One Of The Best Info About Excel Sheet For Income Tax

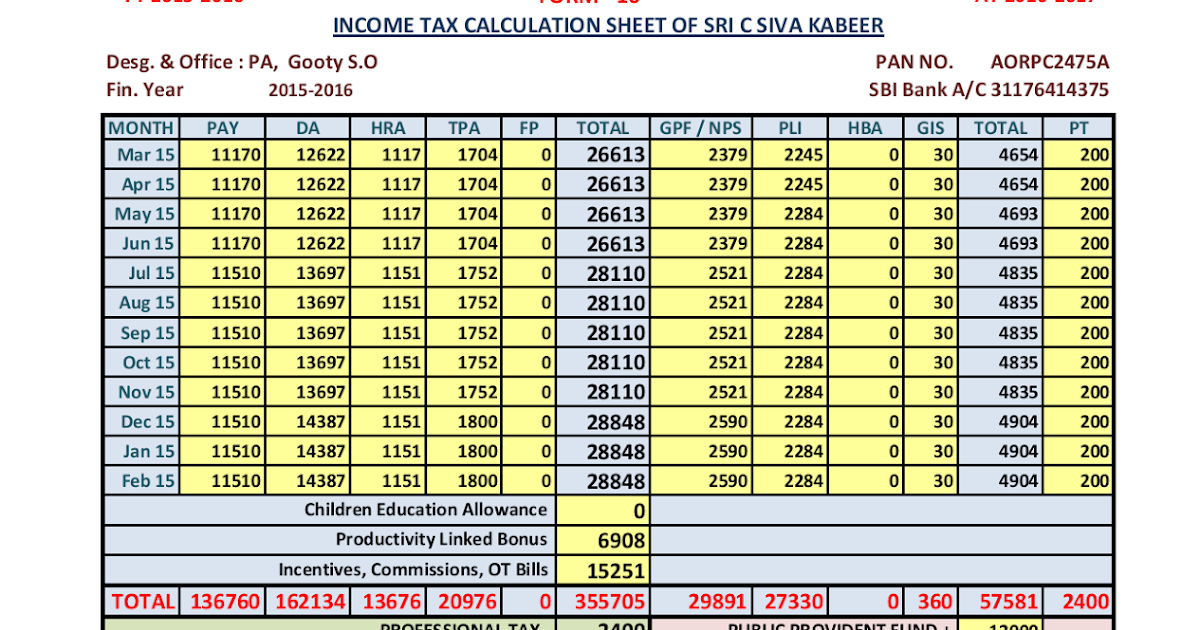

Create two rows to calculate.

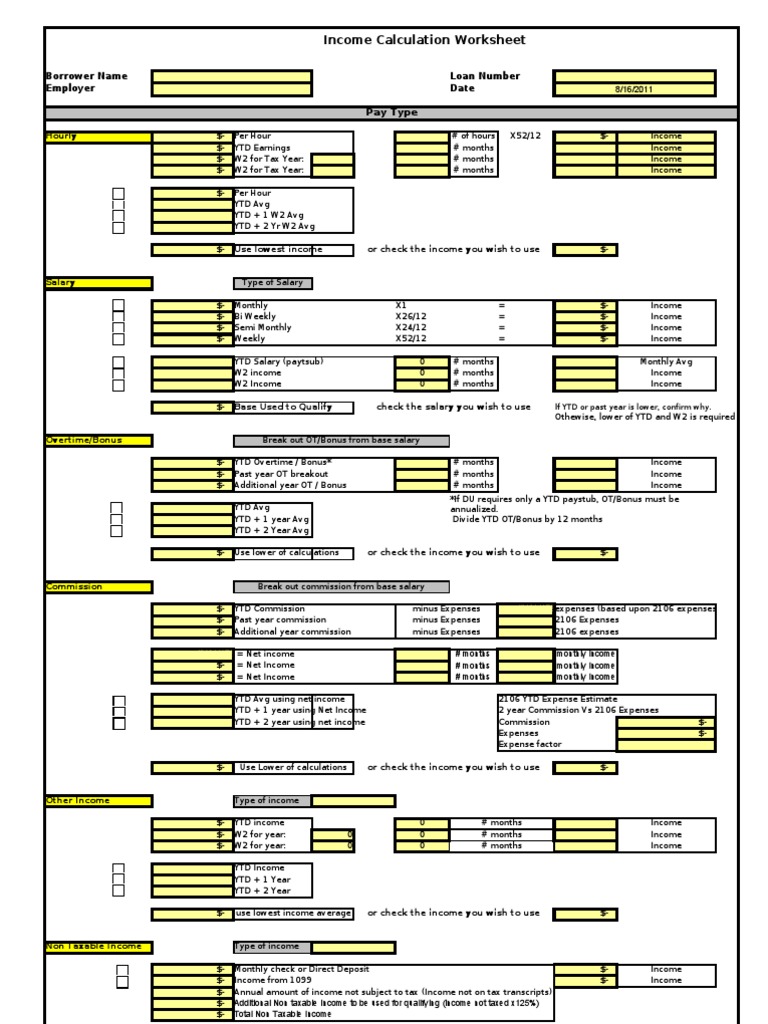

Excel sheet for income tax. Does anyone know of or have a link to an excel spreadsheet? When you receive the spreadsheet download, you need to choose your age (for the relevant. 29/04/2023 by alert tax team.

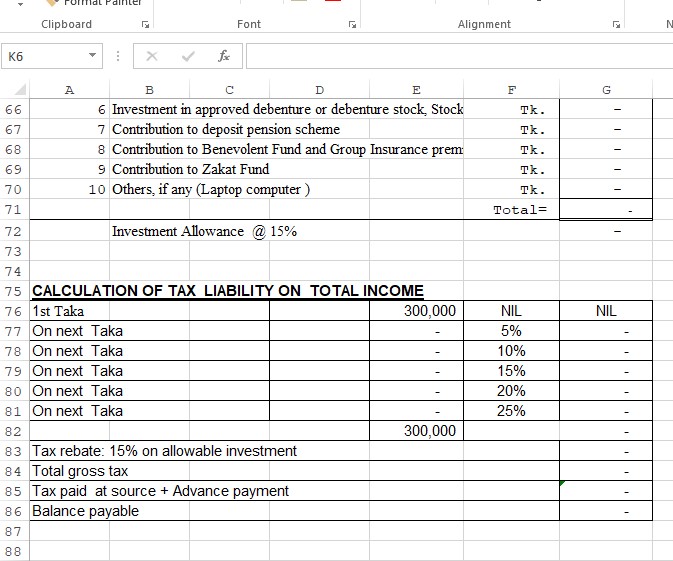

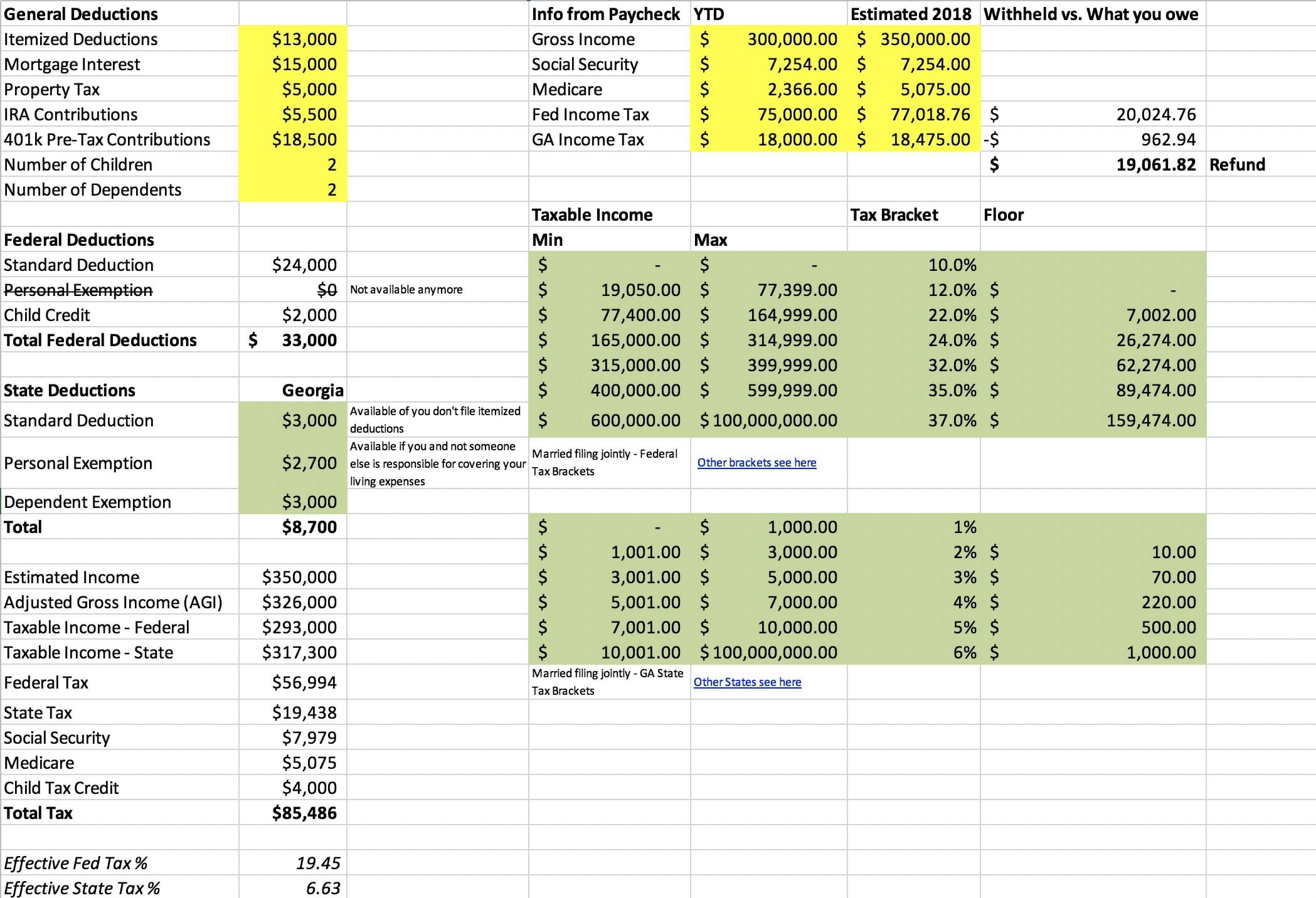

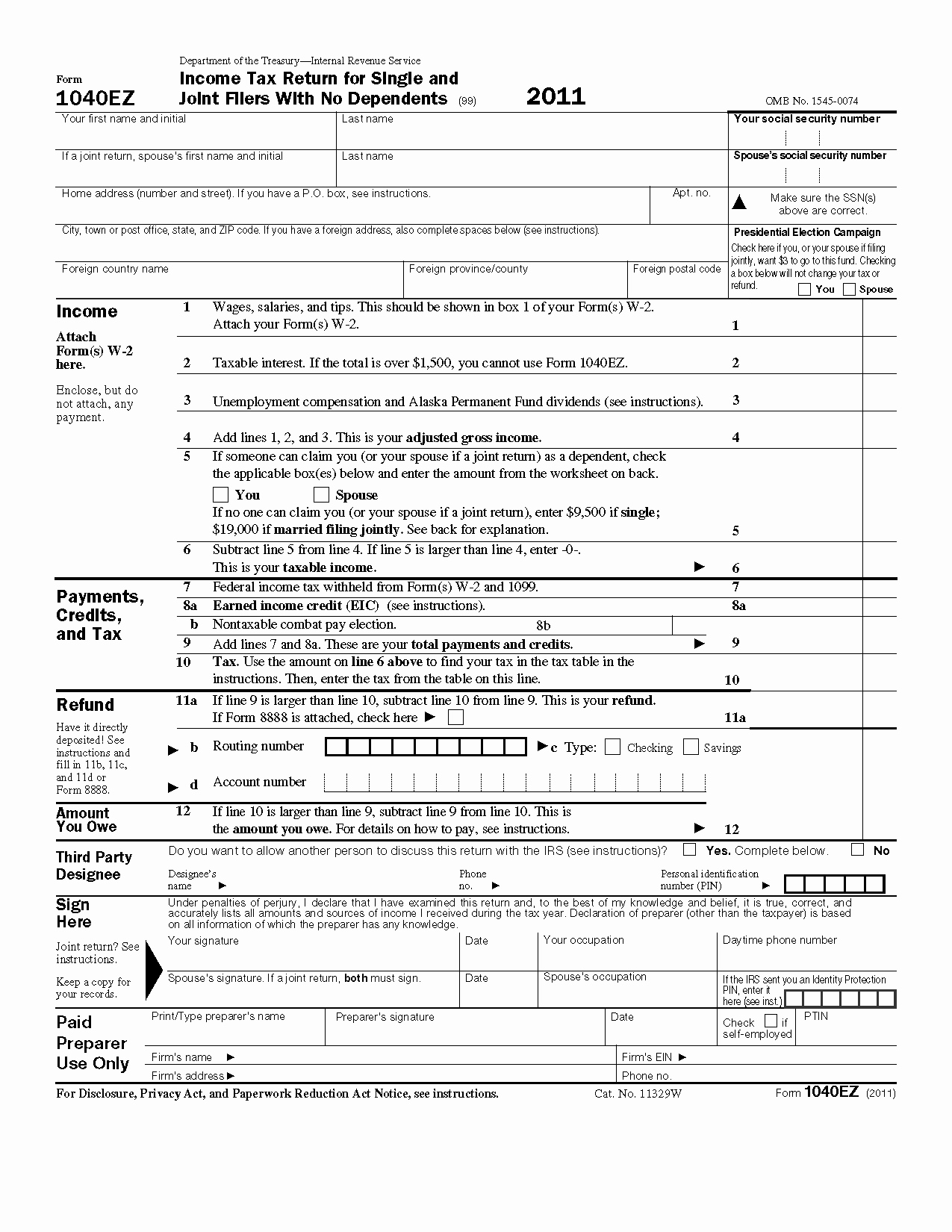

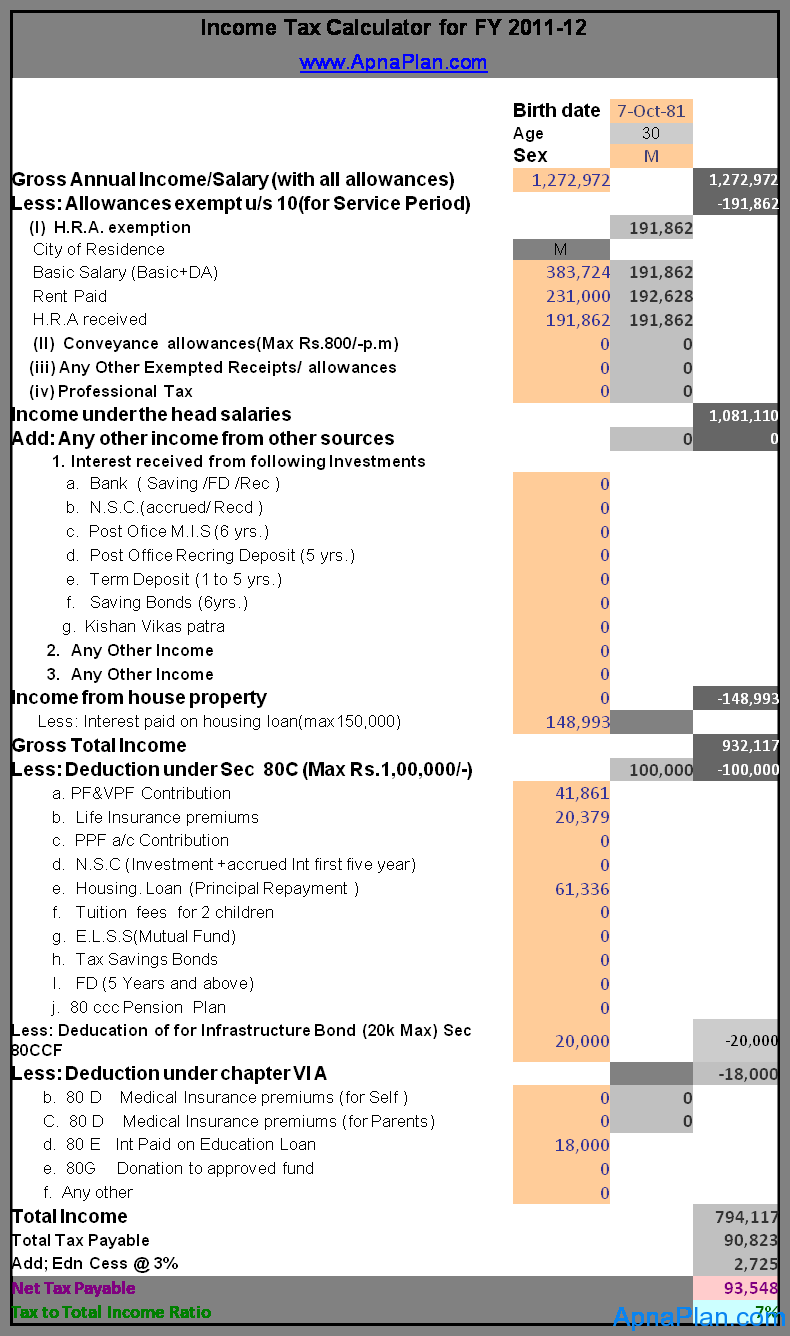

For example, if the income is less than $50,000, the tax rate is 10%;. A recap of the key steps in calculating income tax using the if function in excel. 70,000+ courses availableclassroom learningflexible learningdistance learning

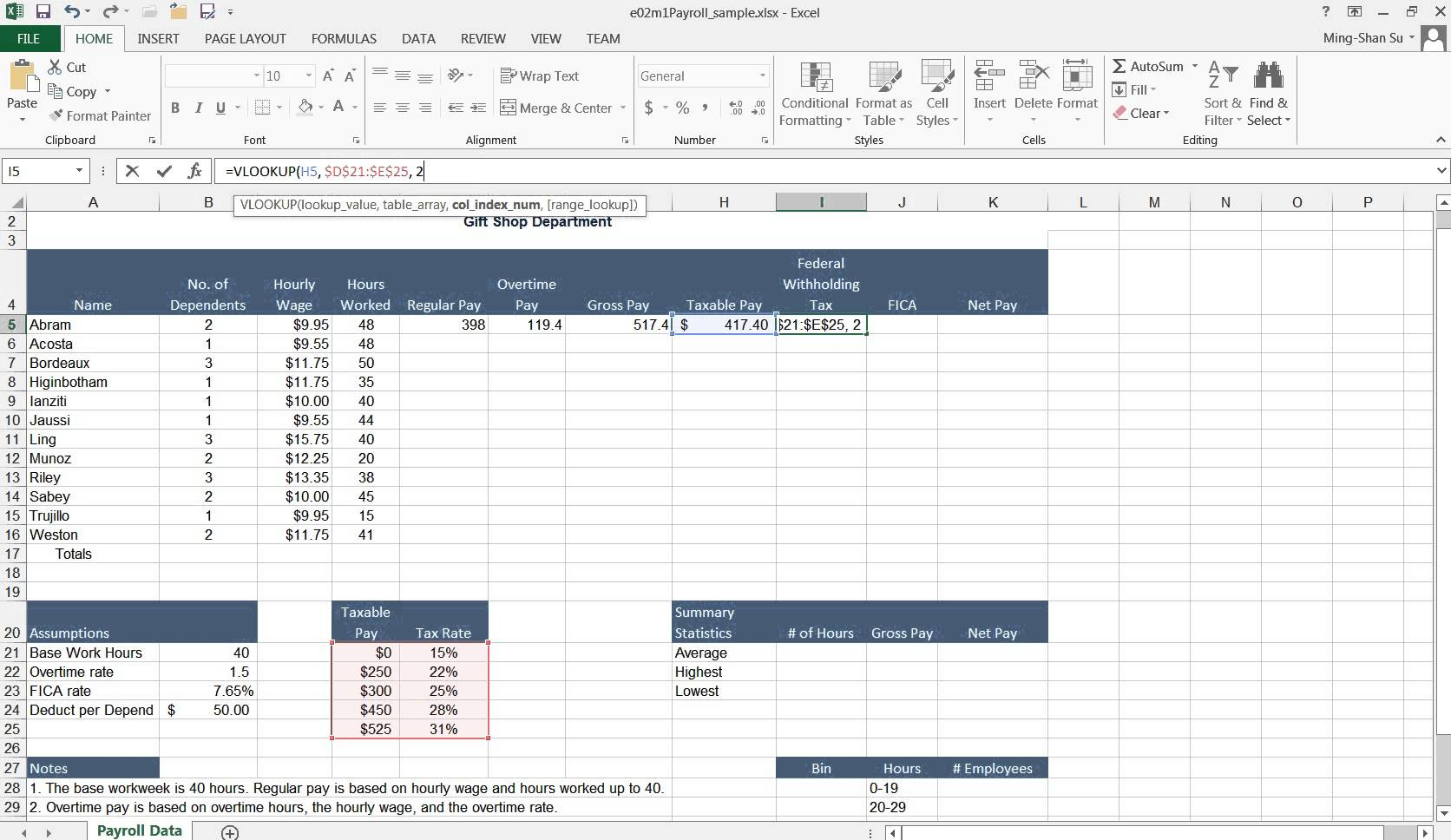

If the taxable income was $50,000, we would like excel to perform the following math. Create columns for income, tax rate, and tax amount;. You can use if formulas to determine the tax rate based on income levels.

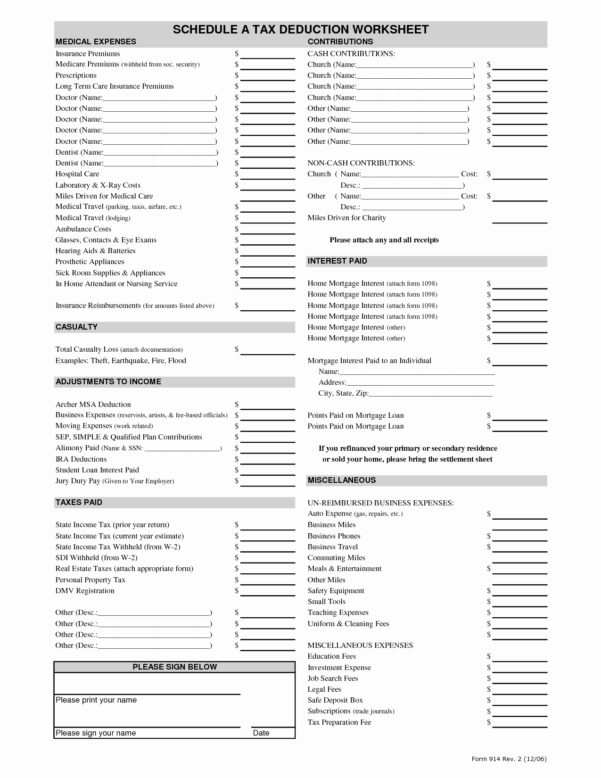

Implications of discontinued operations on taxation. Subtract the total amount of tax credits from the total tax liability to obtain the final tax amount. Microsoft excel offers several standard functions that can be used to calculate your effective tax rate using your.

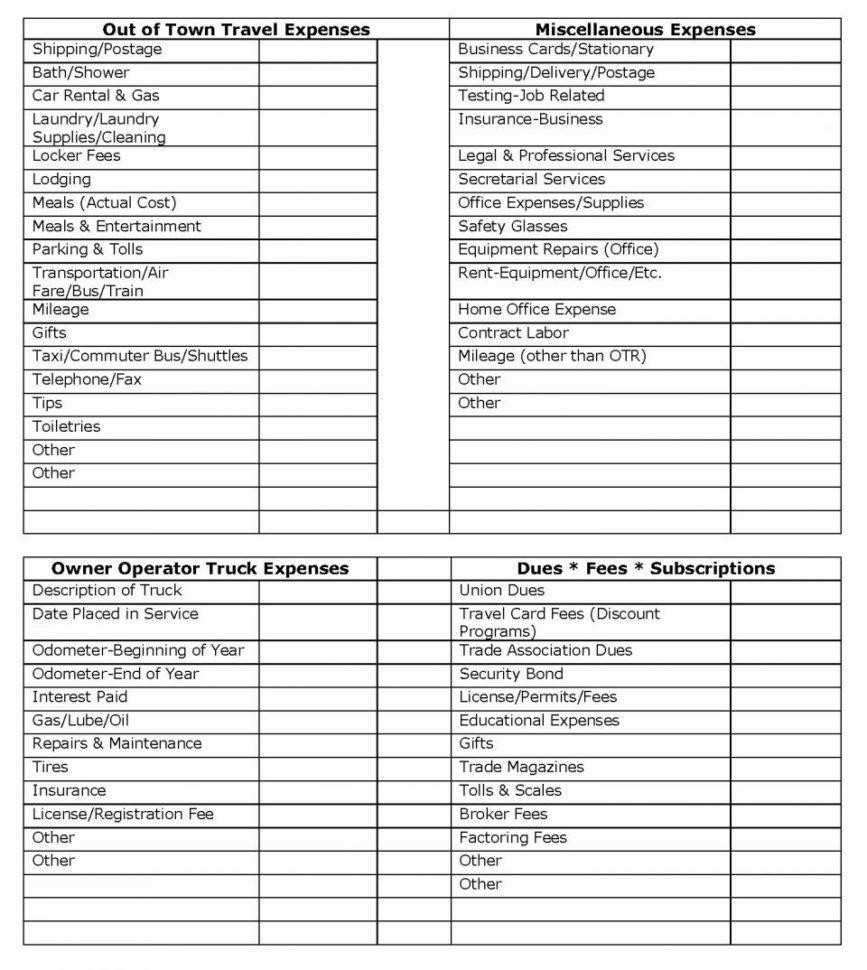

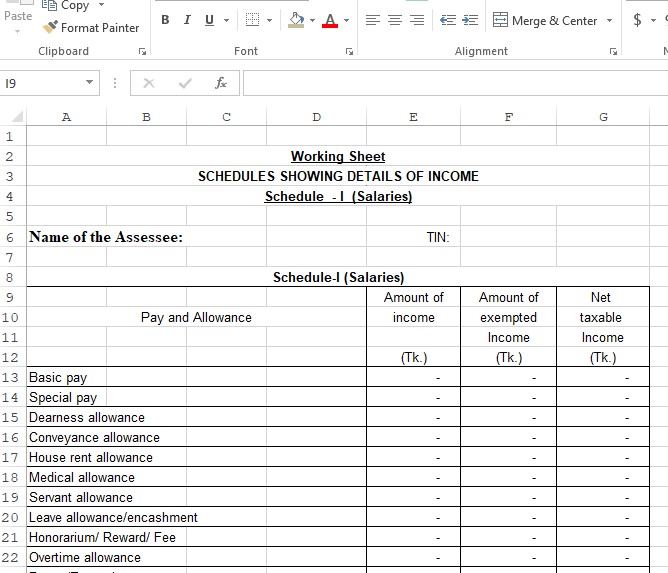

Exemption under section 10 (13a), compute income. Add your gross income, your total exemptions, and deductions. There are a lot of tax documents:

Around 1.2 million personal income taxpayers earn over r500 000 per year, and they represent about 65% of the total personal tax liability. Add a tax column right to the new tax table. Usage in income tax calculation:

Click on the download link. Income tax is zero (0) up to taxable income of rs. In the cell f6 type the formula =e6*d6, and then drag the autofill handle until negative results appear.

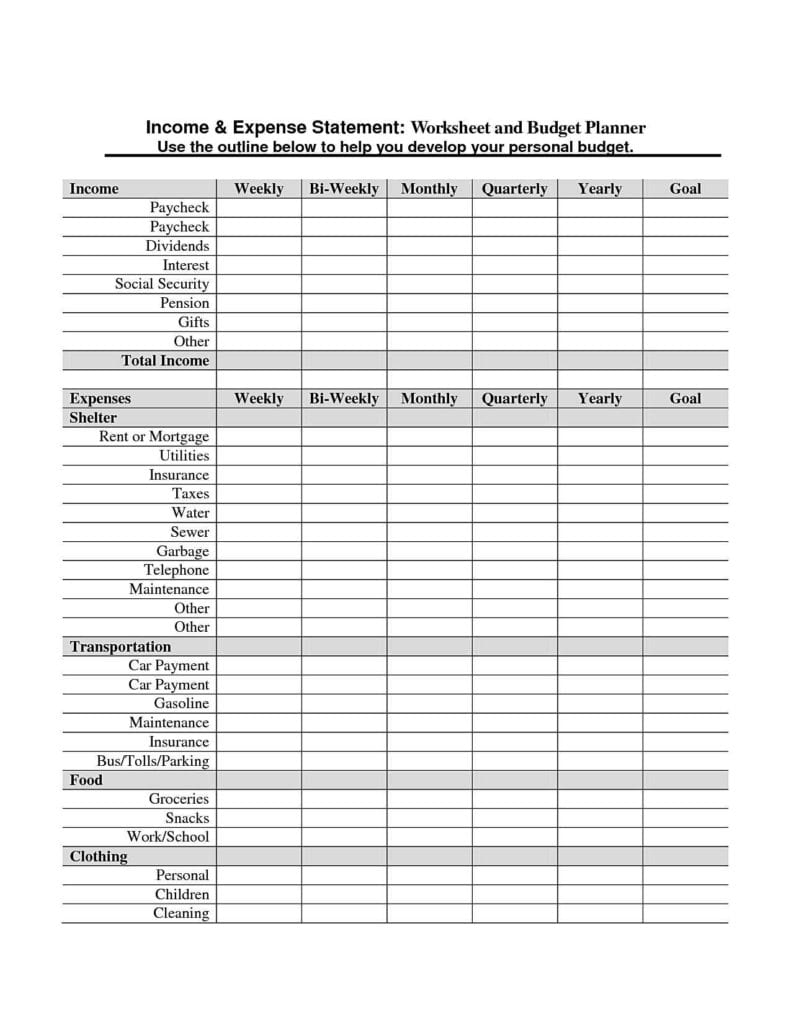

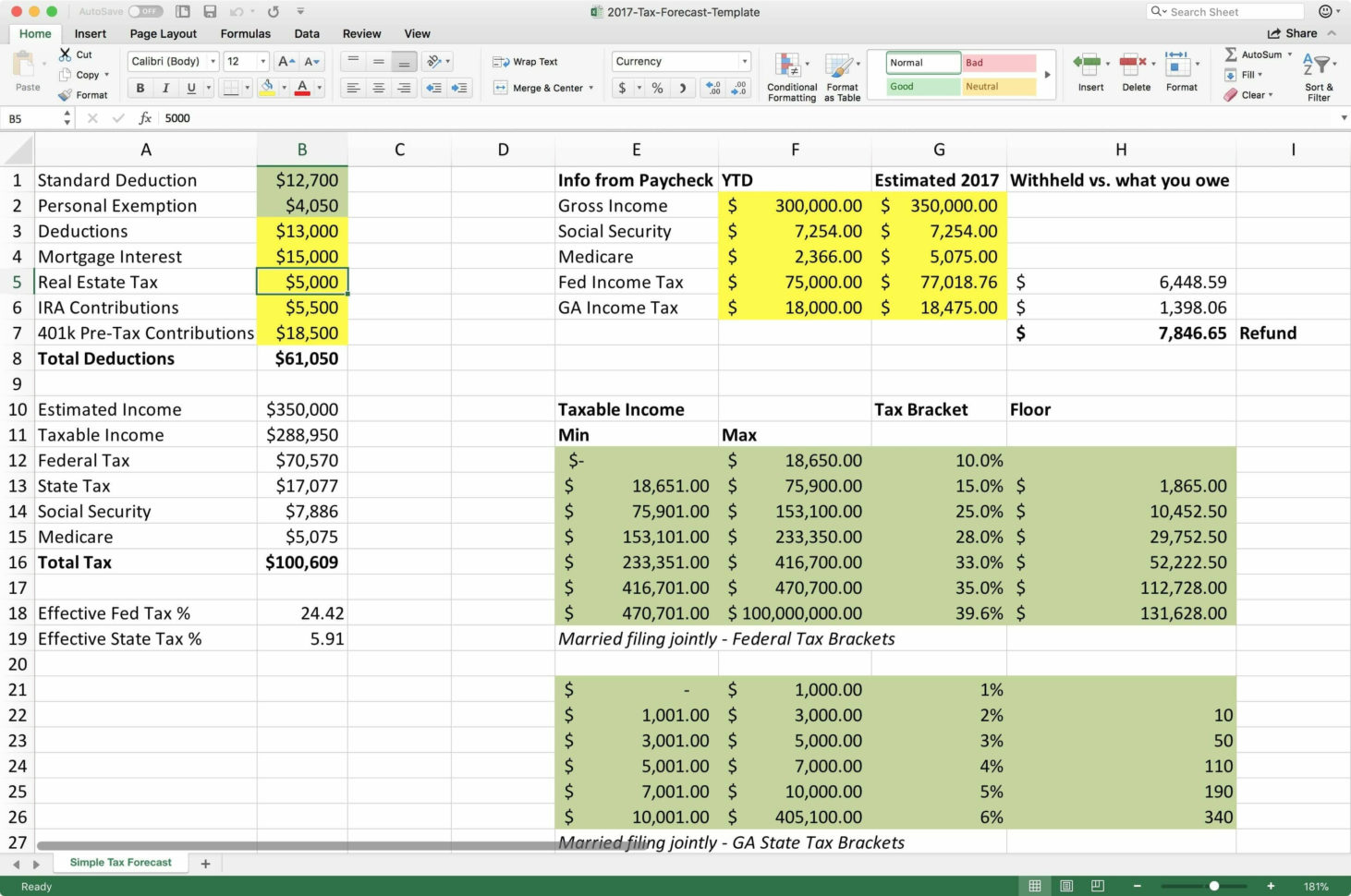

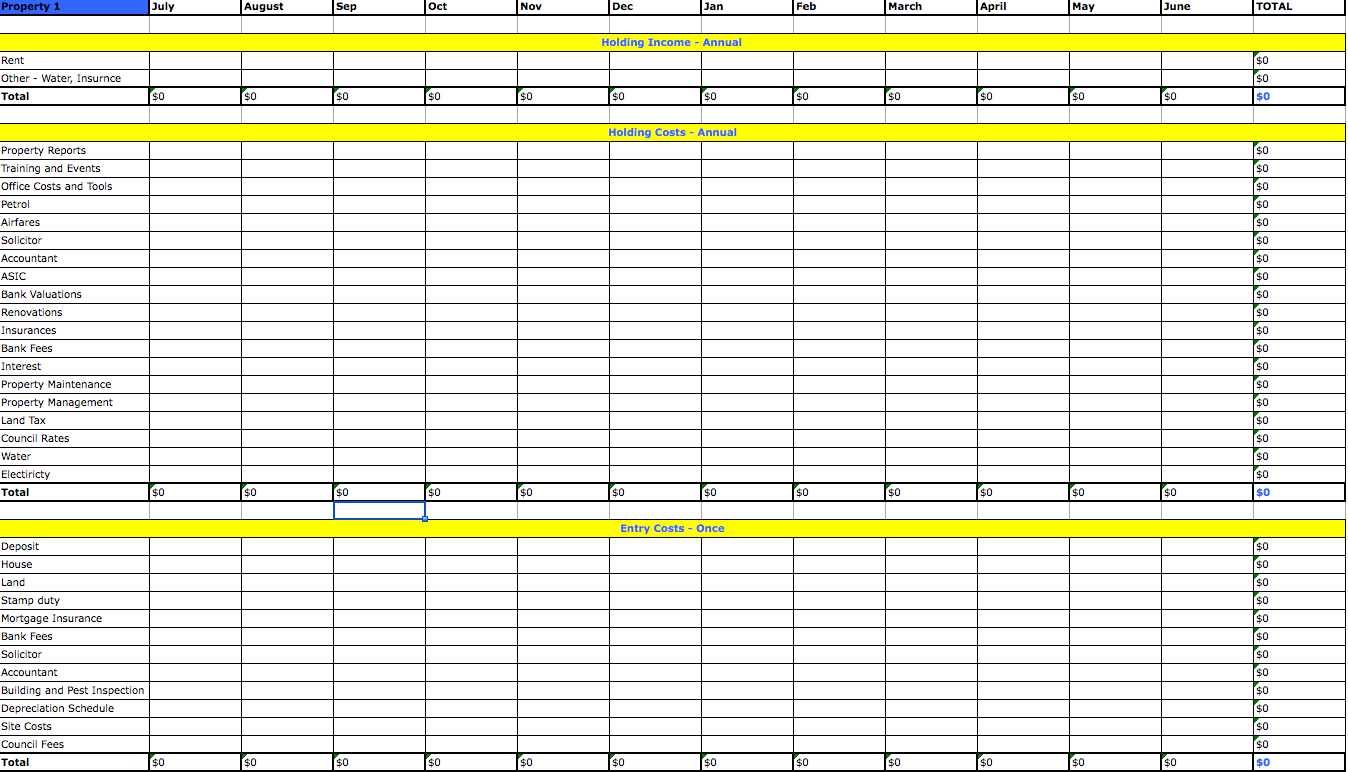

Here's how you can do it: To calculate income tax in excel, you need to set up the spreadsheet properly to ensure accurate calculations. Arrange the income details in a new sheet similar to the above examples.

In this excel tutorial, we will cover the essential steps to effectively manage and calculate your taxes using excel, saving you time and headaches during tax season. Provide information on income tax related to any gain or loss from the discontinued operation. For the additional calculations, create 5 more rows to calculate the.

And fill in your income details. Something that has all the uk personal tax bands and allowances (ideally editable) where you then. In this article, you will see the use of taxable income, tax brackets, the if function, and the vlookup function for the computation of income tax in excel format.