Best Tips About Form 24q Of Income Tax

What is form 24q?

Form 24q of income tax. Statement for tax deducted at source from salaries: Your browser will redirect to requested content shortly. 24q is a quarterly statement of tax deducted at source (tds) from the salary of employees.

Form 24q is a quarterly statement of deduction of tax on salaries. Statement for tax deducted at source on all. The form would have the information on the.

When an employer pays a salary to an employee, the employer is required to deduct tds u/s 192. Form 24q is a statement for tax deducted at source (tds). Form 24q is utilized by the taxpayers for the declaration of the tds returns of the citizen.

Form 24q plays a significant role in income tax compliance, particularly for employers. You can easily file your tds returns through cleartax software i.e. This plan enables you to file your quarterly tds returns related to all specified payments along with salary where tds is required to be deducted and return is required to be filed.

The employer has to file a salary tds return in form 24q, which. Section 192 of the income tax act provides that every person responsible for. This form has to be filled up for declaration of a citizen's tds returns in detail.

Particulars of the tds return forms: You can download form 24q and other relevant tds return forms from official sources. Checking your browser before accessing incometaxindia.gov.in this process is automatic.

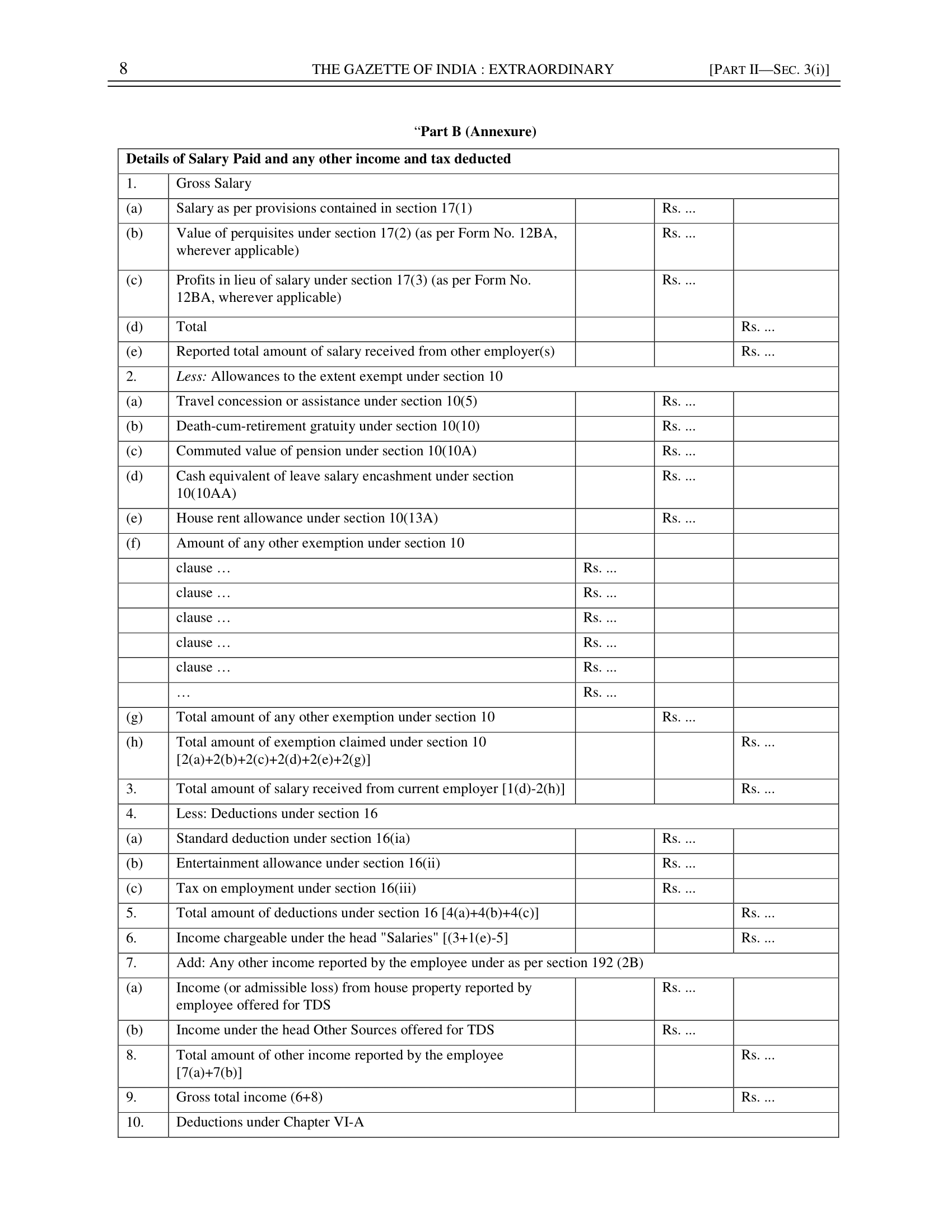

The employer has to file salary tds return in form 24q. Form 24q is a tds return/ statement containing details of tds deducted from the salary of employees by the employer. Details of salary paid to the employees and tds deducted on such payment is to be reported in 24q.

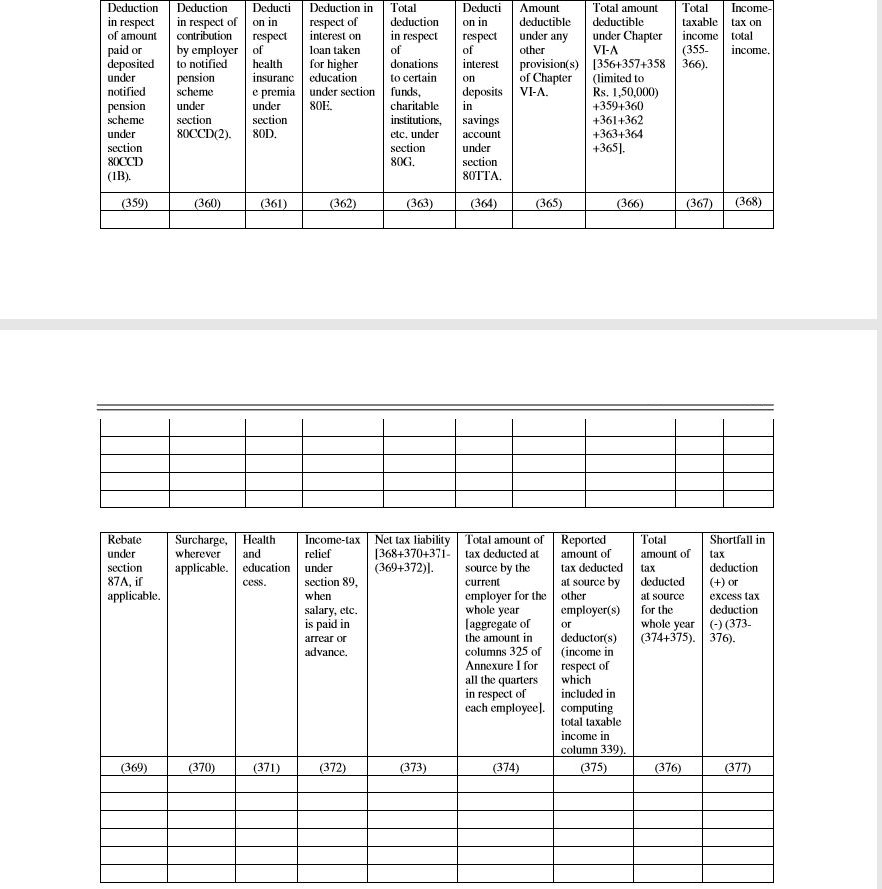

Here is a detailed explanation of all the tds return forms and what they entail. 24q is to be submitted on a quarterly basis. An employer deducts tds under section 192 of the income tax act, 1961, at the time of paying salary to an employee.

24q is used for detailed individual tax declarations, including salary. Employers are required to submit. The form information is based on a citizen's salary payments and the deductions.

The basic difference between form 24q and form 26q is. Taxpayers are also encouraged to read publication 17, your federal income tax (for individuals) for additional guidance. It contains the details of the deductor, the deductees, the challan and the.