Fabulous Info About Describe Cash Flow Statement

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

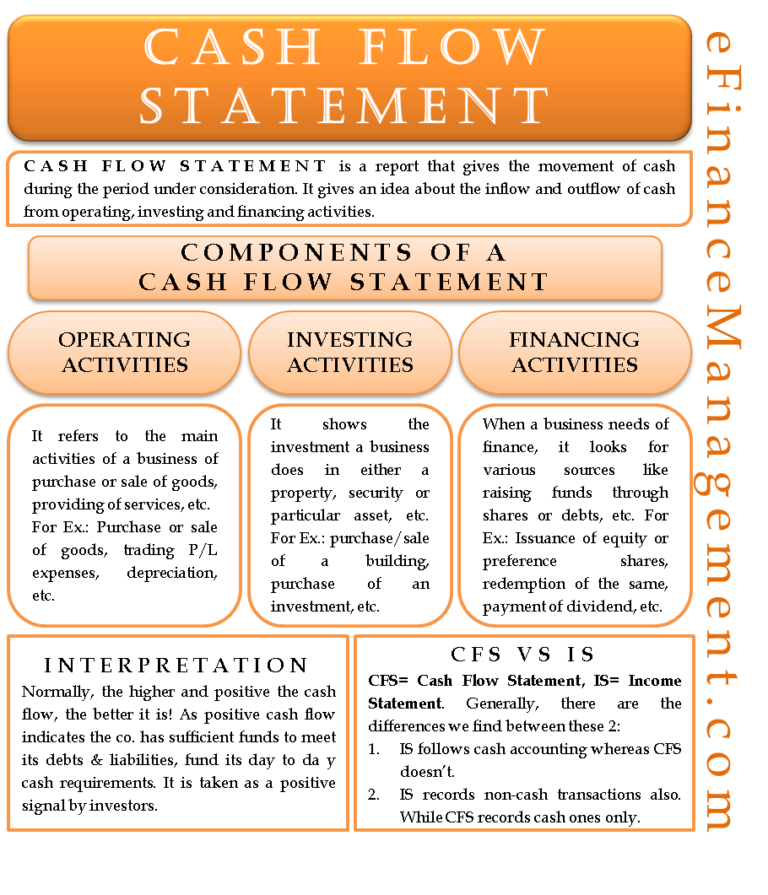

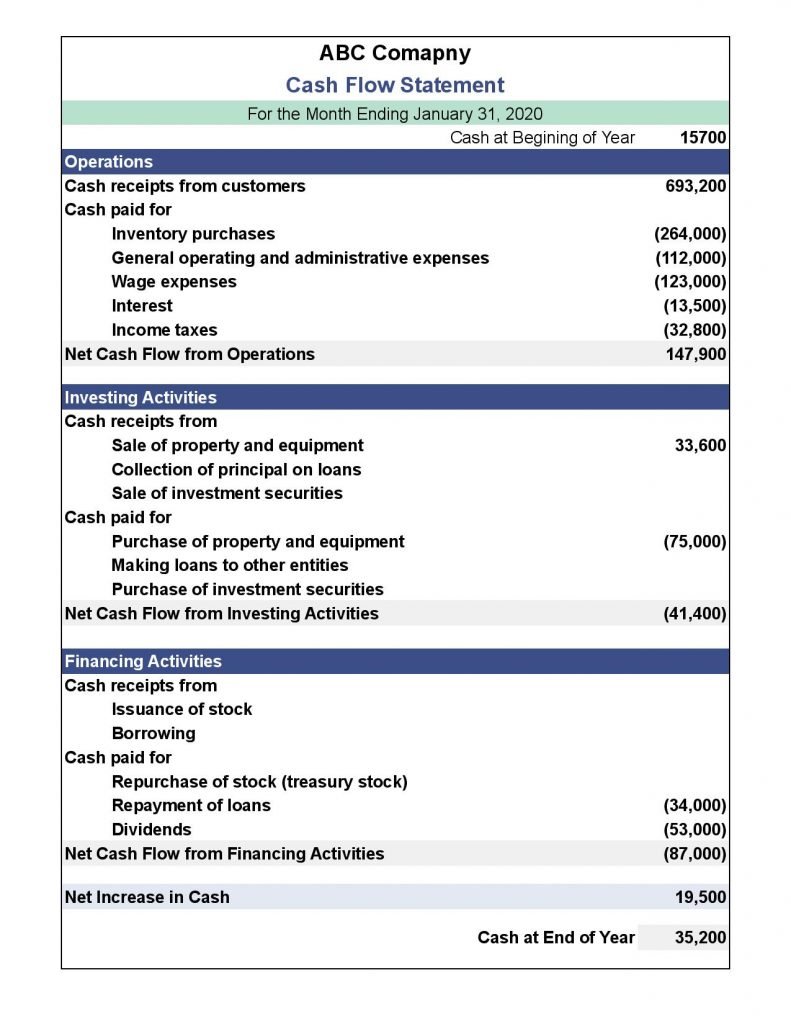

Describe cash flow statement. Cash flow statements are one of the three fundamental financial statements financial leaders use. The three sections of a cash flow statement cash flow from operating activities is cash earned or spent in the course of regular business activity—the main way your. It is an essential document for evaluating the sources and uses of cash for an organization.

The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet. In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. A cash flow statement is a financial statement that shows how cash entered and exited a company during an accounting period.

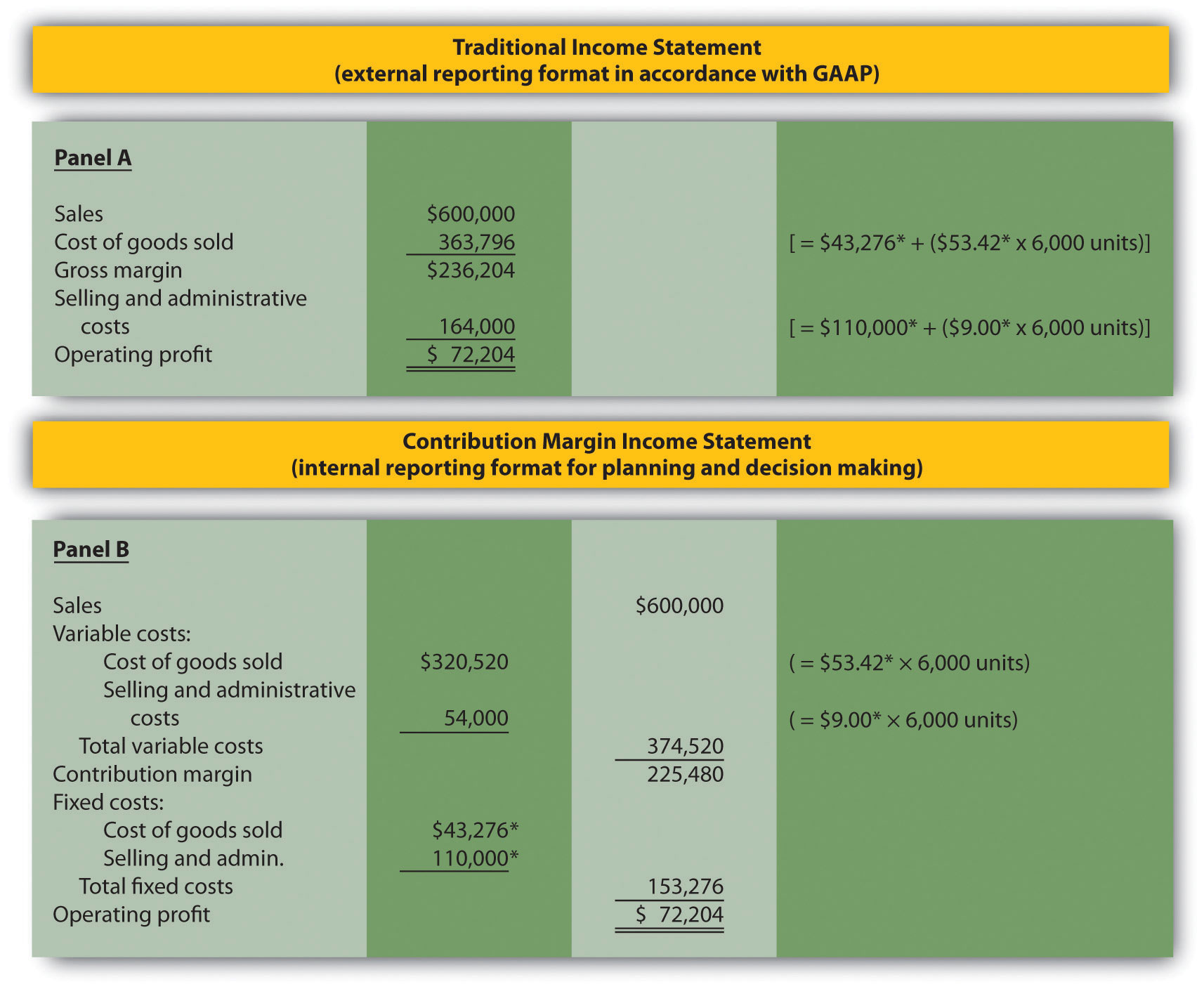

The statement of cash flows is one of. Invoices you sent that haven’t been paid yet invoices you received but haven’t paid Income statement and free cash flow.

This statement is one of the three key reports (with the income statement and the balance sheet) that help in determining a company’s performance. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. Each of the financial statements provides important financial information for both internal and external stakeholders of a company.

In this guide, we’ll go over: The cash flow statement is an important financial statement issued by a company, along with the balance sheet and income statement. What is a cash flow statement?

It also reconciles beginning and ending cash and cash equivalents account balances. A cash flow statement is a financial statement that presents total data. This refers to real cash that flowed into or out of your bank account, so it doesn’t include things like:

The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. The statement of cash flows enables users of the financial statements to determine how well a company’s income. It is usually helpful for making cash forecast to enable short term planning.

A cash flow statement, also known as the statement of cash flows, is a financial statement that shows the flow of cash into and out of your business during a specific period of time. We will use these names interchangeably throughout our explanation, practice quiz, and other materials. The statement of cash flows is a financial statement listing the cash inflows and cash outflows for the business for a period of time.

Please suggest list of best practices that should be activated to prepare cash flow statement both direct and indirect methods for the purposes of statutory reporting and managerial reporting and planning. The main components of the cash flow statement are: The income statement is the most common financial statement and shows a.

To recap, a cash flow statement tells you how much cash you have on hand for a certain period. The cash flow statement provides information about a company’s cash receipts and cash payments during an accounting period. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)