Real Info About Gaap And Ifrs Rules

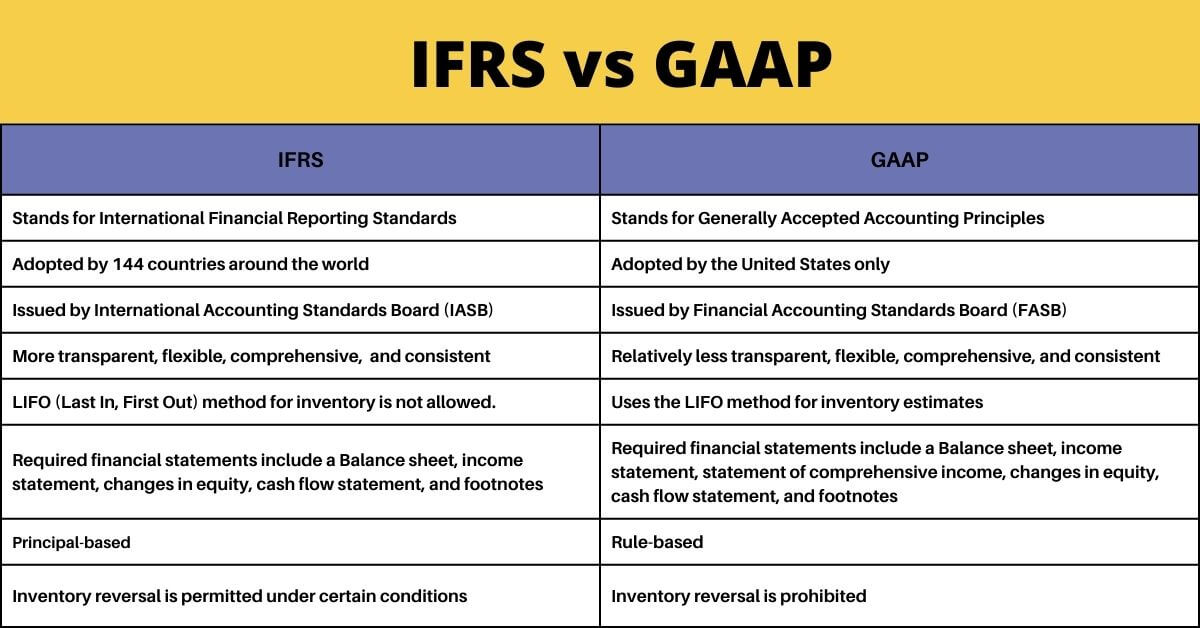

While both ifrs 15 and topic 606 remain substantially converged, certain differences exist that can affect comparability.

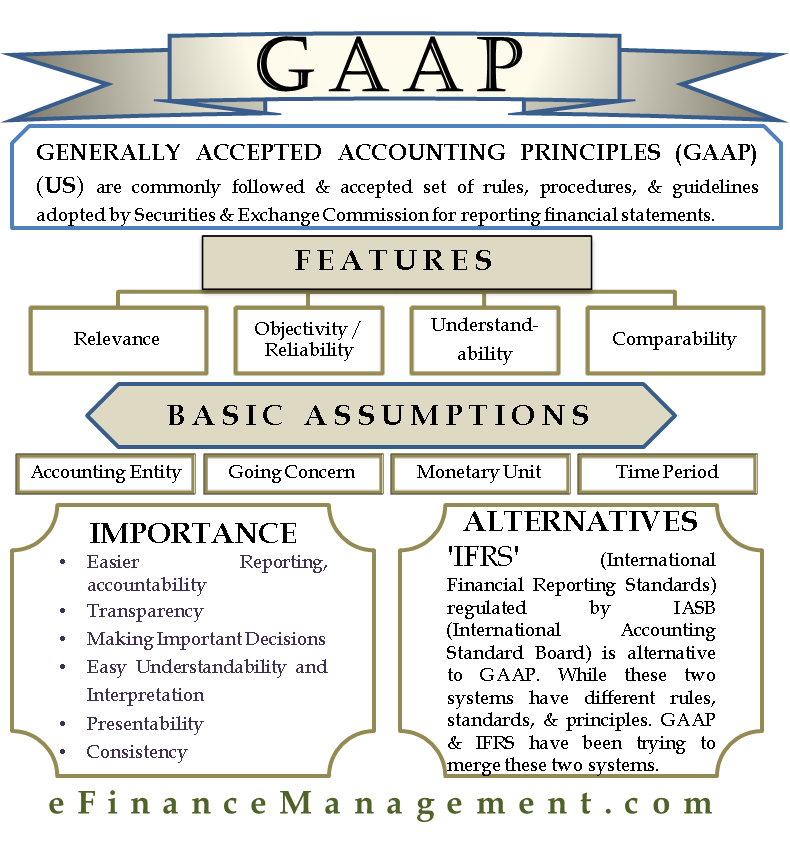

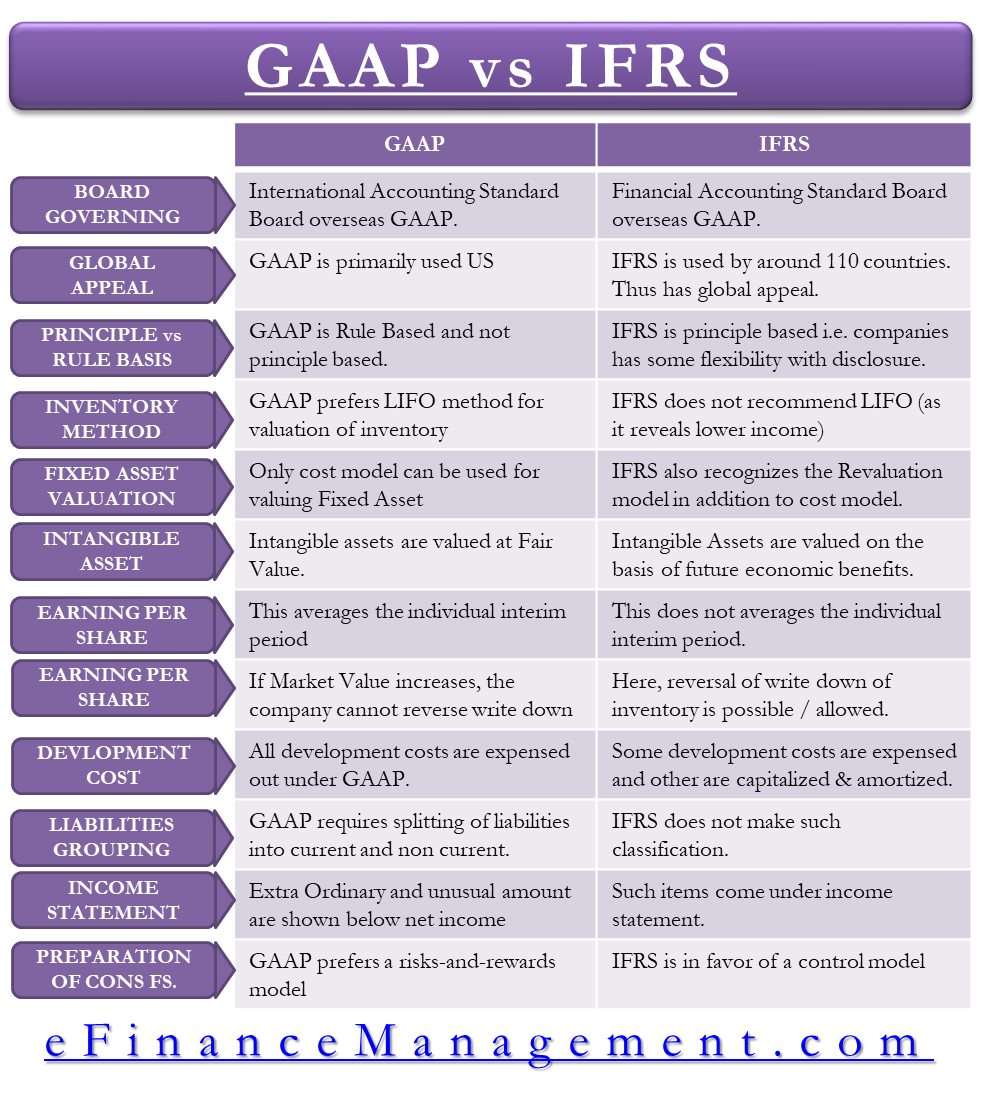

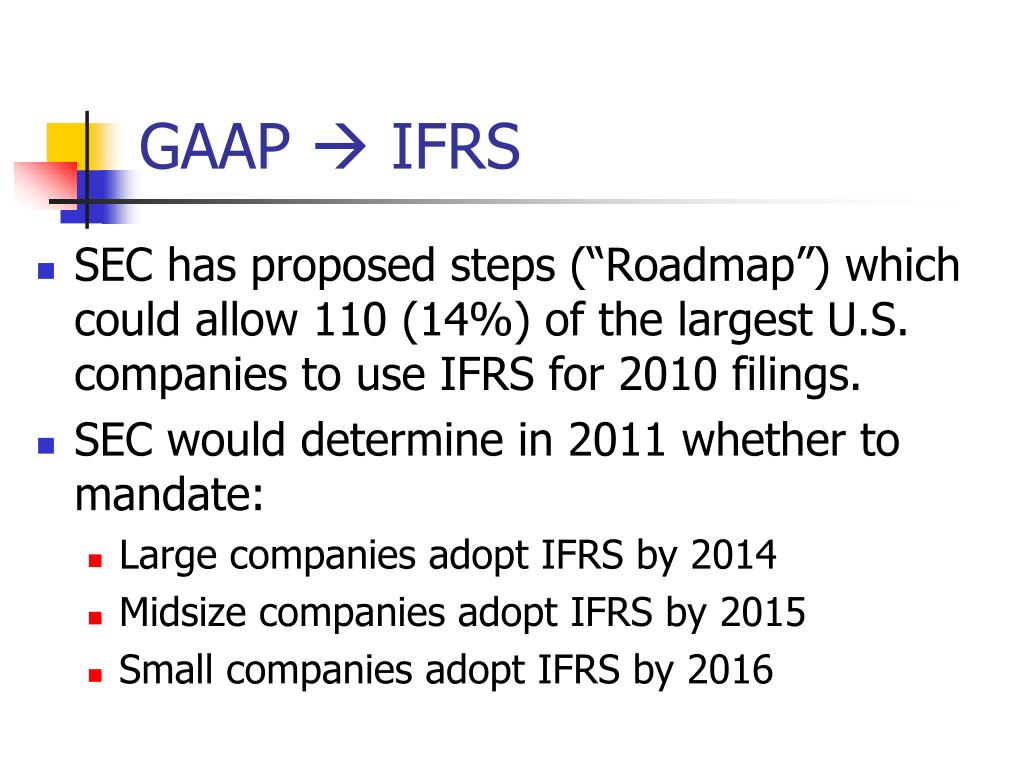

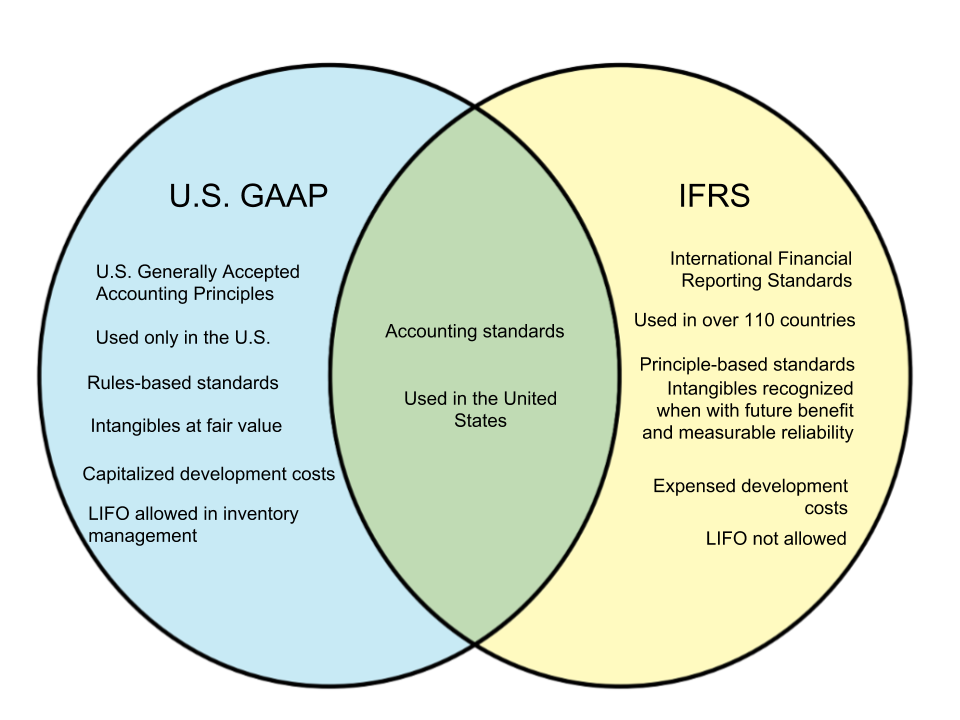

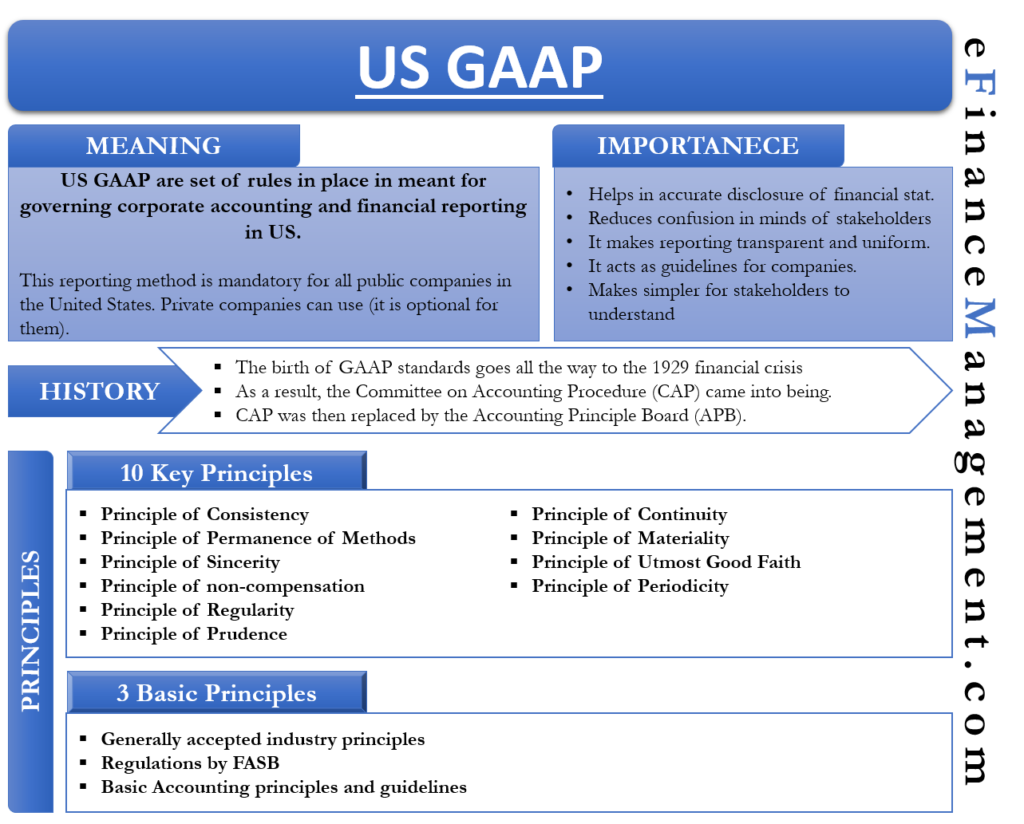

Gaap and ifrs rules. The united states uses a different system, the generally accepted accounting principles (gaap). One of the major differences lies in the conceptual approach: Outside the u.s., the most commonly used accounting regulations are known as the international financial.

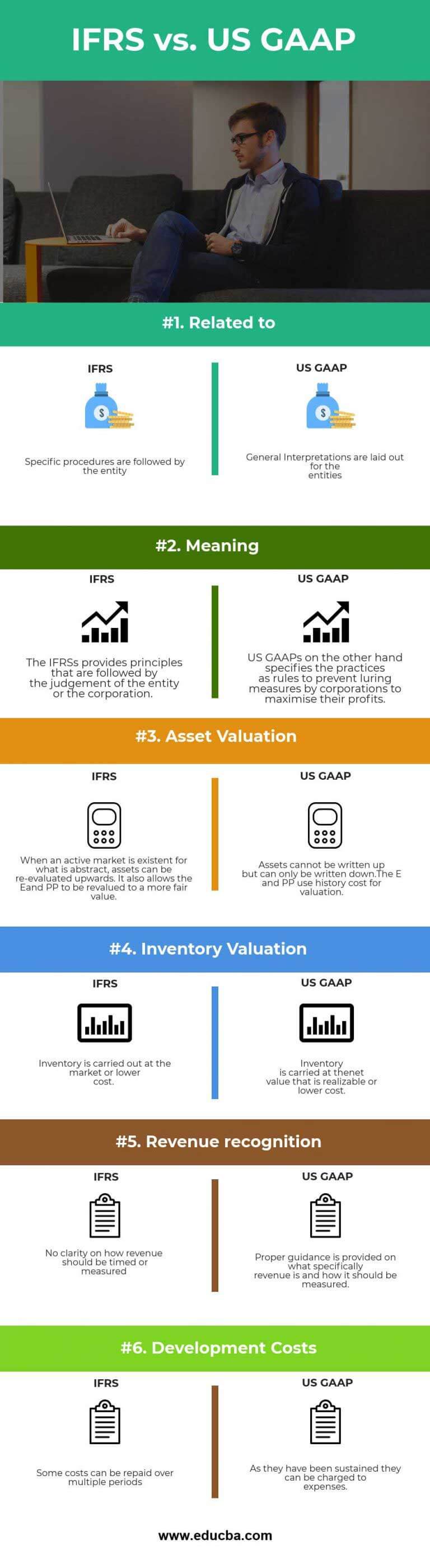

Us gaap requires that fixed assets are measured at their initial cost; One is gaap and the other is. The main distinction appears in their overall organization.

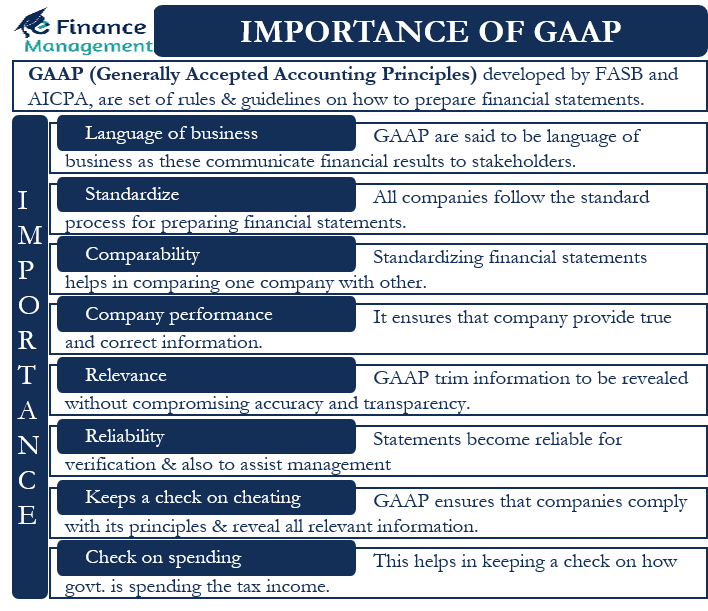

Ifrs guidelines provide much less overall detail than gaap. Their value can decrease via depreciation or impairments, but it cannot increase. Understanding financial reporting standards is essential for both investors and companies in today’s global economy.

What are the key differences between gaap and ifrs? This difference appears in specific details and interpretations. Gaap is set forth in.

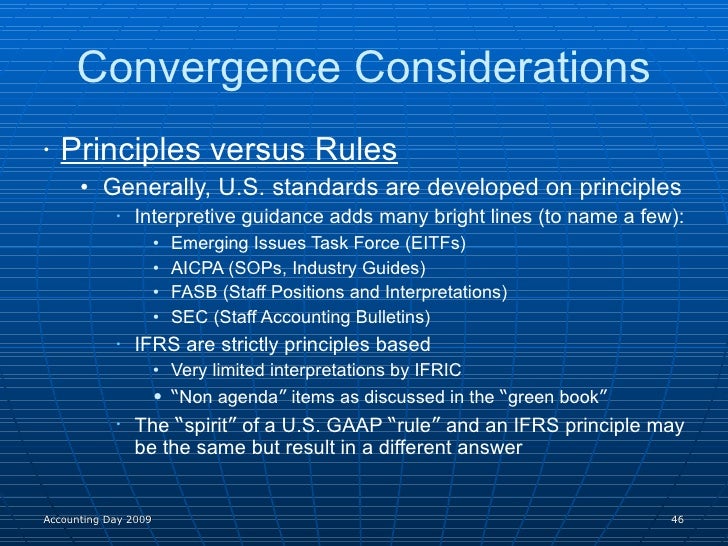

Gaap and ifrs have different rules for accounting for intangible assets such as patents and technology—as well as the r&d that goes into them. Gaap is considered a more “rules based” system of accounting, while ifrs is more “principles based.” the u.s. Many instruments that are classified as a financial liability under ifrs could be classified as equity or temporary equity under.

Gaap prioritizes rules and detailed guidelines, while the ifrs provides general principles to. The are two main sets of accounting standards that most businesses follow. Consequently, the theoretical framework and principles of the ifrs.

How is ifrs 15 different from us gaap? There is no concept of ‘temporary equity’ under ifrs. The ifrs rules govern accounting standards in the european union, as well as in a number of countries in south america and asia.

Gaap and ifrs are the two main accounting frameworks used.