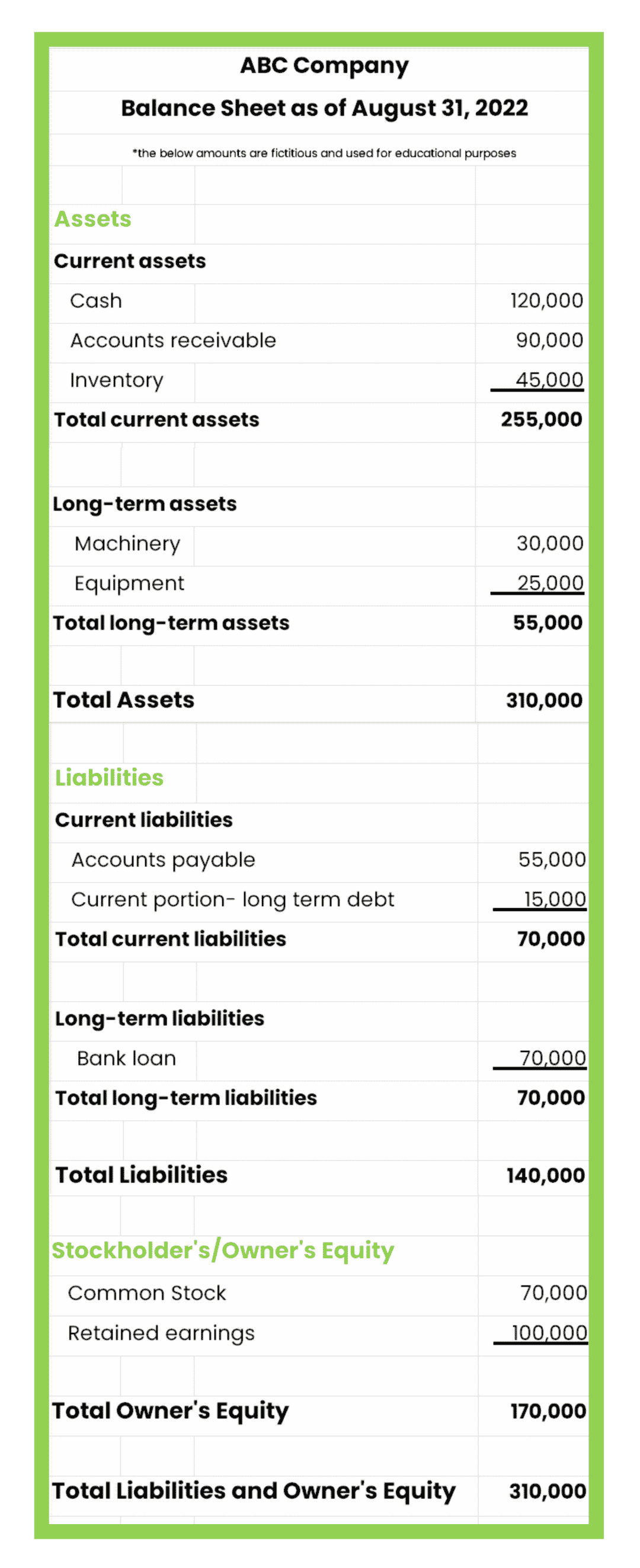

Painstaking Lessons Of Info About Strong Balance Sheet Stocks

Strong balance sheet stocks to buy right now first on our list of cash machine stocks is homebuilder dr horton, ticker dhi, the largest u.s.

Strong balance sheet stocks. The stock was trading at $7.22 on thursday, a few points below this week’s high of $8. As the world's most valuable. Stocks have been slammed this year but morgan.

5 stocks with the strongest balance sheets (aapl, msft) apple, inc. Whether it is with energy stocks, or any other sector, investors are often told to look for companies with strong balance sheets.balance sheets include assets on. In today's video, i cover five dividend stocks that show all these qualities and more.

Australian strong balance sheet stocks. Energy strong balance sheet stocks. Ginn follows the solactive innovative global equity index and holds 468 stocks — a deep enough bench.

With a recession possibly on the horizon, investors may want to consider acquiring stocks with strong balance sheets. Strong balance sheet and sound fundamentals. Companies with a health score of at least 4, ordered by health.

Help for low credit scores. Core positions of your portfolio should be safe, reliable, and consistent. Experts extracted 7 stocks from the list of 220 zacks rank #1 strong buys that has beaten the market more than 2x over with a stunning average gain of +24.3%.

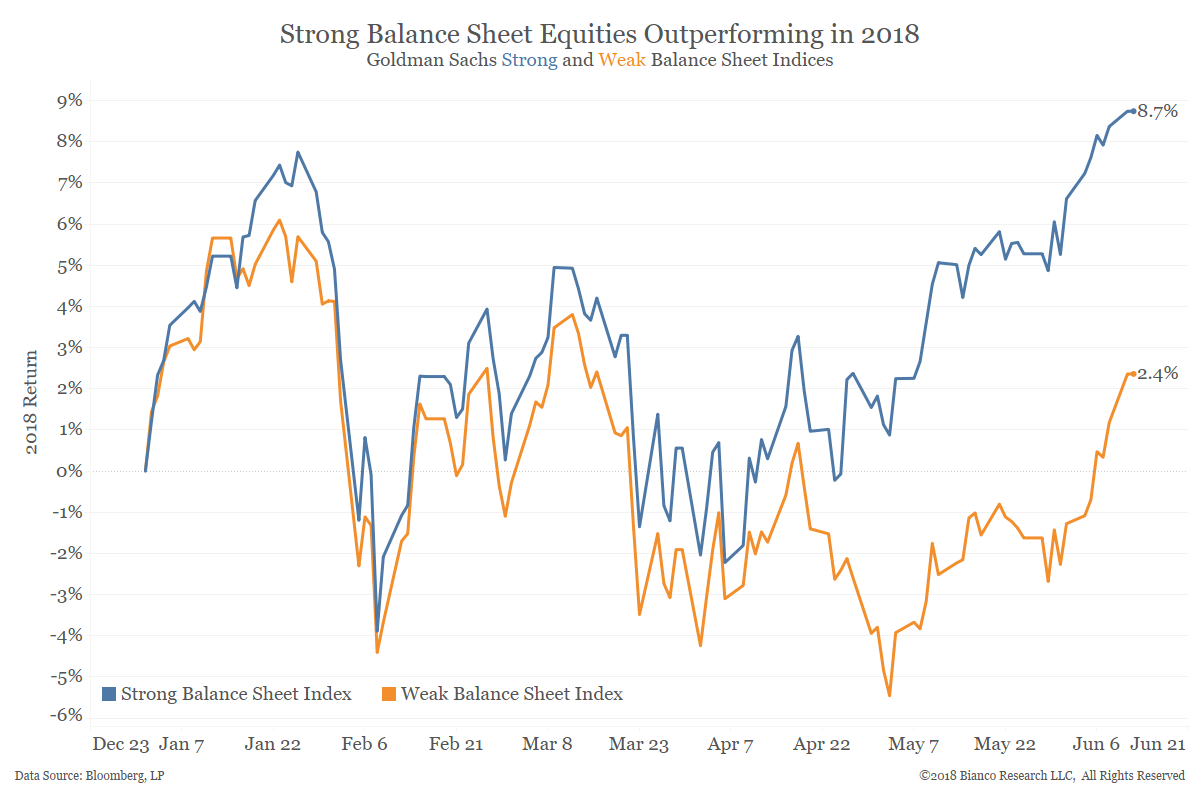

Picking stocks with strong balance sheets these stocks outperformed in both upmarkets and downmarkets, while still keeping volatility low, says cpms’ emily. The key to searching for companies to invest in for the new year is focusing on stocks with solid fundamentals, including healthy balance sheets and lower debt levels. Apple ( aapl) is a stalwart of the strong balance sheet list.

Ug's 4.6 million share count has been historically reliable and gives us a base case. Companies with a health score of at least 4, ordered by. With nearly 50 years of consecutive dividend growth, and such a strong balance sheet, it's no wonder that jnj is found in so many dividend portfolios.

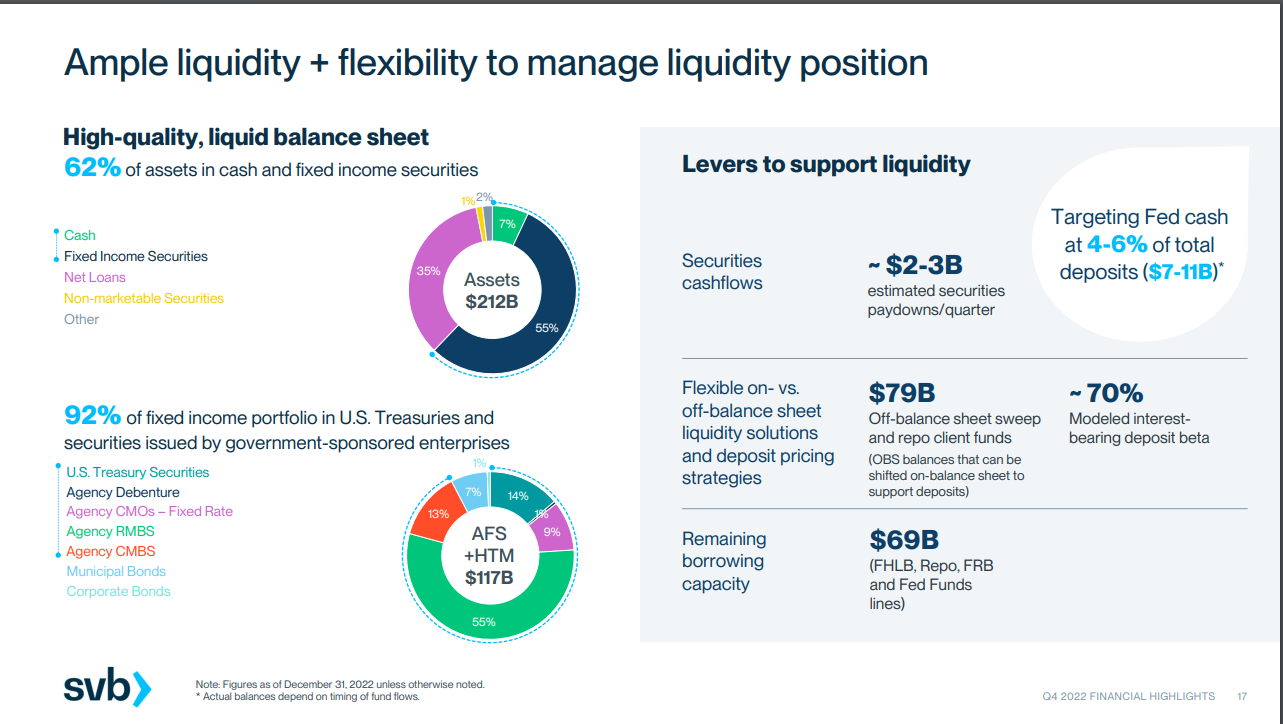

Companies with a strong balance sheet, solid past performance, and high return on equity. 7% of bank of america, and. This strategy looks for stocks trading at a reasonable price relative to earnings growth that also possess strong balance sheets.