Smart Info About Cash Flow Statement Direct And Indirect Method

It also requires a completely separate reconciliation that looks very similar to the indirect method to prove the operating activities section is accurate.

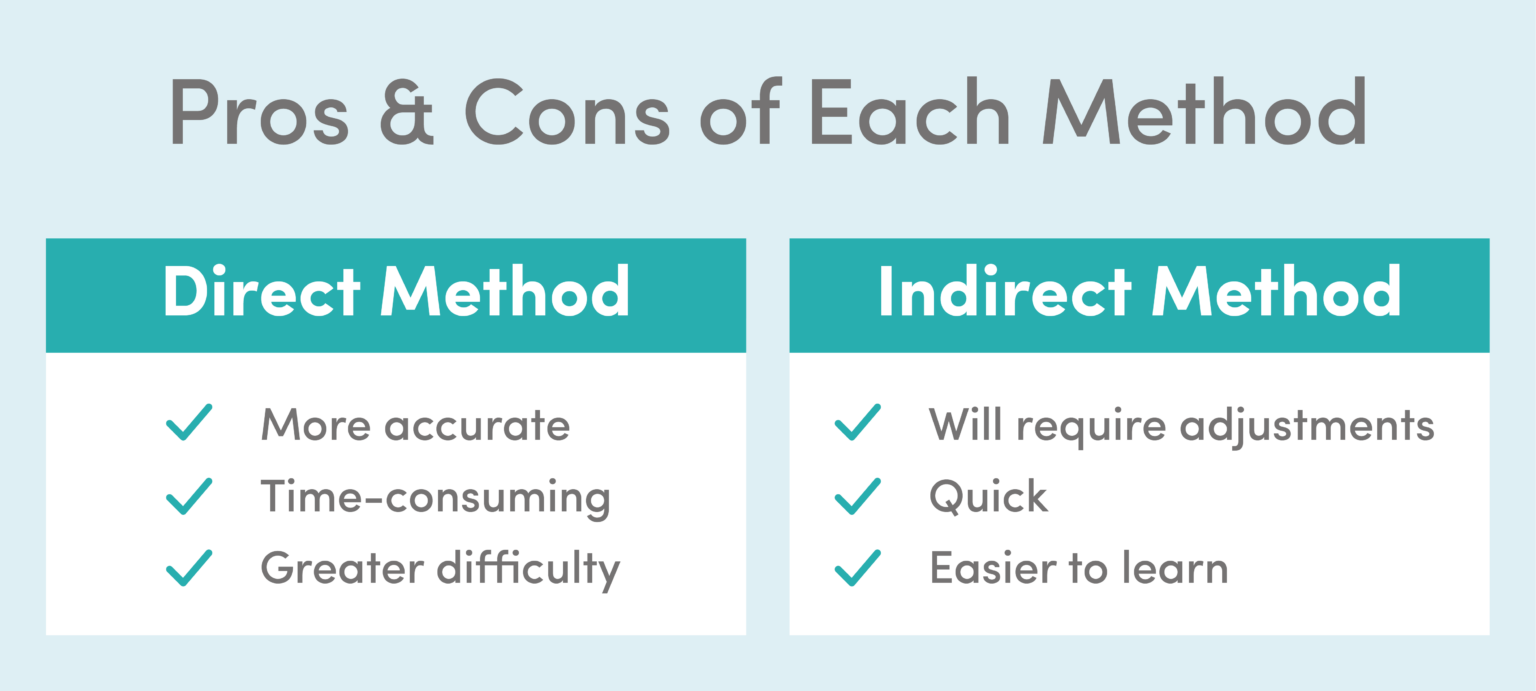

Cash flow statement direct and indirect method. The advantage of the direct method over the indirect method is that it reveals operating cash receipts and payments. The main difference between the direct method and the indirect method of presenting the statement of cash flows (scf) involves the cash flows from operating activities. This is not only difficult to create;

Bp to be activated to prepare cash flow statement go to solution. The indirect method focuses on net income and may include cash that is not yet in the business. The statement of cash flows direct method uses actual cash inflows and outflows from.

Add back noncash expenses, such as depreciation, amortization, and depletion. For example, if a retailer sells an item on credit, the indirect method. A company’s cash flow statement can be prepared with either the direct or indirect cash flow accounting method.

In turn, this method allows for better insights. The indirect method uses net income as the base and converts the income into the cash flow through adjustments. A company can choose the direct method or the indirect method.

The direct method adds up all of the cash payments and receipts, including cash paid to suppliers, cash receipts from customers, and cash paid out in salaries. Though the financial accounting standards board generally prefers the direct method statement of cash flow, both the direct and indirect methods of cash flow are in line with generally accepted accounting principles (gaap). A cash flow statement using the indirect method differs from the direct method of preparing a cash flow statement.

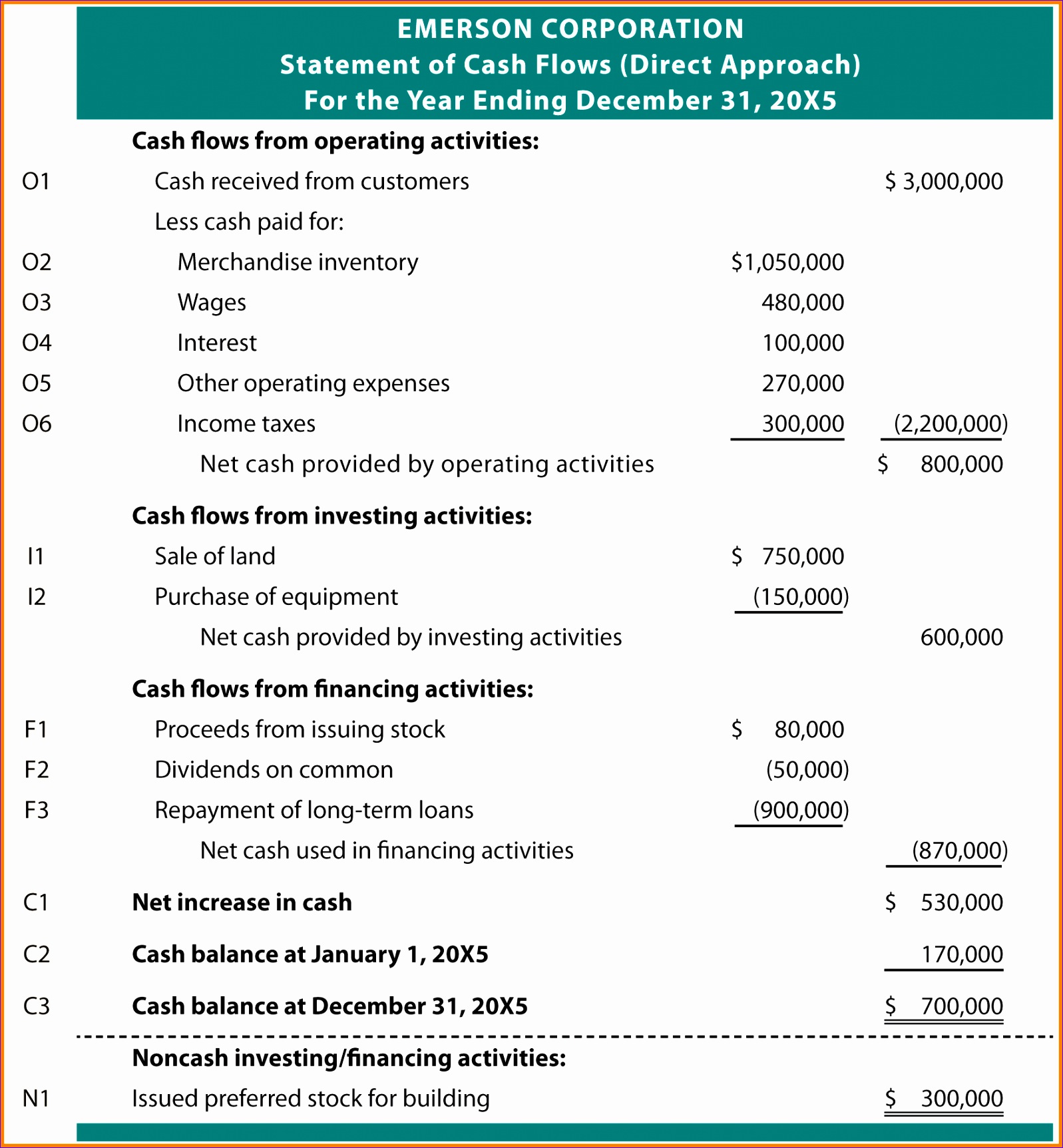

One of the key differences between direct cash flow vs. The direct method and the indirect method are alternative ways to present information in an organization’s statement of cash flows. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows.

The direct method is one of two accounting treatments used to generate a cash flow statement. In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically employees, vendors, etc. The purpose of this is to identify changes in cash payments and company activity receipts.

Definition of a cash flow statement direct cash flow method calculations indirect cash flow method calculations Highlights the statement of cash flows is prepared by following these steps: Blog overview in this article we are going to address the following:

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. The operating activities, investing activities and financing activities. In this article, we explore direct and indirect cash flow, highlight their most notable differences and provide an example of a cash flow statement using both methods.

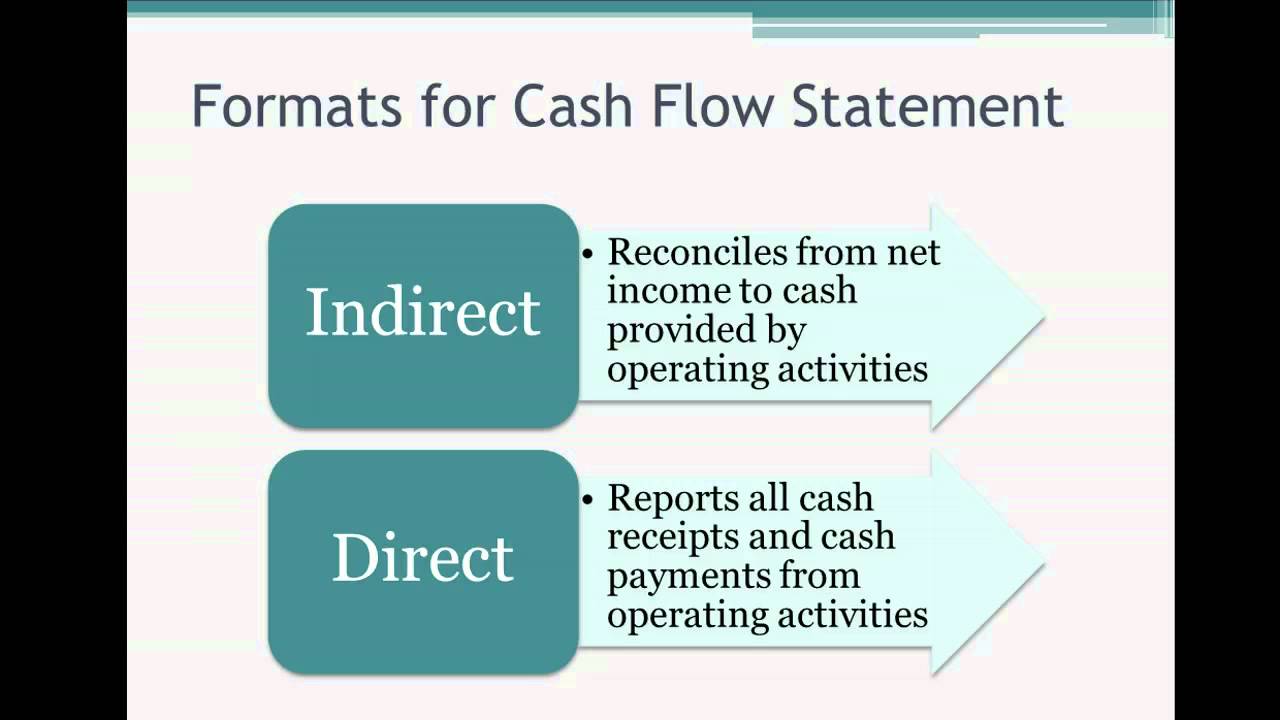

Items that typically do so include: There are two ways to prepare the cash flow statements. Direct method of cash flow statement shows the actual cash inflows and cash outflows from operating activities to arrive at the net cash flows from operating activities.