Brilliant Tips About Income Tax Department 26as

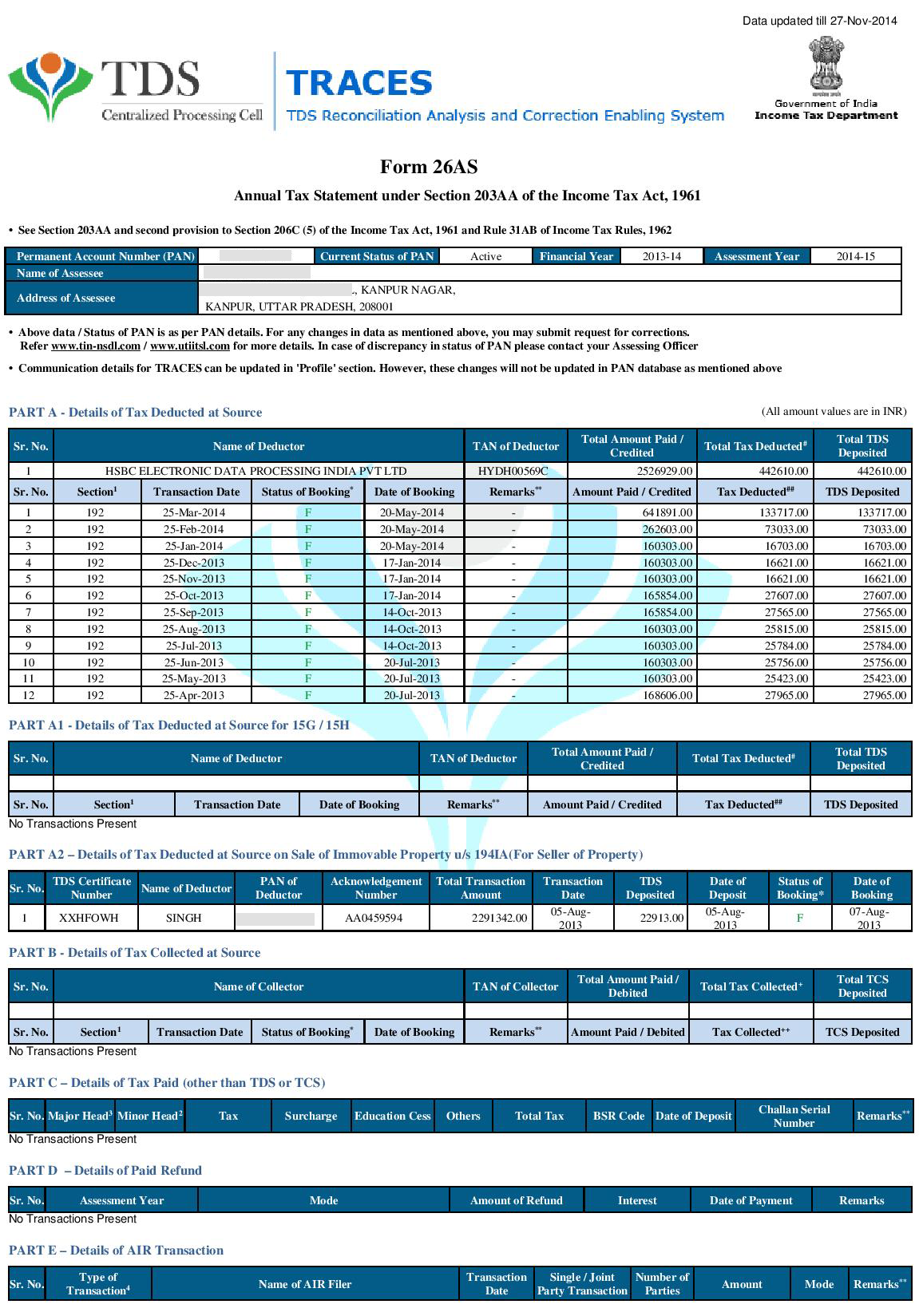

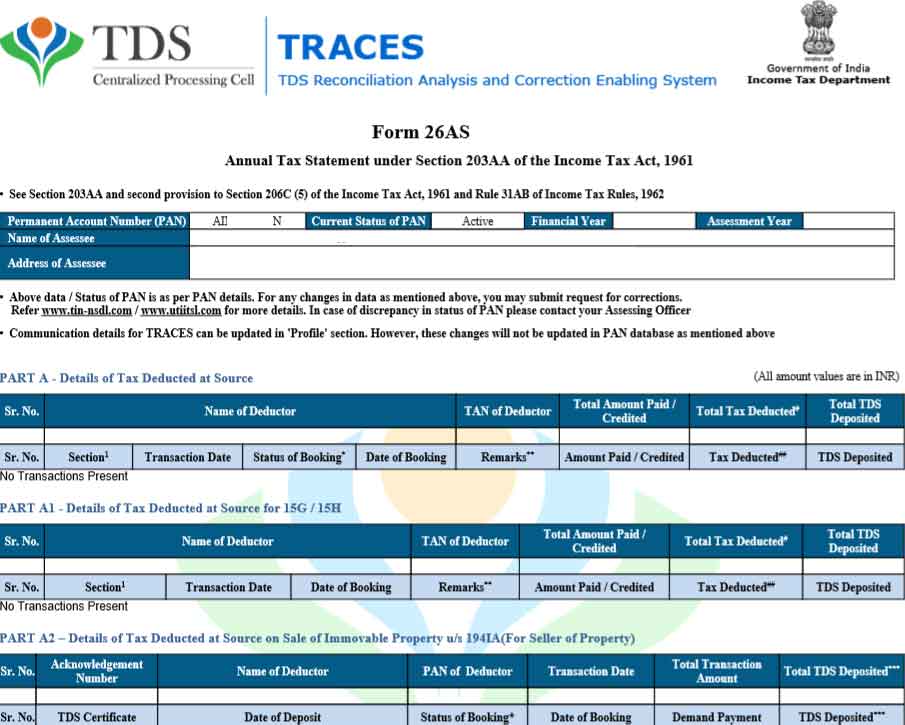

The income tax department’s website provides an option to view form 26as by logging in using one’s pan (permanent account number).

Income tax department 26as. Do not forget to check status of pan of the deductee. Eligible outstanding direct tax demands have been remitted and extinguished. It is known that filing an itr requires a dozen documents, which are essential for a.

If you are not registered with traces, please refer to our e. Here is how to get form 26as: Form 26as can be downloaded from traces website.

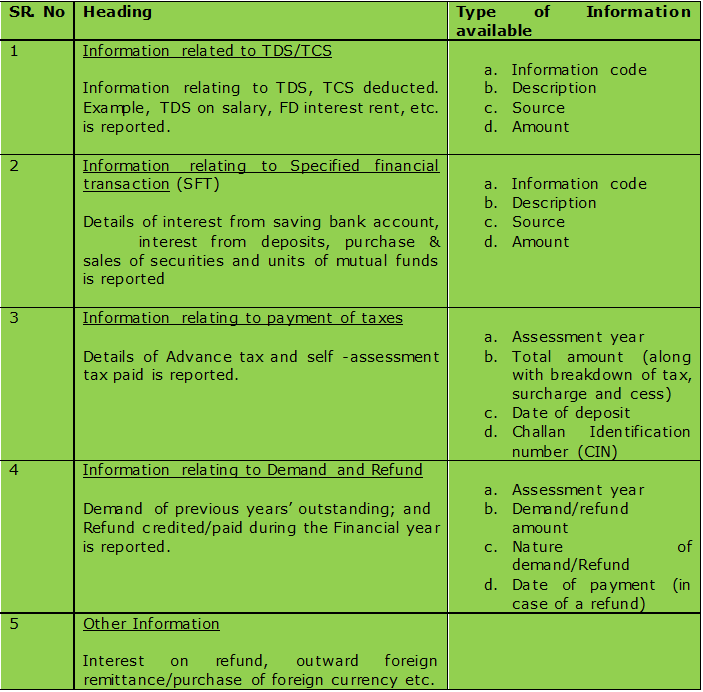

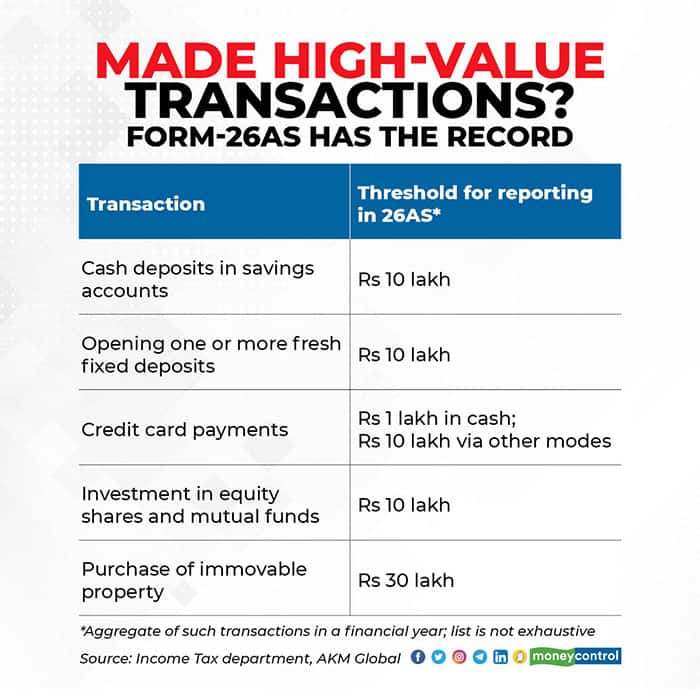

Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and self. Form 26as from the income tax department. It is one of the important.

Who provides form 26as? Form 26as enables a taxpayer to check the amount of tax levied against him. A tax payer who has internet banking access with a bank authorised by the income tax department to show tax credit can use this facility.

The website provides access to the pan holders to view the details of tax credits in form 26as. The income tax department maintains the records for every taxpayer. Please contact your tax consultant for an exact calculation of your tax liabilities.

Last updated on september 28th, 2023. The income tax department has notified new revamped form 26as on may 28, 2020 [1]. In a move that will enhance the flow of information between taxpayers and tax authorities, the income tax department has launched a revised form 26as or annual.

Tax benefits are subject to changes in tax laws. A tax payer can view. Form 26as can be viewed online.

However, the income tax department has clarified that till this new statement is entirely operational, form 26as will continue to be available on the traces portal. Click ‘confirm’ on the disclaimer to be.