Best Info About Opening Balance Sheet Adjustments

This article explains how to treat the main possible post trial balance adjustments, including:

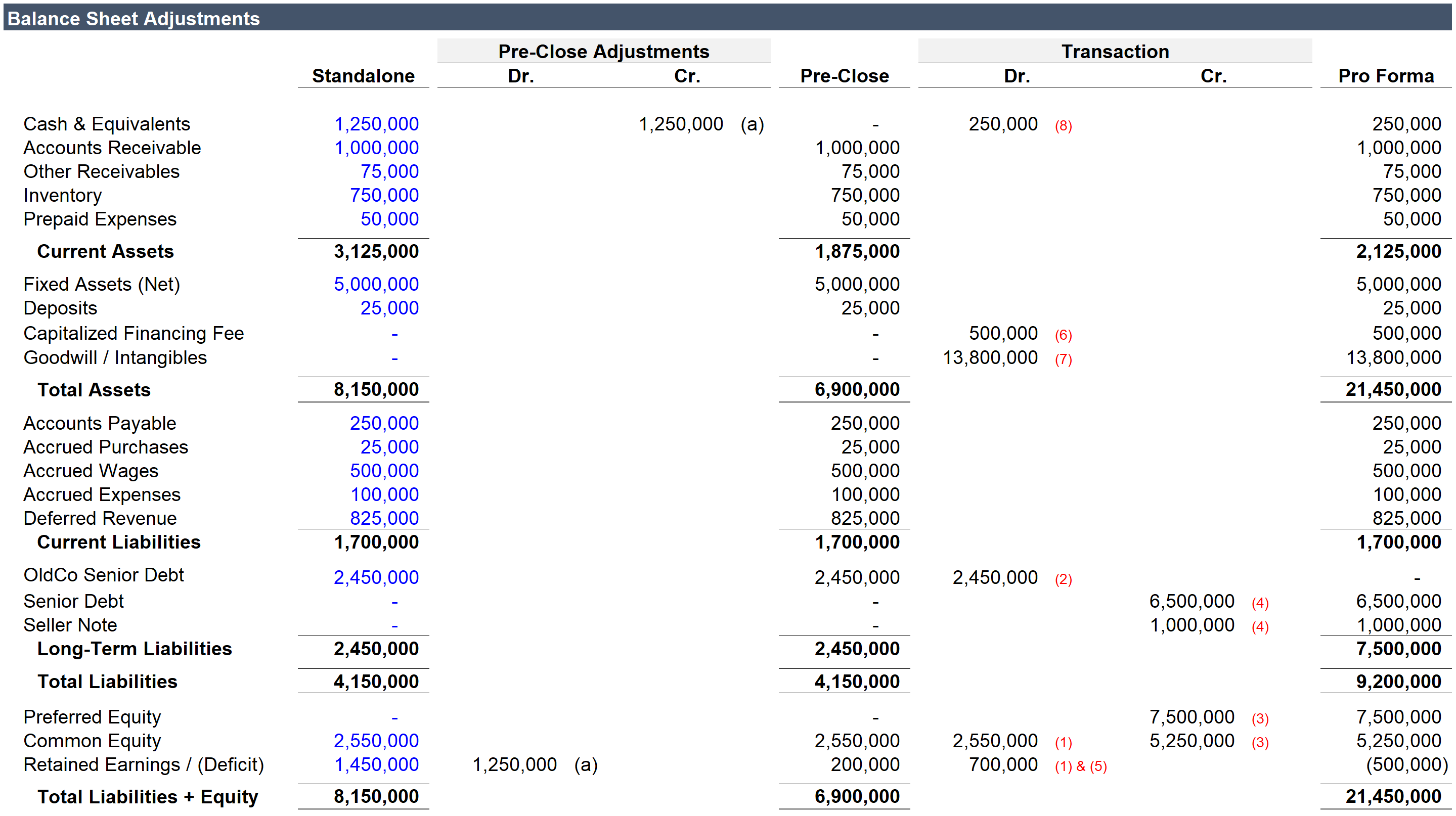

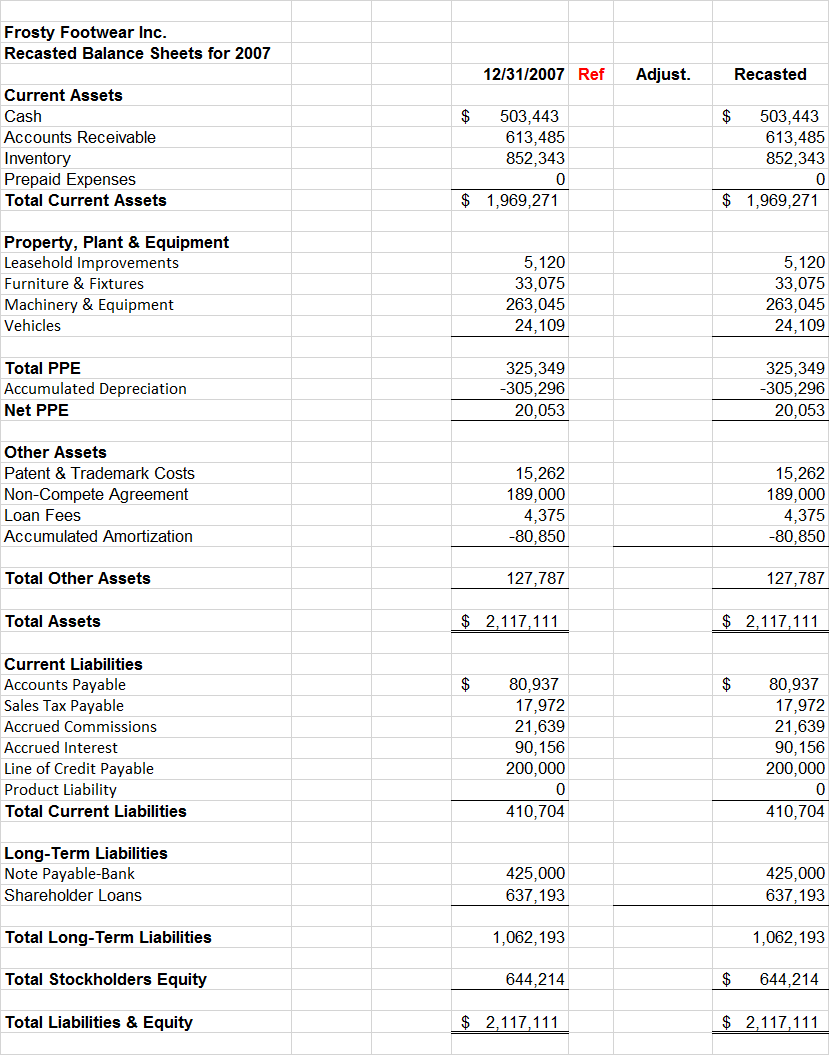

Opening balance sheet adjustments. Irrecoverable debts and allowances for receivables. Two examples of items that are generally adjusted are deferred revenue and inventory. Today we discussed how to make balance sheet adjustments in a merger or acquisition.

After the year end you may need to post adjustments to correct figures on nominal codes in the previous financial year. The opening balance is usually that balance which is brought forward at the beginning of an accounting period from the end of a previous accounting period. The closing day balance sheet often involves some guesswork, and the actual balances may not be available until a few weeks go by.

Your balance sheet identity refers to the three main aspects of your balance sheet: Opening balance equity is an account created by accounting software to offset opening balance transactions. Usually 30 to 90 days after closing, buyer presents an actual balance sheet as of the closing date to seller.

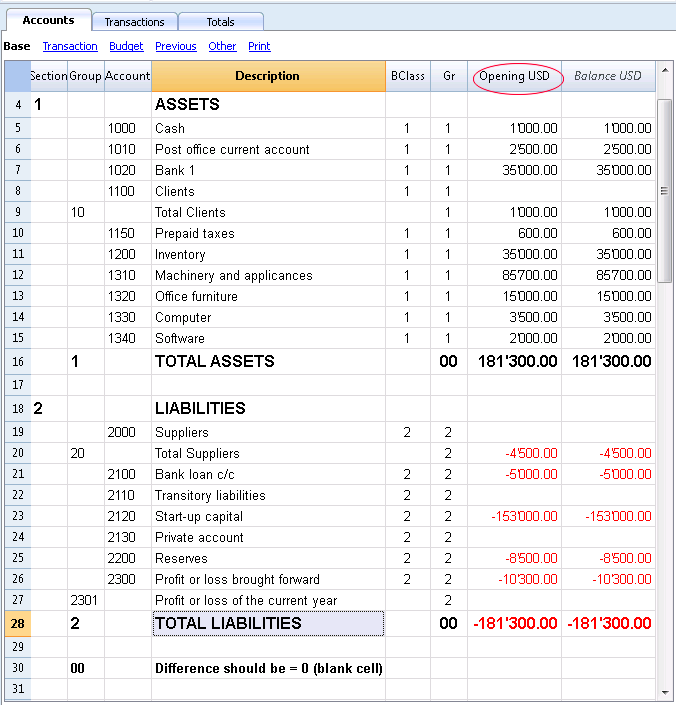

Usually closing stock is given outside the trial balance. Opening balance equity account provides an audit trail for the initial account balances entry and adjustments made during the setup of a new company or the transition to a new accounting system. These balances are usually carried forward from the ending balance sheet for the.

When an acquirer purchases the assets or all of the stock of a target company, the target may cease to exist as a separate entity and the parent’s balance sheet will be adjusted as of the acquisition date. The general rule goes like this: The format, structure, and timing of the buyer’s closing balance sheet and the seller’s dispute notice communications—address the level of support to be provided and the detail in which potential adjustments need to be disclosed.

Merger and acquisition balance sheet adjustments. An effective audit readiness team should have experience in the industry of the acquisition. Assets, liability, and shareholder’s equity.the presentation of these on your balance sheet will be expressed in an.

Enter the same adjustment amount into the related income statement account. It is valued at cost price or market price whichever is less. Pushdown accounting (purchase price allocation) in the context of an acquisition, the target company’s assets and liabilities are written up to reflect the purchase price.

Published on 26 sep 2017. Derecognition of some previous gaap assets and liabilities. Any late adjustments to profit and loss nominal codes cause a previous year adjustment on the balance sheet.

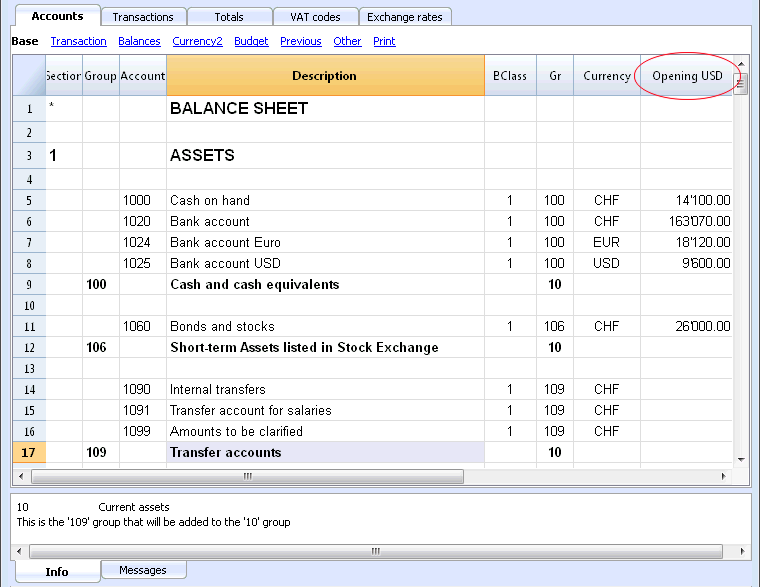

Opening balance equity accounts show up under the equity section of a balance sheet along with the other equity accounts like retained earnings but may not show up on the opening balance sheet if the balance is zero. The opening ifrs balance sheet is the starting point for all subsequent accounting under ifrs and is prepared at the date of transition, which is the beginning of the earliest period for which full comparative information is presented and disclosed in accordance with ifrs. An opening balance sheet contains the beginning balances at the start of a reporting period.

Your previous year’s closing sheet must be identical to your opening balance sheet in the new year. What is an opening balance sheet? The opening balance is the amount of capital or fund in a company’s account at the start of a new financial period.