Fantastic Tips About Included In The Statement Of Owners Equity Are

Comprehensive income— defined as the “change in equity of a business.

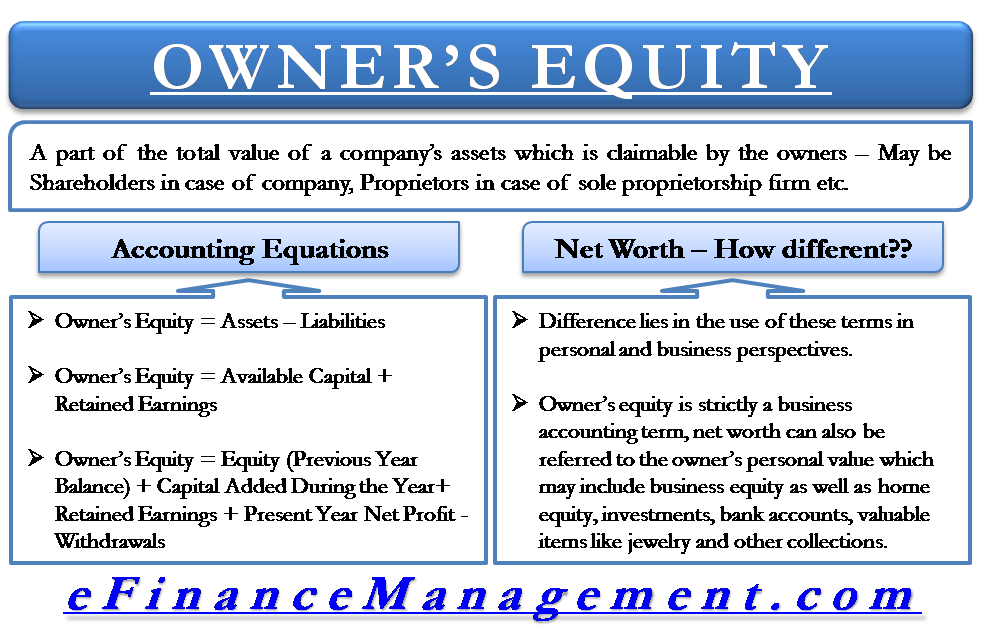

Included in the statement of owners equity are. The area of accounting concerned with. 2.1 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate highlights the study of accounting. In accounting, the statement of owner’s equity shows all components of a company’s funding outside its liabilities and how they change.

Owner’s equity is the amount of the business assets that belong to you as a business owner. The statement of owner’s equity is a financial statement that reports the changes in the equity section of the balance sheet during an accounting period. Owner’s equity is the set of account balances that have cumulative account balances of contributions to date, withdrawals till date, and earnings till date.

Examples of owner’s equity. The changes that are generally reflected in the equity statement include the earned profits, dividends,. The statement of stockholders’ equity is the difference between total assets and total liabilities, and is usually measured monthly, quarterly, or annually.

Terms in this set (19) net income (loss) and withdrawals. The statement of owner’s equity builds off the income statement, starting with revenues and expenses combined ($1,350 net income), adding capital, and subtracting any. What’s included in owner’s equity?

Preferred stock → a special ownership stake in the company that provides holders with a higher claim on a company’s earnings than common stockholders. The statement of owner’s equity addresses the last segment of the accounting equation in detail by laying out the equity elements of the firm and. Distribution to owners— cash, other assets, or ownership interest (equity) provided to owners.

The statement of owner’s equity addresses the last segment of the accounting equation in detail by laying out the equity elements of the firm and highlighting changes in these. For privately owned businesses like sole proprietorships and partnerships, owner’s equity mainly includes the following. The concept is usually applied to a sole.

A statement of owner's equity (soe) shows the owner's capital at the start of the period, the changes that affect capital, and the resulting capital at the end of the period. If your business has assets that are worth $60,000 and liabilities that are worth $20,000, your equity would be $40,000 after using. The list below defines the most common items that appear in the statement of owner’s equity:

Statement of owner’s equity definition: There are a number of assets. Included in the statement of owner's equity are.

The statement of owner's equity portrays changes in the capital balance of a business over a reporting period. This calculation indicates that the owners of the company have a residual. The statement of owner’s equity reports the changes in company equity.

They have a higher claim to dividends or asset.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

![Free Printable Statement Of Owner's Equity Templates [Example]](https://www.typecalendar.com/wp-content/uploads/2023/09/Statement-of-Owners-Equity.jpg)