Ace Tips About Payment Of Dividends Cash Flow

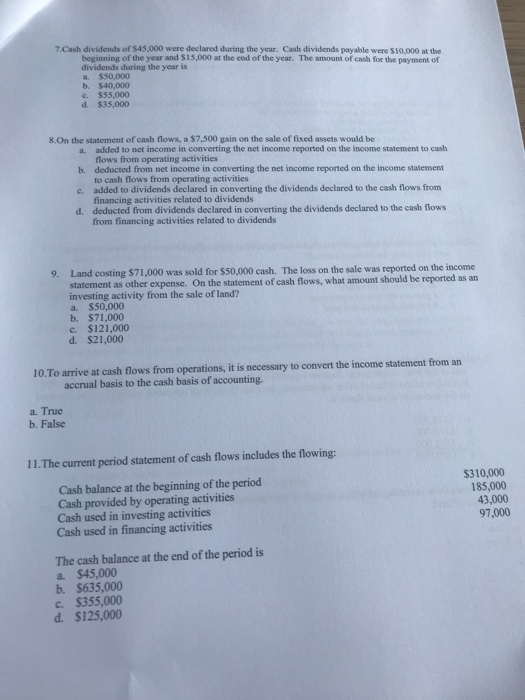

Dividends are typically classified as a cash outflow within the financing activities section of the cash flow statement.

Payment of dividends cash flow. Cash payments made to shareholders as dividends to distribute a portion of the company’s profits are considered cash outflows in the financing activities section. Say your corporation declares and issues $35,000 in stock dividends. Bayer will present a plan to offer investors 11 euro cents ($0.12) per share for fiscal year 2023, down from €2.40 last year, according to a statement monday.

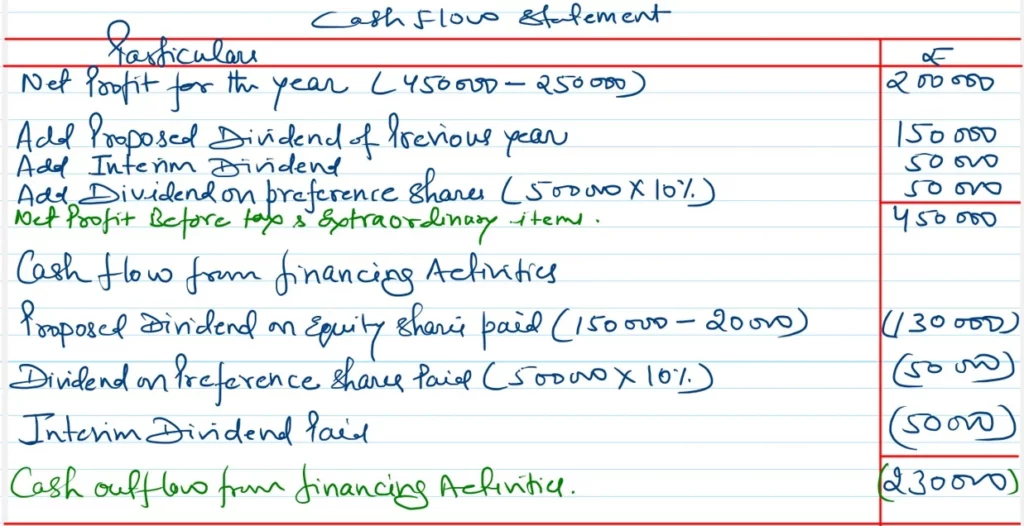

This paper has been prepared for discussion at a public meeting of the international accounting standards board (the board) and does not represent the views of the board or any individual member of. Dividends on the cash flow statement. Payment of dividends:

Cash dividends are a distribution of a corporation's earnings to its stockholders or shareholders. Final word as you can see, dividends are paid from the company’s cash flow, which means that your business needs to keep a close eye on any potential problems. Cash flow from financing (cff) activities is a category in a company’s cash flow statement that accounts for external activities that allow a firm to raise.

Over the last year, the s&p 500 has increased more than 20%. Any cash flows that include payment of dividends, the repurchase or sale of stocks, and bonds would be considered cash flow from financing activities. The new policy — intended to pay.

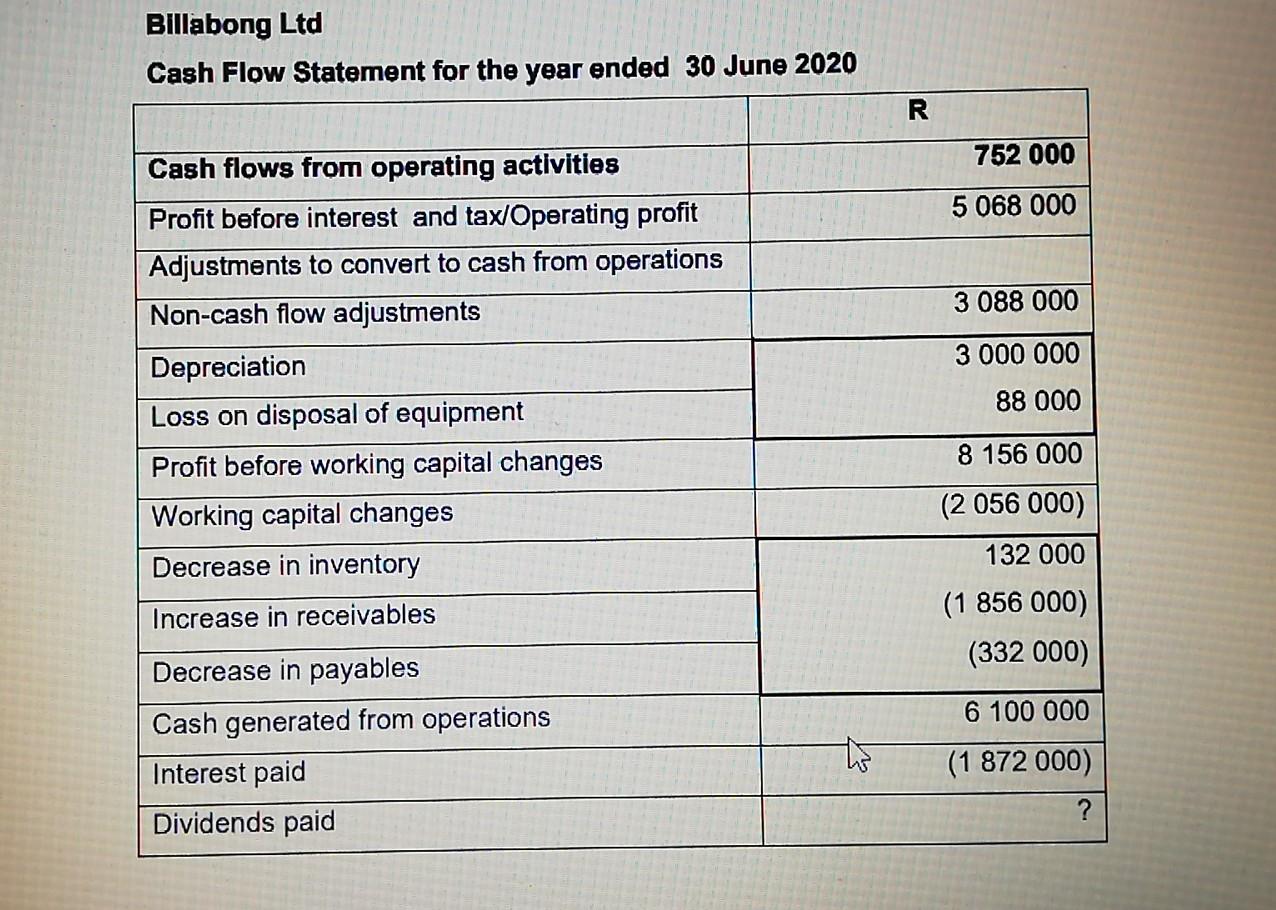

We explain the treatment of dividends and interest paid, and dividends and interest received in the cash flow statement. Understanding the treatment of a dividend a board of directors must approve dividend. The cash flow statement shows a company's cash inflows and outflows during an accounting period.

So paying of dividends would not go here. The motley fool take total dividends divided by net income and you will get dpr. For instance, if a company has 1.

When it’s time to pay out the dividends, dividends payable are debited, removing the liability from the balance sheet, and cash is credited (because dividends are a cash outflow). Dividends on the cash flow statement represent a cash outflow from financing activities. Dividends are typically found in the financing activities section of the cash flow statement.

By doing this, a lender. As a cash outflow, dividend payments reduce the company’s available cash resources. When a company declares and pays dividends, it has an immediate impact on its cash flow.

Dividend payments would be shown in the financing activities section of the cash flow statement. A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, paid to a class of its shareholders. The stock market has been doing well lately.

Cash received from taking out a loan or cash. This is useful in measuring a company's ability to keep paying or even increasing a dividend. If the company has not directly disclosed this information, it is still possible to derive the amount if the investor has access to the company's income statement and its beginning and ending balance.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)