Simple Tips About Cash Flow Ifrs

Notes for further details of relevant developments prior to this, please refer to our deloitte global section.

Cash flow ifrs. On 19 november 2013, the iasb issued ifrs 9 financial instruments (hedge accounting and amendments to ifrs 9, ifrs 7 and ias 39) amending ifrs 9 to include the new general hedge accounting model, allow early adoption of the treatment of fair value changes due to own credit on liabilities designated at fair value through profit or loss a. Taking into account the profit and cash generation in 2023, as well. This paper set out the staff’s rec.

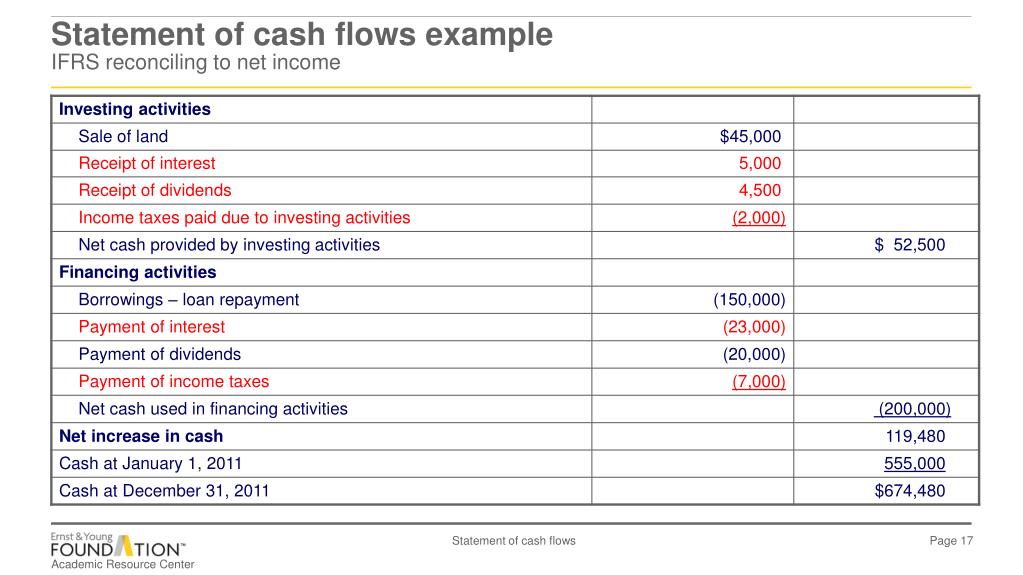

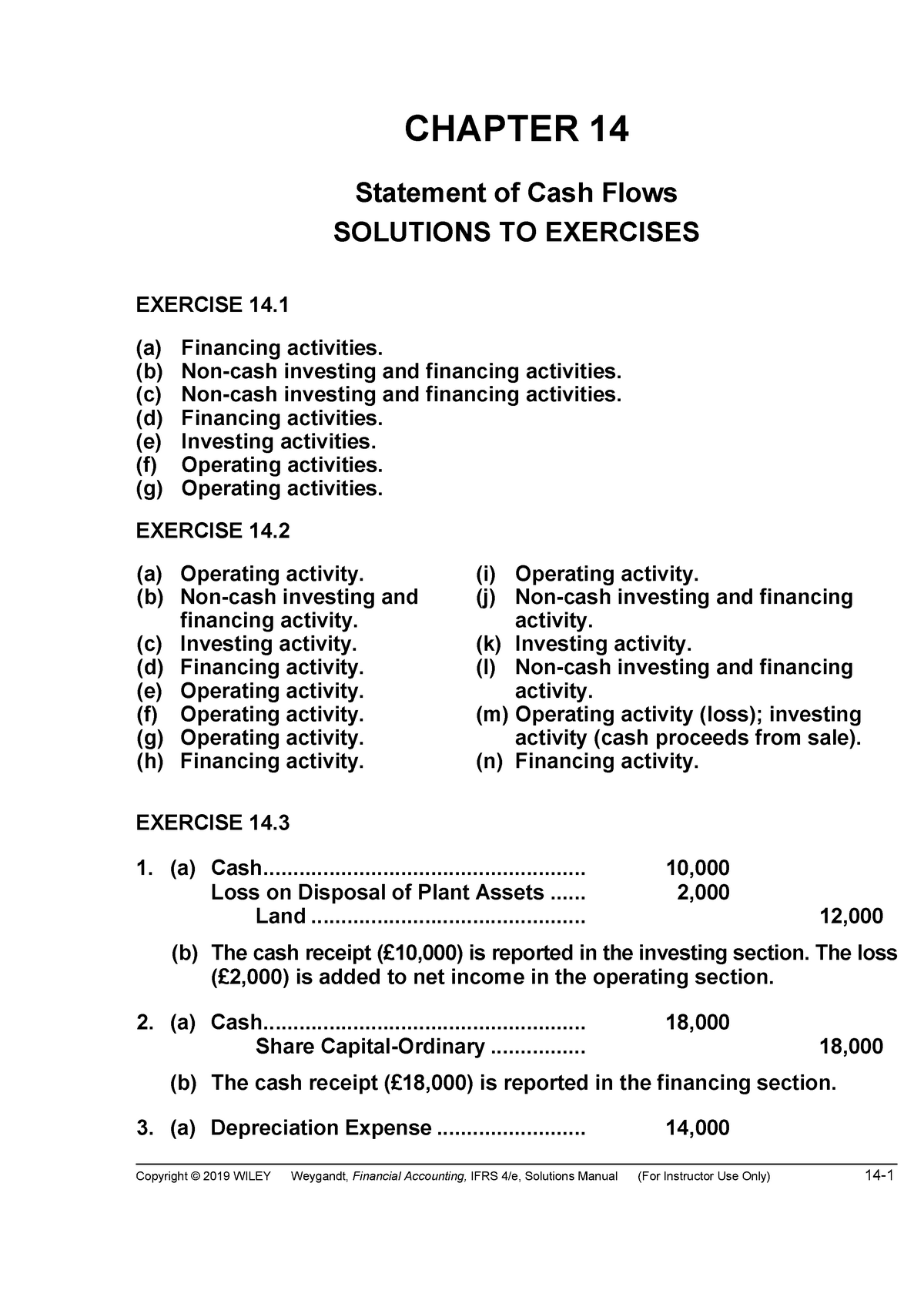

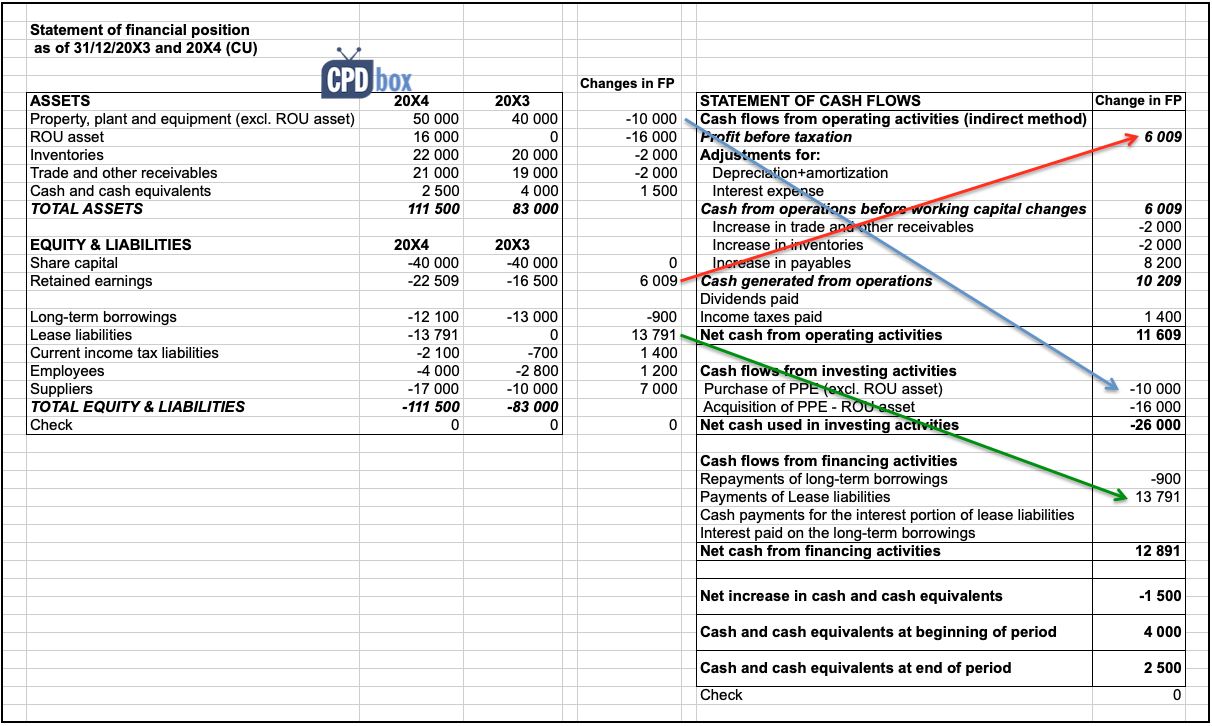

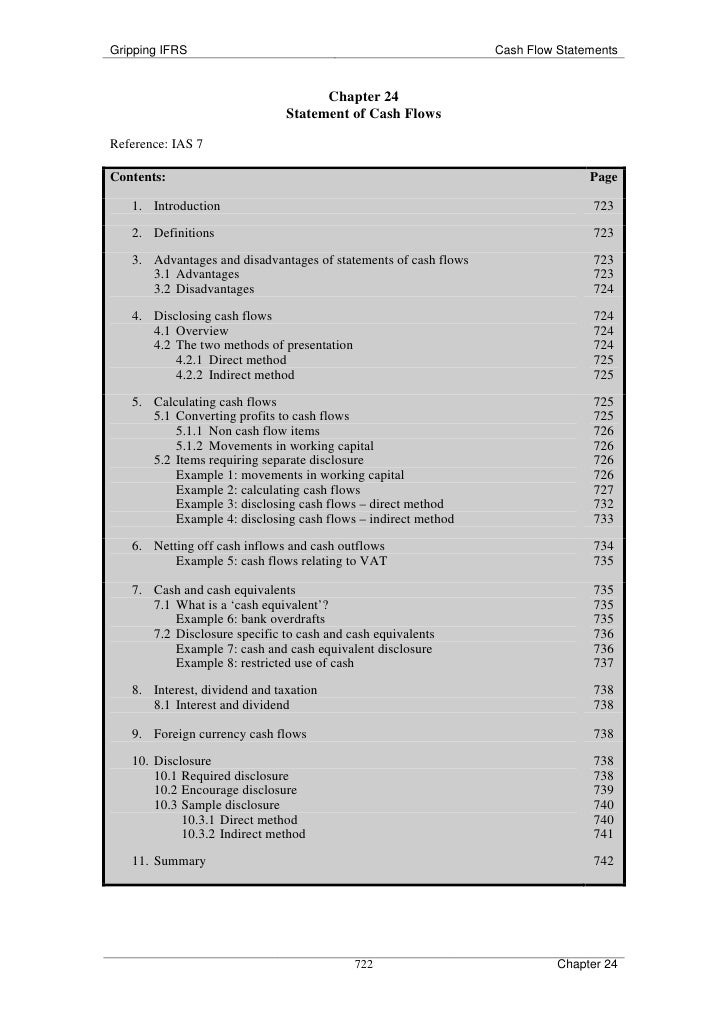

History of ias 7 the following table shows the history of this standard subsequent to the adoption of ifrs in canada. Of financial statements under ifrs1 • the statement of cash flows must be presented with equal prominence with the other statements comprising a complete set of financial statements1 • an entity must include each period for which financial statements are presented • prescribes that cash flows shall generally be presented on a gross basis Examples from ias 7 representing ways in which the requirements of ias 7 for the presentation of the statements of cash flows and segment information for cash flows might be met using detailed xbrl tagging.

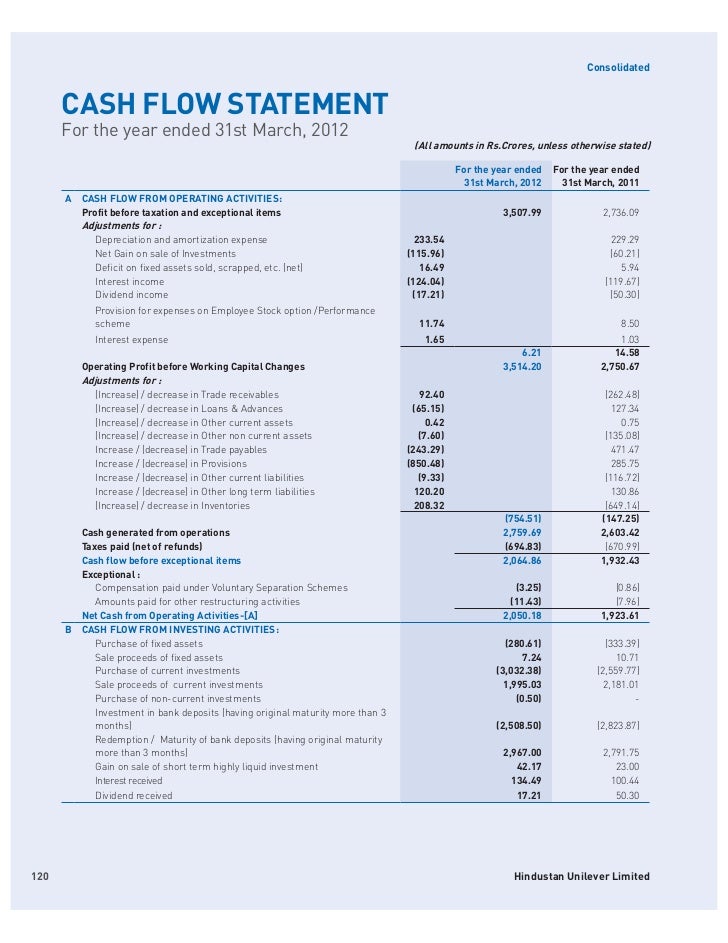

It introduces the subject and reproduces the official text along with explanatory notes and examples designed to enhance understanding of the requirements. The accounting procedures for cash flow hedges can be summarised as follows, as per ifrs 9.6.5.11: 1 the essentials—cash flow statements a statement of cash flows provides investors with information about cash inflows and outflows and the resulting change in cash and cash equivalents.

It requires reporting cash flows from operating activities either by direct or indirect method. The details are as follows: Changes in the fair value of hedging instruments are recognised in oci and are accumulated in a cash flow hedge reserve within equity.

All entities that prepare financial statements in conformity with ifrss are required to present a statement of cash flows. These future cash flows — referred to as “fulfilment cash flows” — include all the. The cash flow hedge reserve is the lesser of the two following measures:

Return on invested capital (roic) improved to 16.8%. Cash flows from (used in) financing activities ias 7.50 d an entity presents its entities are encouraged to report using the direct method. This module focuses on the general requirements for presenting a statement of cash flows applying section 7 statement of cash flowsof the ifrs for smesstandard.

The direct method provides information which may be useful in estimating future cash flows and which is. After generating free cash flow of £2.6bn, including net cash flow from operating activities of £3.8bn, the group closed 2023 with cash of. Under ifrs accounting standards, the primary principle is that cash flows are classified based on the nature of the activity to which they relate.

It requires the cash flows of an entity to be analysed into operating, investing and financing activities. The ‘solely payments of principal and interest’ (sppi) requirements). Adjusted free cash flow €1,164 million, down 2% in constant currencies.

3353113), and is registered as an overseas company in england and wales (reg no: Under us gaap, the classification of an item on the balance sheet, and its related accounting, often informs the appropriate classification in the statement of cash flows. It defines cash and cash equivalents and explains what is and what is not included in cash flow movements.

Ias standards ias 7 statement of cash flows 1h 0m learn the key accounting principles to be applied when preparing a statement of cash flows. You will find sample ifrs statements of cash flows in our model ifrs financial statements. The statement classifies cash flows during a period into cash flows from operating, investing and financing activities:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

![IAS 7 Cash Flows IFRS [ International Accounting Standard 7 ] IFRS 7](https://i.pinimg.com/originals/51/c4/e3/51c4e391a1d330685d14094d830b258d.jpg)