Best Tips About Purchase Of Investments Cash Flow Statement

How to create a cash flow statement.

Purchase of investments cash flow statement. Although the presentation of operating cash flows differs between the two methods,. Cash flows from investing and financing are prepared the same way under the direct and indirect methods for the statement of cash flows. Cash flow types what is cash flow?

Record adjusted ebitda margin fourth. To put it simply, if we receive cash in the transaction we add the cash amount received and if we pay cash in the transaction we sutract the cash amount paid. Some of the examples of such investing activities which are most often seen on cash flow statements’ investing activities section are:

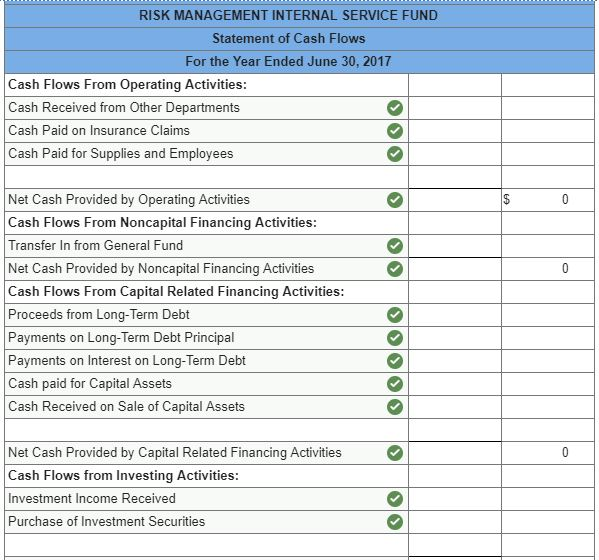

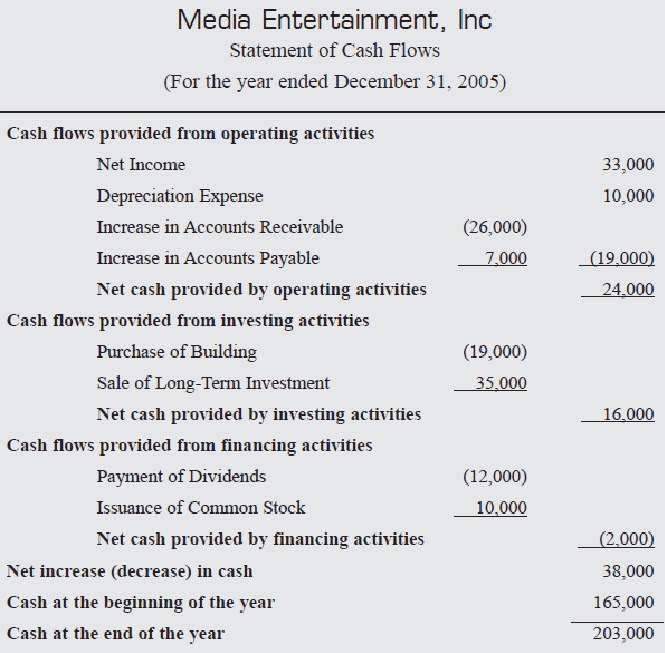

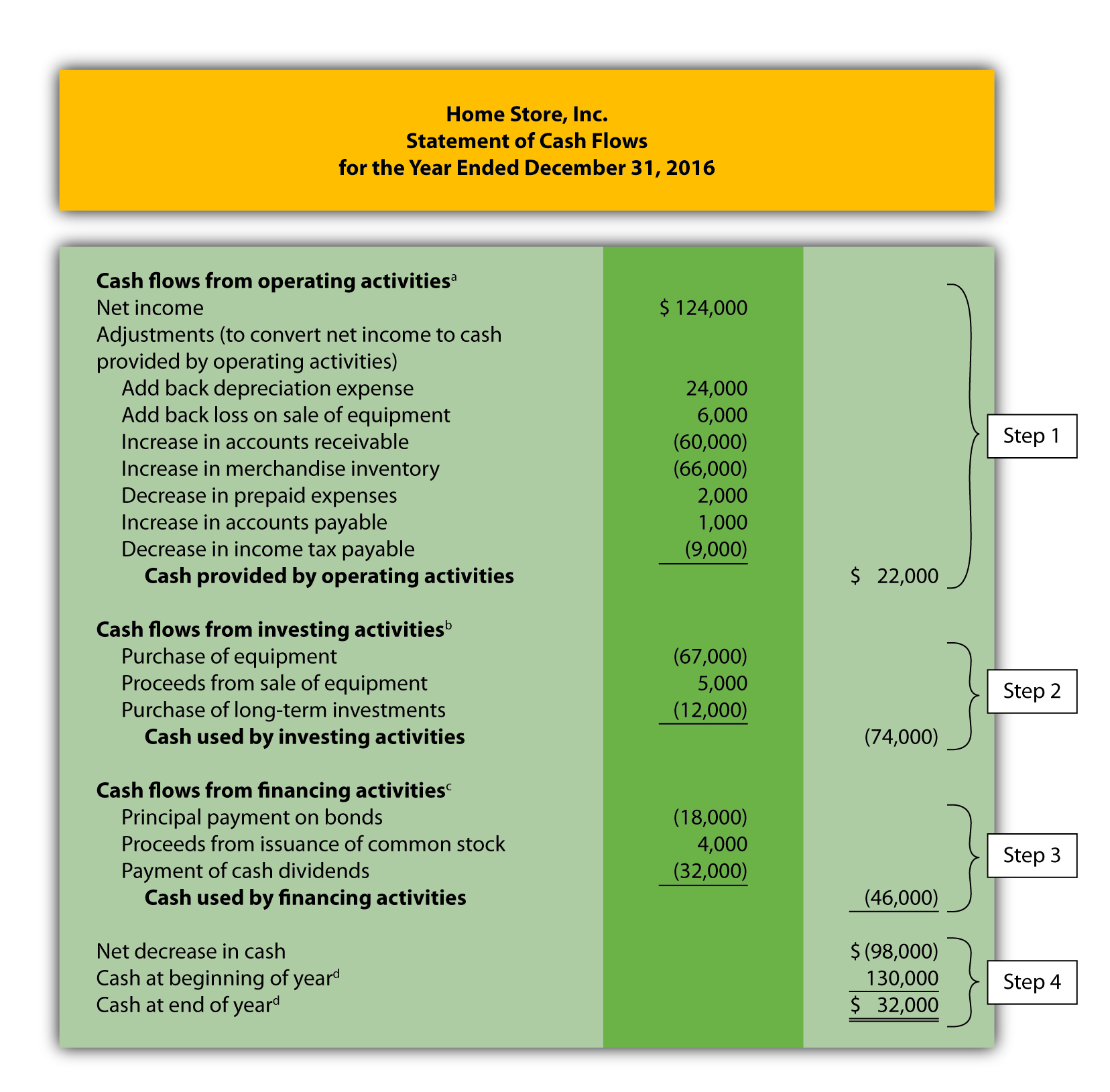

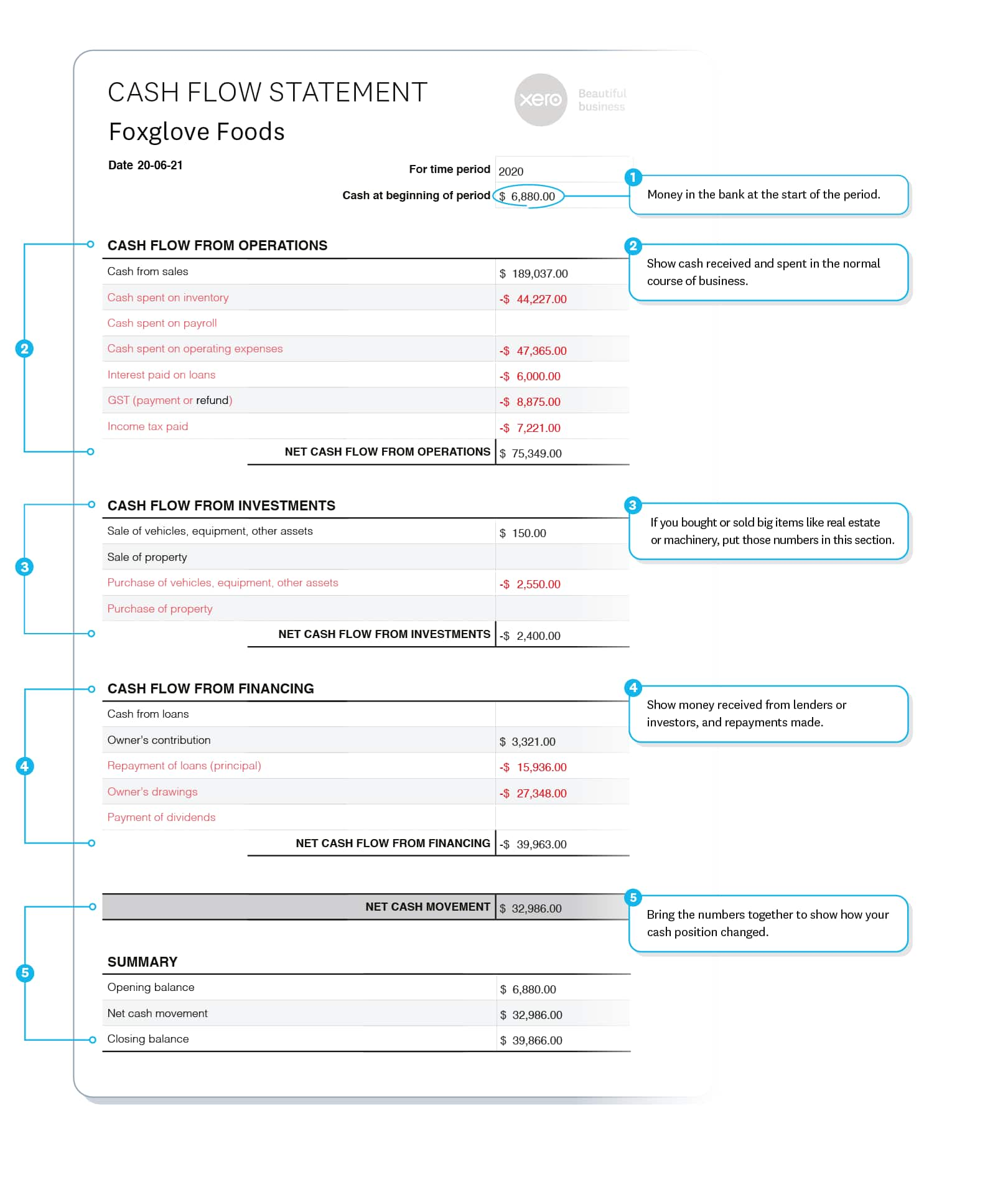

The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during the year. The cash flow statement looks at the inflow and outflow of cash within a company. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

What is cash flow from investing activities? Income from operations of $652 million; Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less than 10 months, according to.

The 3 main types of cash flow cash flow from operations (cfo) cash flow from investing (cfi) cash flow from financing (cff) what about free cash flow? Cash flow from investing:

The cash flow statement is one of the most revealing documents of a firm’s financial. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. If a company's business operations can generate positive cash flow, negative overall cash flow.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. The statement of cash flows classifies cash receipts and disbursements as operating, investing, and financing cash flows. Updated may 22, 2021 reviewed by andy smith what is cash flow from investing activities?

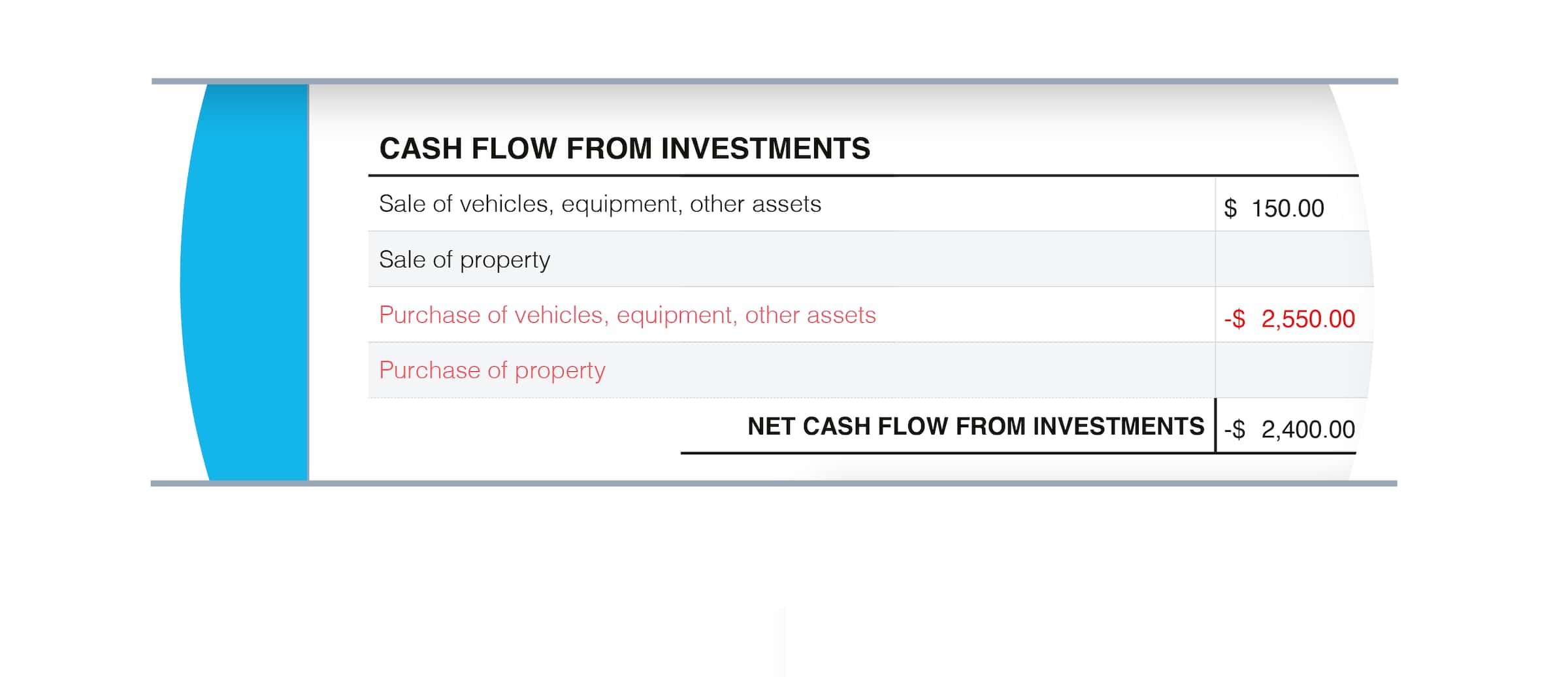

Cash receipts and payments from forward contracts, option contracts, or other trading contracts; Cash flow from investing is listed on a company's cash flow statement. Any purchase of investments in cash, like, for example, the purchase of stocks or bonds, will lead to a decrease in your business’s cash flow, equivalent to the purchasing cost.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. One of the components of the cash flow statement is the cash flow from investing. Dividends or interest received from.

Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period. Enroll in the premium package:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)