Cool Info About Journal Entry For Prepaid Salary

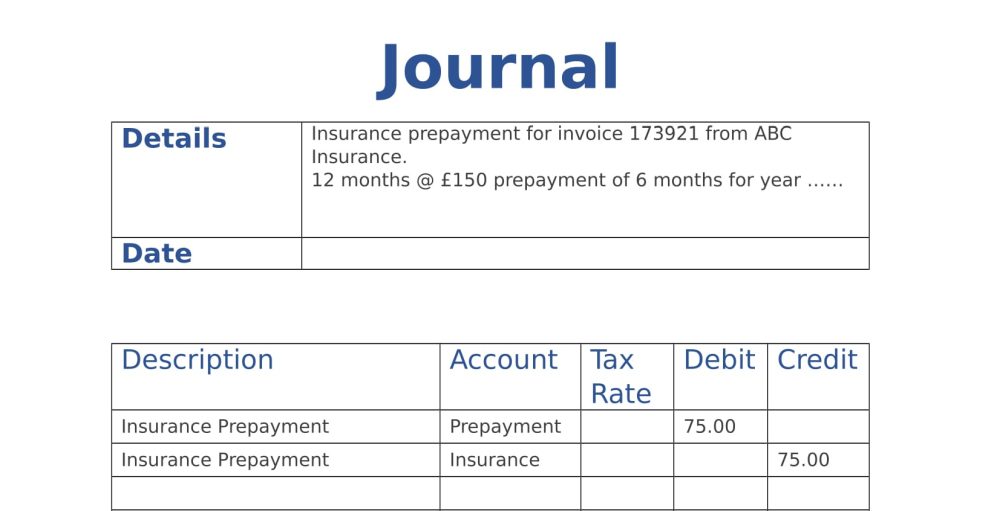

Below are examples of journal entries under two different methods of recording prepaid expenses using the following.

Journal entry for prepaid salary. Accounting and journal entry for rent paid; What are the three types of personal accounts? Such expenses which are concerned with the next.

There are two ways of recording prepayments: Journal entry for prepaid spending. It is the amount of salary paid by an entity in.

Outstanding expenses journal entry with examples. We already studied about accrued salaries journal entry, but here we will study about prepaid salary journal entry. It is further shown under the head current asset in the balance.

Prepaid or unexpired or advance expenses: You typically enter these at the. Journalize the prepaid items in the books of unreal corp.

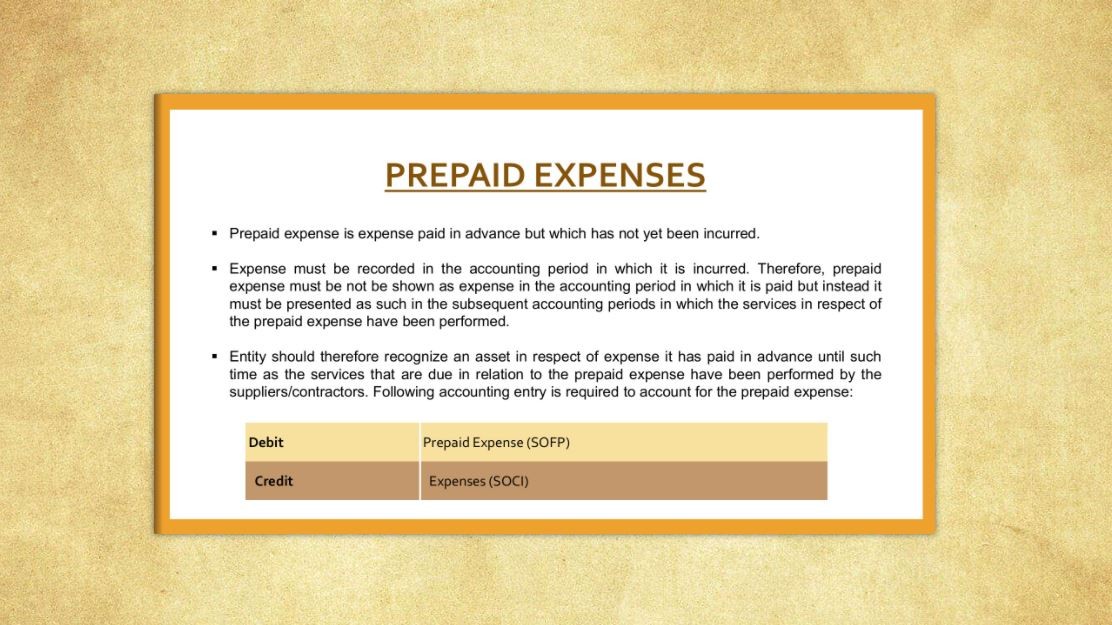

One method for recording a prepaid expense is to record the entire payment in an asset account. A prepaid expense journal entry is a transaction recorded in the accounting books to recognise an expense that. Prepaid salaries journal entries.

Adjusting journal entries are entries in a financial journal that ensure a business allocates its income and expenses properly. Accounting for prepaid expenses accrual basis vs. Journal entry for salary paid in advance.

Examples prepaid expenses journal entry prepaid insurance journal entry prepaid rent journal entry prepaid salary journal entry are prepaid expenses assets?. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid expense is an asset and are increased when debited.

Salary paid in advance is also known as prepaid salary (it is a prepaid expense ). Prepaid expense journal entries. Prepaid expense journal entry suppose company a paid 6 months upfront for office rent worth $12,000.

Journal entry of prepaid expense: What is a prepaid expenses journal entry? These are both asset accounts and do not increase or decrease a company’s balance.

The adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. Most of the company pays employees at the end of the month or even the beginning of next month. However, the company may pay the employees in advance if there are any.