Out Of This World Tips About Ifrs Reporting Standards

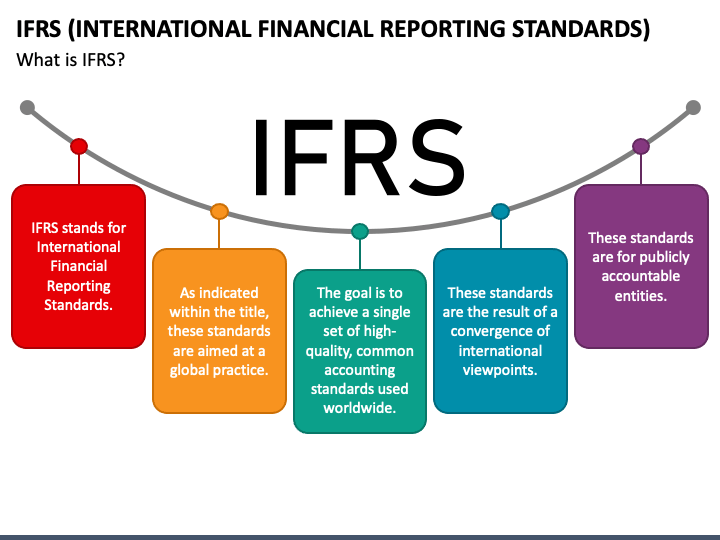

The international financial reporting standards (ifrs) comprises a collection of accounting regulations for public corporations to achieve consistent, open, and straightforward comparability of corporate financial statements globally.

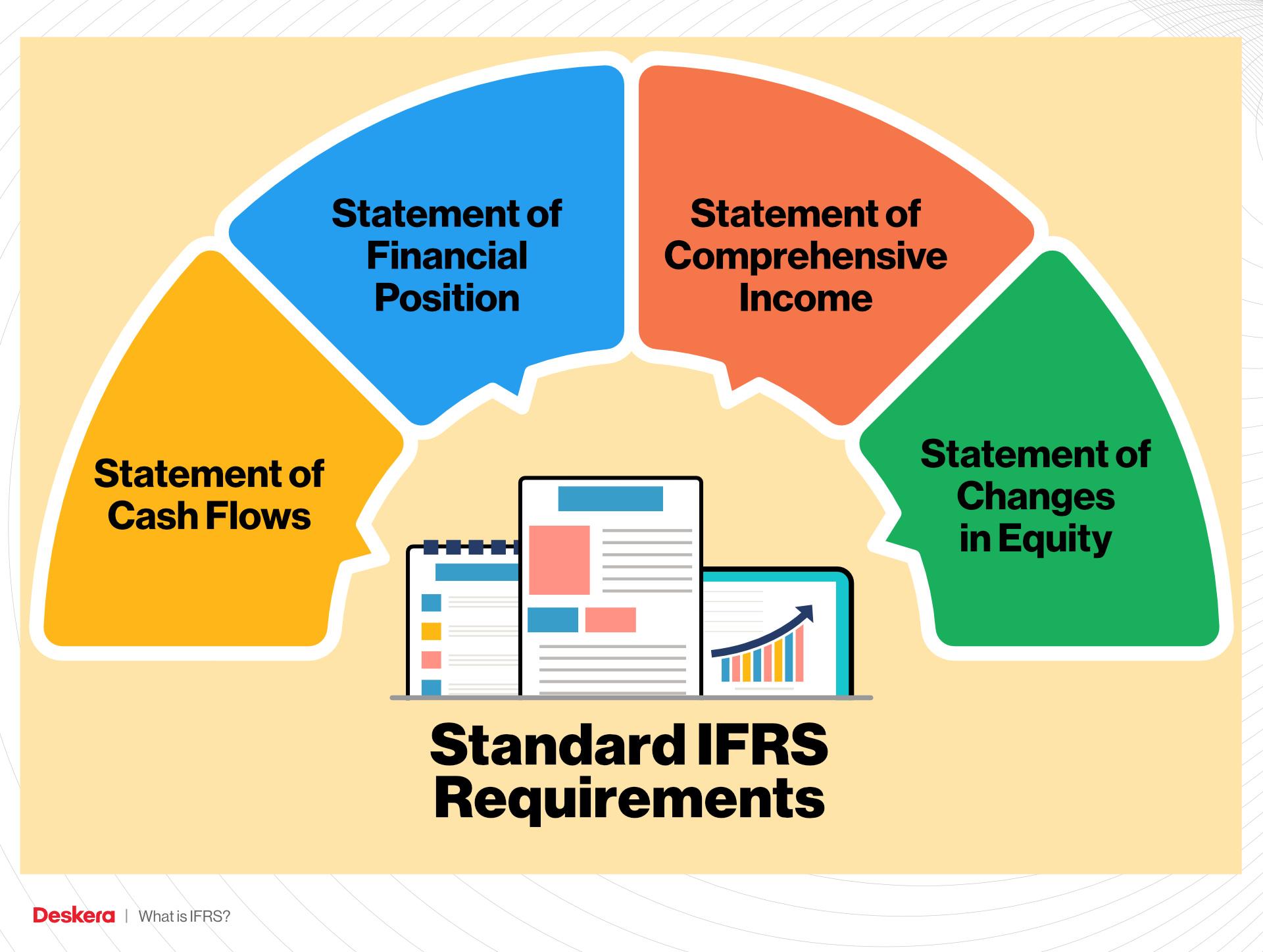

Ifrs reporting standards. Ifrs accounting standards ifrs for smes accounting standard ifrs taxonomy ifrs translations integrated reporting using the standards application support agenda decisions project work open and future projects open consultations completed projects Register with us to receive free access to the hmtl and pdf files of the current year's consolidated issued ifrs accounting standards and ifric interpretations (part a), the conceptual framework for financial reporting and ifrs practice statements, and available translations of standards. [1] [2] the ifrs include

The iasb’s objective is that the. Therefore, this checklist includes disclosure requirements from both ifrs s1 and ifrs s2. Wiley ifrs ® standards 2021 is a revised and comprehensive resource that includes the information needed to interpret and apply the most recent international financial reporting.

International financial reporting standards (ifrss) are international accounting standards issued by the iasb. Ifrs standards are international financial reporting standards (ifrs) that consist of a set of accounting rules that determine how transactions and other accounting events are required to be reported in financial statements. Efrag is undertaking preparatory work in anticipation of.

The 2021 reference for the interpretation and application of the latest international standards. Conceptual framework for financial reportingwas issued by the international accounting standards board in september 2010. International financial reporting standards (ifrs) are a set of accounting rules for the financial statements of public companies that are intended to make them consistent, transparent, and.

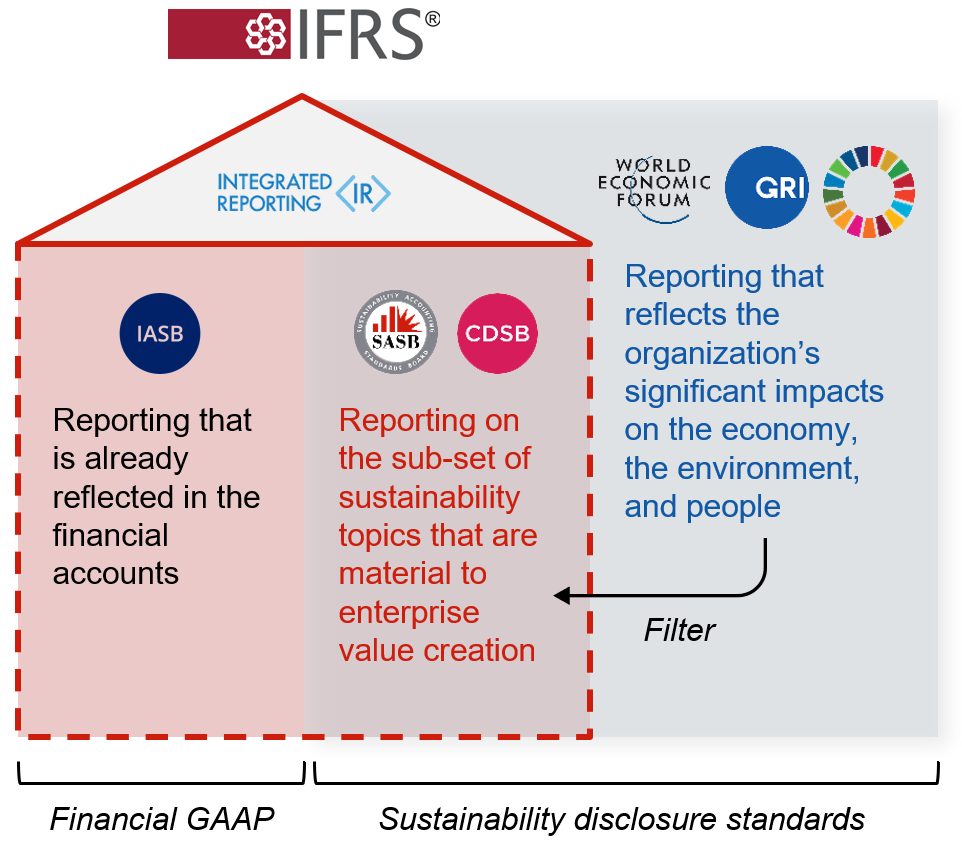

Overview integrated reporting framework integrated thinking principles the international integrated reporting framework and integrated thinking principles are used around the world—in over 75 countries—to advance communication about value creation, preservation and erosion. Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. New accounting standards or amendments.

Ifrs is beneficial for investment, tax planning, and auditing, as well as regulation all across the world. Efrag survey on ifrs 16 — user perspective. Wiley interpretation and application of ifrs ® standards.

Integrated thinking and integrated reporting are mutually reinforcing: For the purposes of this checklist, the. Ifrs s1 and ifrs s2 must always be applied together.

The european financial reporting advisory group (efrag) has launched the second part of its survey on ifrs 16 to seek input from users on whether the standard has improved the reporting on lease activities. This is a list of the international financial reporting standards (ifrss) and official interpretations, as set out by the ifrs foundation. International financial reporting standards, commonly called ifrs, are accounting standards issued by the ifrs foundation and the international accounting standards board (iasb).

They were developed and are maintained by the international accounting standards board (iasb). The iasb is supported by technical staff and a range. International financial reporting standards, or ifrs, is a set of accounting standards aiming to provide transparency, accountability, and efficiency to financial markets across the globe.

Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and. This page contains links to our summaries, analysis,.

:max_bytes(150000):strip_icc()/IFRS_Final_4194858-00f3f3a4c8334cc1aa13b29e692935db.jpg)

.png)