Beautiful Tips About Provision For Doubtful Debts Is An Expense

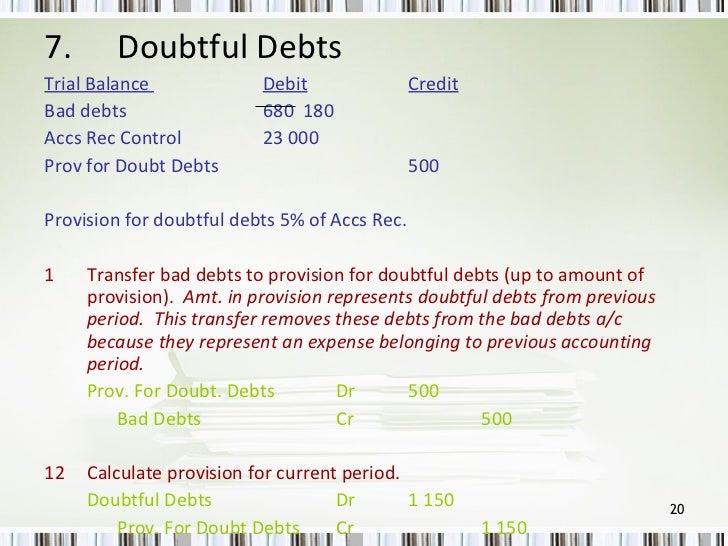

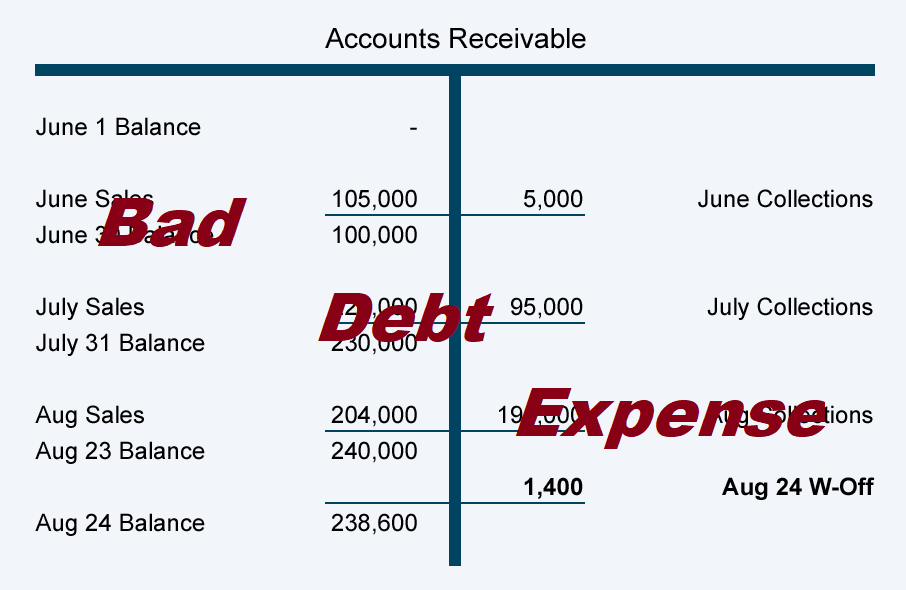

When you eventually identify an actual bad debt, write it off (as described above for a bad debt) by debiting.

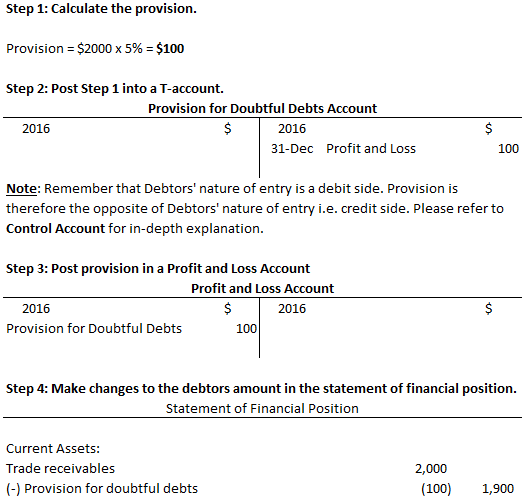

Provision for doubtful debts is an expense. An increase in provision for doubtful debts is an increase in expense. According to ias 37 of international financial reporting. A liability is a present obligation arising from past.

Provision for doubtful debts, on the one hand, is shown on the debit side of the profit. Definition of provisions so what is a provision? Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as write.

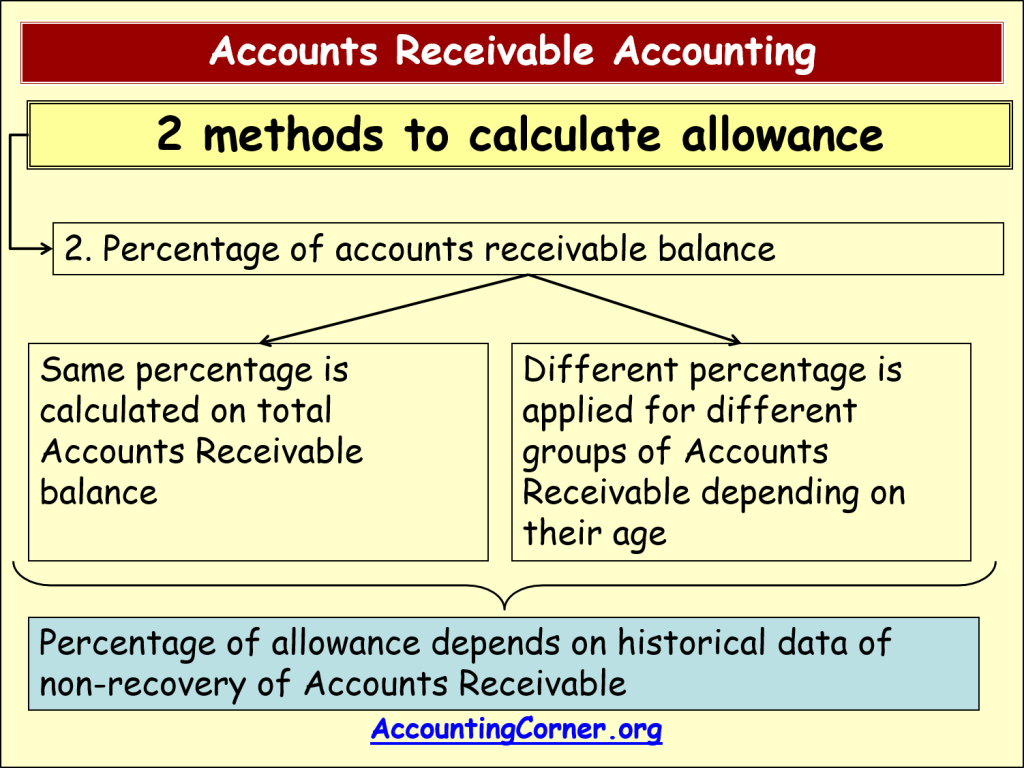

An allowance for doubtful debt can be either a specific debt which is suspected will go unpaid, or a more general allowance based on a percentage of the. Ok, so what is a liability then? New provision for bad debts is deducted from debtors in balance sheet.

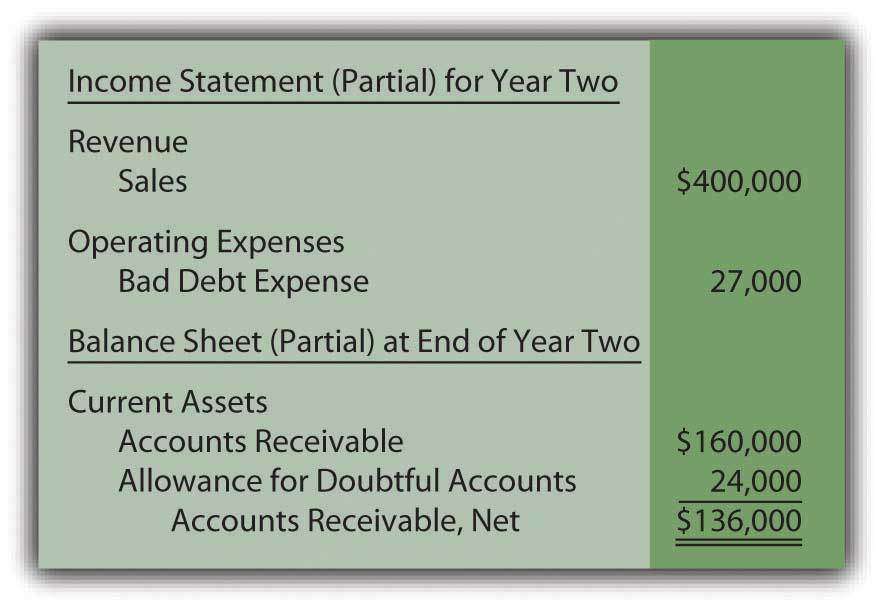

If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an operating expense on the company's income statement. The debit in the transaction is to the bad debt expense. Doubtful debts or bad debts is an expense and has already.

The provision for doubtful debts (or provision for bad debts) is different to doubtful debts (or bad debts). This means that bww believes $48,727.50. (imagine that $18 of yours, isn’t that an expense?) credit provision for doubtful debts.

Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. The provision for doubtful debts is the. Every year the amount gets changed due to the provision.

Bad debt is an amount of debt that a business fails to recover from its debtors. Reduction in provisions for bad or doubtful debts faqs at the end of a financial year, if a business person feels that provisions for bad debts brought forward. Bad debt expense increases (debit), and allowance for doubtful accounts increases (credit) for $48,727.50 ($324,850 × 15%).

The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts. The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position. Provision for bad debts is the estimated percentage of total doubtful debt that must be written off during the next year.

At the end of each financial year,. 2 minutes of reading. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for.

It is a liability of uncertain timing and amount. It is done because the amount of loss is impossible to.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)