Stunning Tips About Two Types Of Cash Flow Statements

This article discusses the “ins” and “outs” of the types of cash flow and how they might impact your business.

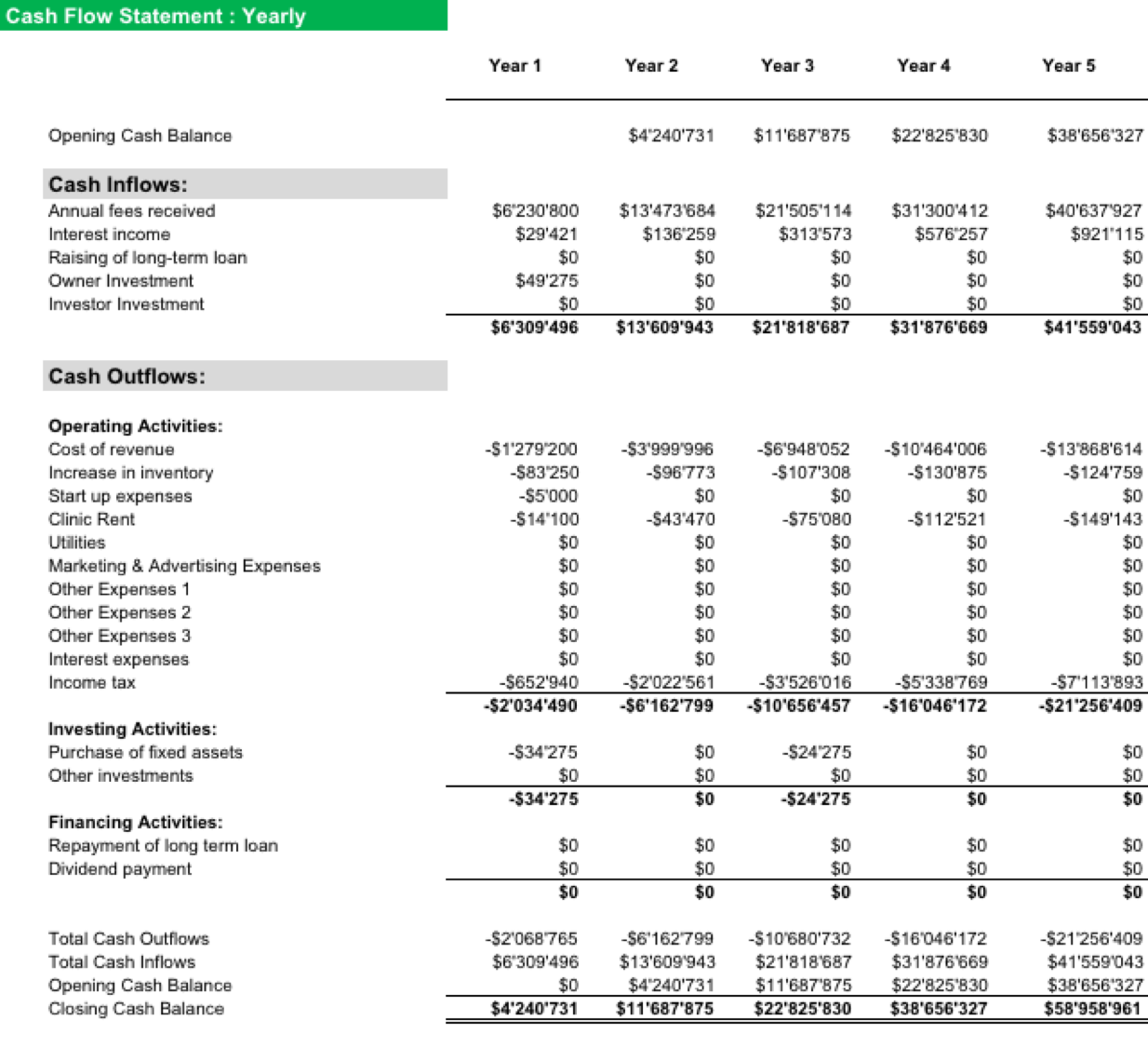

Two types of cash flow statements. Cash flow is the money that streams in and out of your small business—it's a key indicator of your company's financial health. This value can be found on the income statement of the same accounting period. There are two methods for calculating cash flows:

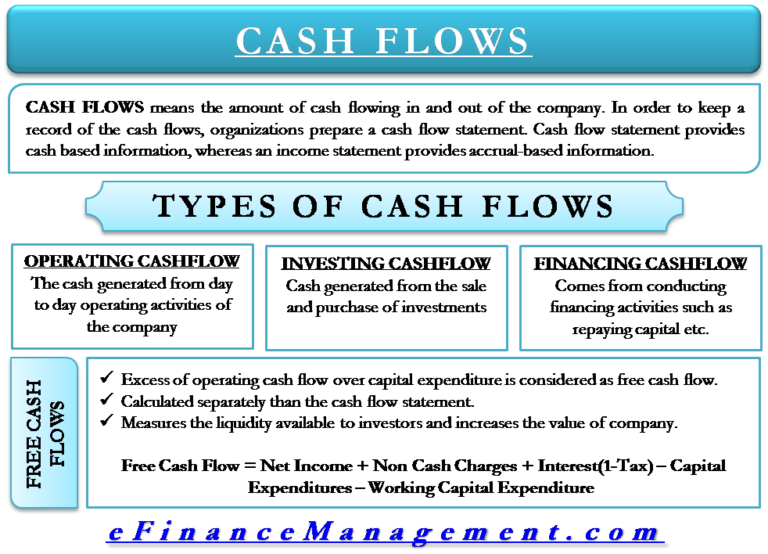

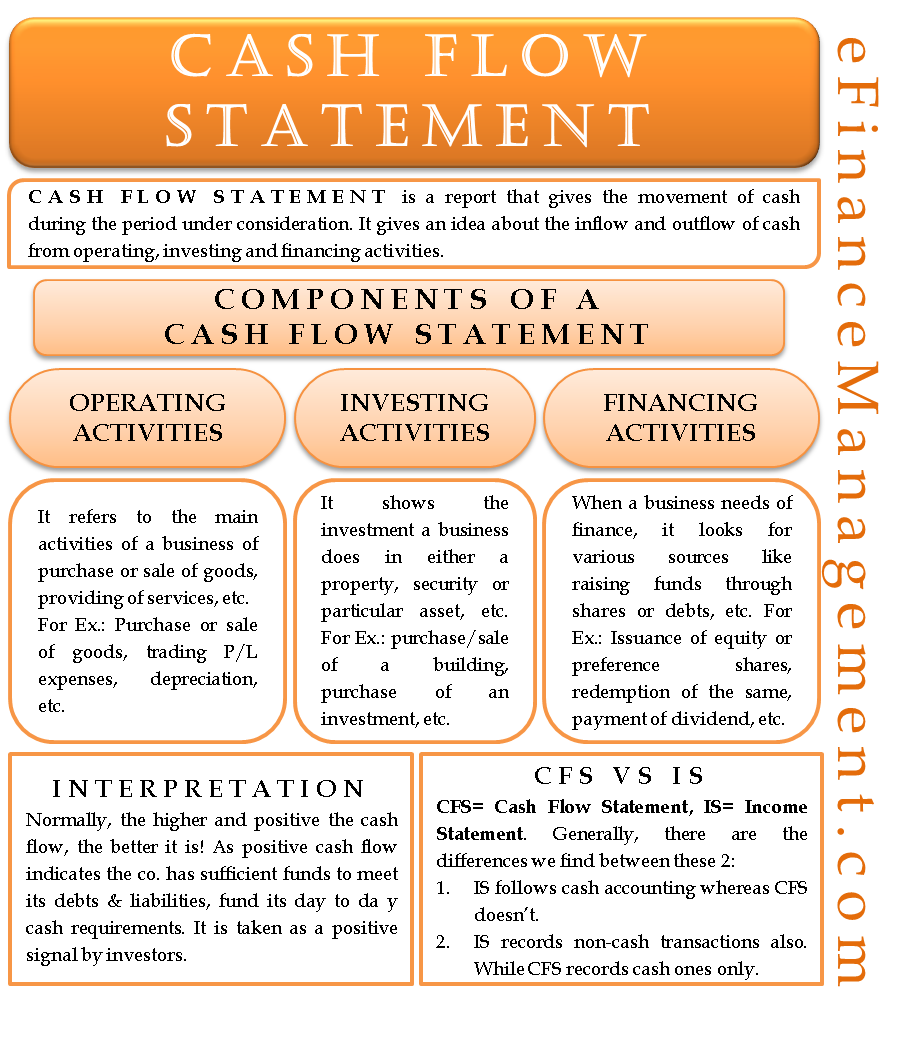

In addition, cash flow statements can include operating, investing, and. Cash flows can include operating cash flow, investing cash flow, financing cash flow, and net cash flow. It has a net outflow of cash, which amounts to $7,648 from its financing activities.

What is cash flow? The main difference between the two types of accounting systems is based on the timing when transactions are being recognized. The cash flow statement is an important document that helps interested parties gain.

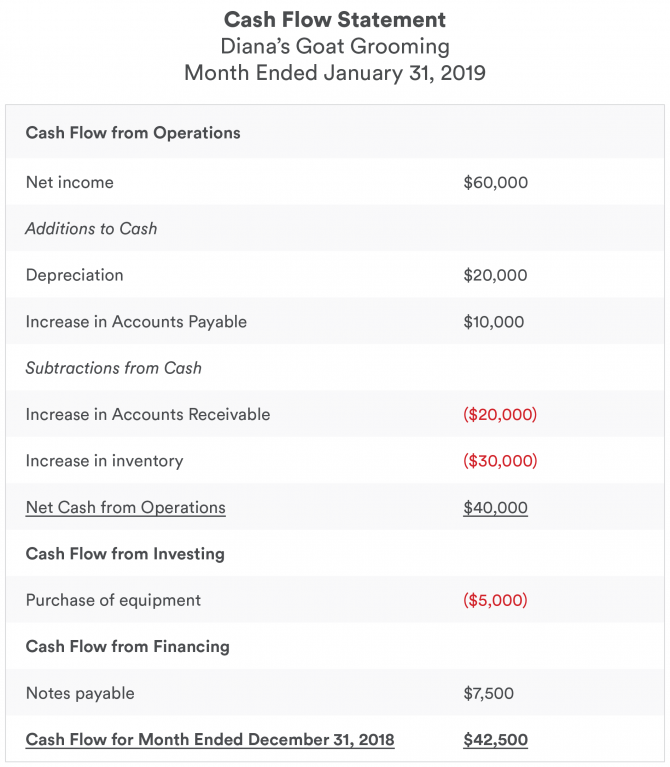

The most common types of cash flow statements are direct and indirect methods. The two different accounting methods, accrual accounting. In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities.

An example of the cash flow statement using the direct method for a hypothetical company is shown here: The direct method, and the indirect method. Essentially, the cash flow statement.

The three main financial statements are the balance sheet, income statement, and cash flow statement. Investopedia / nono flores understanding cash flow businesses take in money from sales as. In order to figure out your company’s cash flow, you can take one of two routes:

There are mainly three types of cash flow in a company's cash flow statement, namely operating cash flow, investing cash flow & financing cash flow. These are segregated so that analysts develop a clear idea of all the cash flows generated by a company’s various activities:. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

It involves liquidity and stability, the capability to influence the amounts and timings of cash flows to adjust to varying conditions and possibilities. The two methods of calculating cash flow are the direct method and the indirect method. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

We hopefully start the year with a balance in our bank account, which is called a positive cash balance. Note that the difference between the two methods lies in computing cash flows from operating activities. A company's cash flow can be categorized as cash flows from operations, investing, and financing.

In contrast, the cash flows from investing and financing activities are treated similarly in direct and indirect methods. Statements of cash flow using the direct and indirect methods. Cash flow statements split your inflow and outflow of cash into three main categories:

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)