Marvelous Tips About Standard Financial Ratios

October 11, 2023 what are financial ratios?

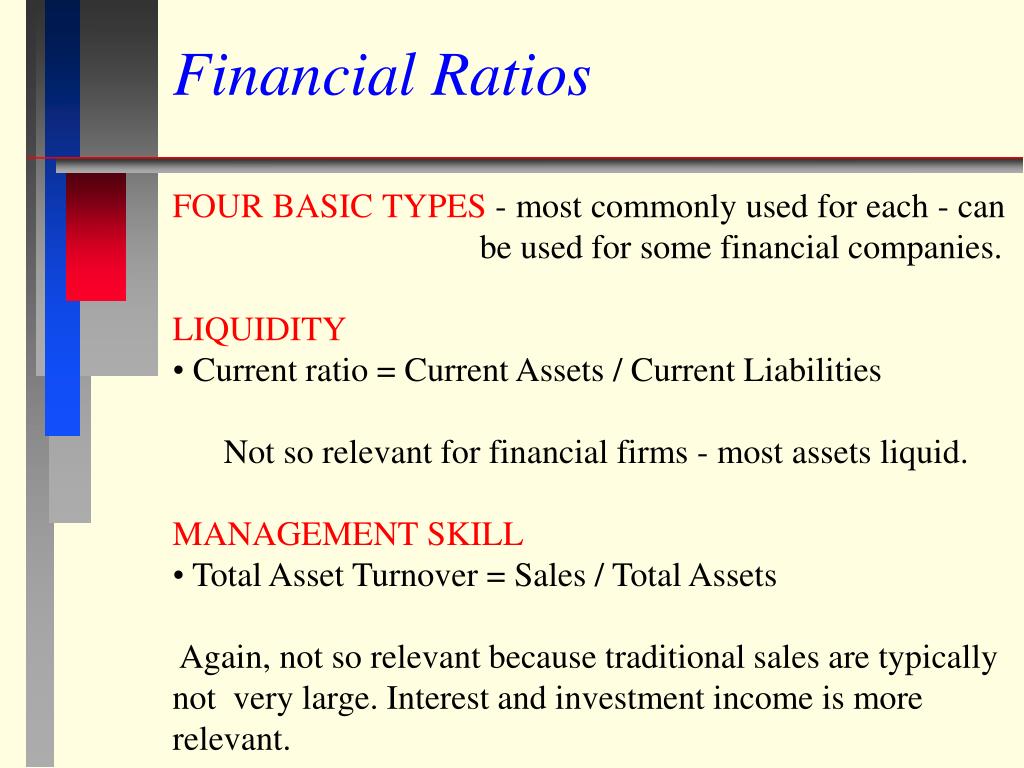

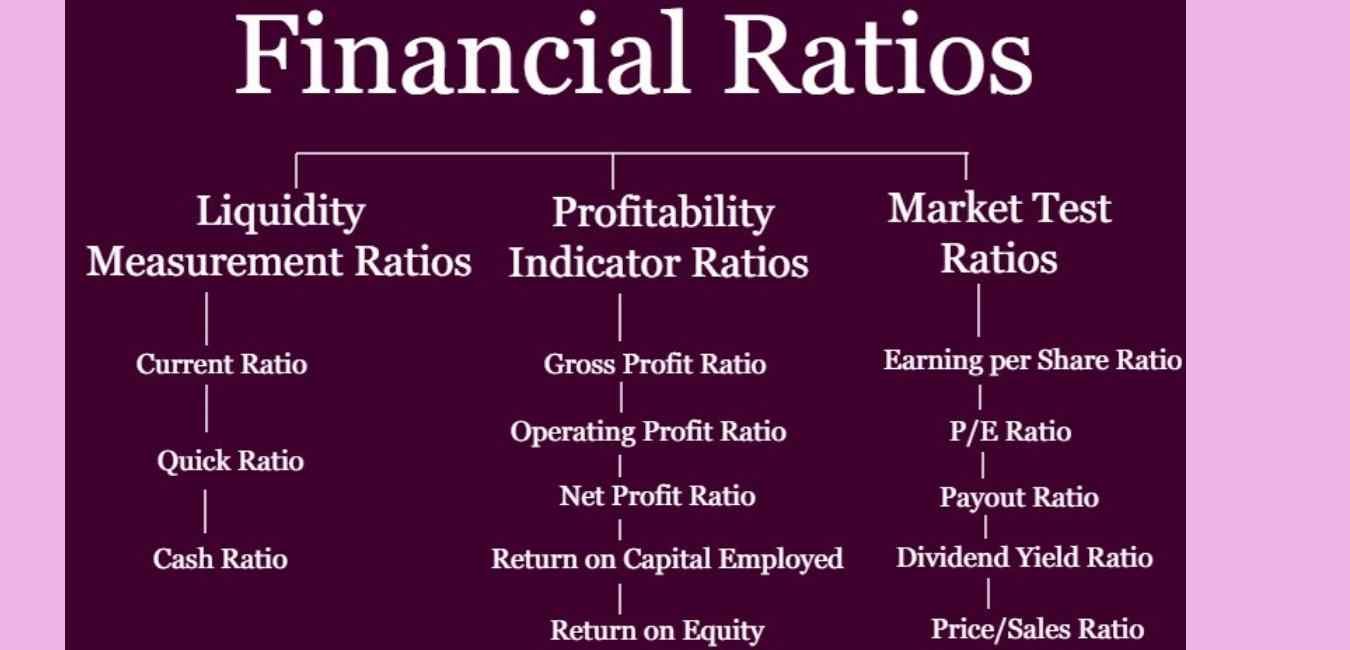

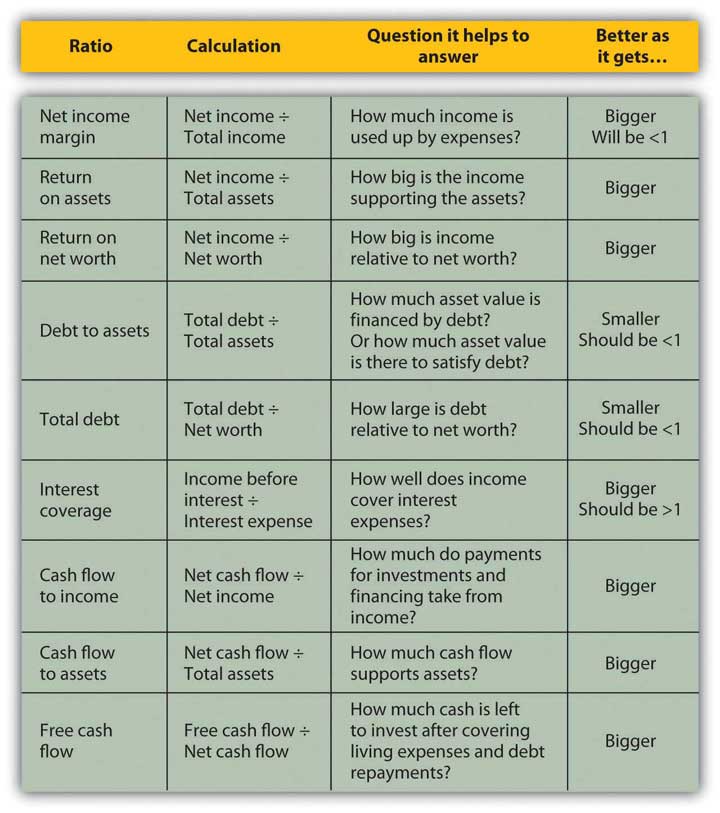

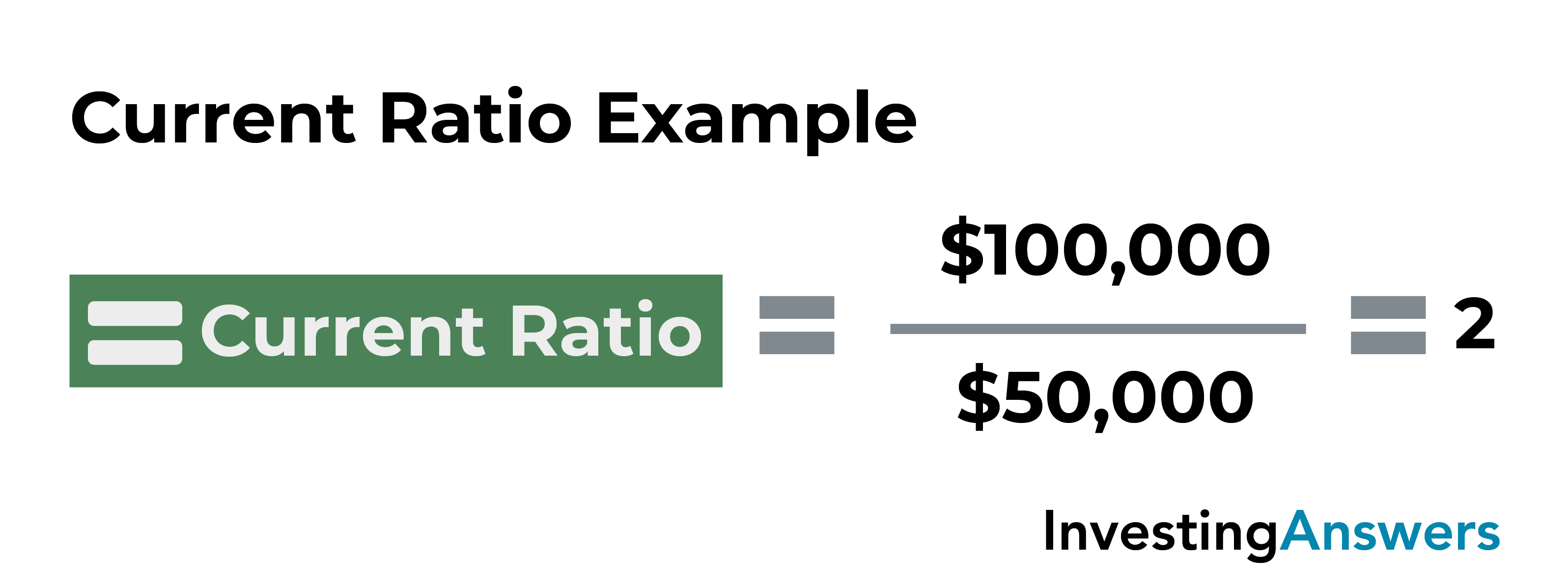

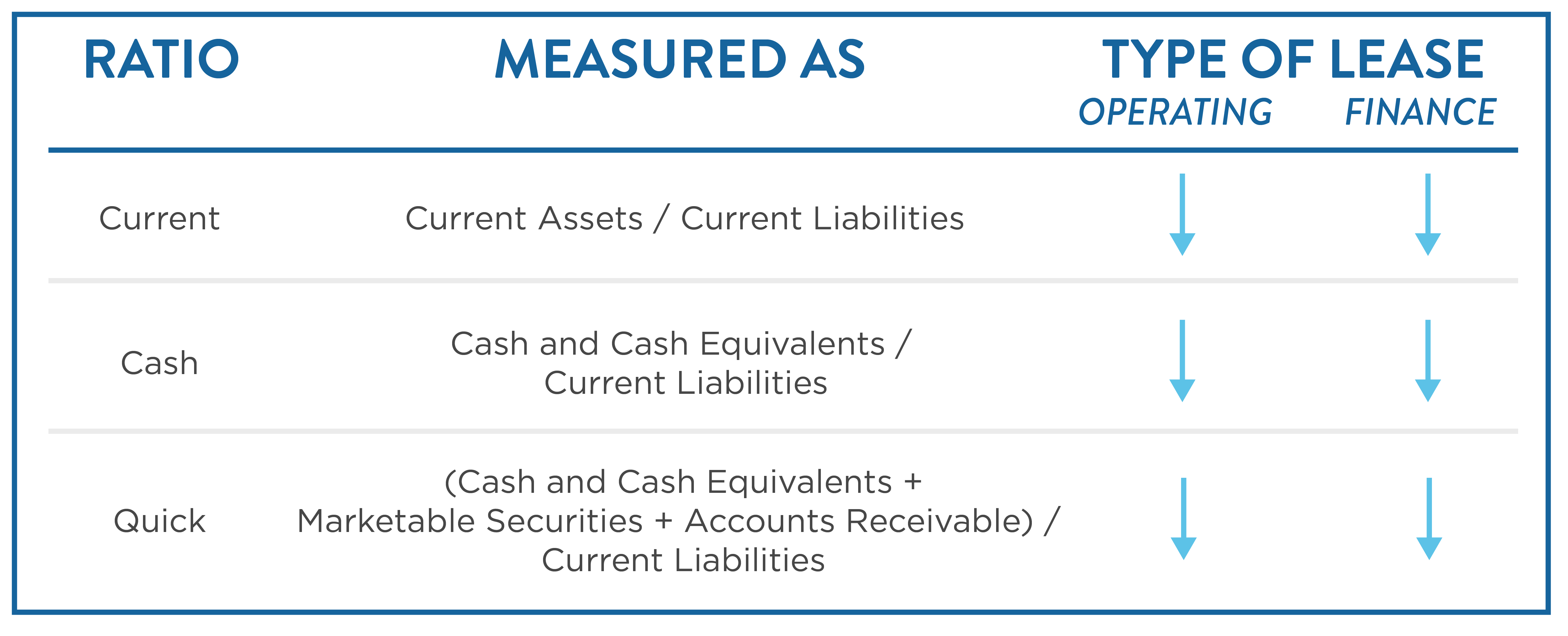

Standard financial ratios. Financial ratios are relationships determined from a company's financial information and used for comparison purposes. Liquidity, solvency, efficiency, profitability, equity, market prospects, investment leverage, and coverage. Financial ratios are grouped into the following categories:

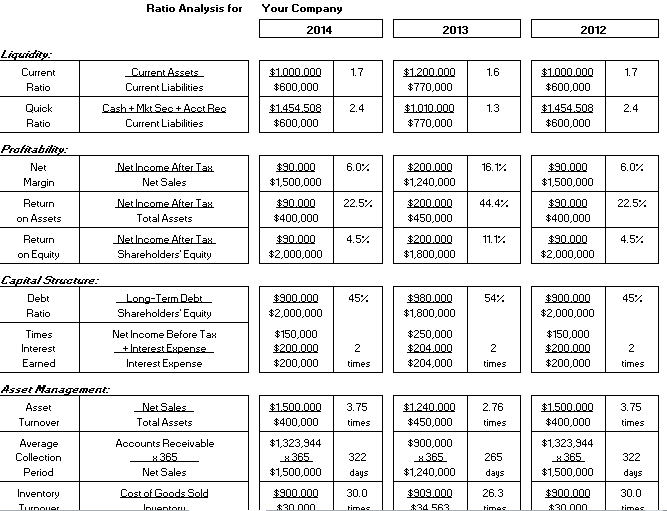

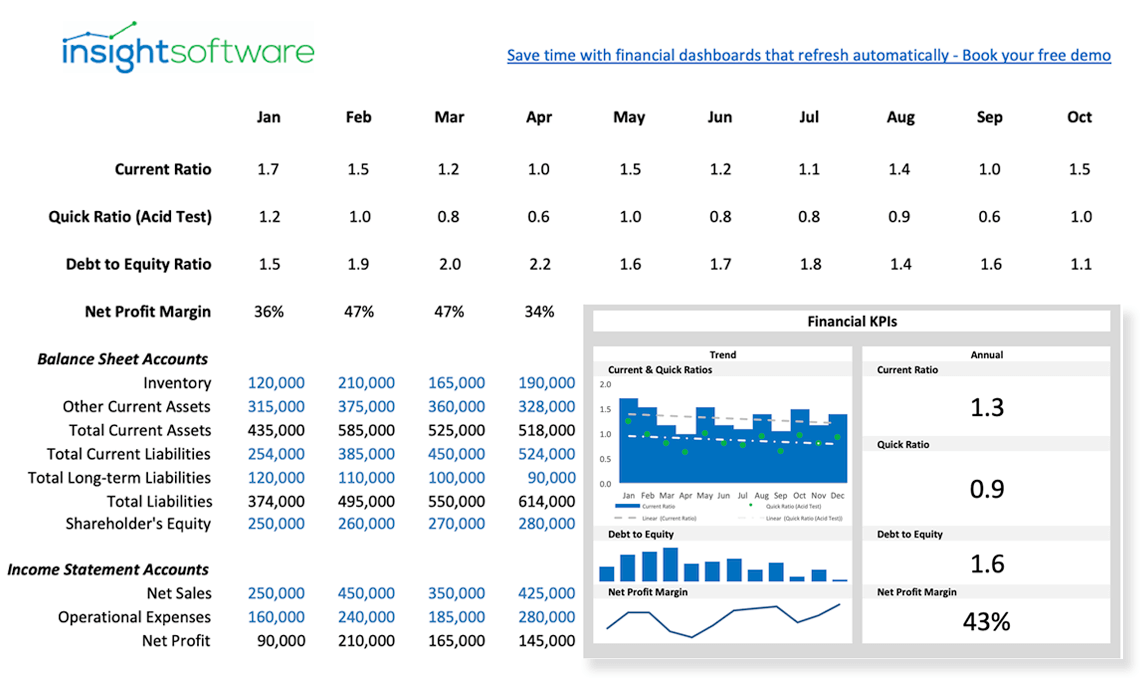

A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements. For making comparisons one of the purposes of financial ratio analysis is to compare an organization's financial performance with comparable firms in the sector to grasp the. Our explanation will involve the following 15 common financial ratios:

These ratios are most commonly employed by individuals outside of a business, since employees typically have more detailed information available to them. Financial ratios compare different line items in the financial statements to yield insights into the condition and results of a business. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise.

Analysts compare financial ratios to industry averages (benchmarking), industry standards or rules of thumbs and against internal trends (trends analysis). Financial ratio analysis compares relationships between financial statement accounts to identify the strengths and weaknesses of a company. Migrant encounters along the southwest border were significantly lower than experienced in december.

Our discussion of 15 financial ratios. Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. They are used to get insights and important information on the company’s performance, profitability, and financial health.

The most useful comparison when performing financial ratio analysis is trend analysis. Liquidity ratios measure a company’s ability to. Customs and border protection (cbp) released operational statistics today for january 2024.

This comprehensive list of financial ratios by industry was gathered by public tax return data provided by the irs. Iso standards are essential for the banking and finance sector, as they provide a common framework for the exchange of information, transactions and services, covering aspects such as payment cards, securities, messaging, identification, and risk management. There are numerous financial ratios that are used for ratio analysis, and they are grouped into the following categories:

Cbp monthly reporting can be viewed on cbp’s stats and summaries webpage. Financial ratios are basic calculations using quantitative data from a company’s financial statements. Learn the most useful financial ratios here.

Rma provides balance sheet and income statement data, and financial ratios compiled from financial statements of more than 240,000 commercial borrowers, classified into three income brackets in over 730 different industry categories. Financial ratios can be classified into ratios that measure: Often used in accounting , there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization.

Analysis of financial ratios serves two. From stock ratios to investor ratios, our expert guide walks you through 20 of the most important financial ratios to analyze a company. Uses and users of financial ratio analysis.