Fine Beautiful Tips About Net Income Is Profit

Revenue is the amount of income generated from the sale of a company's.

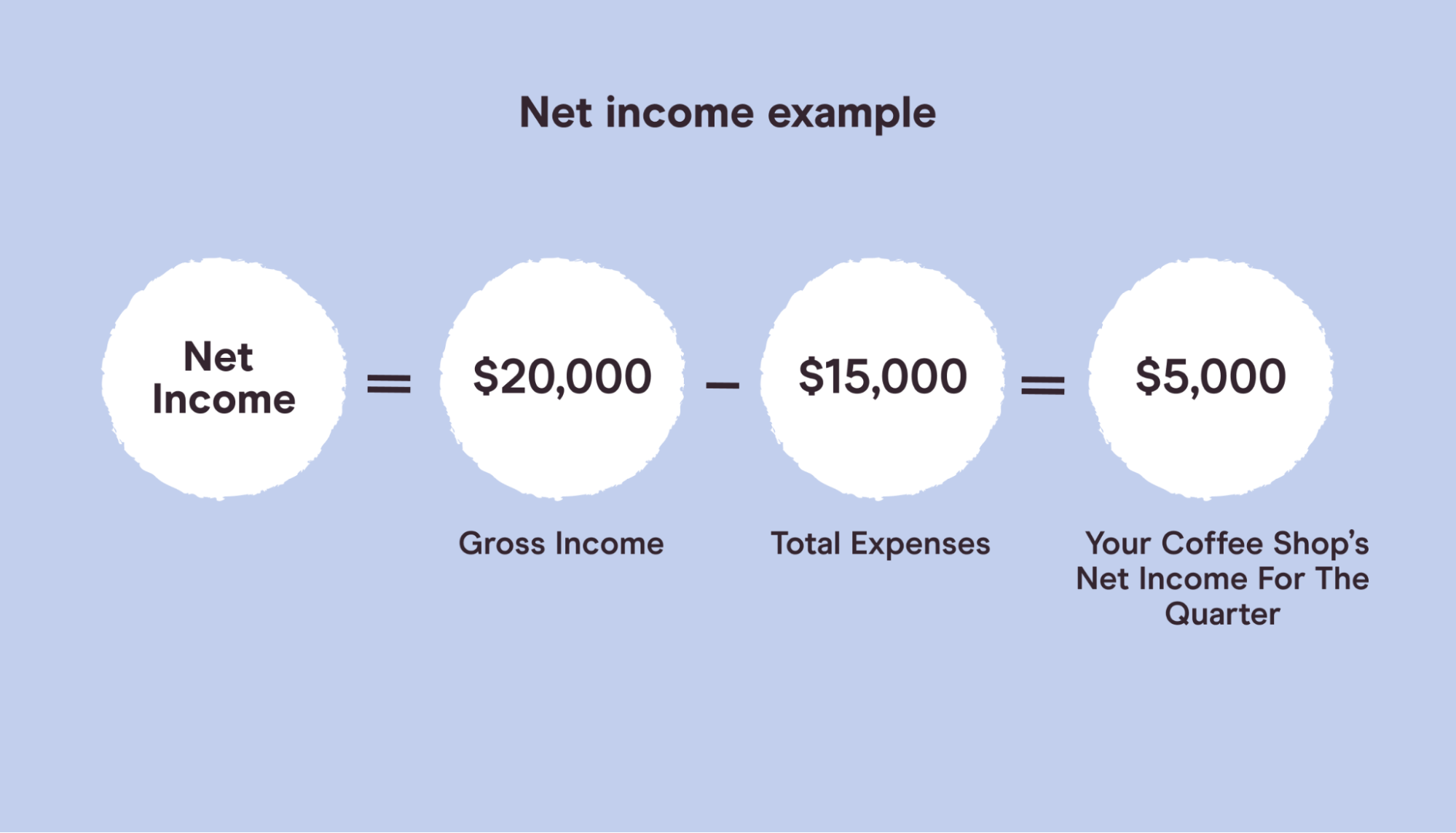

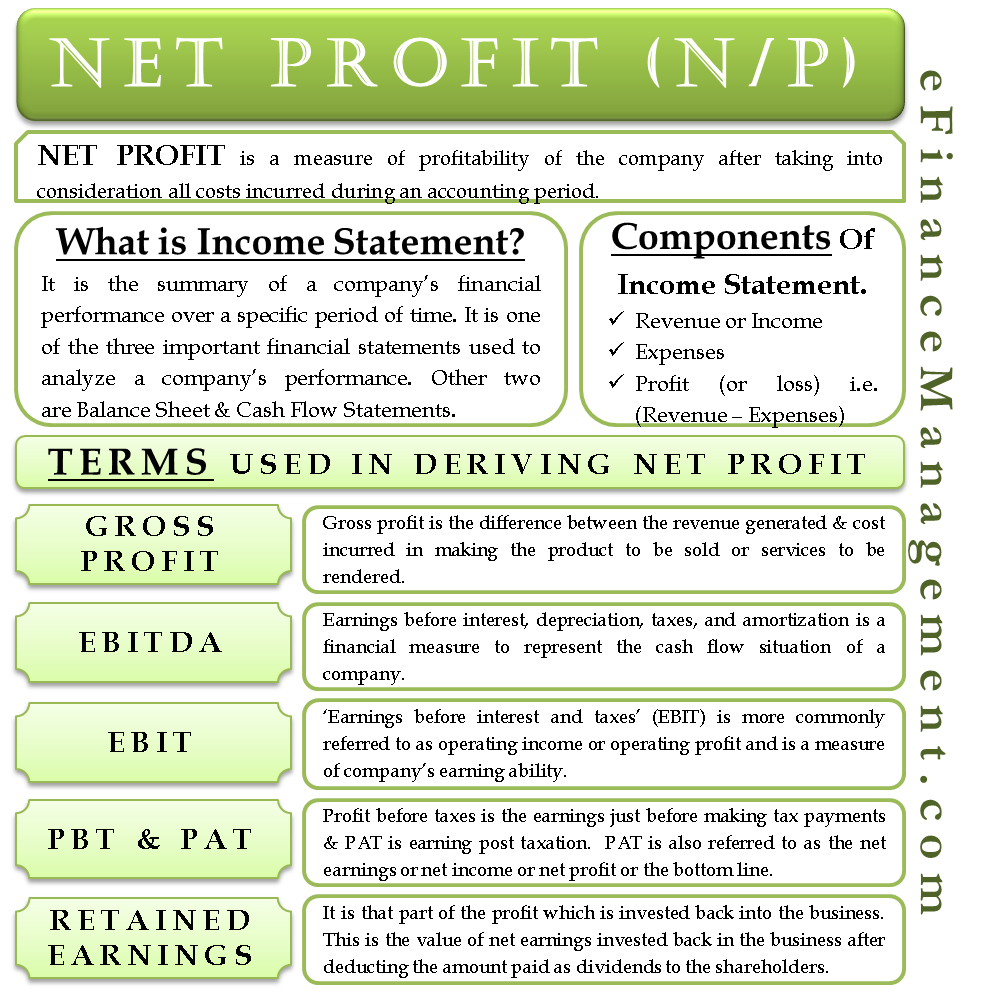

Net income is net profit. Net income is the profit that remains after all expenses and costs, such as taxes, have been subtracted from revenue. Net income is the renowned. Net income reflects the actual profit of a business or individual.

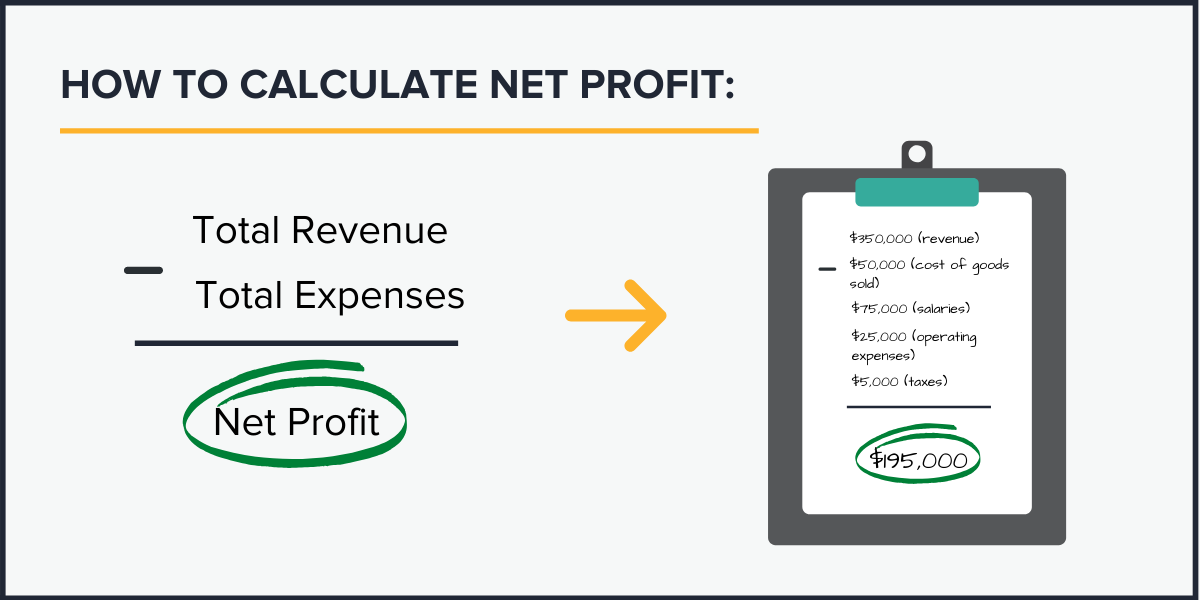

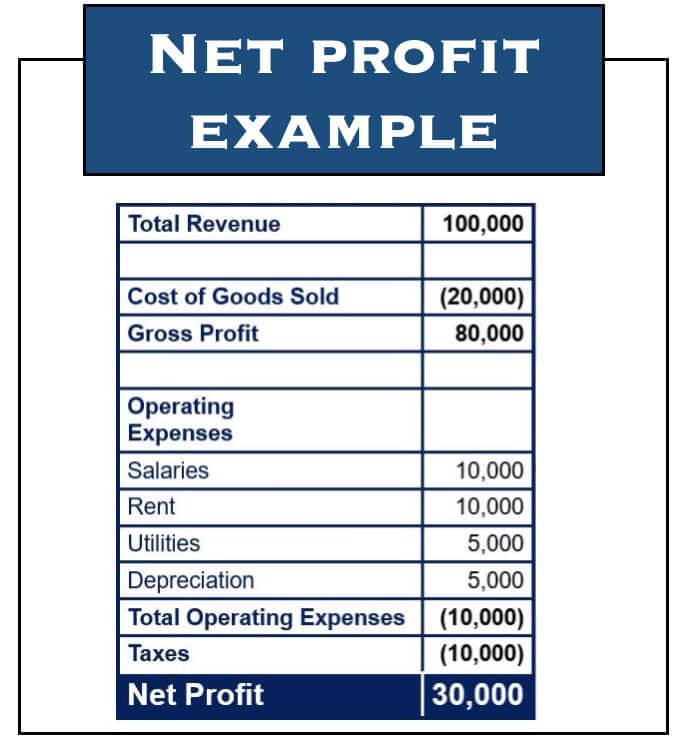

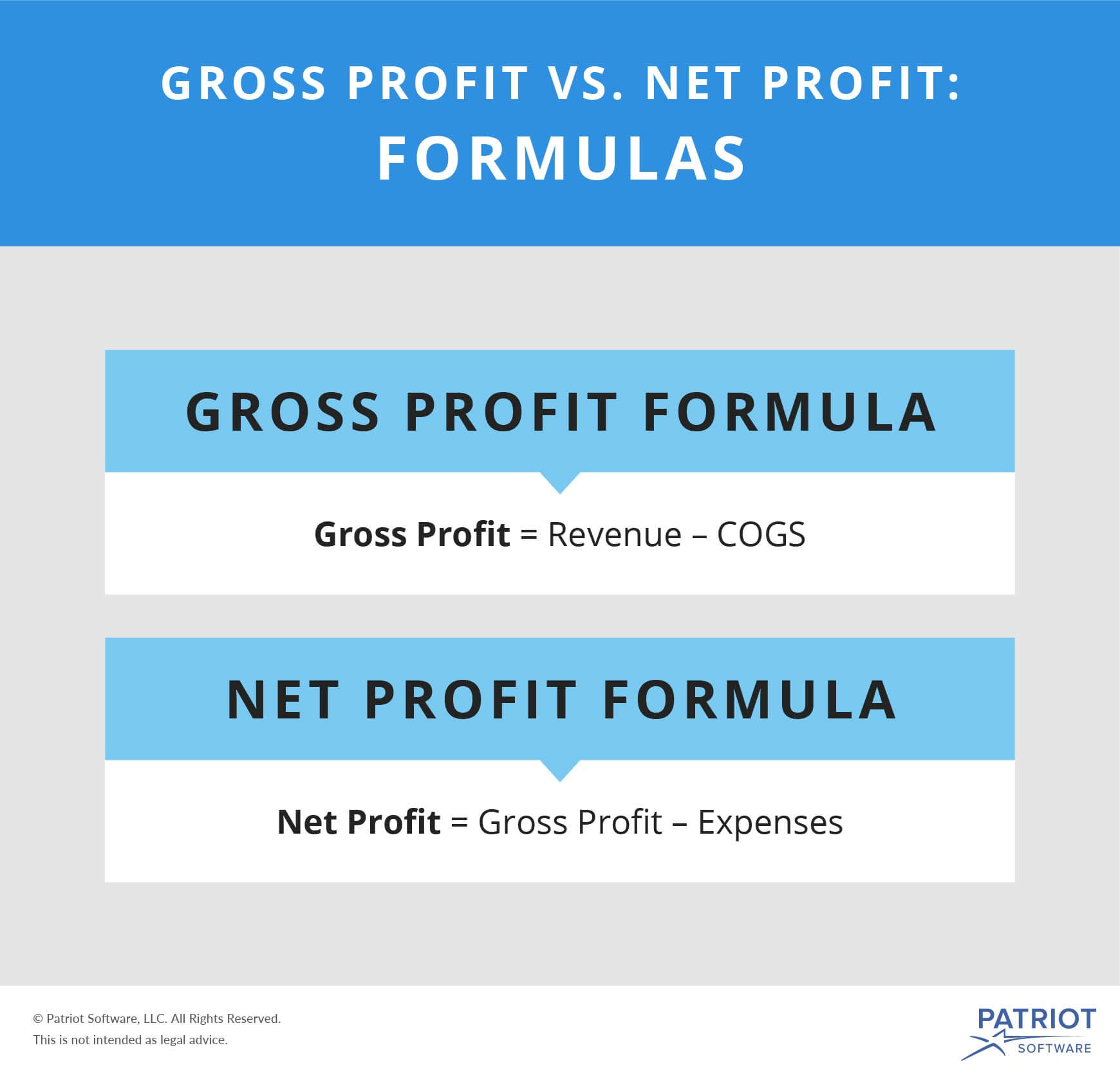

It is found by taking sales revenue and subtracting cogs, sg&a, depreciation and amortization, interest expense, taxes, and any other expenses. Earnings explained net income on business tax returns if the business has a loss net income or profit loss sheet. Net income is gross income minus expenses, interest, and taxes.

Investors and banks consider net income when deciding whether to invest in or lend money to a business. Net income is the last line item on the income statement proper. The business must continue to make money to stay in business.

Some people refer to net income as net earnings, net profit, or simply your “bottom line” (nicknamed from its location at the bottom of the income statement ). In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and. Net income, also known as net profit, is a single number, representing a specific type of profit after all costs and expenses have been deducted from revenue.

Net income is derived from various calculations, including total revenue, expenses and income streams during a. Business accounting software helps you track financial metrics, including net income. The most obvious difference between net income and net profit is that net income is the.

Diane macdonald/getty images businesses are set up to make money for their owners. Net income is profit that can be distributed to business owners or shareholders or invested in business growth. Net income is your company’s total profits after deducting all business expenses.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)