Formidable Info About Negative Investing Cash Flow

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

You generate profits when consumers purchase your goods or services.

Negative investing cash flow. Negative cash flows are investments in, or purchases of, these assets. It can be a good thing in the hands of certain managers to have negative free cash flow early in the company's life if the company has high underlying profitability, good unit economics, and. The investing activities section includes any outflows of cash or sources of cash from.

For instance, investing cash flow might be negative because a company is spending money on assets that improve operations. This means that the company has no excess cash on hand in a given period, which could be a sign of poor financial health. Purchases of marketable securities for $21.9 billion payments acquiring property, plant, and equipment for $7.7 billion payments for.

Negative cash flow can be a source of stress for business owners and can mean that it’s difficult to continue investing in your business’s growth. Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period. Understanding of cash flow from investing.

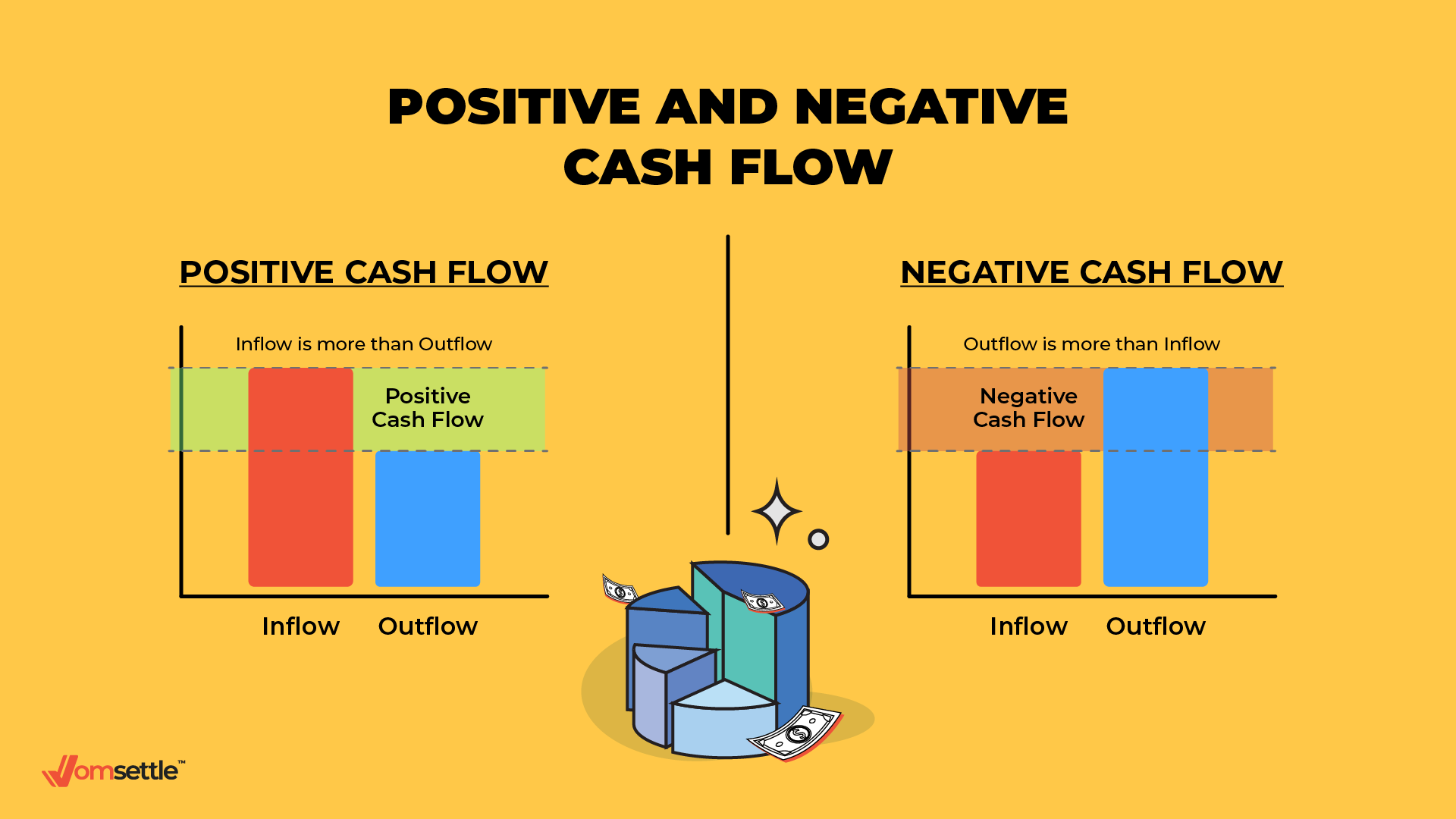

The cfs measures how well a. Investing activities that were cash flow negative are highlighted in red and include: Negative cash flow happens when your expenses are more than your income.

Instead, negative cash flow may be caused by. This means that the company is using its cash to buy or improve. Negative cash flow often indicates the overall poor performance of the company.

Ultimately, your business needs enough money to cover operating expenses. Negative cash flow from investing activities might be due to significant amounts of cash being invested in the company, such as research and development (r&d), and is not always a warning sign. The hit to the cash flow statement comes from negative investing cash flow and negative financing cash flow.

More money came in than went out. Thyssenkrupp ag cut its sales and profit outlook after orders fell and it booked another writedown on its struggling steel business. What is negative cash flow?

Though negative cash flow is not inherently bad, this financial asymmetry is not sustainable or viable for your business in most cases. Effect of negative and positive cash flow: By contrast, if cfi is negative, the company is likely investing heavily into its fixed asset base to generate revenue growth in the coming years.

What does negative free cash flow mean? Cash flow from investing activities is one of the three sections that make up a company's. The amount is positive if the activity generates cash inflow and negative when there is an outflow of cash due to the said activity.

Negative cash flow refers to the situation in the company when cash spending of the company is more than cash generation in a particular period under consideration; According to the example, the company has spent more than it earned in a given timeline. Negative cash flow may indicate something other than financial trouble.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/GettyImages-612737000-005e93c7d1614e3dbfd3b424f0570349.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)