Cool Tips About Idbi Home Loan Statement For Income Tax

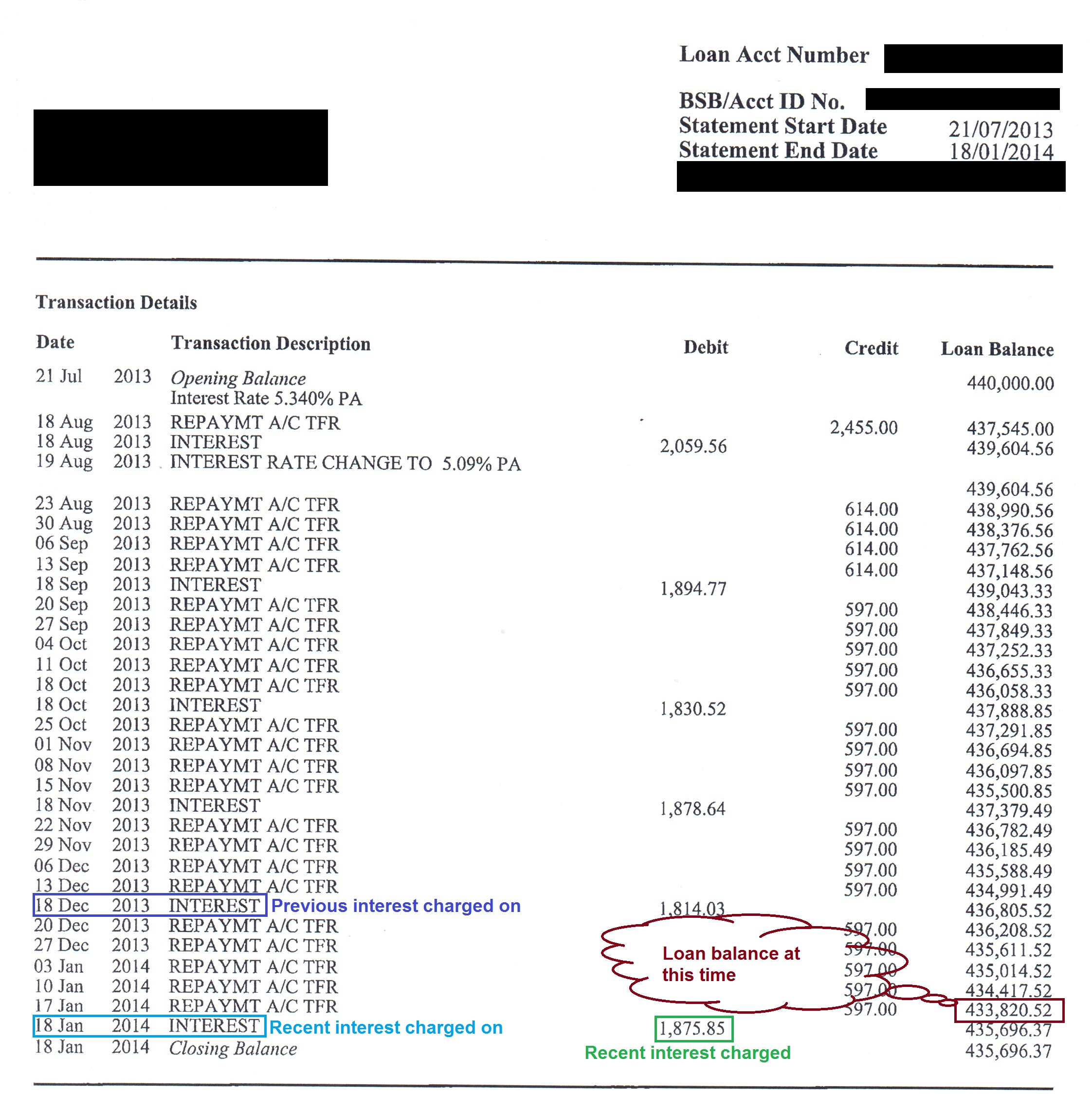

At the end of the financial year, a final interest certificate is issued, summarizing the borrower’s principal and interest repayments.

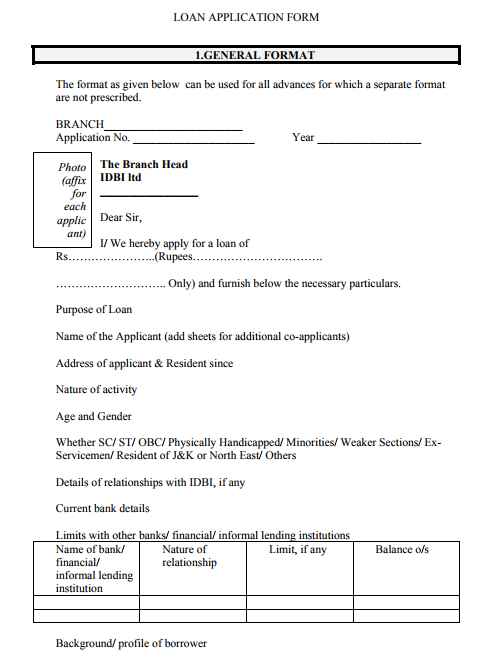

Idbi home loan statement for income tax. Enter the needed information for the mortgage. How will idbi bank decide my home loan eligibility? Idbi home borrow statement:

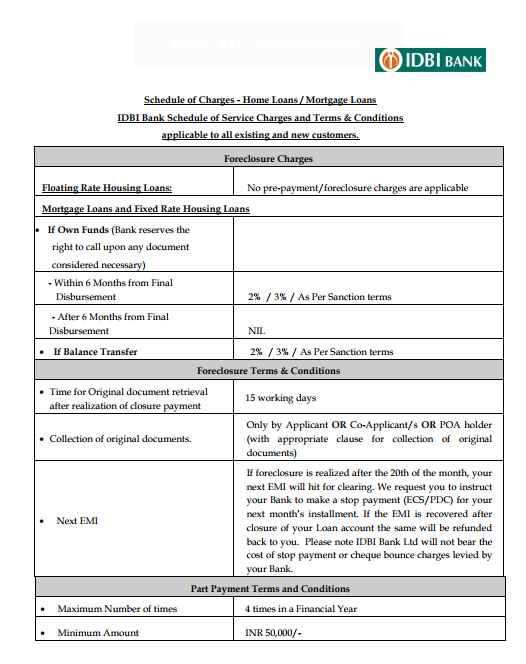

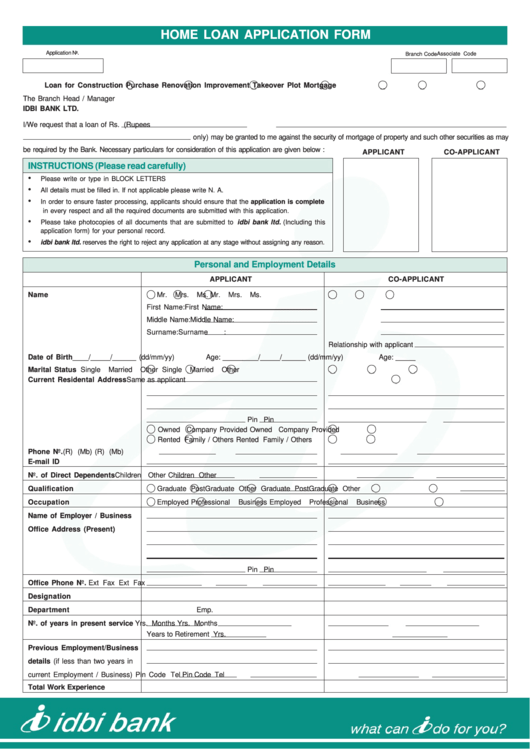

Find out the detailed process to view and download the home take statement fork various purposes. You can now send in your application for home loan statement online using the hdfc bank internet banking portal. This may include salary slips, income tax returns, bank statements, or other relevant documents.

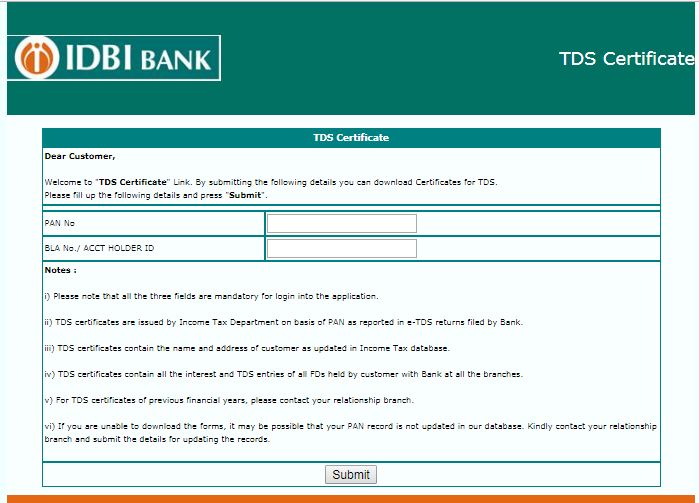

As usual, provide your username and password. I) please note that all the three fields are mandatory for login into the application. Actual duration of loan is subjected to bank’s discretion.

Home loans eligibility calculator; Simply put, the idbi bank home loan statement is a vital document for taxation purposes, as well as for understanding your loan better. We will assess your loan eligibility based on your age, qualification, income, number of dependents, spouse income, stability and continuity of your occupation, assets, liability base and your savings history and based on the value of the property proposed to be purchased.

Idbi home loan statement: Email id updation request you can call us from your registered mobile number and self authenticate to update email id in your account. Found out this extended proceed to view and download the back loan statement for different goals.

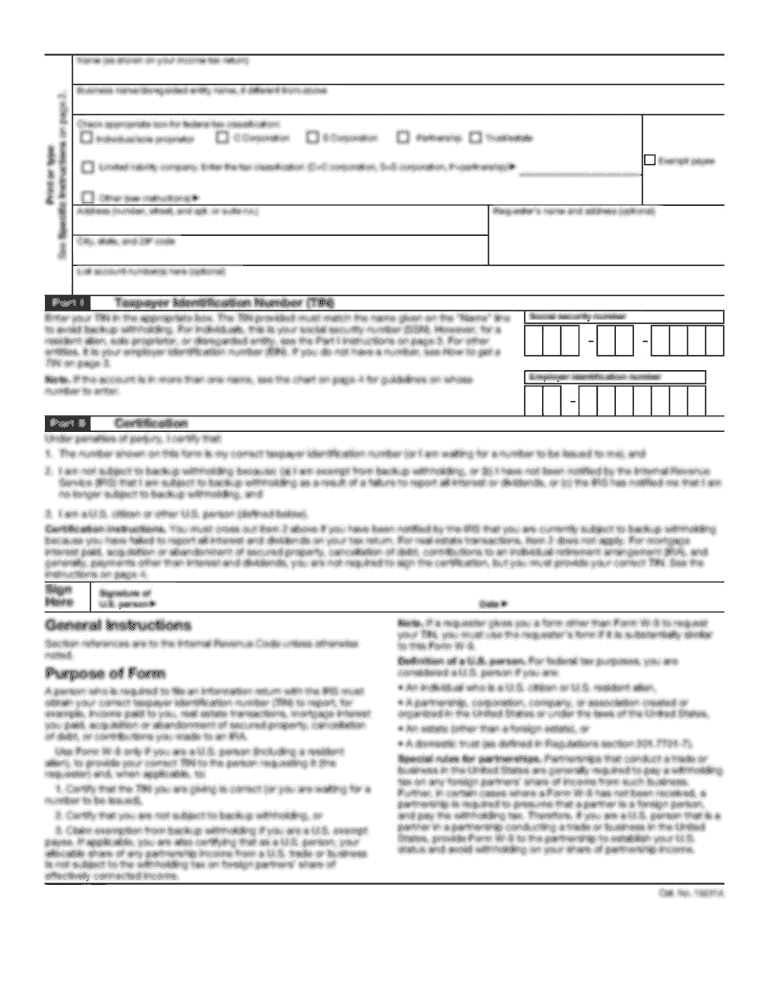

Idbi store get loan statements can be useful in various situations. Without it, you can’t provide proof of payment when claiming tax deductions. Tax certificate for income tax purposes.

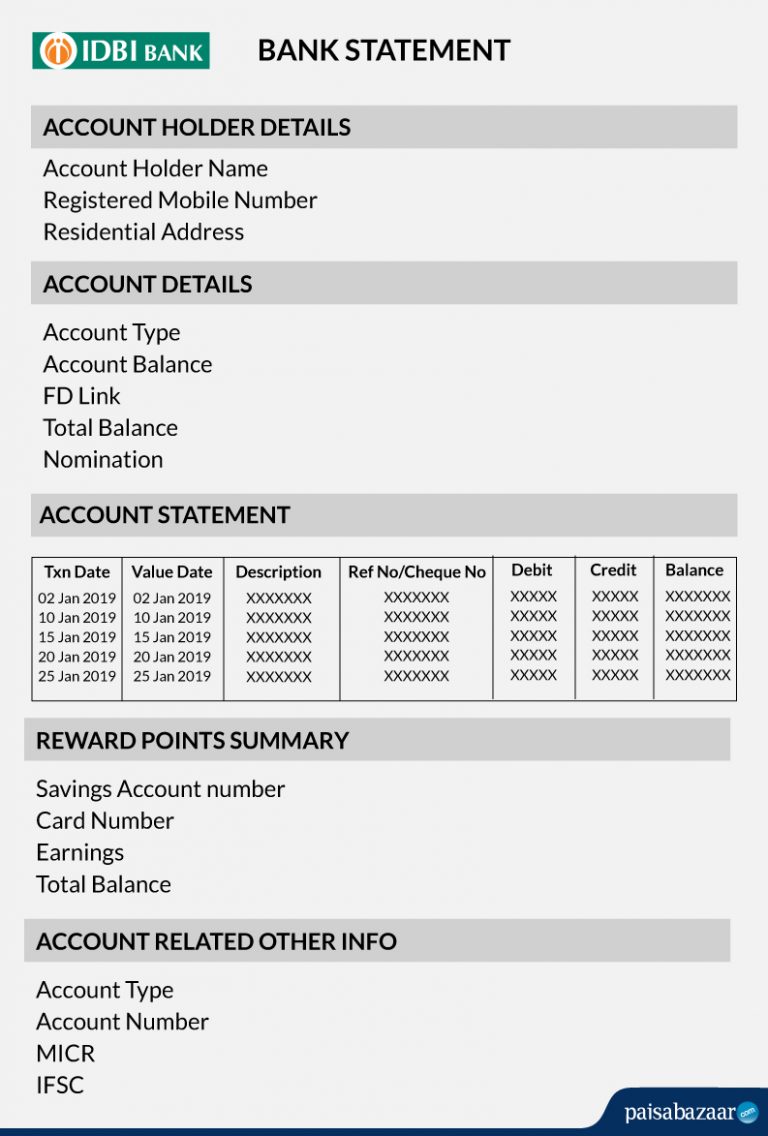

Documents about the property being financed, such as the agreement, title deed, noc from the builder, and property valuation reports, are necessary for verification purposes. You can view your income tax certificate through this portal only if you have a home loan or an education loan account with the bank if you have provided your updated email id to the bank, then you can access your home loan statements for the present financial year until the final day of the month prior. You can view your income tax certificate through is welcome no if you have a home loan or into training loan account.

Iii) tds certificates contain the name and address of customer as updated in income tax database. Use net banking log in to the official idbi bank online portal enter your user id and password as usual Generate / download idbi home loan interest (provisional / final) certificate & statements.steps to download kindly get your tax certificate & statement down.

Net banking access the official idbi bank website. Read about idbi net banking. Section 80 c of the indian income tax act.

Know about tax benefit on home loan, housing loan interest deduction, income tax rebate on home loan. This certificate is crucial for claiming income tax deductions under section 24b for home loan interest payments and section 80c for principal payments. Idbi home loans have maximum payback tenure of up to 30 years.