Months

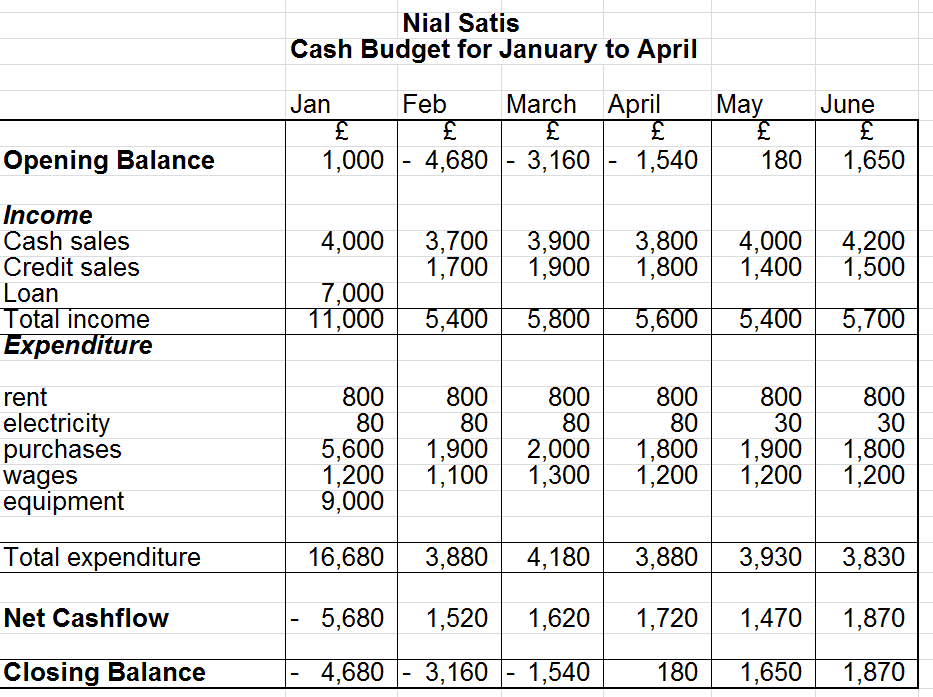

We'll start by looking at the cash budget for a new trading.

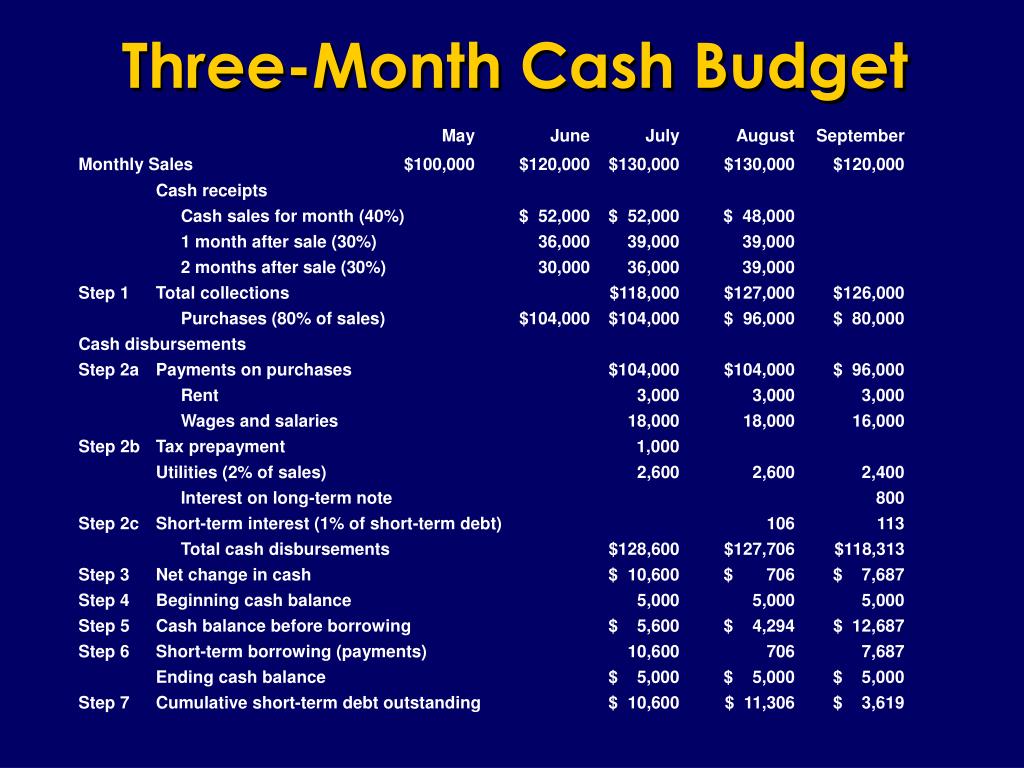

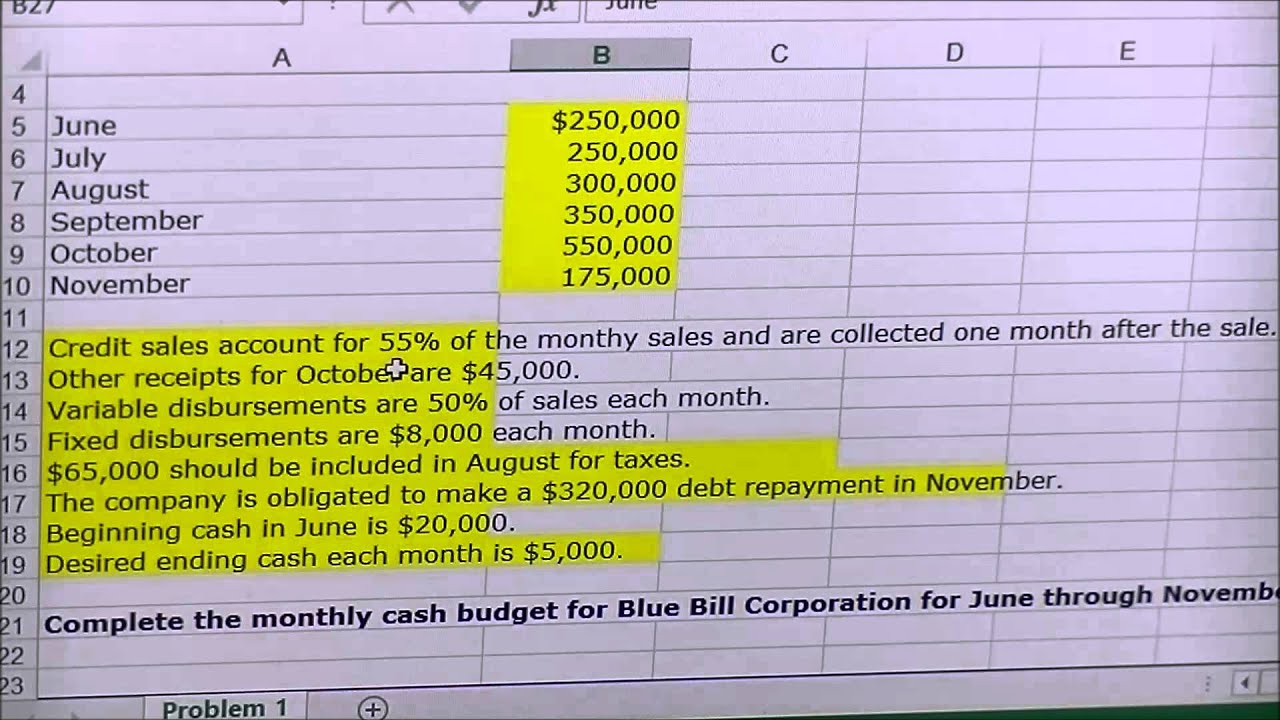

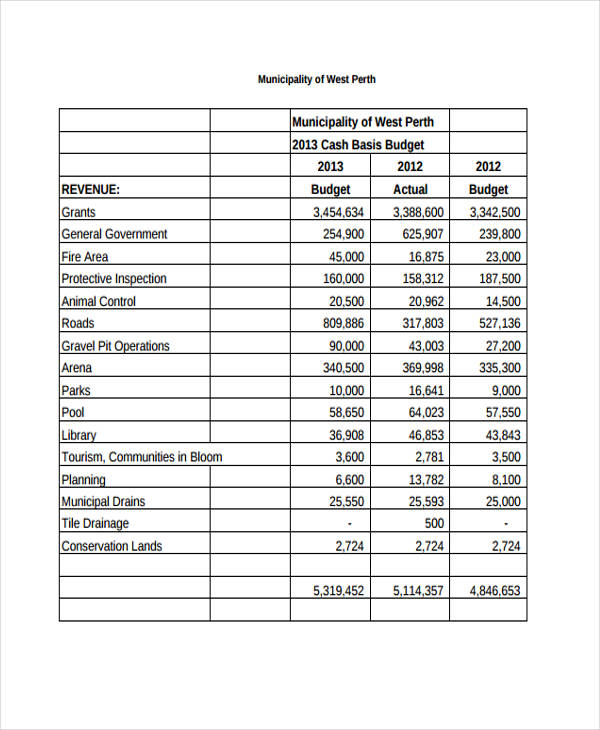

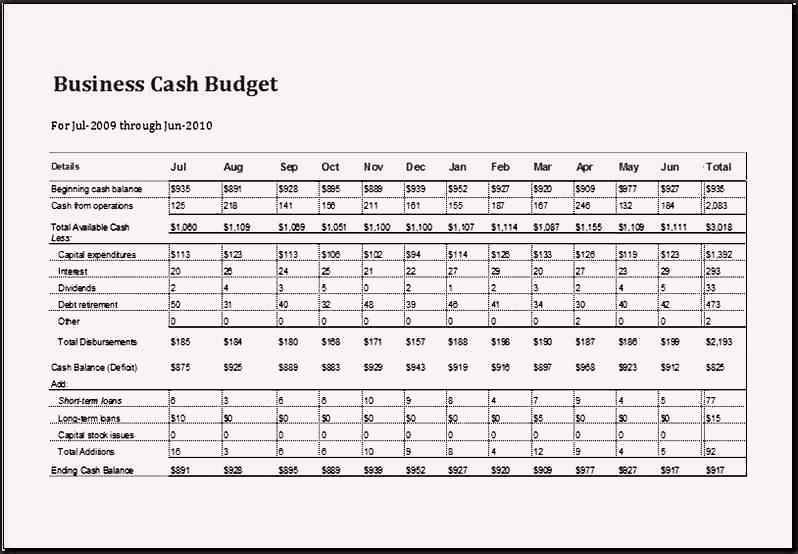

Example of cash budget for 3 months. The cash budget’s significance extends to strategic planning,. From the following forecasts of income and expenditure, prepare a cash budget for the months jan. Capital expenditure to be incurred:

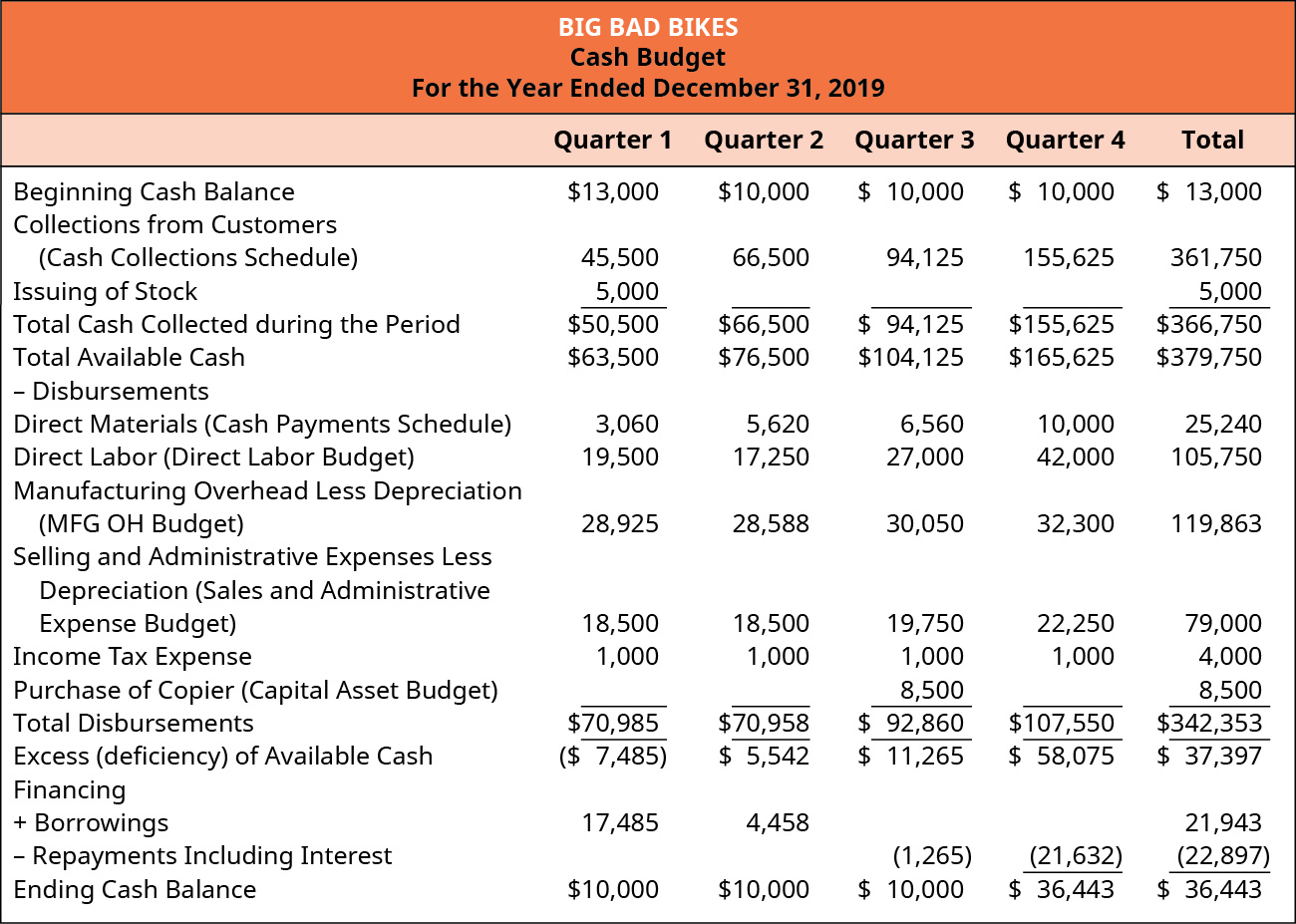

Key takeaways cash flow budgeting forecasts cash inflows and outflows over specific periods, like annually or monthly. In case of a deficiency, loan is obtained at. Cash flow budget is a flexible cash flow planning tool for a restaurant.

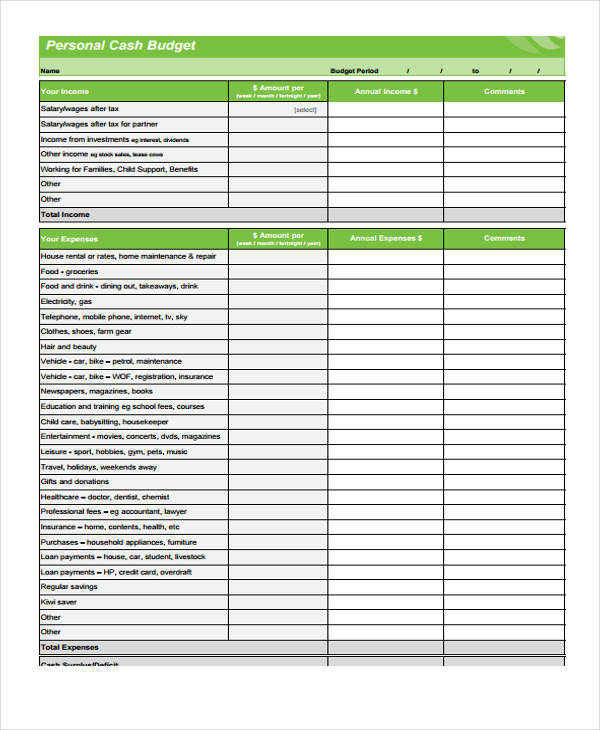

Below is an example of a generic monthly cash budget template in excel that you can download and use for your own purposes. Company a maintains a minimum cash balance of $5,000. It should be divided into the shortest time period possible, so management can be quickly made.

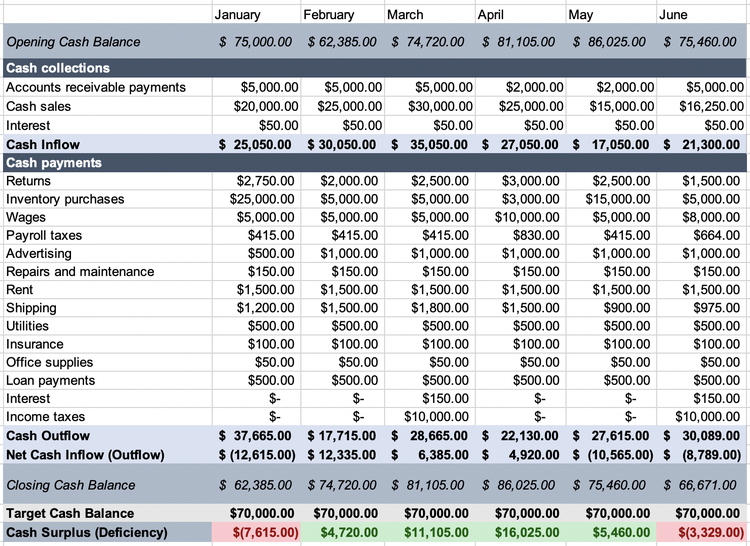

Below is an example of a generic monthly cash budget template in excel that you can download and use for your own purposes. Standard periods include monthly, quarterly, or. A cash budget is an income statement, bank statement, and cash flow statement all in one.

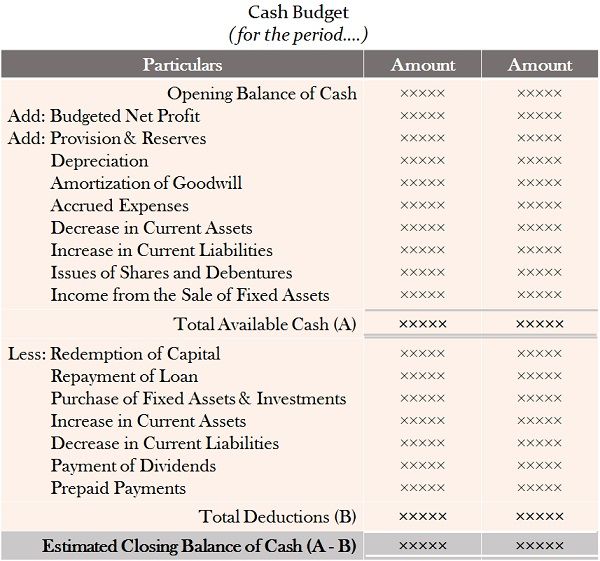

Key points what do you think, making a cash budget is important for any business? The following example illustrates the format of cash budget. The following are illustrative examples of a cash budget.

It would help you to forecast. Here's an example of a cash budget a company might make: Decide the time frame for your cash budget.

For operating businesses, maintaining a healthy cash position is essential to meet. Example of a cash budget template. A dividend of rs 10,000 is payable in april.

The customers are allowed a credit period of 2 months. This article shows how to build up a cash budget using the receipts and payments account. Additional information in follows :

Frequently asked questions how do you prepare a cash budget? For example, you may forecast $10,000 in revenue this month, but if you offer credit or payment plans to your customers and only 40% of them pay in cash, this. It ensures companies have enough cash for daily.

The cash budget is the combined budget of all inflows and outflows of cash. A company assesses its finances to determine how much income it will have in the next three. To prepare a cash budget, cash inflow and outflow must be determined.